PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844583

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844583

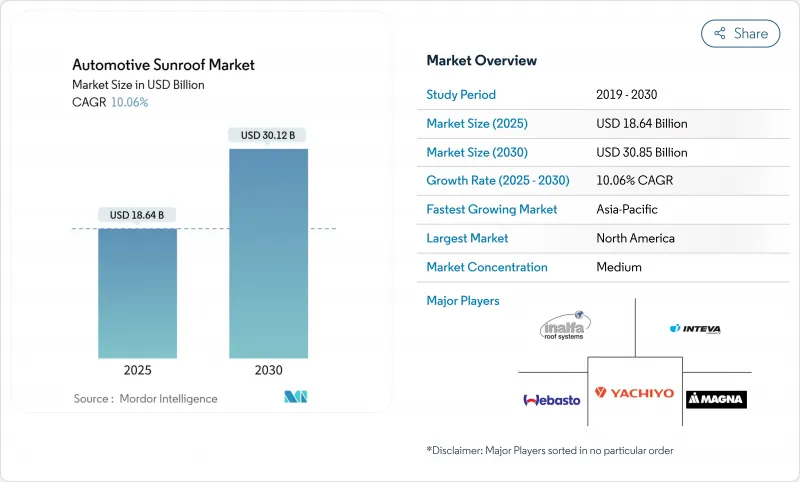

Automotive Sunroof - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Sunroof Market holds a value of USD 18.64 billion in 2025 and is forecast to reach USD 30.12 billion by 2030, expanding at a 10.06% CAGR.

Over the next five years, demand will increase as panoramic systems move from luxury vehicles into mid-segment models, helped by cost-down learning curves, modular platform engineering, and aggressive trim-line packaging by volume brands. Growth also reflects a structural shift toward SUVs, wider battery-electric vehicle (BEV) penetration that favors fixed glass roofs for thermal management, and rapid adoption of electrochromic smart glass that mitigates heat and glare. Beyond product pull, regional cost advantages in Asia-Pacific, North American consumer preference for large vehicles, and regulatory drives toward lightweight materials reinforce the upward trajectory. Suppliers that combine high-volume manufacturing with smart-glass partnerships are positioned to capture incremental value, even as new challenges arise from architectural clashes between roof glass and autonomous driving sensors

Global Automotive Sunroof Market Trends and Insights

SUV Mix Shift in OEM Production Plans

Global assembly schedules tip toward SUVs, whose taller rooflines can accept larger glass apertures without compromising rollover ratings. Between fiscal 2019 and 2024, the share of Indian SUVs doubled, and similar mixed gains appeared in North America and Europe. Electric SUVs add impetus because battery packs demand flat under-floors, letting designers exploit expansive roof panels for a lounge-like cabin. Engineering sunroof openings in the earliest body-in-white phase reduces later rework; thus, OEM programme charters now include sunroof attachment points by default. Tier-1 suppliers such as Inalfa respond by installing dedicated SUV roof-line welding cells and tooling, boosting annual capacity beyond 6 million units to keep pace with booking schedules.

EV OEM Adoption of Solar-Integrated Roofs

Photovoltaic roof modules deliver trickle charge to 12-volt batteries and cabin electronics, offsetting parasitic drain in battery-electric vehicles. Earlier, it would be a 2-3 km daily recovery range under high-irradiance conditions, enough to win eco-conscious buyers. Tesla pilots reinforced consumer awareness, and Mercedes' concept sedans integrate multi-junction cells beneath laminated safety glass. Although production complexity rises, premium margins and environmental branding justify near-term deployment. Suppliers collaborate with solar-cell specialists to ensure durability against vibration and hail impact. As unit economics improve, niche adoption is expected to expand into fleet and ride-hail BEVs that remain parked outdoors for long stretches.

High Installation and Warranty Cost

Total bill-of-materials and labor for a factory-fitted sunroof can equal 3-5% of a small car's retail price, creating a hurdle in emerging economies where value perception is acute. Precision tooling and extensive leak testing lengthen takt times on final assembly lines. Warranty liabilities stretch over the vehicle's lifespan, forcing OEMs to over-engineer seals and drainage channels. Electrochromic glass and solar cells add electronics that must survive vibration and thermal cycles, further inflating field-failure reserves. While suppliers such as Inalfa leverage economies of scale to trim variable costs, initial outlays remain material enough to slow penetration in entry-level models.

Other drivers and restraints analyzed in the detailed report include:

- Premium-Feature Pull in Mid-Segment Cars

- Innovations in Laminated and Electro-Chromic Glass

- Leakage / NVH concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glass retained an 86.52% share of the automotive sunroof market in 2024 thanks to optical clarity, scratch resistance, and established float-glass supply chains. The segment accounted for the majority of glazing exports from AGC and Fuyao. Yet, fabric and polycarbonate alternatives are climbing at a 15.25% CAGR as OEMs chase every kilogram of mass reduction in electric crossovers. Fabric modules shave up to 20 kg per roof and improve center-of-gravity height, a critical factor for roll-stability algorithms.

Polycarbonate adoption also meets tougher pedestrian-protection rules by flexing under head-form impact, a design that rigid glass cannot match. Early tooling costs remain higher, but modular inserts compatible with existing stampings ease transition. Over time, the lightweight materials' automotive sunroof market size should expand as battery packs grow and range anxiety forces aggressive mass targets. Traditional glass suppliers invest in hybrid-laminate lines to hedge against displacement risk, while aerospace composite firms explore co-curing carbon fiber frames with polycarbonate skins for ultra-luxury nameplates. This competitive interplay keeps margins under pressure but accelerates material science breakthroughs.

Panoramic roofs captured 64.25% of the automotive sunroof market in 2024 and deliver the fastest 17.31% CAGR outlook, buoyed by customers who equate larger glass with upscale ambience. Two-pane setups run nearly full length, offering second-row passengers the same sky view once reserved for front occupants. BEV architectures accommodate these spans because battery packs strengthen floorpan torsion, reducing roof-cut rigidity penalties.

For automakers, differentiating a compact SUV with a full-width sunroof costs less than retuning a powertrain, so design studios favor the feature in facelift programmes. Built-in tilt-slide variants continue to serve sedans, while pop-up and spoiler types fill niche sporty coupes where aero drag overshadows cabin spaciousness. The automotive sunroof market size growth in panoramic systems also fuels demand for smart-glass electronics, as larger surface areas magnify solar load and glare concerns. Suppliers integrate zonal dimming and sequential opening sequences, features that tie into ambient-lighting scripts and voice assistants, keeping the category technologically vibrant through 2030.

The Automotive Sunroof Market is Segmented by Material Type (Glass, Fabric, and More), Sunroof System Type (Built-In, Tilt-N-Slide, and More), Operation Type (Electric and Manual), Vehicle Type (Hatchback, Sedan, and More), Vehicle Propulsion (ICE, BEV, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 38.26% of 2024 revenue, supported by consumer appetite for large vehicles and high take-rates of premium convenience features. Standardizing panoramic glass on mid-size SUVs from domestic brands sustains volume, while luxury imports raise the technical bar with electrochromic tinting and solar harvesting. Stringent rollover standards drive robust steel or aluminum reinforcement frames, but the established regulatory environment lets suppliers amortize tooling over long cycles, keeping margins healthy.

Asia-Pacific shows the steepest growth path at a 13.71% CAGR through 2030. China leads in absolute volume, pairing rising BEV share with substantial government incentives for local components. India's component sector grows at an 8% CAGR, enabling domestic sourcing that lowers landed cost and removes tariff exposure. Joint ventures such as Inalfa-Gabriel ramp plants near Pune will serve next-generation crossovers with panoramic roofs tailored for monsoon sealing requirements. Southeast Asia's production hubs follow, aided by import duty exemptions for parts localized within ASEAN.

Europe sustains a premium technology profile, with German OEMs pioneering laminated glazing and zonal SPD dimming. Lightweight directives spur composite roof frames that cut vehicle CO2 emissions under WLTP. Suppliers co-locate R&D in the region's automotive clusters to work closely with styling studios. Elsewhere, South America plus the Middle East and Africa remain nascent, but pickup conversion markets and tourism vans create pockets of demand for simple, manually operated spoilers. As economic indicators improve, supplier playbooks emphasize modular kits that can scale from entry-level glass to electrochromic without redesigning sheet metal.

- Webasto Group

- Inalfa Roof Systems BV

- Inteva Products LLC

- Magna International Inc.

- Yachiyo Industry Co. Ltd

- BOS GmbH and Co. KG

- Aisin Corporation

- CIE Automotive SA

- Hyundai Mobis Co. Ltd

- Signature Automotive Products

- Mitsuba Corporation

- AGC Automotive

- Fuyao Glass Industry Group

- Saint-Gobain Sekurit

- Ningbo Sun-Manner

- Shenzhen CIMC Tianda

- Jiangsu Altopro

- Xinquan Automotive

- Corning Automotive Glass

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premium-feature Pull in Mid-segment Cars

- 4.2.2 SUV Mix Shift in OEM Production Plans

- 4.2.3 Innovations in Laminated and Electro-chromic Glass

- 4.2.4 EV OEM Adoption of Solar-integrated Roofs

- 4.2.5 Weight-saving Polycarbonate Modules (Under-radar)

- 4.2.6 Dealer OTA Sunroof-unlock Upgrades (Under-radar)

- 4.3 Market Restraints

- 4.3.1 High Installation and Warranty Cost

- 4.3.2 Leakage / NVH Concerns

- 4.3.3 Stricter Rollover-roof Regulations (Under-radar)

- 4.3.4 AV Roof-sensor Real-estate Clash (Under-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Glass

- 5.1.2 Fabric

- 5.1.3 Others

- 5.2 By Sunroof System Type

- 5.2.1 Built-in

- 5.2.2 Tilt-n-Slide

- 5.2.3 Panoramic

- 5.2.4 Pop-Up / Spoiler

- 5.3 By Operation Type

- 5.3.1 Electric

- 5.3.2 Manual

- 5.4 By Vehicle Type

- 5.4.1 Hatchback

- 5.4.2 Sedan

- 5.4.3 SUV

- 5.4.4 MPV / Others

- 5.5 By Vehicle Propulsion

- 5.5.1 ICE

- 5.5.2 BEV

- 5.5.3 HEV / PHEV

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Rest of the Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Ghana

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Webasto Group

- 6.4.2 Inalfa Roof Systems BV

- 6.4.3 Inteva Products LLC

- 6.4.4 Magna International Inc.

- 6.4.5 Yachiyo Industry Co. Ltd

- 6.4.6 BOS GmbH and Co. KG

- 6.4.7 Aisin Corporation

- 6.4.8 CIE Automotive SA

- 6.4.9 Hyundai Mobis Co. Ltd

- 6.4.10 Signature Automotive Products

- 6.4.11 Mitsuba Corporation

- 6.4.12 AGC Automotive

- 6.4.13 Fuyao Glass Industry Group

- 6.4.14 Saint-Gobain Sekurit

- 6.4.15 Ningbo Sun-Manner

- 6.4.16 Shenzhen CIMC Tianda

- 6.4.17 Jiangsu Altopro

- 6.4.18 Xinquan Automotive

- 6.4.19 Corning Automotive Glass

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment