PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844596

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844596

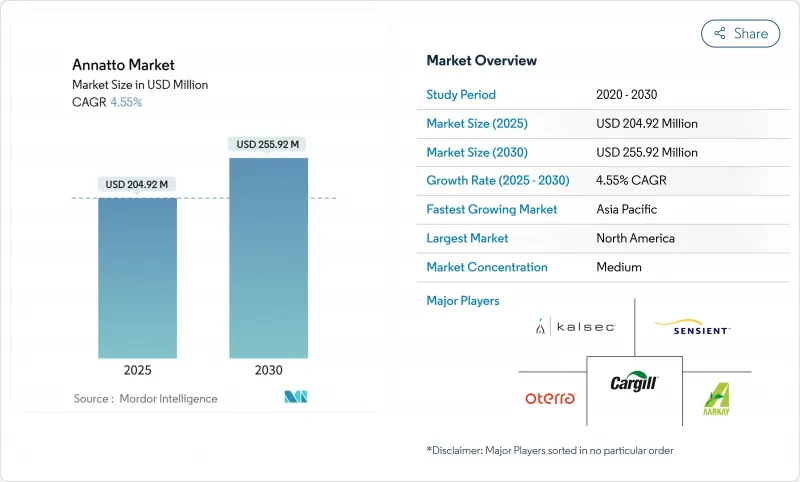

Annatto - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

In 2025, the global annatto market was valued at USD 204.92 million. Projections indicate a rise to USD 255.92 million by 2030, with revenues expanding at a CAGR of 4.55%.

This uptick in demand is largely driven by food and beverage companies adapting to the FDA's April 2025 ruling. The FDA mandated the phasing out of petroleum-derived synthetic dyes from the national food supply by the close of 2026, elevating the status of natural colorants to a regulatory imperative. North America, bolstered by entrenched clean-label preferences and transparent regulatory pathways, commands the largest regional share. Meanwhile, the Asia-Pacific region is witnessing the swiftest growth, spurred by China's recent enactment of a plant-based coloring foods law and Japan's robust functional-food market. Innovations are emerging around emulsified annatto grades, designed to enhance stability in water-dominant matrices. Additionally, the organic sub-segment is gaining traction, especially after the USDA's March 2024 tightening of its Strengthening Organic Enforcement (SOE) rule.

Global Annatto Market Trends and Insights

Growing demand for natural food colorants

The FDA's decision to phase out synthetic dyes is reshaping market dynamics, driving a surge in demand for natural alternatives. This regulatory shift is compounded by state-level actions in West Virginia, Virginia, California, and Texas, where bans on specific synthetic dyes in food products, particularly in school meal programs, are now in effect. These measures effectively eliminate the cost advantage of synthetic dyes, positioning annatto as a cost-effective and sustainable alternative. Furthermore, the FDA's approval in May 2025 of three natural colorants-galdieria extract blue, butterfly pea flower extract, and calcium phosphate-indicates a more efficient regulatory pathway for natural options. This development is likely to accelerate the introduction of innovative annatto-based formulations to the market. However, manufacturing capacity constraints remain a significant bottleneck. Industry leaders like Chr. Hansen are addressing this challenge by investing in new anthocyanin production facilities, while emerging players such as Sparxell are developing cellulose-based alternatives to bridge supply gaps and meet the increasing demand for natural colorants.

Rising preference for organic and non-gmo variants

The organic annatto market segment demonstrates strong growth potential, driven by consumer preferences for natural and certified products, commanding 15-20% higher prices compared to conventional alternatives. The implementation of the USDA's Strengthening Organic Enforcement rule in March 2024 introduces comprehensive traceability requirements through NOP Import Certificates, establishing a more rigorous framework for organic certification. While this regulation creates significant barriers for new market entrants, it strengthens the position of established organic producers and enhances market integrity. Brazilian organic annatto production continues to expand strategically, responding to sustained premium pricing, although strict organic certification protocols limit rapid production scaling. The emergence of biotechnology alternatives has elevated the importance of non-GMO verification in the market. Companies like Phytolon are developing advanced fermentation-derived pigments using genetically engineered yeast, while maintaining compliance with non-GMO classifications, reflecting the evolving technological landscape in natural colorant production.

Price volatility of annatto seeds

Annatto seed prices continue to exhibit significant volatility, driven by the concentrated production in Brazil and Peru, where weather patterns and agricultural policies frequently disrupt supply chains. Brazil's 2024-25 crop plan allocated USD 88.2 billion for agricultural support. However, the 11% reduction in effective funding due to currency devaluation may hinder agricultural productivity and investment in the sector. Seasonal harvesting patterns further intensify price instability. Large-scale users increasingly adopt forward contracting to manage price risks and ensure supply stability. However, small and medium processors face significant challenges in navigating price unpredictability, which affects their operational planning and profitability. Biotechnology-driven alternatives, such as Phytolon's fermentation-based production, offer a promising solution by providing price stability and reducing reliance on traditional agricultural production.

Other drivers and restraints analyzed in the detailed report include:

- Growth of plant-based meat and dairy analogues

- Expansion of processed and packaged food sector

- Color instability in water-based formulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, oil-soluble annatto holds a dominant 43.51% share of the market, reflecting its critical role in high-fat food applications. Its lipophilic properties ensure seamless color integration while maintaining product stability, making it a preferred choice for manufacturers. This dominance is rooted in annatto's natural compatibility with fat-based systems, which has made it indispensable in cheese, butter, and processed meat production for over 200 years. The segment's market leadership highlights the food industry's reliance on proven, effective solutions. However, price sensitivity in emerging markets continues to limit the adoption of premium oil-soluble variants. Regulatory advantages further strengthen this segment's position, as oil-soluble annatto extracts face fewer formulation restrictions under FDA guidelines compared to water-based alternatives, which often require additional stabilizers to meet regulatory standards.

Emulsified annatto is the fastest-growing segment, projected to achieve a 7.45% CAGR through 2030. This growth is driven by its ability to address the technical challenges of both oil and water-soluble applications through advanced stabilization chemistry. Companies like ADM have introduced patented micronization technology and emulsion systems that significantly enhance stability against heat and light, overcoming traditional limitations that have hindered the adoption of natural colorants in complex applications. Supporting this growth, Oterra launched its I-Colors Bold line in September 2024, featuring ultrafine milled powders that deliver deeper color intensity at lower dosages. This innovation addresses cost concerns while broadening application possibilities. Emulsified formulations are particularly gaining traction in beverage applications, where they effectively eliminate separation issues commonly associated with traditional oil-soluble variants, ensuring improved product aesthetics and consistency.

The Global Annatto Market Report Segments the Industry by Product Type (Oil-Soluble, Water-Soluble, and Emulsified), Nature (Organic and Conventional), Application (Food and Beverage, Cosmetic and Personal Care, Animal Feed, and Other Applications) and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America secures its position as the market leader with a 31.49% share, driven by stringent regulatory frameworks and growing consumer demand for clean-label products. The FDA's proactive measures to phase out synthetic dyes have significantly boosted the adoption of natural alternatives like annatto. The region's well-established food processing infrastructure and consumer willingness to pay premium prices create a favorable environment for high-value annatto applications. Additionally, regulatory clarity under 21 CFR 73.30 provides manufacturers with the confidence needed for long-term supply chain planning. Canada's alignment with U.S. regulatory trends and Mexico's expanding processed food industry contribute to the region's market stability. Meanwhile, the USMCA trade agreement opens new opportunities for Brazilian annatto suppliers to strengthen their presence in the North American market.

Asia-Pacific is poised to be the fastest-growing region, with a projected CAGR of 7.52% through 2030, fueled by rapid urbanization, increasing disposable incomes, and evolving food safety regulations. China's upcoming standardization of plant-based coloring food regulations, set for May 2025, is expected to streamline market access and establish quality standards that favor established suppliers. Japan's functional food market, valued at approximately USD 13 billion, presents significant growth opportunities as the Japan Food Additives Association, under the Ministry of Health, Labor and Welfare, promotes the safe use of natural colorants. In India, the expanding food processing sector and rising consumer awareness of natural ingredients are driving demand for annatto. While the region's diverse regulatory landscape necessitates localized compliance strategies, ongoing harmonization efforts through ASEAN initiatives are likely to simplify market entry for international suppliers, enhancing growth prospects.

South America, led by Brazil as the dominant annatto producer, faces a unique set of dynamics as it balances domestic supply with export opportunities. Brazil's agricultural sector benefits from substantial government support, including a R$ 475.5 billion allocation under the 2024-25 crop plan. However, currency devaluation poses challenges to export competitiveness. The IBGE forecasts a 5.8% growth in agricultural production for 2025, ensuring a stable supply of annatto seeds. Brazil's efforts to diversify its export markets are creating new opportunities beyond traditional destinations in North America and Europe. Peru, the second-largest global producer of annatto, provides additional supply chain resilience. However, political instability and infrastructure limitations in Peru hinder its growth potential. The region's proximity to major consumer markets offers logistical advantages, while Brazil's expertise in cultivation ensures consistent quality, meeting the demands of premium applications.

- Aarkay Food Products Ltd.

- AICA Kogyo Co., Ltd (AICA Color)

- Amerilure Inc.

- Biocon Colors

- Cargill, Incorporated

- FMC Corporation

- Novozymes A/S

- International Flavors & Fragrances (Frutarom)

- Kalsec Inc.

- DIC Corporation (Sun Chemical)

- Sensient Technologies Corporation

- Oterra A/S

- Archer Daniels Midland Company

- Givaudan S.A

- Fiorio Colori S.p.A.

- IFC Solutions, Inc.

- D.B. Dyechem

- Roquette Freres S.A. (Sethness Roquette)

- FoodRGB Inc.

- Vinayak Ingredients Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for natural food colorants

- 4.2.2 Rising preference for organic and non-gmo variants

- 4.2.3 Growth of plant-based meat and dairy analogues

- 4.2.4 Expansion of processed and packaged food sector

- 4.2.5 Increasing adoption of plant-based and vegan diets

- 4.2.6 Expanding applications in cosmetics and pharmaceuticals

- 4.3 Market Restraints

- 4.3.1 Price volatility of annatto seeds

- 4.3.2 Color instability in water-based formulations

- 4.3.3 Limited geographic cultivation and raw material availability

- 4.3.4 Competition from alternative natural colorants

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Oil-Soluble

- 5.1.2 Water-Soluble

- 5.1.3 Emulsified

- 5.2 By Nature

- 5.2.1 Organic

- 5.2.2 Conventional

- 5.3 By Application

- 5.3.1 Food and Beverage

- 5.3.1.1 Dairy Products

- 5.3.1.2 Bakery and Confectionery

- 5.3.1.3 Beverages

- 5.3.1.4 Meat and Plant-based Analogues

- 5.3.1.5 Others Food and Beverages

- 5.3.2 Cosmetic and Personal Care

- 5.3.3 Animal Feed

- 5.3.4 Other Application

- 5.3.1 Food and Beverage

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Colombia

- 5.4.2.4 Chile

- 5.4.2.5 Peru

- 5.4.2.6 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Netherlands

- 5.4.3.6 Poland

- 5.4.3.7 Belgium

- 5.4.3.8 Sweden

- 5.4.3.9 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 Indonesia

- 5.4.4.6 South Korea

- 5.4.4.7 Thailand

- 5.4.4.8 Singapore

- 5.4.4.9 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Aarkay Food Products Ltd.

- 6.4.2 AICA Kogyo Co., Ltd (AICA Color)

- 6.4.3 Amerilure Inc.

- 6.4.4 Biocon Colors

- 6.4.5 Cargill, Incorporated

- 6.4.6 FMC Corporation

- 6.4.7 Novozymes A/S

- 6.4.8 International Flavors & Fragrances (Frutarom)

- 6.4.9 Kalsec Inc.

- 6.4.10 DIC Corporation (Sun Chemical)

- 6.4.11 Sensient Technologies Corporation

- 6.4.12 Oterra A/S

- 6.4.13 Archer Daniels Midland Company

- 6.4.14 Givaudan S.A

- 6.4.15 Fiorio Colori S.p.A.

- 6.4.16 IFC Solutions, Inc.

- 6.4.17 D.B. Dyechem

- 6.4.18 Roquette Freres S.A. (Sethness Roquette)

- 6.4.19 FoodRGB Inc.

- 6.4.20 Vinayak Ingredients Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK