PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844565

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844565

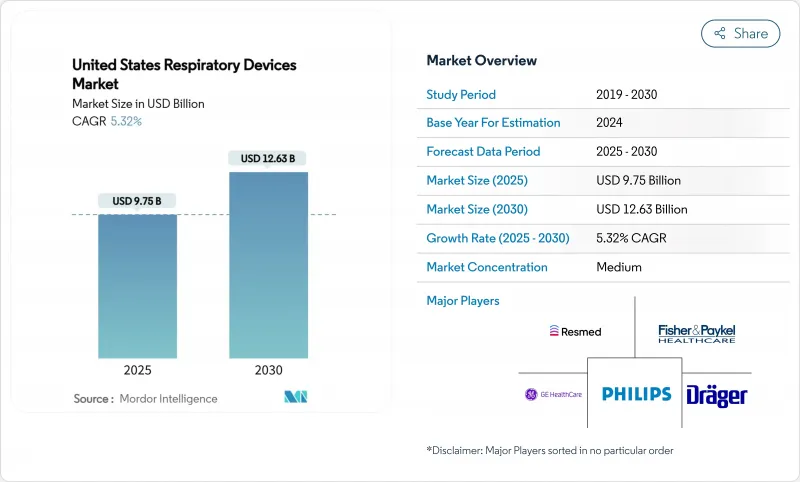

United States Respiratory Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States Respiratory Devices Market size is estimated at USD 9.75 billion in 2025, and is expected to reach USD 12.63 billion by 2030, at a CAGR of 5.32% during the forecast period (2025-2030).

Demand growth follows rising chronic respiratory disease prevalence, an aging population that prefers treatment at home, and the Centers for Medicare & Medicaid Services (CMS) widening reimbursement for home oxygen therapy and non-invasive ventilation. Intensifying wildfire seasons, particularly in western states, elevate consumer interest in air-purifying respiratory products, while artificial-intelligence (AI) algorithms embedded in diagnostic tools speed time-to-care and improve clinical accuracy. Concurrently, recall-driven quality scrutiny compels manufacturers to invest in safer materials and smarter sensors, sharpening the competitive focus on patient safety. Moderate industry consolidation persists as leading brands acquire digital-health start-ups to integrate hardware, software, and data analytics into unified care platforms.

United States Respiratory Devices Market Trends and Insights

Rising COPD & Asthma Prevalence Among U.S. Adults

COPD affects 12.5 million diagnosed adults and asthma affects 26.8 million Americans, with prevalence peaking in southeastern and midwestern counties. State-level COPD rates vary from 3% in Hawaii to 12% in West Virginia, mirroring disparities in environmental exposures and healthcare access. COPD mortality spans 41-171 deaths per 100,000 adults, underscoring the ongoing therapeutic burden. These epidemiologic patterns fuel demand for nebulizers, oxygen concentrators, and digital inhalers capable of predicting exacerbations by monitoring inspiratory flow metrics. Annual direct and indirect asthma costs near USD 80 billion, intensifying payer interest in cost-effective home-based respiratory solutions.

Aging Demographics and Home-care Shift

Nearly one quarter of Americans will be 65 years or older by 2060, prompting a structural shift toward in-home therapy and remote patient monitoring. Medicare beneficiaries recorded over 240k COPD-related hospitalizations in recent times, amplifying the need for portable oxygen concentrators and home ventilators. Remote patient monitoring users already number about 50 million and are expected to double by the end of the decade as reimbursement aligns with value-based care incentives. The Patient-Driven Groupings Model increases operational complexity but rewards providers that demonstrate measurable outcome improvements using connected respiratory platforms. Long-term mechanical ventilation cases more than doubled over two decades, tightening capacity in post-acute facilities and driving investment in home-compatible ventilators.

High Up-front Cost & Hospital Capital Budget Cycles

Most U.S. hospitals allocate major equipment purchases once per fiscal year, extending replacement decisions 12-18 months and deferring acquisition of advanced ventilators and imaging-grade ultrasound devices. A 2.93% payment cut in the 2025 Physician Fee Schedule compresses operating margins, especially in rural facilities with thin cash reserves. Value-based reimbursement requires clear clinical-outcome evidence for capital requests, raising the bar for device makers to supply real-world data. Although COPD's annual economic toll nears USD 50 billion, the longer payback period for sophisticated diagnostics can slow adoption, particularly where patient volumes are modest. Manufacturers offer leasing and per-use subscription models to mitigate sticker shock, but uptake remains mixed outside large health systems.

Other drivers and restraints analyzed in the detailed report include:

- CMS Reimbursement Expansion for Home Oxygen Therapy & NIV

- Uptake of Smart, Connected Respiratory Devices via Tele-health

- Stringent FDA Approval Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutic devices commanded 46.54% of the 2024 United States respiratory devices market, anchored by positive airway pressure (PAP) systems and home ventilators that address both chronic and acute conditions. The installed base generates high-margin consumables demand, while AI-driven adherence algorithms elevate therapeutic efficacy. Diagnostic & monitoring devices remain the fastest-growing category at a 6.65% CAGR through 2030 as FDA-cleared home-use spirometers and AI auscultation software migrate testing from clinics to living rooms. Disposables retain steady uptake because masks, filters, and breathing circuits require periodic replacement, ensuring recurring revenue.

A key growth inflection stems from vibrating mesh nebulizers that deliver superior deposition in COPD therapy, prompting formulary inclusion by major payers. Portable oxygen concentrators integrate cloud connectivity, allowing clinicians to titrate flow remotely and aligning with home-care trends. Diagnostic smart patches that track respiratory rate and sleep motion shorten sleep-apnea diagnosis cycles. Combined, these factors add incremental value to the United States respiratory devices market size while intensifying competition around data-driven user experiences.

The United States Respiratory Devices Market Report is Segmented by Product Type (Diagnostic & Monitoring Devices, Therapeutic Devices, Disposables), Indication (COPD, Asthma, Sleep Apnea, Infectious Diseases, Other Respiratory Disorders), End User (Hospitals & Clinics, Home-Care Settings, and More), and Geography (Northeast, Midwest, Southeast, West, Southwest). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Koninklijke Philips

- Resmed

- Fisher & Paykel Healthcare

- Medtronic

- GE Healthcare

- Dragerwerk AG

- Getinge

- Baxter

- Vyaire Medical

- Hamilton Medical

- Beijing Aeonmed Co. Ltd.

- Mindray

- React Health

- Medical Depot, Inc.

- Asahi Kasei

- AirLife

- Flexicare (Group) Limited (Allied Medical LLC)

- Teleflex

- OMRON Healthcare, Inc

- ICU Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising COPD & Asthma Prevalence Among U.S. Adults

- 4.2.2 Aging Demographics and Home-care Shift

- 4.2.3 CMS Reimbursement Expansion for Home Oxygen Therapy & NIV

- 4.2.4 Uptake of Smart, Connected Respiratory Devices via Tele-health

- 4.2.5 Growth of Ambulatory Surgical Centers Driving Portable Ventilation

- 4.2.6 Wild-fire Smoke Episodes Elevating Home Airway-Care Demand

- 4.3 Market Restraints

- 4.3.1 High Up-front Cost & Hospital Capital Budget Cycles

- 4.3.2 Stringent FDA Approval Timelines

- 4.3.3 Recalls & Safety Concerns Undermining Brand Trust

- 4.3.4 Limited Awareness of Early Diagnosis

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 Spirometers

- 5.1.1.2 Sleep Test Devices

- 5.1.1.3 Peak Flow Meters

- 5.1.1.4 Pulse Oximeters

- 5.1.1.5 Capnographs

- 5.1.1.6 Other Diagnostic & Monitoring Devices

- 5.1.2 Therapeutic Devices

- 5.1.2.1 CPAP Devices

- 5.1.2.2 BiPAP Devices

- 5.1.2.3 Humidifiers

- 5.1.2.4 Nebulizers

- 5.1.2.5 Oxygen Concentrators

- 5.1.2.6 Ventilators (Invasive, Non-invasive)

- 5.1.2.7 Inhalers (MDI, DPI, Soft-Mist)

- 5.1.2.8 Other Therapeutic Devices

- 5.1.3 Disposables

- 5.1.3.1 Masks (CPAP, Oxygen, Nebulizer)

- 5.1.3.2 Breathing Circuits

- 5.1.3.3 Filters & Cannulas

- 5.1.3.4 Other Disposables

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Indication

- 5.2.1 COPD

- 5.2.2 Asthma

- 5.2.3 Sleep Apnea

- 5.2.4 Infectious Diseases

- 5.2.5 Other Respiratory Disorders

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Home-care Settings

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Emergency & Trauma Centers

- 5.3.5 Long-Term Care Facilities

- 5.4 By Region

- 5.4.1 Northeast

- 5.4.2 Midwest

- 5.4.3 Southeast

- 5.4.4 West

- 5.4.5 Southwest

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 ResMed

- 6.3.3 Fisher & Paykel Healthcare Ltd

- 6.3.4 Medtronic plc

- 6.3.5 GE HealthCare

- 6.3.6 Dragerwerk AG

- 6.3.7 Getinge

- 6.3.8 Baxter

- 6.3.9 VYAIRE

- 6.3.10 Hamilton Medical

- 6.3.11 Beijing Aeonmed Co. Ltd.

- 6.3.12 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.13 React Health

- 6.3.14 Medical Depot, Inc.

- 6.3.15 Asahi Kasei Corporation (ZOLL Medical Corporation)

- 6.3.16 AirLife

- 6.3.17 Flexicare (Group) Limited (Allied Medical LLC)

- 6.3.18 Teleflex Incorporated

- 6.3.19 OMRON Healthcare, Inc

- 6.3.20 ICU Medical, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment