PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844555

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844555

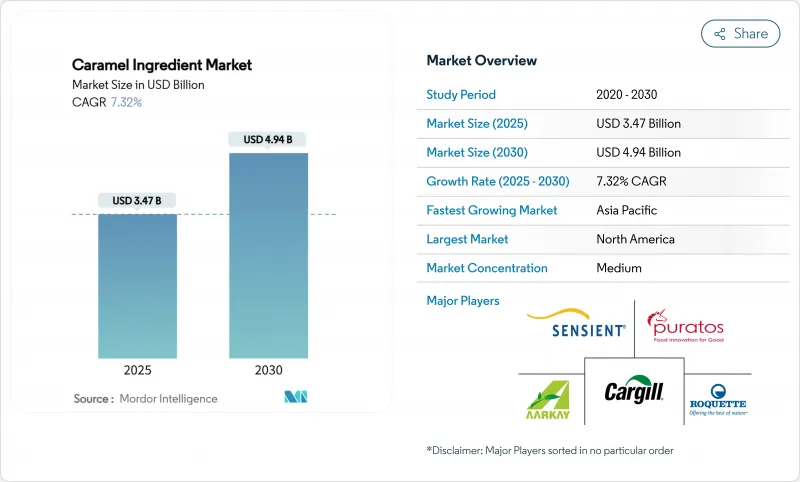

Caramel Ingredient - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The caramel ingredients market size reached USD 3.47 billion in 2025 and is projected to reach USD 4.94 billion by 2030, growing at a CAGR of 7.32%.

The market growth is driven by increasing demand for clean-label products, as consumers seek more natural and transparent ingredient lists in their food and beverage purchases. Regulations phasing out synthetic dyes across major markets, particularly in Europe and North America, have further accelerated the adoption of caramel ingredients as natural alternatives in food manufacturing. The consistent consumer preference for indulgent flavors in confectionery, beverages, bakery products, and dairy applications maintains steady demand throughout the year. Despite sugar price fluctuations in global markets due to weather conditions and supply chain disruptions, the industry continues to expand as manufacturers implement diverse sourcing strategies from multiple suppliers and regions, while focusing on natural offerings with higher margins. Natural caramel ingredients maintain premium pricing due to their clean-label appeal, superior quality, and growing application scope in various food segments, while FDA exemption from color-additive certification streamlines the approval process for manufacturers, reducing time-to-market for new products.

Global Caramel Ingredient Market Trends and Insights

Surging Demand for Confectionery Products

As consumers increasingly gravitate towards premium indulgent products, the confectionery market is witnessing a surge in demand for caramel ingredients. This trend is especially pronounced in developed markets, where refined taste preferences play a pivotal role in shaping product development and manufacturing. The introduction of sophisticated flavor profiles and innovative product formulations underscores the market's evolution. A testament to this trend is Luker Chocolate's October 2023 debut of its Caramelo 33% chocolate couverture, underscoring the industry's embrace of premium caramel-based offerings and the ingredient's adaptability in upscale applications. With consumers showing a penchant for bold flavors and multi-sensory experiences, caramel has emerged as a pivotal ingredient, enhancing both texture and flavor depth in confectionery items. This evolution is mirrored in the rising demand for unique flavor pairings and varied textural experiences, spanning from traditional chocolates to contemporary fusion delights. Catering to these sophisticated consumer tastes and stringent sustainability standards, Cargill offers manufacturers a broad spectrum of confectionery ingredients, including specialized glucose syrups and tailored caramel formulations.

Rising Popularity of Caramel-flavored Beverages

As global markets tighten sugar regulations, the beverage industry turns to caramel flavoring, balancing compliance with consumer appeal. Kerry Group's Tastesense Advanced solutions empower beverage makers to retain caramel's signature taste, aligning with the Union of European Beverage Associations' ambitious 10% sugar reduction goal set for 2019-2025. This move underscores the industry's pivot towards health-conscious offerings. The demand for such innovations is evident: low and no-calorie beverages have surged in the European refreshing beverage market, highlighting shifting consumer tastes and regulatory influences. Caramel flavoring's reach now spans beyond classic soft drinks; energy drink producers are infusing caramel notes to temper bold caffeine flavors, appealing to health-savvy consumers who value natural ingredients and rich taste. This trend is underscored by Symrise's 5.9% organic growth in its Taste, Nutrition, and Health segment in Q1 2025, spotlighting the rising appetite for advanced flavor systems, especially those centered on caramel. In the Asia-Pacific, where traditional and Western flavor preferences meld, the embrace of caramel flavoring presents vast opportunities for ingredient suppliers, spurring innovation and market growth across the region's varied beverage scene.

Fluctuating Raw Material Prices

Raw material price volatility poses a significant challenge to the caramel ingredient market, with sugar price increases in 2024 creating substantial margin pressure across the value chain. The USDA's October 2024 Sugar and Sweeteners Outlook reported reduced U.S. sugar supply for 2023/24, primarily due to adverse weather conditions. Drought and warm temperatures decreased beet sugar production to 5.17 million short tons raw value, affecting both domestic and international markets. These supply constraints have compelled manufacturers to adjust their pricing strategies and seek alternative sourcing options. The volatility affects not only sugar but also corn-based sweeteners and other essential ingredients, including dairy products and stabilizers used in caramel production. This market-wide instability requires manufacturers to implement sophisticated supply chain management practices, including long-term contracts, hedging strategies, and diversified supplier networks to maintain operational continuity. Additionally, manufacturers are investing in inventory management systems and exploring vertical integration opportunities to better control costs and ensure consistent supply availability.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand from the Bakery Sector

- Rising Demand for Natural Food Colorants

- Competition from Alternative Sweeteners and Flavors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural caramel ingredients held a 68.15% market share in 2024, as the industry shifted toward clean-label formulations to meet regulatory requirements and evolving consumer preferences. The natural segment is expected to grow at a 9.15% CAGR through 2030, significantly exceeding the growth rate of synthetic alternatives. This growth is primarily driven by increasing consumer demand for natural ingredients, heightened awareness of clean-label products, and stricter regulations across global markets. Synthetic and artificial caramel ingredients maintain their position in cost-sensitive applications, specific industrial processes, and manufacturing scenarios where natural alternatives are not economically viable or lack the required stability for product formulation. Advanced production methods have enhanced yield efficiency, optimized resource utilization, and reduced manufacturing costs, making natural caramel ingredients increasingly competitive with synthetic options in terms of both performance and pricing.

The market segmentation indicates a comprehensive industry-wide shift toward sustainability and transparency. Manufacturers are substantially increasing their investments in natural production capabilities and research and development to benefit from premium pricing opportunities and meet growing market demands. Natural caramel ingredients have a significant regulatory advantage as they are exempt from FDA color additive certification requirements, offering a more straightforward and cost-effective market entry pathway compared to synthetic alternatives that face increased regulatory oversight and compliance requirements.

Liquid and syrup caramel ingredients hold 62.15% market share in 2024, maintaining their dominant position in beverage and confectionery applications due to easy incorporation and uniform flavor distribution. These formats excel in applications requiring precise control over color, flavor intensity, and texture profiles. Powder formats are experiencing the highest growth rate with an 8.69% projected CAGR through 2030. This growth stems from their benefits in dry mix applications, longer shelf life, and lower transportation costs. The powder segment shows significant expansion in bakery applications, where manufacturers require ingredients that integrate into existing production processes without major equipment changes. The format's stability in varying temperature conditions and resistance to moisture make it particularly suitable for industrial-scale production. Paste and granular formats occupy niche applications requiring specific texture or dissolution properties, such as premium confectionery and specialized dairy products.

Processing technology advancements enable manufacturers to develop caramel ingredients tailored to specific end-use applications. These innovations include improved encapsulation techniques, particle size control, and enhanced stability mechanisms. Cargill exemplifies this market adaptation through its product range of liquid and powder caramel solutions that serve various application segments. The company's portfolio includes specialized formulations for different temperature ranges, pH levels, and processing conditions. Liquid caramel maintains its market position through versatility in high-volume applications and established distribution networks, while powder formats gain market share in emerging regions where storage and distribution advantages offer competitive benefits. The market's evolution reflects increasing demand for application-specific solutions that optimize both production efficiency and final product quality.

The Report Covers Caramel Ingredients Market and is Segmented by Source (Natural, and Synthetic/Artificial), Form (Liquid/Syrup, Powder, and Others), Function (Color, Flavor, Filling and Topping, and Other) Application (Bakery, Confectionery, Beverages, Dairy and Frozen Desserts, and More), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounts for 38.15% of the caramel ingredients market in 2024, supported by advanced processing infrastructure and comprehensive FDA regulations that facilitate natural caramel approval. Regional manufacturers address cost challenges, including the USDA-reported 2023/24 sugar deficit of approximately 12%, through strategic price adjustments and operational efficiencies. Infrastructure investments demonstrate sustained market demand. The region's dominance is further reinforced by the presence of major manufacturers like Cargill, ADM, and Kerry Group, who maintain extensive R and D facilities and production networks.

Asia-Pacific is projected to grow at 8.92% CAGR through 2030, driven by rapid economic growth and increasing consumer adoption of Western-style processed foods. Urbanization and higher disposable incomes, particularly in China and India, fuel the consumption of Western beverages and confectionery products. The market's innovation potential was highlighted at the 29th IFIA Exhibition in Tokyo, which hosted 377 exhibitors showcasing ingredient technologies and attracted over 45,000 industry professionals.

Europe demonstrates consistent market growth. The Union of European Beverage Associations' sugar-reduction program benefits from caramel's ability to provide flavor complexity without additional calories. Germany, the United Kingdom, and France remain primary demand centers, backed by established confectionery manufacturing traditions dating back centuries. Southern European markets are expanding as artisanal bakery exports, incorporating caramel to improve product appearance and extend shelf life. The region's growth is supported by stringent quality standards and increasing consumer preference for natural ingredients.

- Cargill, Incorporated

- Sensient Technologies Corporation

- Aarkay Food Products Ltd

- Puratos Group

- Roquette Freres

- Givaudan SA

- Bakels Worldwide

- Nigay SAS

- Martin Braun KG

- Alvin Caramel Colours (India) Pvt Ltd

- Barry Callebaut

- Ingredion Incorporated

- Sugar Foods Corporation (Concord Foods, LLC)

- Novasol Ingredients Pvt. Ltd

- Nactarome S.P.A (Royal Buisman)

- San Soon Seng Food Industries (S3)

- Metarom Group

- Oterra A/S

- Burke Candy & Ingredients

- H E Stringer Flavours Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for confectionery products

- 4.2.2 Rising popularity of caramel-flavored beverages

- 4.2.3 Increasing demand from the bakery sector

- 4.2.4 Rising demand for natural food colorants

- 4.2.5 Increasing adoption of caramel in savory applications

- 4.2.6 Expanding applications in the dairy industry

- 4.3 Market Restraints

- 4.3.1 Fluctuating raw material prices

- 4.3.2 Competition from Alternative Sweeteners and Flavors

- 4.3.3 Health Concerns Over High Sugar Content

- 4.3.4 Limited shelf life of caramel ingredients

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Natural

- 5.1.2 Synthetic/Artificial

- 5.2 By Form

- 5.2.1 Liquid/Syrup

- 5.2.2 Powder

- 5.2.3 Others

- 5.3 By Function

- 5.3.1 Color

- 5.3.2 Flavor

- 5.3.3 Filling and Topping

- 5.3.4 Other

- 5.4 By Application

- 5.4.1 Confectionery

- 5.4.2 Bakery

- 5.4.3 Beverages

- 5.4.4 Dairy and Frozen Desserts

- 5.4.5 Snacks and Cereals

- 5.4.6 Other

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill, Incorporated

- 6.4.2 Sensient Technologies Corporation

- 6.4.3 Aarkay Food Products Ltd

- 6.4.4 Puratos Group

- 6.4.5 Roquette Freres

- 6.4.6 Givaudan SA

- 6.4.7 Bakels Worldwide

- 6.4.8 Nigay SAS

- 6.4.9 Martin Braun KG

- 6.4.10 Alvin Caramel Colours (India) Pvt Ltd

- 6.4.11 Barry Callebaut

- 6.4.12 Ingredion Incorporated

- 6.4.13 Sugar Foods Corporation (Concord Foods, LLC)

- 6.4.14 Novasol Ingredients Pvt. Ltd

- 6.4.15 Nactarome S.P.A (Royal Buisman)

- 6.4.16 San Soon Seng Food Industries (S3)

- 6.4.17 Metarom Group

- 6.4.18 Oterra A/S

- 6.4.19 Burke Candy & Ingredients

- 6.4.20 H E Stringer Flavours Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK