PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844551

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844551

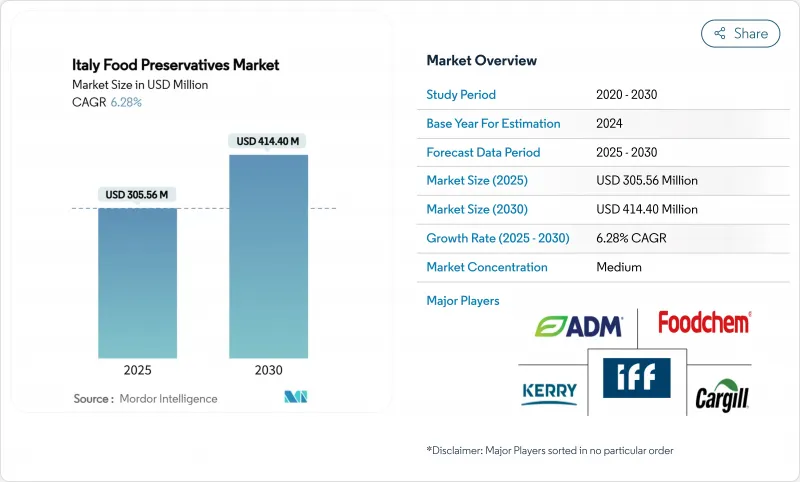

Italy Food Preservatives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Italy food preservatives market is valued at USD 305.56 million in 2025 and is projected to reach USD 414.40 million by 2030, growing at a CAGR of 6.28%.

The market shows strongest growth in Northern Italy's industrial regions, driven by urban lifestyle patterns, expanding ready-meal production, and concentrated meat and seafood processing facilities requiring preservation solutions. The market adapts to evolving EU regulations, promoting natural preservative adoption while maintaining synthetic preservatives in mass-market products. Antimicrobial preservatives remain the primary choice for ensuring food safety, while antioxidants show rapid growth due to expansion in chilled meals and premium oil categories. The market structure features moderate consolidation, with international companies like Cargill, BASF, and Kerry competing with local specialists who focus on Mediterranean-sourced natural preservatives to meet clean-label requirements.

Italy Food Preservatives Market Trends and Insights

Wider Acceptance of Convenience Foods Products

The Italian convenience food market is growing significantly, particularly in the northern regions, where urbanization and busy lifestyles drive demand for ready-to-eat products. Data from the Italian Ministry of Health's NutrInform Battery app shows increased consumption of pre-packaged foods, with notable growth in urban centers like Milan, Turin, and Bologna. This trend creates demand for preservatives that maintain food safety and extend shelf life while meeting clean-label requirements. Pre-packaged salad consumption increased by 22% in Northern Italy in 2024, compared to 8% in Southern regions, demonstrating regional differences in convenience food adoption. The trend is expected to expand southward, presenting opportunities for preservative applications in regions traditionally focused on fresh food.

Innovation and Product Launches in Preservative Market

The Italian food preservatives market is undergoing transformation due to regulatory requirements and evolving consumer preferences. The Italian Ministry of Health's 2024-2025 monitoring report indicates that manufacturers submitted 28 new preservative formulations for regulatory approval in 2024, with 65% comprising natural or clean-label solutions. This shift reflects a broader industry trend toward sustainable and consumer-friendly preservation methods. The European Food Safety Authority's (EFSA) ongoing re-evaluation of food additives has intensified innovation as manufacturers develop alternative preservatives . The assessment process includes comprehensive safety reviews and efficacy testing of both existing and new preservative compounds. EFSA's 2024 assessment of common preservatives has led to product reformulations, specifically for items containing sulfites and synthetic antioxidants. These changes have prompted food manufacturers to invest in research and development of novel preservation technologies while ensuring compliance with evolving regulatory standards.

Regulations on Utilisation of Preservatives in Food Products

Italy's regulatory framework for food preservatives aligns with EU regulations while maintaining additional national provisions, creating compliance challenges for manufacturers. The Italian Ministry of Health's National Control Plan for food additives and flavorings 2025-2027 has strengthened the monitoring of preservative usage, with emphasis on sulfites, nitrates, and synthetic antioxidants. In 2024, official controls identified non-compliance issues with sulfur dioxide and sulfites in 12% of sampled products, leading to product recalls and financial penalties. These regulatory requirements present specific challenges for international companies entering the Italian market, as they must comply with both EU-wide and Italy-specific regulations.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Organic and Natural-Based Products

- Technological Innovations Driving Food Preservation Market

- Growing Health Awareness Increases Demand for Natural Preservatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Italian food preservatives market remains dominated by synthetic preservatives, which hold a 63.22% market share in 2024. This dominance stems from their cost-effectiveness, stability, and broad antimicrobial properties, with sorbates and benzoates being the primary choices in bakery products, beverages, and dairy items. The European Food Safety Authority's ongoing re-evaluation of food additives has created regulatory uncertainty, further highlighted by the Italian Ministry of Health's 2024 monitoring program, which found 12% of products containing sulfites exceeding permitted levels, leading to increased compliance costs for manufacturers.

Natural preservatives, currently at 36.78% market share, demonstrate strong growth potential with a 6.91% CAGR (2025-2030), surpassing overall market growth. Manufacturers are directing research and devlopment investments toward natural preservative development, anticipating stricter synthetic regulations. Local processors are exploring fermentation-derived lactates and vinegar blends that offer comparable antimicrobial effectiveness while minimizing taste impact. However, adoption in price-sensitive market segments remains limited due to inconsistent performance and higher costs.

Antimicrobial preservatives hold a dominant 56.94% share in the Italian food preservatives market in 2024. This dominance reflects Italy's emphasis on microbiological safety in food products. The Italian Ministry of Health's National Control Plan for food additives 2025-2027 prioritizes monitoring antimicrobial preservatives, particularly in meat products, ready meals, and bakery items.

The antioxidants segment is projected to grow at a CAGR of 7.82% during 2025-2030. This growth stems from the Italian food industry's requirements for extended shelf life while maintaining nutritional value and sensory qualities. The Italian Ministry of Agriculture's Strategic Plan for Innovation and Research identifies antioxidants as a priority development area, with emphasis on natural antioxidants from agricultural by-products, supporting circular economy initiatives.

The Italy Food Preservatives Market is Segmented by Type (Synthetic, and Natural), Function (Antimicrobial, and Antioxidants), Form (Dry/Granular and Liquid), Application (Bakery and Confectionery, Meat and Poultry, Ready Meals, Sweet and Savory Snacks, Sauces and Dressings, Edible Oils, and Other Applications). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Archer Daniels Midland Company

- Cargill Incorporated

- Kerry Group plc

- BASF SE

- DSM-firmenich

- Corbion NV

- Jungbunzlauer Suisse AG

- Tate & Lyle PLC

- International Flavors & Fragrances Inc.

- Celanese Corporation

- Kemin Industries

- Galactic

- Novonesis (Chr. Hansen Holding A/S)

- Ingredion Incorporated

- Roquette Freres

- Silvateam S.p.A.

- Barentz International BV

- Solvay SA

- Lallemand Inc.

- Fratelli Pagani S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Wider Acceptance of Convenience Foods Products

- 4.2.2 Innovation and Product Launches in Preservative Market

- 4.2.3 Rising Demand for Organic and Natural-Based Products

- 4.2.4 Technological Innovations Driving Food Preservation Market

- 4.2.5 Expanding Organic and Clean Label Preservative Adoption

- 4.2.6 Growth in Meat and Seafood Processing Sector

- 4.3 Market Restraints

- 4.3.1 Regulations on Utlisation of Preservatives in Food Products

- 4.3.2 Growing Health Awareness Increases Demand for Natural Preservatives

- 4.3.3 Shift Towards Fresh and Minimally Processed Food

- 4.3.4 Increase in Demand for Additive Free" Products"

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Synthetic

- 5.1.2 Natural

- 5.2 By Function

- 5.2.1 Antimicrobial

- 5.2.2 Antioxidants

- 5.3 By Form

- 5.3.1 Dry/Granular

- 5.3.2 Liquid

- 5.4 By Application

- 5.4.1 Bakery and Confectionery

- 5.4.2 Meat and Poultry

- 5.4.3 Ready Meals

- 5.4.4 Sweet and Savory Snacks

- 5.4.5 Sauces and Dressings

- 5.4.6 Edible Oils

- 5.4.7 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Rank Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill Incorporated

- 6.4.3 Kerry Group plc

- 6.4.4 BASF SE

- 6.4.5 DSM-firmenich

- 6.4.6 Corbion NV

- 6.4.7 Jungbunzlauer Suisse AG

- 6.4.8 Tate & Lyle PLC

- 6.4.9 International Flavors & Fragrances Inc.

- 6.4.10 Celanese Corporation

- 6.4.11 Kemin Industries

- 6.4.12 Galactic

- 6.4.13 Novonesis (Chr. Hansen Holding A/S)

- 6.4.14 Ingredion Incorporated

- 6.4.15 Roquette Freres

- 6.4.16 Silvateam S.p.A.

- 6.4.17 Barentz International BV

- 6.4.18 Solvay SA

- 6.4.19 Lallemand Inc.

- 6.4.20 Fratelli Pagani S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK