PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844560

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844560

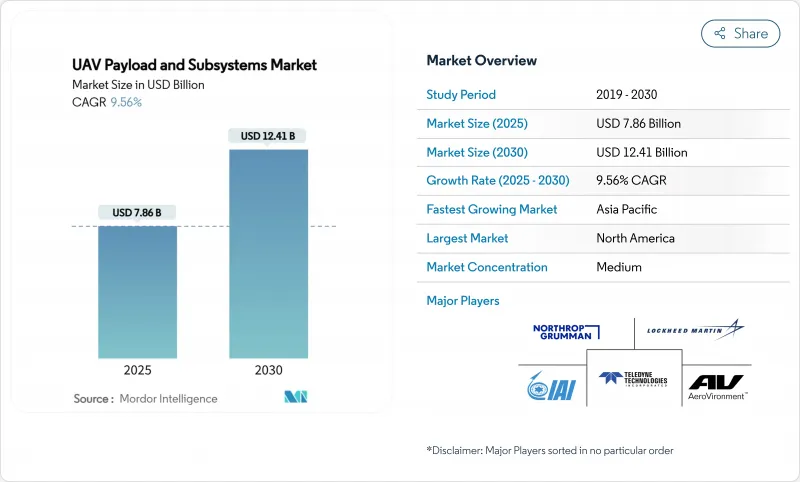

UAV Payload And Subsystems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UAV payload and subsystems market is valued at USD 7.86 billion in 2025 and is forecasted to reach USD 12.41 billion by 2030, advancing at a 9.56% CAGR.

Ongoing military-modernization programs, higher defense outlays, and institutional shifts toward unmanned platforms anchor this growth trajectory. The US Department of Defense alone earmarked USD 10.1 billion for unmanned-vehicle acquisition and R&D in fiscal 2025, highlighting sustained federal commitment. Electronic-warfare (EW) payloads post the fastest segment CAGR at 10.35%, while tactical UAVs remain the volume leaders, capturing 27.85% of the UAV-class segmentation. Regionally, North America retains the largest position with a 35.45% share in 2024, but Asia-Pacific logs the highest 9.75% CAGR, propelled by East Asia's defense-spending jump to USD 411 billion in 2023. Endurance-critical propulsion and power subsystems command 37.85% share, whereas flight-control systems record an 11.23% CAGR as autonomy becomes essential in GPS-denied environments.

Global UAV Payload And Subsystems Market Trends and Insights

Expanding defense ISR budgets

Rising intelligence, surveillance, and reconnaissance allocations underline how information dominance shapes modern force planning. The FY-2025 US budget dedicates USD 10.1 billion to unmanned systems that blend sensor fusion with real-time processing. Comparable spending moves in Japan, South Korea, and Australia confirm a shared belief that faster data cycles shorten the kill chain and protect crews. Procurement offices now prioritize multi-spectral sensors, high-bandwidth datalinks, and onboard analytics that can convert raw imagery into actionable cues during a single pass. This demand surge positions the UAV payload and subsystems market for sustained double-digit growth through the decade.

On-board AI processors for contested environments

Edge-computing chipsets allow drones to identify threats and adjust flight paths without cloud connectivity. MIT testing cut trajectory-tracking error by 50%, proving that onboard inference improves autonomy when jamming blocks command links. Militaries now specify rugged AI hardware that endures vibration, temperature swings, and electromagnetic attack, ensuring mission completion even when GNSS signals vanish. These processors also enable rapid sensor fusion, letting operators push more payload types onto the same airframe. As a result, avionics suppliers that integrate advanced GPUs and neural accelerators see rising order volumes.

Export-control and flight-regulation hurdles

ITAR, EAR, and MTCR rules oblige manufacturers to vet every component and customer, creating paperwork that can delay deliveries by months. Firms often design "export-light" versions that drop advanced encryption, range, or payload options, diluting performance to stay compliant. Smaller innovators struggle with the legal overhead, ceding market share to primes that maintain in-house compliance teams. Civil aviation regulators add another layer, mandating see-and-avoid sensors and fail-safe controls before flights in national airspace. Together, these barriers restrict the global diffusion of cutting-edge subsystems.

Other drivers and restraints analyzed in the detailed report include:

- Swarm concepts driving interoperable communications subsystems

- Modular Open-Systems Architecture (MOSA) mandates

- Weight-power trade-offs limiting endurance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sensors accounted for USD 2.46 billion and 31.25% of the UAV payload and subsystems market in 2024. Electronic-warfare configurations, however, will outpace all others at a 10.35% CAGR as spectrum dominance becomes indispensable. The UAV payload and subsystems market size for EW is forecast to double by 2030, helped by modular pod architectures that retrofit onto legacy airframes. US Marine Corps integration of T-SOAR pods on MQ-9 demonstrators underscores a doctrine shift toward active counter-radar measures.

Weaponized payloads log mid-single-digit growth, buoyed by miniaturized glide munitions and loitering warheads. Imaging payloads gain from AI-powered automatic-target-recognition algorithms, easing operator workload. Communications and datalinks struggle with RF congestion, yet demand persists for L-band and S-band relays that guarantee resilient mesh networks in swarms. Niche "other" payloads-chemical detection, cyber-exfiltration kits-capture small but strategic orders.

Propulsion and power retained a 37.85% share in 2024, reflecting their status as the primary cost element. Heavy-fuel engines, hybrid generators, and high-voltage distribution harnesses dominate procurement. Conversely, flight-control software and hardware will grow 11.23% annually, the highest among subsystems, as autonomy drives procurement. The UAV payload and subsystems market size tied to flight-control suites is projected at USD 2.1 billion by 2030, up from USD 1.2 billion in 2025. Draper's guidance package on Stratolaunch's Talon-A1 shows how advanced control laws enable hypersonic profiles.

Navigation and guidance modules blend MEMS inertial sensors with celestial and terrain-referenced updates to maintain precision without GNSS. Honeywell's Compact Inertial Navigation System delivers centimeter accuracy, widening mission envelopes. Communications subsystems pivot toward open-architecture radios with anti-jam modes. Automated launch-and-recovery gear is evolving rapidly to support dispersed operations from roads or naval decks.

The UAV Payload and Subsystems Market Report is Segmented by Payload Type (Sensors, Weaponry, and More), Subsystem Type (Propulsion and Power, and More), UAV Class (Nano and Micro UAVs, Mini UAVs, and More), End User (Military and Law Enforcement), Application (Combat and Strike, Logistics, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's mature defense ecosystem delivered 35.45% of global revenue in 2024. The region benefits from robust R&D and E funding, joint industry-government labs, and clear acquisition roadmaps. The UAV payload and subsystems market leverages volume programs such as MQ-25, XQ-58, and collaborative-combat-aircraft prototypes, ensuring stable OEM order books.

Asia-Pacific registers the steepest 9.75% CAGR. Rising territorial tensions spur indigenous development programs across China, India, Japan, and South Korea. Joint-venture factories in India produce heavy-fuel engines and composite wings, while Singapore's defense-research agency co-develops AI-navigation chips with local SMEs. Government offsets mandate local content, encouraging supplier footprints across the region.

Europe ranks third by value, sustained by NATO interoperability mandates. The Eurodrone MALE initiative and loyal-wingman projects in the United Kingdom and Italy anchor demand for sensor and EW payloads certified to STANAG standards. However, stringent export rules occasionally hamper third-country sales.

The Middle East shows lumpy yet significant demand tied to rapid capabilities acquisition. Saudi Arabia and the UAE invest in localized final-assembly lines to secure technology transfer, while Israel's component suppliers continue exporting radar, EO-IR, and datalink kits. Africa remains nascent and limited by fiscal constraints, but is adopting affordable Chinese and Turkish tactical models for border security.

- AeroVironment, Inc.

- BAE Systems plc

- Elbit Systems Ltd.

- Teledyne Technologies Incorporated

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Textron Systems Corporation (Textron Inc.)

- The Boeing Company

- General Atomics Aeronautical Systems Inc. (General Atomics)

- RTX Corporation

- Thales Group

- Saab AB

- Leonardo S.p.A

- Kratos Defense & Security Solutions, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding defense ISR budgets

- 4.2.2 On-board AI processors for contested environments

- 4.2.3 Swarm concepts driving interoperable comms subsystems

- 4.2.4 Modular Open-Systems Architecture (MOSA) mandates

- 4.2.5 Geopolitical tensions driving procurement acceleration

- 4.2.6 Shift toward domestic manufacturing capabilities

- 4.3 Market Restraints

- 4.3.1 Export-control and flight-regulation hurdles

- 4.3.2 Weight-power trade-offs limiting endurance

- 4.3.3 RF-spectrum congestion affects datalinks

- 4.3.4 Rare-earth supply risks for advanced sensors

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Payload Type

- 5.1.1 Sensors

- 5.1.2 Weaponry

- 5.1.3 Communications and Datalinks

- 5.1.4 Electronic Warfare (EW) Systems

- 5.1.5 Imaging and Mapping Systems

- 5.1.6 Other Payloads

- 5.2 By Subsystem Type

- 5.2.1 Propulsion and Power

- 5.2.2 Flight Control Systems (FCS)

- 5.2.3 Navigation and Guidance

- 5.2.4 Communications and Datalinks

- 5.2.5 Launch and Recovery Systems

- 5.3 By UAV Class

- 5.3.1 Nano and Micro UAVs (Less than 2 kg)

- 5.3.2 Mini UAVs (2 to 20 kg)

- 5.3.3 Tactical UAVs (20 to 150 kg)

- 5.3.4 MALE

- 5.3.5 HALE

- 5.3.6 Fixed-Wing VTOL UAVs

- 5.4 By End User

- 5.4.1 Military

- 5.4.2 Law Enforcement

- 5.5 By Application

- 5.5.1 Intelligence, Surveillance, and Reconnaissance (ISR)

- 5.5.2 Combat/Strike

- 5.5.3 Logistics

- 5.5.4 Search and Rescue (SAR)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 France

- 5.6.2.3 Germany

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Israel

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AeroVironment, Inc.

- 6.4.2 BAE Systems plc

- 6.4.3 Elbit Systems Ltd.

- 6.4.4 Teledyne Technologies Incorporated

- 6.4.5 Israel Aerospace Industries Ltd.

- 6.4.6 L3Harris Technologies, Inc.

- 6.4.7 Lockheed Martin Corporation

- 6.4.8 Northrop Grumman Corporation

- 6.4.9 Textron Systems Corporation (Textron Inc.)

- 6.4.10 The Boeing Company

- 6.4.11 General Atomics Aeronautical Systems Inc. (General Atomics)

- 6.4.12 RTX Corporation

- 6.4.13 Thales Group

- 6.4.14 Saab AB

- 6.4.15 Leonardo S.p.A

- 6.4.16 Kratos Defense & Security Solutions, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment