PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844576

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844576

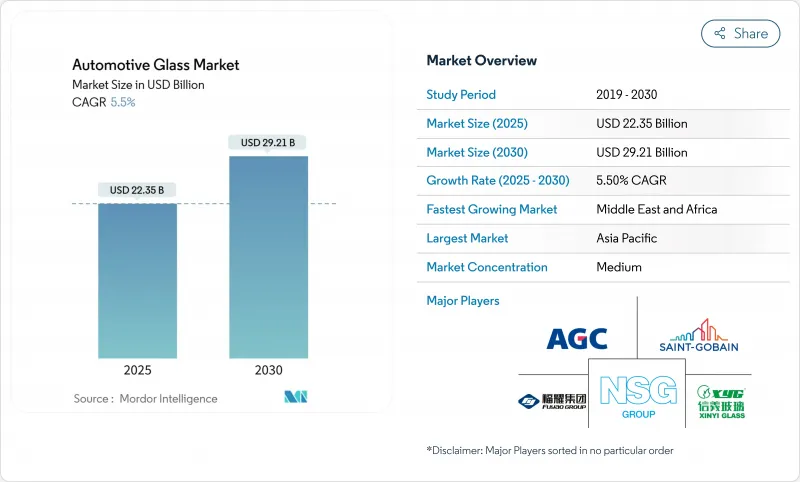

Automotive Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive glass market size stands at USD 22.35 billion in 2025 and is projected to reach USD 29.21 billion by 2030, reflecting a steady 5.5% CAGR during the forecast period (2025-2030).

Rising vehicle production, stricter safety mandates, and the shift toward electric mobility are sustaining momentum even as raw-material prices and logistics costs fluctuate. Growing demand for panoramic roofs, lightweight laminated windshields, and electrochromic glazing is encouraging manufacturers to scale specialized lines and deepen partnerships with OEMs. The emphasis on larger glass surfaces in SUVs, coupled with regulatory pressure to cut CO2 emissions, is accelerating the adoption of coated and multi-functional products. Together, these forces position the automotive glass market for resilient, technology-led growth through the decade.

Global Automotive Glass Market Trends and Insights

Shift Toward Panoramic Glazing In EV Platforms

Electric-vehicle makers are installing larger roof panes to enhance cabin ambience and brand identity. Tesla's Cybertruck and Mercedes-Benz's Vision V concept integrate electrochromic roofs that modulate tint levels, cutting cabin temperatures by up to 18°F and lowering HVAC loads. Glass area per vehicle is forecast to surge, prompting suppliers to invest in wide-format bending, low-E coatings, and infrared-absorbing interlayers. This premium specification is expected to permeate mid-priced EVs as production costs fall, supporting sustained growth in the automotive glass market.

OEM Demand For Lightweight Laminated Glass To Meet CO2 Targets

European regulations set a 100 g/km fleet-average CO2 goal for 2030, pushing automakers to shave every kilogram. EPA studies of the 2017 Ford GT show laminated glazing contributed materially to a 30% mass drop. Thin-gauge laminates using ionoplast interlayers now trim weight by up to 30% without compromising impact performance. AGC and Saint-Gobain are commercializing 1.6-mm windshield constructions that pair weight savings with acoustic damping, reinforcing long-term prospects for the automotive glass market.

Supply-Chain Crunch Of Specialty Interlayers (PVB, Ionoplast)

Kuraray's PVB capacity expansions have not kept pace with rising demand for acoustic and HUD-grade films, extending lead times and forcing allocation programs. European laminators report spot shortages, compelling them to prioritize OEM production over aftermarket orders. Experimental bio-based interlayers deliver promising mechanical gains of 53.1% but remain years from scale. Short-term supply stress may temper automotive glass market growth until new plants start up.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Sunroof Penetration In SUVs

- Regulation-Led Mandatory Safety Glazing For Side Windows

- Margin Erosion From Chinese Float-Glass Overcapacity Flooding EU Market

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Regular glass commanded 82.70% of the automotive glass market share in 2024, thanks to cost efficiency and entrenched production assets. Laminated variants are gaining against tempered formats because they keep shards intact on impact, satisfying global safety norms. The shift tightens the supply of specialty interlayers, yet it positions laminators for higher value capture as OEMs demand thinner, lighter constructions. Smart glass, though only a minority today, is projected to post a 12.8% CAGR, carving out niches in luxury vehicles and high-end EVs.

Electrochromic roofs dominate early adoption; suspended particle devices (SPD) deliver faster switching and durability, as shown in Mercedes-Benz's Vision V prototype. Polymer-dispersed liquid crystal (PDLC) windows target privacy partitions, while thermochromic films remain pre-commercial. As economies of scale improve, smart glass will expand beyond flagships, bolstering the automotive glass market.

Windshields held 44.60% of the automotive glass market size in 2024, underpinned by mandatory fitment and rising ADAS sensor content. Complexity drives up unit value, reinforcing supplier-OEM co-development cycles. Sunroofs, however, are the fastest-growing application at 10.2% CAGR as SUVs standardize large openings for panoramic vistas.

Backlites see modest traction from acoustic laminates, though warranty issues temper speed. Sidelites transition to laminated construction to meet ejection-prevention laws, especially in Europe and Japan. Rear-view mirrors and quarter windows integrate electrochromic anti-glare coatings, adding feature content without large area demand. Collectively, the application mix underpins steady expansion in the automotive glass market.

The Automotive Glass Market Report is Segmented by Glass Type (Regular Glass and Smart Glass), Application (Windshield, Sunroof and More), Vehicle Type (Passenger Cars, and More), Propulsion (Internal Combustion Engine, Battery Electric Vehicle (BEV), and More), Sales Channel (OEM, and Aftermarket), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated the automotive glass market, with 49.20% of the revenue in 2024, anchored by China's vast output and rapid domestic uptake. Government incentives have kept plants near capacity, while India's production climb adds a fresh demand axis. Conferences in Shanghai spotlight intelligent glazing, LiDAR transparency, and AR-HUD integration, showcasing continual innovation. Japan and South Korea supply advanced laminated and coated products for premium OEMs, preserving high-margin niches as part of the broader automotive glass market.

Producers combat margin squeeze from Chinese imports by pivoting into smart glass and sustainability programs. AGC and Saint-Gobain's joint Volta furnace evidences a strategic move to slash CO2 intensity. Meanwhile, North America remains influential due to the demand for SUVs. The United States features vibrant aftermarket activity; brands such as Auto Glass Now scale national footprints to capture replacement revenue.

The Middle East and Africa are expected to be the fastest climbers at 7.1% CAGR through 2030. Saudi Arabia's silica-rich deposits attract float-glass investments intended to localize supply. Subsidies aligned with broader industrial-diversification agendas incentivize auto-component production, broadening the region's stake in the automotive glass market. South America's outlook is tied chiefly to Brazilian assembly volumes, while Africa's growth centers on South Africa's relatively mature sector. Proximity production strategies help global suppliers balance freight costs and just-in-time expectations across these varied geographies.

- AGC Inc. (Asahi Glass)

- Saint-Gobain S.A.

- Nippon Sheet Glass Co. Ltd.

- Fuyao Glass Industry Group Co. Ltd.

- Xinyi Glass Holdings Ltd.

- Guardian Automotive (Koch Industries)

- Webasto SE

- Carlex Glass America LLC

- Magna International Inc.

- Vitro Automotive

- Corning Incorporated

- Sisecam Automotive

- Shanghai Yaohua Pilkington Glass

- Gentex Corporation

- AGP Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift Toward Panoramic Glazing In EV Platforms

- 4.2.2 OEM Demand For Lightweight Laminated Glass To Meet CO2 Targets

- 4.2.3 Rapid Sunroof Penetration In SUVs

- 4.2.4 Regulation-Led Mandatory Safety Glazing For Side Windows

- 4.2.5 Growing Retrofit Of HUD-Compatible Windshields By Premium OEMs

- 4.2.6 Integration Of Embedded Sensors For ADAS Functionality

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Crunch Of Specialty Interlayers (PVB, Ionoplast)

- 4.3.2 Margin Erosion From Chinese Float-Glass Overcapacity Flooding EU Market

- 4.3.3 High Warranty Costs Linked To Acoustic Laminated Backlights In SUVs

- 4.3.4 Slow Replacement Cycles In Mature Aftermarket Channels

- 4.4 Value-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 OEM vs. Aftermarket Trend Analysis

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Glass Type

- 5.1.1 Regular Glass

- 5.1.1.1 Laminated Glass

- 5.1.1.2 Tempered Glass

- 5.1.2 Smart Glass

- 5.1.2.1 Electrochromic

- 5.1.2.2 Suspended Particle Device (SPD)

- 5.1.2.3 Polymer Dispersed Liquid Crystal (PDLC)

- 5.1.2.4 Thermochromic

- 5.1.1 Regular Glass

- 5.2 By Application

- 5.2.1 Windshield

- 5.2.2 Backlite (Rear Window)

- 5.2.3 Sidelite (Side Windows)

- 5.2.4 Sunroof

- 5.2.5 Rear-view & Side-view Mirrors

- 5.2.6 Other Glazing (Quarter & Vent)

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.1.1 Hatchback

- 5.3.1.2 Sedan

- 5.3.1.3 SUV & Crossover

- 5.3.1.4 Luxury & Sports

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.1 Passenger Cars

- 5.4 By Propulsion

- 5.4.1 Internal Combustion Engine (ICE)

- 5.4.2 Battery Electric Vehicle (BEV)

- 5.4.3 Hybrid Electric Vehicle (HEV/PHEV)

- 5.4.4 Fuel Cell Electric Vehicles (FCEV)

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 AGC Inc. (Asahi Glass)

- 6.4.2 Saint-Gobain S.A.

- 6.4.3 Nippon Sheet Glass Co. Ltd.

- 6.4.4 Fuyao Glass Industry Group Co. Ltd.

- 6.4.5 Xinyi Glass Holdings Ltd.

- 6.4.6 Guardian Automotive (Koch Industries)

- 6.4.7 Webasto SE

- 6.4.8 Carlex Glass America LLC

- 6.4.9 Magna International Inc.

- 6.4.10 Vitro Automotive

- 6.4.11 Corning Incorporated

- 6.4.12 Sisecam Automotive

- 6.4.13 Shanghai Yaohua Pilkington Glass

- 6.4.14 Gentex Corporation

- 6.4.15 AGP Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment