PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844554

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844554

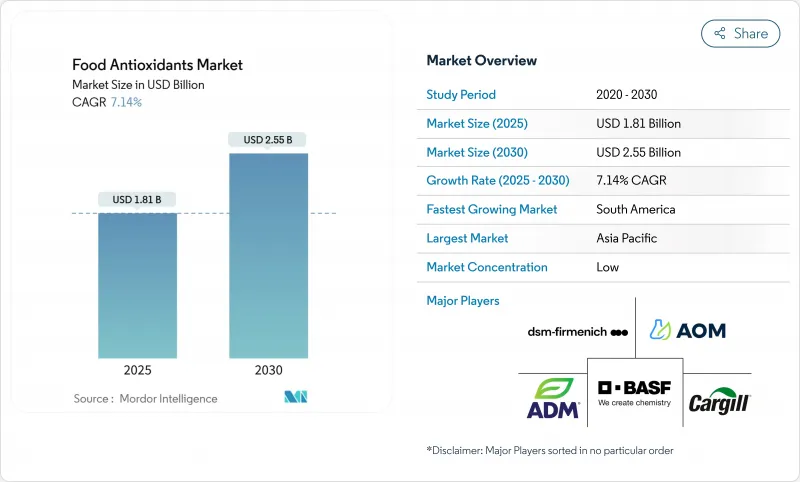

Food Antioxidants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Food Antioxidants Market stands at USD 1.81 billion in 2025, projected to reach USD 2.55 billion by 2030, growing at a CAGR of 7.14%.

This growth trajectory reflects the market's resilience amid shifting consumer preferences toward clean-label products and heightened awareness of oxidative deterioration in food products. The food antioxidants sector is experiencing a fundamental transformation as manufacturers pivot from synthetic to natural alternatives, responding to regulatory pressures and evolving consumer health consciousness. The convergence of food safety concerns, extended shelf-life requirements, and clean-label demands is driving innovation in delivery systems, with nanoencapsulation and liposome technologies enabling more efficient and targeted antioxidant applications in diverse food matrices.

Global Food Antioxidants Market Trends and Insights

Expansion of Processed and Convenience Food Requiring Extended Shelf-life

The growth in processed and convenience food products is driving increased demand for antioxidant solutions that prevent oxidative deterioration and extend shelf life. Global urbanization and consumer preference for ready-to-eat options have prompted manufacturers to implement advanced antioxidant systems for maintaining product quality across distribution networks. The need for effective preservation methods has become particularly critical as supply chains lengthen and products require longer shelf stability. Antioxidants in processed foods now serve dual purposes - preserving products while protecting their nutritional value and sensory characteristics. These compounds help prevent rancidity, maintain color stability, and protect essential nutrients from degradation during storage and distribution.

The food industry's focus on clean label ingredients has also influenced antioxidant selection, with natural alternatives gaining prominence over synthetic options. Technological developments in antioxidant delivery, such as microencapsulation and edible coatings, enable more precise and effective applications in complex food formulations. These advanced delivery systems improve the stability of antioxidant compounds and ensure their sustained release throughout the product's shelf life. The integration of these technologies has expanded the application scope of antioxidants across various food categories, including bakery, meat products, beverages, and dairy items.

Regulatory Approvals Widening Antioxidant Usage across Emerging Markets

Regulatory frameworks governing food antioxidants are evolving rapidly, creating both opportunities and challenges for market participants. Recent approvals, such as China's National Health Commission's authorization of hydroxytyrosol in August 2024, are expanding the toolkit available to food manufacturers in key emerging markets. These regulatory shifts are particularly significant in Asia-Pacific and South America, where growing middle-class populations are driving demand for processed foods with longer shelf lives.

The approval process for novel antioxidants is becoming more streamlined in many jurisdictions, with regulatory bodies increasingly recognizing the dual benefits of food waste reduction and enhanced nutritional preservation. However, manufacturers must navigate a complex patchwork of regional regulations, with the European Food Safety Authority (EFSA) maintaining particularly stringent requirements for safety assessments of food additives, including antioxidants, in 2025. This regulatory diversification is creating competitive advantages for companies with robust regulatory affairs capabilities and global compliance expertise.

Price Volatility and Limited Supply of Natural Raw Materials

The shift toward natural antioxidants is creating supply chain vulnerabilities that threaten market growth and price stability. Natural antioxidant sources, including plant extracts, spices, and algae, are subject to agricultural variability, climate impacts, and geopolitical disruptions that synthetic alternatives largely avoid. This supply uncertainty is particularly challenging for food manufacturers accustomed to the consistent availability and pricing of synthetic antioxidants.

Manufacturers are responding by developing vertical integration strategies, investing in controlled cultivation of key botanical sources, and exploring novel extraction technologies to improve yield and reduce costs. The development of more stable, standardized natural antioxidant ingredients is becoming a strategic priority for suppliers seeking to overcome these supply chain challenges and provide food manufacturers with the reliability needed for large-scale commercial applications.

Other drivers and restraints analyzed in the detailed report include:

- Growing Functional Food and Nutraceutical Launches Formulated with Antioxidants

- Rising Awareness About Oxidative Stress and Age-related Disorders

- Safety Concerns and Regulatory Scrutiny of Synthetic Antioxidants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic antioxidants maintain their market leadership with a 53.49% share in 2024, driven by their cost-effectiveness, stability, and established performance in food preservation applications. However, the market is witnessing a pronounced shift as natural antioxidants are projected to grow at a CAGR of 9.55% from 2025-2030, significantly outpacing the overall market growth rate. This transition is fueled by mounting consumer demand for clean-label products and increasing regulatory scrutiny of synthetic alternatives like BHA and BHT. The natural segment encompasses diverse antioxidant classes, including carotenoids, tocopherols, ascorbates, and polyphenols, each offering unique functional properties and application advantages.

The competitive dynamics between natural and synthetic segments are evolving rapidly, with technological innovations narrowing the performance gap that has historically favored synthetic options. Recent advancements in extraction technologies and formulation science have enhanced the stability and efficacy of natural antioxidants, making them viable alternatives in applications previously dominated by synthetic options. Within the natural segment, polyphenols are emerging as particularly promising due to their potent antioxidant activity and additional health benefits, creating opportunities for value-added product positioning beyond simple preservation claims.

The chemically synthesized source segment leads the market with a 35.66% share in 2024, benefiting from established manufacturing infrastructure and consistent quality attributes. However, algae-based antioxidants are revolutionizing the market with a projected CAGR of 10.56% from 2025-2030, the highest growth rate among all source segments. This exceptional growth is driven by the unique advantages of microalgae as antioxidant producers, including their sustainability credentials, high bioactive compound concentration, and ability to be cultivated on non-arable land without competing with traditional agriculture. Plant extracts maintain a significant market position, offering familiar natural options derived from rosemary, green tea, and other botanical sources.

Technological advancements in microalgae cultivation are accelerating this trend, with innovations in photobioreactors and harvesting techniques improving production efficiency and reducing costs. The "other" source segment, which includes animal-derived antioxidants and novel sources like bacterial fermentation products, represents a small but innovative portion of the market with specialized applications in premium food products.

The Food Antioxidants Market is Segmented Into Type (Natural and Synthetic), Source (Plant Extracts, Algae-Based, Chemically-Synthesized, and Others), Form (Dry, Liquid, and Others), Application (Processed Foods, Beverages, Fats and Oils, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates the Food Antioxidants Market with a 33.99% share in 2024, driven by rapid urbanization, expanding food processing industries, and increasing consumer awareness of food safety and quality. China leads regional consumption, with its food antioxidant market bolstered by regulatory developments, including the National Health Commission's approval of five new food raw materials and eight new food additives in February 2025, expanding the toolkit available to manufacturers. India is emerging as a high-growth market within the region. Japan's mature market is characterized by sophisticated consumer preferences for clean-label products and natural preservation solutions, driving innovation in plant-based antioxidants. The region's growth is further supported by the increasing adoption of Western dietary patterns and the expansion of convenience food sectors across developing economies.

North America represents the second-largest regional market, characterized by advanced regulatory frameworks and consumer-driven demand for natural antioxidants. Europe follows closely, with its market distinguished by stringent regulatory oversight from the European Food Safety Authority (EFSA) and strong consumer preference for clean-label products. Key markets within Europe include Germany, France, the UK, and the Netherlands, which are significant importers of natural additives and centers for food innovation.

South America is emerging as the fastest-growing region with a projected CAGR of 8.28% from 2025-2030. The region's growth is fueled by increasing exports of processed foods, rising domestic consumption of packaged products, and a growing focus on natural ingredients. Argentina's food industry is increasingly focused on value-added exports, creating opportunities for antioxidant applications in shelf-life extension of premium products. The Middle East and Africa region, while currently the smallest market, is showing promising growth potential driven by urbanization, increasing disposable incomes, and the expansion of modern retail formats that favor packaged foods with extended shelf lives.

- BASF SE

- Archer-Daniels-Midland Company (ADM)

- Cargill Incorporated

- International Flavors and Fragrances Inc.

- DSM-Firmenich

- Eastman Chemical Company

- Kalsec Inc.

- Kemin Industries Inc.

- Advanced Organic Materials S.A.

- International Flavors and Fragrances Inc.

- Camlin Fine Sciences Ltd.

- BTSA Biotecnologias Aplicadas

- Vitablend Nederland B.V.

- Naturex (Givaudan)

- Kerry Group plc

- Galactic S.A.

- Lycored Corp.

- Algatech Ltd.

- Prinova Group LLC

- Barentz International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of processed and convenience food requiring extended shelf-life

- 4.2.2 Regulatory approvals widening antioxidant usage across emerging markets

- 4.2.3 Growing functional food and nutraceutical launches formulated with antioxidants

- 4.2.4 Rising awareness about oxidative stress and age-related disorders

- 4.2.5 Growing innovations in food processing and antioxidant formulations

- 4.2.6 Rising consumer demand for natural antioxidants in clean-label foods

- 4.3 Market Restraints

- 4.3.1 Price volatility and limited supply of natural raw materials

- 4.3.2 Safety concerns and regulatory scrutiny of synthetic antioxidants

- 4.3.3 Efficacy loss in plant-based meat analogues during processing

- 4.3.4 Competition from non-additive shelf-life technologies

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Natural

- 5.1.1.1 Carotenoids

- 5.1.1.2 Tocopherols

- 5.1.1.3 Ascorbates

- 5.1.1.4 Polyphenols

- 5.1.1.5 Others

- 5.1.2 Synthetic

- 5.1.1 Natural

- 5.2 By Source

- 5.2.1 Plant Extracts

- 5.2.2 Algae-based

- 5.2.3 Chemically-Synthesized

- 5.2.4 Others

- 5.3 By Form

- 5.3.1 Dry

- 5.3.2 Liquid

- 5.3.3 Others

- 5.4 By Application

- 5.4.1 Processed Foods

- 5.4.1.1 Bakery and Confectionery

- 5.4.1.2 Snack Products

- 5.4.1.3 Meat and Poultry

- 5.4.1.4 Dairy and Frozen Desserts

- 5.4.1.5 Other Processed Foods

- 5.4.2 Beverages

- 5.4.3 Fats and Oils

- 5.4.4 Infant and Clinical Nutrition

- 5.4.5 Others

- 5.4.1 Processed Foods

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Archer-Daniels-Midland Company (ADM)

- 6.4.3 Cargill Incorporated

- 6.4.4 International Flavors and Fragrances Inc.

- 6.4.5 DSM-Firmenich

- 6.4.6 Eastman Chemical Company

- 6.4.7 Kalsec Inc.

- 6.4.8 Kemin Industries Inc.

- 6.4.9 Advanced Organic Materials S.A.

- 6.4.10 International Flavors and Fragrances Inc.

- 6.4.11 Camlin Fine Sciences Ltd.

- 6.4.12 BTSA Biotecnologias Aplicadas

- 6.4.13 Vitablend Nederland B.V.

- 6.4.14 Naturex (Givaudan)

- 6.4.15 Kerry Group plc

- 6.4.16 Galactic S.A.

- 6.4.17 Lycored Corp.

- 6.4.18 Algatech Ltd.

- 6.4.19 Prinova Group LLC

- 6.4.20 Barentz International

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK