PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844569

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844569

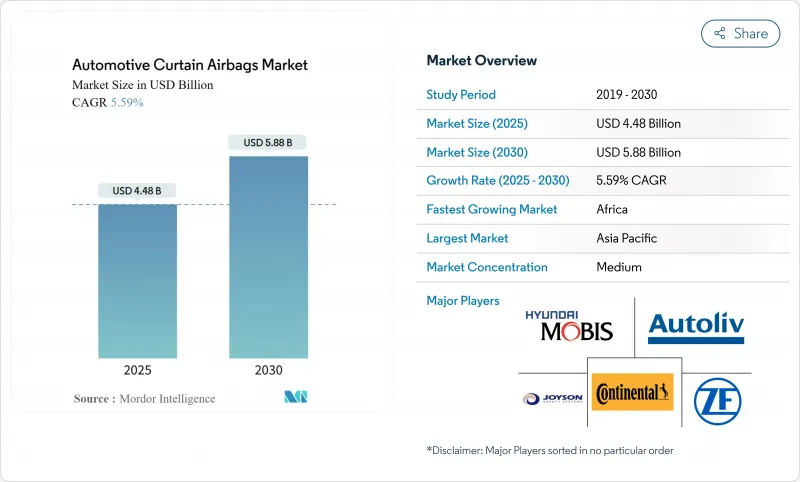

Automotive Curtain Airbags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive curtain airbags market size stands at USD 4.48 billion in 2025 and is projected to reach USD 5.88 billion by 2030, registering a 5.59% CAGR.

This momentum reflects the convergence of stringent global side-impact legislation, the boom in sport-utility vehicle (SUV) deliveries, and the packaging freedom created by electric-vehicle (EV) skateboard platforms . Mandatory compliance with FMVSS 214, Euro NCAP far-side protocols, and GTR 14 forces every volume carmaker to embed roof-rail curtains in both developed and emerging markets, accelerating standard fitment rates. Consumer demand for five-star crash scores across India, Brazil, and the ASEAN bloc intensifies OEM focus on full-length curtains, while joint ventures such as Toyobo-Indorama's nylon-6,6 weaving plant in Thailand mitigate fabric tightness that previously throttled production. Rollover-oriented SUV lines and expansive crossover portfolios thus become the single largest absorption channel for Automotive curtain airbags market deployments worldwide.

Global Automotive Curtain Airbags Market Trends and Insights

Stringent Side-Impact & Rollover Regulations Drive Global Adoption

Global Technical Regulation 14 aligns head-injury criteria across markets and forces OEMs to specify curtain airbags on every platform, not just export trims. Australia's new side-impact rule lowered occupant fatalities by 30% once curtain deployment became compulsory. Earlier, NHTSA projected its side-airbag mandate would save 311 lives per year-a target now verified through empirical crash-database reviews. With India moving toward mandatory six-airbag legislation and Brazil's NCAP tying star ratings to roof-rail curtains, suppliers benefit from a regulatory cascade that eliminates optional-equipment status for side curtains. Consequently, volume commitments for fabric, inflators, and initiators stay locked years in advance, safeguarding capacity utilization even in cyclical downturns.

Rising Global SUV & CUV Penetration Increases Roof-Rail Fitment

SUV deliveries represent the fastest-growing light-vehicle category, a trend that directly lifts per-vehicle curtain count. Ford's 15-ft-long, five-row airbag points to the engineering leap required to safeguard occupants in stretched vans and three-row crossovers. Insurance Institute for Highway Safety data corroborate a 37% drop in driver deaths when head-protecting curtains deploy. China's domestic SUV boom and India's migration from hatchbacks to compact SUVs assure a multi-year uplift in curtain volumes, further embedding this driver in global demand curves.

Recalls & Litigations from Inflator Defects Raise Risk Premium

NHTSA's 2024 recall of 298,700 Chrysler and Dodge sedans for Side Airbag Inflatable Curtain rupture risk revived public anxiety around shrapnel injuries. Legal settlements inflate supplier insurance premiums, while OEMs lengthen validation protocols, adding cost and delaying model launches. BMW, Kia, and Toyota faced similar curtain-related recalls in 2024-2025, reinforcing investor caution in the Automotive curtain airbags industry.

Other drivers and restraints analyzed in the detailed report include:

- Integration of ADAS with Passive Safety Suites

- Consumer Demand for 5-Star NCAP Ratings in Emerging Economies

- Price Pressure on Entry-Level Models Limits Standardization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Head-only curtains secured 51.25% of the Automotive curtain airbags market share in 2024, supported by a proven 31% fatality reduction in side-impact crashes. Regulatory agencies continue to weigh head-injury criteria heavily, ensuring perennial demand. Combo curtains, which merge head and torso coverage in a single module, log an 8.31% CAGR through 2030 and gain traction in premium three-row SUVs seeking simpler bill-of-material counts.

Manufacturers refine weaving density and vent-hole geometry to sustain six-second inflation, protecting occupants against secondary hits in multi-roll incidents. Autoliv's latest three-row design spans 2.5 m and deploys in 35 ms, illustrating how suppliers address cabin length growth. As Chinese MPV platforms stretch to court ride-hailing services, ultra-long curtains promise the next adoption wave for the Automotive curtain airbags market.

SUVs accounted for 44.36% of the Automotive curtain airbags market size in 2024 and are on pace for a 9.12% CAGR. Their high center of gravity increases rollover exposure, necessitating extended roof-rail coverage. Crossovers in the B- and C-segments sell briskly in China, India, and the United States, pushing suppliers to develop low-profile modules that clear panoramic-sunroof frames.

Sedans decline gradually, yet regional tastes in Japan and South Korea maintain steady curtain demand for compact four-doors. Pickup trucks and MPVs create lucrative niches; Ford's commercial van curtain illustrates the complexity of spanning five seating rows without compromising deployment timing. EV SUVs bring new engineering variables: floor batteries stiffen side sills, transferring intrusion force upward, so curtains must remain inflated longer to prevent head contact with shattered glass.

The Global Automotive Curtain Airbags Market is Segmented by Curtain Airbag Type (Torso Curtain Airbags, Head Curtain Airbags and More), Vehicle Type (Hatchback, Sedan, Sports Utility Vehicles, and More), End User (OEM and Aftermarket), Inflator Technology (Pyrotechnic, Stored Gas, and More), Sales Channel (Traditional Dealerships and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the Automotive curtain airbags market with 46.18% revenue share in 2024, driven by China's large production base and India's regulatory push for six airbags. Domestic OEMs such as Geely and Maruti embed full-length curtains even in sub-USD 10,000 hatches to meet export targets. Japan's pyrotechnic expertise propels propellant chemistry breakthroughs at Daicel, which supplies hybrid inflators worldwide. South Korea pairs ADAS algorithms with passive systems to refine deployment timing across premium electric vehicle (EV) lineups.

North America remains pivotal through FMVSS 214 compliance and strong SUV sales. United States Level-4 autonomy pilots promote low-temperature hybrid inflators, giving suppliers a proving ground for extreme-climate solutions. Mexico's assembly plants adopt identical curtain specifications for cross-border models, streamlining tier-one tooling. Canada supports module sub-assembly under regional parts-content rules, adding value to its auto sector.

Europe emphasizes sustainability and technology integration. Germany's premium EV expansion drives advanced vent-hole metering, while France and Italy encourage mechanical stitching that enables rapid post-crash deflation to aid emergency access. Africa, while starting from a lower base, is the fastest-growing region with a 6.18% CAGR through 2030. South African CKD plants integrate dual-stage curtains aligned with EU export homologation. Kenya and Nigeria launch used-vehicle import restrictions, compelling new-car sales that bundle full safety suites. GCC states adopt UN R135, obliging Japanese and US SUV imports to include head-protecting curtains at customs inspection.

- Autoliv Inc.

- Joyson Safety Systems

- ZF Friedrichshafen AG

- Continental AG

- Hyundai Mobis Co. Ltd

- Toyoda Gosei Co. Ltd

- Daicel Corporation

- ARC Automotive Inc.

- iSi Automotive GmbH

- Ashimori Industry Co. Ltd

- Nihon Plast Co. Ltd

- Porcher Industries SA

- Toray Industries Inc.

- East Joy Long Motor

- Neaton Auto Products

- Sumitomo Corporation

- TRW Automotive Holdings Corp.

- Visteon Corporation

- Bosch Passive Safety Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Side-Impact & Rollover Regulations (FMVSS 214, Euro NCAP, GTR 14)

- 4.2.2 Rising Global SUV & CUV Penetration Increasing Roof-Rail Airbag Fitment

- 4.2.3 Integration of ADAS/Active Safety Suites Boosting Passive Safety Content

- 4.2.4 Consumer Demand for 5-Star NCAP Ratings in Emerging Economies

- 4.2.5 EV Skateboard Platforms Freeing Packaging Space for Larger Curtain Airbags

- 4.2.6 Low-Temperature Hybrid Inflators Enabling Safe OOP Deployment in Robo-Taxis

- 4.3 Market Restraints

- 4.3.1 Recalls & Litigations From Inflator Defects (Takata, ARC) Raise Risk Premium

- 4.3.2 Price Pressure on Entry-Level Models Limits Standardisation in Low-Cost Cars

- 4.3.3 Nylon-6,6 Fabric & Initiator Supply Shortages Causing OEM Production Delays

- 4.3.4 Structural Battery Packs in EVs Offering Alternative Side-Impact Protection

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Curtain Airbag Type

- 5.1.1 Torso Curtain Airbags

- 5.1.2 Head Curtain Airbags

- 5.1.3 Combo Curtain Airbags

- 5.2 By Vehicle Type

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 Sports Utility Vehicle

- 5.2.4 Pick-up Trucks & MPVs

- 5.3 By End User

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Inflator Technology

- 5.4.1 Pyrotechnic

- 5.4.2 Stored Gas

- 5.4.3 Hybrid / Low-temperature Hybrid

- 5.5 By Sales Channel

- 5.5.1 Traditional Dealerships

- 5.5.2 Online & Direct-to-Consumer

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Morocco

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 6.4.1 Autoliv Inc.

- 6.4.2 Joyson Safety Systems

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Continental AG

- 6.4.5 Hyundai Mobis Co. Ltd

- 6.4.6 Toyoda Gosei Co. Ltd

- 6.4.7 Daicel Corporation

- 6.4.8 ARC Automotive Inc.

- 6.4.9 iSi Automotive GmbH

- 6.4.10 Ashimori Industry Co. Ltd

- 6.4.11 Nihon Plast Co. Ltd

- 6.4.12 Porcher Industries SA

- 6.4.13 Toray Industries Inc.

- 6.4.14 East Joy Long Motor

- 6.4.15 Neaton Auto Products

- 6.4.16 Sumitomo Corporation

- 6.4.17 TRW Automotive Holdings Corp.

- 6.4.18 Visteon Corporation

- 6.4.19 Bosch Passive Safety Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment