PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844543

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844543

United States Food Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

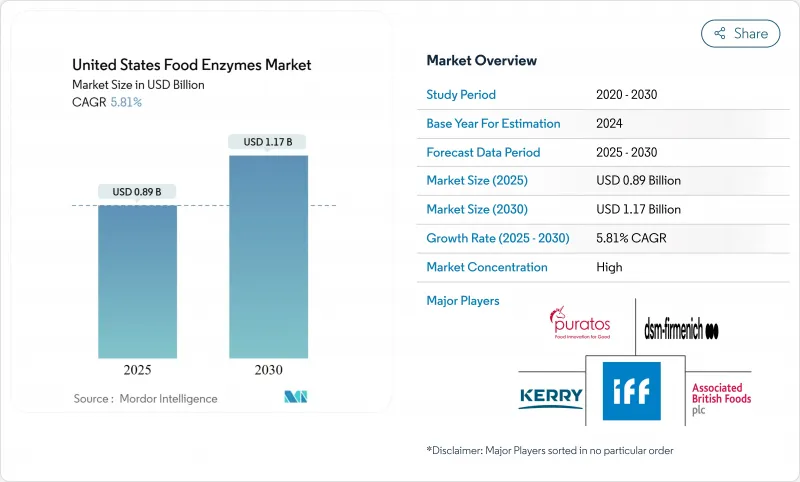

The United States food enzymes market size stands at USD 0.89 billion in 2025 and is projected to reach USD 1.17 billion by 2030, at a CAGR of 5.81% during the forecast period (2025-2030).

This growth trajectory reflects the sector's maturation beyond basic processing aids toward sophisticated biotechnological solutions that address emerging consumer demands and regulatory pressures. Robust demand for clean-label processing aids, steady modernization of bakery and dairy plants, and stricter sustainability mandates continue to reposition enzymes from cost-saving additives to strategic bioprocessing tools. Manufacturers deploy carbohydrases, proteases, and emerging lipase systems to shorten production cycles, reduce energy use, and achieve label simplification without sacrificing taste or safety. On the demand side, specialty nutrition, plant-based alternatives, and functional food launches present fresh revenue streams, while renewed focus on supply-chain resilience is accelerating domestic enzyme capacity investments.

United States Food Enzymes Market Trends and Insights

Expansion of functional and fortified food segment

Consumer demand for health-optimized food products has created substantial opportunities for specialized enzyme applications that enhance nutrient bioavailability and create novel functional properties. The FDA's approval of alpha-galactosidase from genetically modified Saccharomyces cerevisiae for guar gum processing demonstrates regulatory acceptance of advanced enzyme technologies in functional food production according to the European Food Safety AuthorityFurther, Amplifye's launch of the P24 protease enzyme, which increases amino acid absorption by approximately 30% and targets improved blood glucose control, exemplifies how enzyme innovation is addressing specific health outcomes rather than general processing efficiency. This shift toward therapeutic-adjacent applications positions enzymes as active ingredients rather than passive processing aids, justifying premium pricing and creating differentiated market positions.

Strong growth in the United States baking industry

The United States baking sector's resilience during economic uncertainty has created sustained demand for enzyme solutions that optimize production efficiency and product quality. Enzyme applications in baking have evolved beyond traditional amylase use toward specialized solutions for clean-label formulations and extended shelf life, addressing consumer preferences for recognizable ingredients without sacrificing product performance. The industry's focus on automation creates opportunities for enzyme systems that reduce variability and enable consistent quality across different production environments. Rising input costs and labor shortages have made enzyme-enabled process optimization essential for maintaining profitability, particularly for mid-tier operators competing against both artisanal producers and large-scale manufacturers.

Regulatory compliance and labeling requirements impact market growth

The complex regulatory landscape for enzyme approvals creates significant barriers to market entry and product innovation, particularly for novel enzyme applications that lack established safety profiles. The FDA's GRAS notification process, while providing a pathway for enzyme approval, requires extensive documentation and safety studies that can cost millions of dollars and take years to complete according to FDA (Food and Drug Administration). State-level variations in labeling requirements add complexity for manufacturers operating across multiple jurisdictions, requiring different formulations or labeling approaches for the same product. The increasing consumer demand for transparency has elevated scrutiny of enzyme sources and production methods, creating pressure for more detailed disclosure that may reveal proprietary information. Regulatory uncertainty around genetically modified enzyme sources continues to create market segmentation, with some applications requiring non-GMO alternatives that may have inferior performance characteristics or higher costs.

Other drivers and restraints analyzed in the detailed report include:

- Rising trend of plant-based and vegan food products

- Advancement in microbial and genetically modified enzymes

- Impact of environmental and processing factors on enzyme performance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Carbohydrase enzymes hold 59.43% market share in 2024, dominating food processing applications from baking to brewing. The segment's dominance stems from the ubiquity of carbohydrate substrates in food processing and the mature technology platforms that enable cost-effective production at scale. Amylases lead this segment, particularly in baking where they improve dough properties and shelf life. Pectinases support juice and wine production, while cellulases serve brewing and plant-based food processing. Specialized carbohydrases handle oligosaccharide modification in functional foods.

Lipase enzymes project 6.74% CAGR through 2030, driven by dairy processing, flavor development, and plant-based foods. Protease enzymes maintain positions in meat and dairy processing but face growth limitations. The development of extremophilic enzymes represents an emerging opportunity, with research demonstrating superior performance under harsh processing conditions that conventional enzymes cannot tolerate according to PMC (PubMed Central). Other enzyme categories, including transglutaminase and glucose oxidase, address specialized applications in processed foods and baking, respectively, maintaining stable but limited market positions.

Powder formulations dominate with 65.14% market share in 2024 and project 6.85% CAGR through 2030, driven by superior stability and handling convenience. The powder form's advantages include enhanced storage capabilities, efficient transportation, and precise dosing accuracy, reducing operational complexity in food processing. Their longer shelf life and temperature stability make them ideal for complex supply chains, while compatibility with automated systems improves processing efficiency.

Liquid enzyme formulations are facing challenges in stability and handling requirements. While liquid forms excel in applications requiring immediate activity and liquid processing integration, they require cold storage and have shorter shelf lives. These formulations maintain relevance in specialized processing, particularly where precise pH control is needed, despite powder forms' overall advantages.

The United States Food Enzymes Market is Segmented by Type (Carbohydrase, Protease, Lipase, and Other Enzymes), Form (Powder, Liquid), Source (Plant, Microbial, Animal), and Application (Bakery and Confectionery, Dairy and Desserts, Beverages, Meat and Meat Products, Soups, Sauces, and Dressings, Other Applications). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- International Flavors & Fragrances, Inc.

- Puratos Group

- DSM-Firmenich AG

- Kerry Group plc

- Associated British Foods plc

- Amano Enzyme Inc.

- Creative Enzymes

- Advanced Enzyme Technologies

- Jiangsu Boli Bioproducts Co., Ltd

- BRAIN Biotech AG

- Novonesis Group

- Corbion NV

- Enzyme Development Corporation

- Sunson Industry Group Co., Ltd.

- Neogen Corporation

- Qingdao Vland Biotech Inc.

- Lallemand Inc.

- INVIVO GROUP

- BIO-CAT, Inc.

- The Archer-Daniels-Midland Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of functional and fortified food segment

- 4.2.2 Strong growth in the United States baking industry

- 4.2.3 Rising trend of plant-based and vegan food products

- 4.2.4 Growing demand for processed and packaged food products

- 4.2.5 Boom in craft beer and artisanal food sector

- 4.2.6 Advancement in microbial and genetically modified enzymes

- 4.3 Market Restraints

- 4.3.1 Regulatory compliance and labeling requirements impact market growth

- 4.3.2 Impact of environmental and processing factors on enzyme performance

- 4.3.3 Varying enzyme performance on different substrate materials

- 4.3.4 Legal challenges and patent disputes shape enzyme technology market

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Carbohydrase

- 5.1.1.1 Amylases

- 5.1.1.2 Pectinases

- 5.1.1.3 Cellulases

- 5.1.1.4 Other

- 5.1.2 Protease

- 5.1.3 Lipase

- 5.1.4 Other Enzymes

- 5.1.1 Carbohydrase

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By Source

- 5.3.1 Plant

- 5.3.2 Microbial

- 5.3.3 Animal

- 5.4 By Application

- 5.4.1 Bakery and Confectionery

- 5.4.2 Dairy and Desserts

- 5.4.3 Beverages

- 5.4.4 Meat and Meat Products

- 5.4.5 Soups, Sauces, and Dressings

- 5.4.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 International Flavors & Fragrances, Inc.

- 6.4.2 Puratos Group

- 6.4.3 DSM-Firmenich AG

- 6.4.4 Kerry Group plc

- 6.4.5 Associated British Foods plc

- 6.4.6 Amano Enzyme Inc.

- 6.4.7 Creative Enzymes

- 6.4.8 Advanced Enzyme Technologies

- 6.4.9 Jiangsu Boli Bioproducts Co., Ltd

- 6.4.10 BRAIN Biotech AG

- 6.4.11 Novonesis Group

- 6.4.12 Corbion NV

- 6.4.13 Enzyme Development Corporation

- 6.4.14 Sunson Industry Group Co., Ltd.

- 6.4.15 Neogen Corporation

- 6.4.16 Qingdao Vland Biotech Inc.

- 6.4.17 Lallemand Inc.

- 6.4.18 INVIVO GROUP

- 6.4.19 BIO-CAT, Inc.

- 6.4.20 The Archer-Daniels-Midland Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK