PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907250

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907250

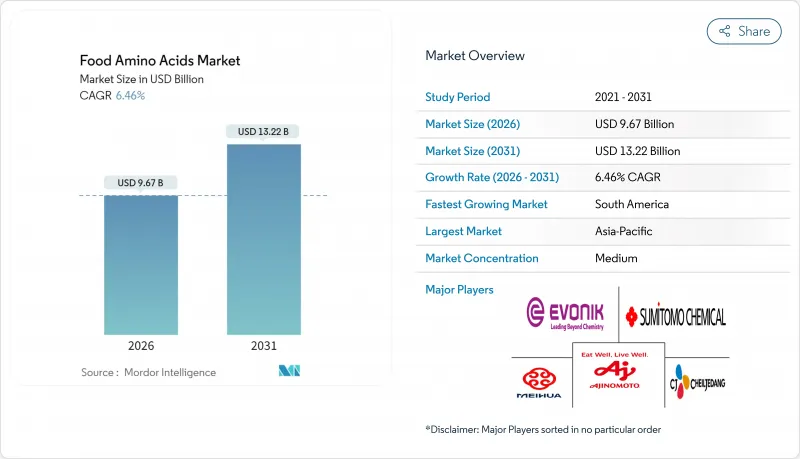

Food Amino Acids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The food amino acids market is expected to grow from USD 9.08 billion in 2025 to USD 9.67 billion in 2026 and is forecast to reach USD 13.22 billion by 2031 at 6.46% CAGR over 2026-2031.

This growth is primarily attributed to the declining costs of precision fermentation technologies, which have made amino acid production more efficient and cost-effective. Additionally, the rising consumer preference for clean-label products, which prioritize transparency, natural ingredients, and minimal processing, is driving the incorporation of amino acids in food formulations. Moreover, regulatory bodies are redefining the criteria for "healthy" foods, encouraging manufacturers to fortify their products with amino acids to align with these updated standards. These factors collectively contribute to the robust expansion of the food amino acids market.

Global Food Amino Acids Market Trends and Insights

Growing demand for high-protein functional foods

The protein revolution in functional foods is driving amino acid demand beyond traditional supplementation into mainstream food applications. Consumers are increasingly seeking functional foods that offer health benefits beyond basic nutrition, with a particular focus on protein-enriched options. According to the Food and Agriculture Organization (FAO), protein consumption is expected to rise globally due to its essential role in muscle repair, immune function, and overall health. Additionally, the International Food Information Council (IFIC) highlights that consumer awareness regarding the benefits of amino acids in promoting muscle health and recovery has been steadily increasing. This trend is further supported by government initiatives promoting protein-rich diets to combat malnutrition and improve public health. For instance, the United States Department of Agriculture (USDA) has been actively encouraging the inclusion of high-protein foods in dietary guidelines to address nutritional deficiencies. As a result, the demand for food amino acids, which are key components in formulating these functional foods, is projected to grow significantly during the forecast period.

Growing nutraceutical and dietary-supplement penetration

The increasing penetration of nutraceuticals and dietary supplements is a significant driver of the Global Food Amino Acids Market. Consumers are becoming more health-conscious, leading to a growing demand for functional foods and supplements that provide additional health benefits. According to the Council for Responsible Nutrition (CRN), around 74% of adults in the United States reported taking dietary supplements in 2023 , showcasing a steady rise in consumption. Similarly, the European Food Safety Authority (EFSA) has emphasized the importance of amino acids in dietary supplements for maintaining overall health and well-being. Government initiatives promoting health and wellness, such as India's National Nutrition Mission and the U.S. Department of Agriculture's dietary guidelines, are also contributing to the increased adoption of these products. This trend is expected to bolster the growth of the food amino acids market significantly.

Volatile prices of key feedstocks

The volatile prices of key feedstocks act as a significant restraint in the market. Fluctuations in the costs of raw materials, such as soybeans, corn, and other agricultural products, directly impact the production costs of amino acids. These price variations are often driven by factors like unpredictable weather conditions, geopolitical tensions, and changes in trade policies. Such instability in feedstock prices creates challenges for manufacturers in maintaining consistent profit margins and pricing strategies, thereby hindering market growth. Additionally, the rising demand for these feedstocks in other industries, such as biofuels and animal feed, intensifies competition and further contributes to price volatility. This competition often leads to supply shortages, forcing manufacturers to pay premium prices, which can disrupt production schedules and increase operational costs. The lack of price stability also complicates long-term planning and investment decisions for companies operating in the food amino acids market.

Other drivers and restraints analyzed in the detailed report include:

- Infant-formula fortification mandates

- Advancements in microbial fermentation and enzymatic production technologies

- Stringent purity and allergen regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, the non-essential segment captured a dominant 52.12% of the market share. Non-essential amino acids continue to lead the market, primarily due to their established roles in flavor enhancement and food processing. These amino acids are synthesized by the human body and are not required through dietary intake, making them versatile for various applications. Among them, glutamic acid stands out, serving both as a taste enhancer and a fundamental protein building block. Other non-essential amino acids, such as alanine and aspartic acid, also contribute significantly to the market by being integral to metabolic processes and food formulations.

Essential amino acids are on a growth trajectory, boasting an 8.73% CAGR projected through 2031. Unlike non-essential amino acids, essential amino acids cannot be synthesized by the human body and must be obtained through diet or supplementation. The performance nutrition sector's focus on comprehensive amino acid profiles has spurred heightened demand for essential amino acids. This is especially true for branched-chain amino acids (leucine, isoleucine, and valine), known for their role in activating mTOR and AMPK pathways, which are crucial for muscle protein synthesis. Additionally, essential amino acids like lysine and methionine are gaining traction due to their importance in supporting immune function and overall health.

Plant-based fermentation held a 41.65% market share in 2025, capitalizing on established infrastructure for glucose-fed bacterial production. This type of fermentation primarily utilizes plant-based raw materials, such as corn, sugarcane, or other carbohydrate-rich sources, to produce amino acids through microbial processes. It benefits from cost efficiency, scalability, and the ability to leverage existing production facilities, making it a preferred choice for large-scale amino acid manufacturing. Additionally, plant-based fermentation aligns with the increasing consumer demand for natural and sustainable production methods, further driving its adoption in the market.

Meanwhile, precision fermentation, buoyed by declining DNA synthesis costs and AI-enhanced strain engineering, is the market's "fastest-growing" segment, boasting a 9.31% CAGR. Precision fermentation involves the use of genetically engineered microorganisms to produce specific amino acids with high precision, purity, and efficiency. This method is gaining significant traction due to advancements in synthetic biology, which enable the development of optimized microbial strains tailored for amino acid production. Precision fermentation also offers the flexibility to produce rare or specialty amino acids that are challenging to obtain through traditional methods.

The Food Amino Acids Market Report is Segmented by Product Type (Essential Amino Acids and Non-Essential Amino Acids), Source (Plant-Based Fermentation, Synthetic Chemical Synthesis and More), Form (Powder and Liquid), Application (Dietary Supplements, Infant Nutrition and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, Asia-Pacific commands a dominant 33.59% market share, underscoring its integrated supply chain strengths and robust governmental backing for biotechnology. However, this dominance isn't without challenges: trade tensions and heightened regulatory scrutiny cast a shadow of uncertainty over Chinese suppliers, who hold the reins of global production capacity. Key growth drivers for the region include a surge in health consciousness, urbanization, and a burgeoning middle class with a penchant for premium nutrition. While India's nutraceutical market is on the rise and Japan boasts cutting-edge fermentation technologies, it's China's vast manufacturing scale that ties these elements together, forging a holistic ecosystem for amino acid production and consumption.

South America is on the fast track, projected to grow at an impressive 8.50% CAGR through 2031. The region's momentum is fueled by initiatives like agricultural waste valorization and significant investments in precision fermentation. A notable highlight is Liberation Labs' collaboration with NEOM, focusing on animal-free protein production. Brazil's robust fermentation infrastructure, bolstered by its agricultural assets, sets the stage for an expansion in amino acid production. Meanwhile, Argentina's burgeoning nutraceutical market fuels a rising demand for specialized amino acid formulations.

North America and Europe also play significant roles in the food amino acids market. North America benefits from advanced research and development capabilities, a well-established nutraceutical industry, and increasing consumer demand for functional foods. Europe, on the other hand, leverages its stringent regulatory framework and focus on sustainability to drive innovation in amino acid production. Both regions contribute to the global market through technological advancements and a growing emphasis on health and wellness trends.

- Ajinomoto Co., Inc.

- Evonik Industries AG

- Meihua Holdings Group Co., Ltd.

- CJ CheilJedang Corporation

- Sumitomo Chemical Co., Ltd.

- Kyowa Hakko Bio Co. Ltd

- Daesang Corporation

- Global Bio-Chem Technology Group

- Wuxi Jinghai Amino Acid Co., Ltd.

- AMINO GmbH

- Sichuan Tongsheng Amino Acid Co., Ltd.

- Shijiazhuang Jirong Pharmaceutical Co., Ltd.

- Vinstar Biotech Pvt Ltd

- Vizag chemical

- Hexon Laboratories Private Limited

- 7HILL AGROTECH

- AB Enterprises

- Hebei Huanwei Biotech Co.,Ltd

- Brova Limited

- Foodchem International Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for high-protein functional foods

- 4.2.2 Growing nutraceutical and dietary-supplement penetration

- 4.2.3 Infant-formula fortification mandates

- 4.2.4 Increasing use of amino acids as food additives for flavor enhancement

- 4.2.5 Advancements in microbial fermentation and enzymatic production technologies

- 4.2.6 Personalised-nutrition platforms recommending amino profiles

- 4.3 Market Restraints

- 4.3.1 Volatile prices of key feedstocks

- 4.3.2 Stringent purity and allergen regulations

- 4.3.3 Supply-demand imbalance in specialty essential amino acids

- 4.3.4 Fermentation-plant environmental and odour compliance risk

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Essential Amino Acids

- 5.1.1.1 Lysine

- 5.1.1.2 Methionine

- 5.1.1.3 Tryptophan

- 5.1.1.4 Phenylalanine

- 5.1.1.5 Threonine

- 5.1.1.6 Others

- 5.1.2 Non-Essential Amino Acids

- 5.1.2.1 Glutamic Acid

- 5.1.2.2 Aspartic Acid

- 5.1.2.3 Proline

- 5.1.2.4 Others

- 5.1.1 Essential Amino Acids

- 5.2 By Source

- 5.2.1 Plant-based Fermentation

- 5.2.2 Synthetic Chemical Synthesis

- 5.2.3 Precision Fermentation

- 5.3 By Form

- 5.3.1 Powder

- 5.3.2 Liquid

- 5.4 By Application

- 5.4.1 Dietary Supplements

- 5.4.2 Sports and Performance Nutrition

- 5.4.3 Functional Beverages

- 5.4.4 Bakery and Confectionery

- 5.4.5 Infant Nutrition

- 5.4.6 Medical and Clinical Nutrition

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 Spain

- 5.5.2.4 France

- 5.5.2.5 Italy

- 5.5.2.6 Netherlands

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Singapore

- 5.5.3.8 Thailand

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ajinomoto Co., Inc.

- 6.4.2 Evonik Industries AG

- 6.4.3 Meihua Holdings Group Co., Ltd.

- 6.4.4 CJ CheilJedang Corporation

- 6.4.5 Sumitomo Chemical Co., Ltd.

- 6.4.6 Kyowa Hakko Bio Co. Ltd

- 6.4.7 Daesang Corporation

- 6.4.8 Global Bio-Chem Technology Group

- 6.4.9 Wuxi Jinghai Amino Acid Co., Ltd.

- 6.4.10 AMINO GmbH

- 6.4.11 Sichuan Tongsheng Amino Acid Co., Ltd.

- 6.4.12 Shijiazhuang Jirong Pharmaceutical Co., Ltd.

- 6.4.13 Vinstar Biotech Pvt Ltd

- 6.4.14 Vizag chemical

- 6.4.15 Hexon Laboratories Private Limited

- 6.4.16 7HILL AGROTECH

- 6.4.17 AB Enterprises

- 6.4.18 Hebei Huanwei Biotech Co.,Ltd

- 6.4.19 Brova Limited

- 6.4.20 Foodchem International Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK