PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844598

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844598

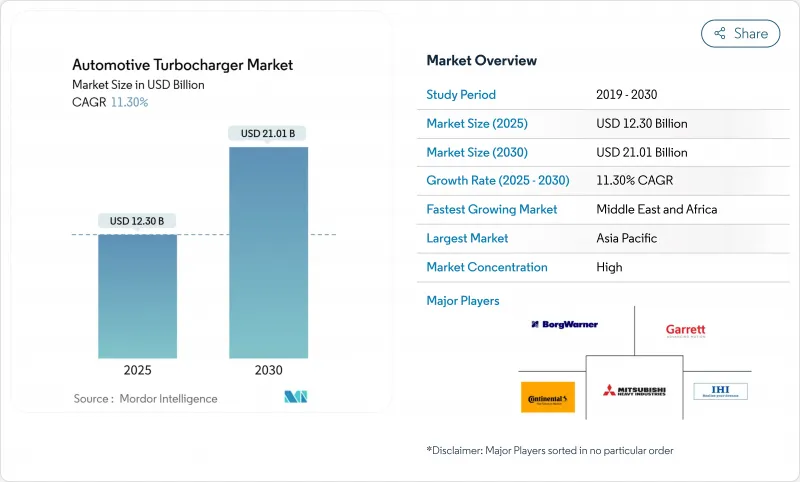

Automotive Turbocharger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The turbocharger market reached USD 12.30 billion in 2025 and is forecast to climb to USD 21.01 billion by 2030, reflecting an 11.30% CAGR.

Persistent emissions mandates, engine-downsizing strategies, and the shift to hybrid powertrains drive the turbocharger market toward higher-efficiency, electric-assist, and hydrogen-ready solutions. Technology spending is moving quickly from simple wastegate architectures to variable geometry and 48 V e-boost systems that can meet Euro 7 and similar regulations. Automakers view electric turbochargers as the most direct path to near-instant torque delivery without compromising fleet-average fuel economy. At the same time, component makers prioritize designs that suit fuel-cell air management. Competitive dynamics remain intense because the top five suppliers already supply most global volume. Yet, each is racing to secure design wins in hydrogen ICE, fuel-cell, and 400 V hybrid platforms.

Global Automotive Turbocharger Market Trends and Insights

Stricter CO2 and NOx Legislation Accelerating Turbo-Gasoline Adoption

Emissions regulations are fundamentally altering turbocharger deployment strategies across global automotive markets. The Euro 7 regulation introduces particulate number limits for spark ignition vehicles and mandates gasoline particulate filters for all engines, creating technical requirements that favor turbocharged configurations. Light-duty gasoline engines must integrate enhanced fuel injection and combustion technologies to meet ultra-low emissions thresholds, positioning turbochargers as essential for achieving required power density while maintaining emissions compliance. The regulation's phased implementation creates sustained demand for variable geometry turbochargers to optimize exhaust gas recirculation and aftertreatment system efficiency. This regulatory framework extends beyond Europe, with China and India implementing similar standards, representing over 40% of global vehicle production. The technical complexity of meeting these standards while maintaining performance characteristics drives manufacturers toward sophisticated turbocharging solutions that can modulate boost pressure in real-time based on emissions requirements.

Engine Downsizing for Fleet-Average Fuel-Economy Compliance

Fleet-average fuel economy regulations are compelling manufacturers to extract maximum efficiency from smaller displacement engines through advanced turbocharging. The Corporate Average Fuel Economy standards in North America and similar regulations in Europe create economic incentives for manufacturers to replace larger naturally aspirated engines with smaller turbocharged alternatives. This trend enables manufacturers to maintain performance characteristics while achieving significant fuel economy improvements, with turbocharged engines delivering 20-40% better fuel efficiency compared to naturally aspirated equivalents. The downsizing strategy particularly benefits from twin-scroll and variable geometry turbocharger technologies that minimize turbo lag while maximizing low-end torque production. Manufacturers are increasingly adopting integrated exhaust manifold designs and electric wastegate actuators to optimize transient response characteristics. The economic pressure to meet fleet-average targets creates sustained demand for turbocharging solutions across vehicle segments, from compact passenger cars to mid-size SUVs where downsizing strategies yield the greatest compliance benefits.

Rapid BEV Penetration Eliminates Forced-Induction Requirements

Battery electric vehicle adoption creates structural headwinds for turbocharger demand as manufacturers transition production capacity toward electric powertrains. The fundamental architecture of BEVs eliminates internal combustion engines, removing the need for forced induction systems and creating a zero-sum relationship between electric vehicle penetration and turbocharger market growth. China's new energy vehicle market demonstrates this dynamic, with BEV sales growth directly correlating with reduced demand for traditional turbocharging solutions. However, the transition creates opportunities for turbocharger manufacturers in fuel cell applications, where compressed air delivery systems require specialized centrifugal compressors. IHI Corporation developed electric turbochargers specifically for hydrogen fuel cell systems, featuring oil-free operation and mechatronic integration to optimize fuel cell efficiency. The technology addresses fuel cell air supply requirements while maintaining turbocharger manufacturers' core competencies in rotating machinery and aerodynamic design.

Other drivers and restraints analyzed in the detailed report include:

- Rising Commercial-Vehicle Output in Asia-Pacific Elevates Turbo Demand

- OEM Shift to 48V Electric-Assist Turbos for Transient Response

- Competitive Cost Of Modern Naturally-Aspirated Engines in Less than 1.2L

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars, by contrast, hold the largest turbocharger market share at 54.11% in 2024, due to the widespread use of small, turbo-gasoline engines that satisfy fleet targets. Commercial trucks and buses contribute 22%, and light commercial vans make up 18%. Equipment makers now specify variable-geometry and electrically assisted units that maintain boost under constant-speed operation and dusty conditions. Off-highway machinery is on track for a 12.90% CAGR between 2025 and 2030, the fastest in the global turbocharger market.

The agriculture and construction machinery boom in developing economies underpins this momentum. Turbo suppliers are designing water-cooled bearing housings and wider compressor maps for these harsh duty cycles. As emissions laws reach non-road engines, OEMs adopt exhaust-aftertreatment that works best with a responsive turbo. The turbocharger market size allocated to off-highway platforms therefore, scales in tandem with government spending on rural mechanization and infrastructure builds. OEM service programs also push remanufactured units to control lifecycle cost and keep uptime high.

Diesel held 60.51% of the turbocharger market size in 2024 because of its dominance in freight and off-highway segments, yet hydrogen ICE applications will accelerate at a 26.30% CAGR. Cummins' new hydrogen engine turbo features bespoke aerodynamics to cope with higher exhaust flow and water vapor. Gasoline engines account for 32%, lifted by Euro 7 conformity, while CNG and LPG combined sit at 6%.

Hydrogen ICE testing shows up to 165% more power with turbocharging compared to naturally aspirated modes, and zero-carbon combustion is possible when renewable hydrogen is used. Turbo suppliers are therefore investing in seals and stainless materials that defeat hydrogen embrittlement. The turbocharger market share for hydrogen systems is low today, but strong policy backing positions it as a strategic segment for decade-end growth.

The Automotive Turbocharger Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, and Off-Highway), Fuel Type (Gasoline, Diesel, CNG/LPG, and Hydrogen ICE), Sales Channel (OEM Fitment and Aftermarket), Turbo Technology (Wastegate, VGT, Twin-Scroll, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific dominates the global turbocharger market with a 48.89% share in 2024, reflecting the region's position as the world's largest automotive manufacturing hub and fastest-growing vehicle market, while the Middle East and Africa region is forecast to grow the fastest at 13.23% CAGR. China's heavy-duty trucking industry demonstrates the region's market dynamics, with approximately 900,000 units sold in 2023 following recovery from previous year declines. CNG and LNG trucks gain market share due to lower fuel costs and advantages in emissions. The region benefits from substantial manufacturing capacity expansion, with Mitsubishi Heavy Industries increasing Chinese turbocharger production by 20% annually to meet rising local demand, establishing four additional assembly lines to achieve an annual output of 4.35 million units.

Europe maintains a significant market share, driven by stringent emissions regulations and technological leadership in advanced turbocharger systems. The European Union's Euro 7 emissions regulation, published in May 2024, mandates stricter NOx and particulate matter limits while introducing onboard monitoring systems for emissions compliance, creating sustained demand for variable geometry and electric turbocharger technologies. The regulation's implementation timeline, spanning 2026 to 2034 across vehicle categories, positions Europe as a testing ground for next-generation turbocharger technologies that will eventually spread to global markets.

North America represents 18.5% of the global market, with growth driven by Corporate Average Fuel Economy standards that incentivize turbocharger adoption across vehicle segments. The region benefits from manufacturers achieving 20-40% fuel efficiency improvements through engine downsizing strategies that rely heavily on advanced turbocharging technologies. Cummins' launch of its next-generation 6.7L Turbo Diesel engine for Ram Heavy Duty trucks in January 2025, featuring a new variable-geometry turbocharger and improved air management systems, demonstrates the region's focus on high-performance commercial vehicle applications. The North American market's emphasis on pickup trucks and commercial vehicles creates demand for robust turbocharger designs capable of handling high-torque applications, while the region's adoption of 48V mild-hybrid systems drives innovation in electric-assist turbocharger technologies.

- Garrett Motion Inc.

- BorgWarner Inc.

- IHI Corporation

- Mitsubishi Heavy Industries Ltd.

- Cummins Inc. (Turbo Technologies)

- Continental AG

- BMTS Technology GmbH and Co. KG

- Keyyang Precision Co., Ltd.

- Rotomaster International

- Turbo Energy Private Limited

- MAHLE GmbH

- Valeo SA

- Eaton Corporation

- Hyundai Mobis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter CO2 and NOx legislation is accelerating turbo-gasoline adoption

- 4.2.2 Engine downsizing for fleet-average fuel-economy compliance

- 4.2.3 Rising commercial-vehicle output in Asia-Pacific elevates turbo demand

- 4.2.4 OEM shift to 48 V electric-assist turbos for transient response

- 4.2.5 Integration of e-turbos in hybrid and plug-in hybrid architectures

- 4.2.6 Early adoption in hydrogen ICE and fuel-cell air-compression stacks

- 4.3 Market Restraints

- 4.3.1 Rapid BEV penetration eliminates forced-induction requirements

- 4.3.2 Competitive cost of modern naturally-aspirated engines in less than 1.2 L

- 4.3.3 Turbo-lag perception limiting consumer acceptance in key markets

- 4.3.4 Critical-metal (Nd-Fe-B) supply risk for high-speed e-machine rotors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers / Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium and Heavy Commercial Vehicles

- 5.1.4 Off-highway (Agricultural, Construction)

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 CNG/LPG

- 5.2.4 Hydrogen Internal-Combustion

- 5.3 By Sales Channel

- 5.3.1 OEM Fitment

- 5.3.2 Replacement / Aftermarket

- 5.4 By Turbo Technology

- 5.4.1 Wastegate Turbocharger

- 5.4.2 Variable Geometry Turbocharger (VGT)

- 5.4.3 Twin-Scroll Turbocharger

- 5.4.4 Electric Turbocharger

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Garrett Motion Inc.

- 6.4.2 BorgWarner Inc.

- 6.4.3 IHI Corporation

- 6.4.4 Mitsubishi Heavy Industries Ltd.

- 6.4.5 Cummins Inc. (Turbo Technologies)

- 6.4.6 Continental AG

- 6.4.7 BMTS Technology GmbH and Co. KG

- 6.4.8 Keyyang Precision Co., Ltd.

- 6.4.9 Rotomaster International

- 6.4.10 Turbo Energy Private Limited

- 6.4.11 MAHLE GmbH

- 6.4.12 Valeo SA

- 6.4.13 Eaton Corporation

- 6.4.14 Hyundai Mobis

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment