PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844602

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844602

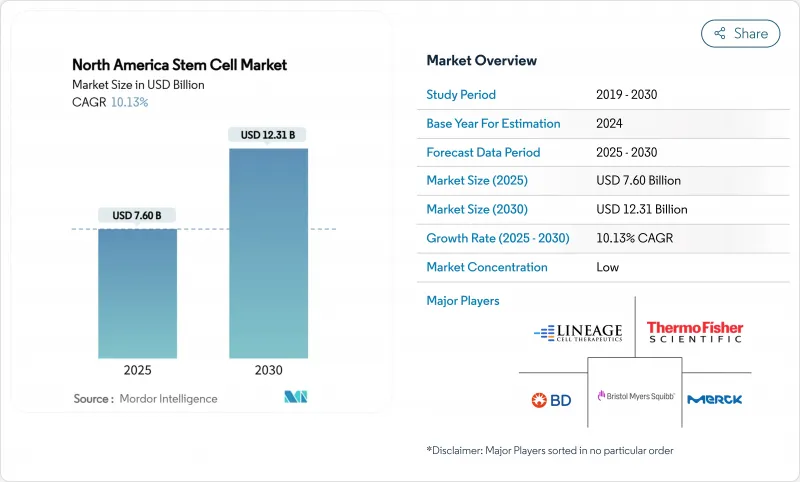

North America Stem Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Stem Cell Market size is estimated at USD 7.60 billion in 2025, and is expected to reach USD 12.31 billion by 2030, at a CAGR of 10.13% during the forecast period (2025-2030).

A decisive mix of accelerated FDA pathways, deep private-equity liquidity and hospital-based manufacturing hubs is propelling the North America stem cell market toward sustained double-digit expansion. Fast-track and Regenerative Medicine Advanced Therapy (RMAT) designations are shrinking development timelines, while Pentagon and Veterans Affairs grants are moving battlefield innovations into civilian care settings, further enlarging the addressable patient pool. In parallel, corporate decarbonization targets are steering capital toward "green bioprocessing," giving early movers a cost and branding edge. Collectively, these demand-side and supply-side forces reinforce the region's standing as the global test bed for next-generation regenerative therapies.

North America Stem Cell Market Trends and Insights

Accelerated FDA Fast-Track and RMAT Designations

A broader RMAT mandate has re-charted the North America stem cell market by halving historical development timelines. Approval of remestemcel-L for pediatric graft-versus-host disease validated mesenchymal stem-cell efficacy and emboldened sponsors to file similar applications in neurology and cardiology. Encelto, the first encapsulated allogeneic gene therapy for rare eye disease, further shows regulators' tolerance for innovative delivery platforms. As potency assays gain consensus, industry analysts expect RMAT approvals to cover at least 25 distinct indications by 2028, cementing the North America stem cell market as the world's regulatory bellwether.

Surge in Private Equity Funding for Off-the-Shelf MSC Platforms

Series A and Series B rounds topping USD 20 million now routinely target automated allogeneic manufacturing lines. Kincell Bio's USD 22 million raise earmarked solely for scaling multipurpose mesenchymal stromal cell (MSC) production underscores investors' tilt toward platforms with economy-of-scale upside. With per-dose costs projected to drop from USD 500,000 to USD 50,000 once automation matures, the North America stem cell market is witnessing a venture-capital-driven race to build the region's first vertically integrated "cell-factories."

High COGS of GMP-Scale Allogeneic Manufacturing

GMP-grade allogeneic therapies still cost 3-4 times more than traditional biologics because of intensive quality controls and skilled-labor demands. Automation platforms from Ori Biotech promise 70% labor savings, yet capital outlays remain prohibitive for emerging firms. Contract development and manufacturing organizations (CDMOs) are experiencing overcapacity in some segments while facing shortages in specialized capabilities, creating pricing volatility that impacts overall market economics.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Hospital-Affiliated Stem-Cell Centers Across the U.S.

- Integration of CRISPR With iPSC Pipelines

- Patchwork State-Level Reimbursement Rules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Adult stem cells controlled 51.86% of the North America stem cell market in 2024, supported by decades of safety data and streamlined regulatory precedent. Their entrenched clinical use in orthopedic, hematology and autoimmune disorders secures recurrent demand, yet scalability limits remain for large-volume indications. Induced pluripotent counterparts, though smaller today, are climbing at a 9.86% CAGR as CRISPR integration and closed-system bioreactors overhaul production economics.

AI-guided culture optimization is expected to trim iPSC batch failures and compress costs, positioning gene-edited lines for broad allogeneic deployment over the next decade. Ethical constraints continue to confine human embryonic cells to niche research programs, ensuring adult and iPSC lines will shape the commercial core of the North America stem cell industry landscape. The competitive dynamics between these product types are increasingly driven by manufacturing economics rather than purely scientific considerations, with companies seeking the optimal balance between safety, efficacy, and commercial viability.

Orthopedic procedures represented 25.12% of 2024 revenue, leveraging well-established intra-articular and spinal applications that align with surgeons' familiarity and reimbursement pathways. However, neurological indications are projected to post an 11.56% CAGR as first-in-human trials for Parkinson's disease, spinal cord injury and multiple sclerosis validate durable functional improvements.

Robust Defense Department funding for traumatic brain and nerve injury accelerates translational pipelines, reinforcing confidence among civilian payors. Oncology, cardiovascular and wound-care segments provide ancillary upside but will require continued process-yield gains to temper cost-of-goods concerns across the North America stem cell market. The application landscape is increasingly driven by unmet medical need rather than technical feasibility, with companies focusing on conditions where stem cells can provide unique therapeutic benefits unavailable through traditional pharmaceuticals.

The North America Stem Cell Market Report is Segmented by Product Type (Adult Stem Cells, Induced Pluripotent Stem Cells, and More), Application (Neurological Disorders, Orthopedic Treatment, and More), Treatment Type (Allogeneic Therapy, Autologous Therapy, and More), End User (Hospitals & Specialty Clinics, and More), and Geography (United States, Canada, Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Thermo Fisher Scientific

- Beckton Dickinson

- Merck

- Lonza Group

- Mesoblast Ltd.

- Fate Therapeutics Inc.

- Bristol-Myers Squibb (Bluebird Bio)

- Lineage Cell Therapeutics

- BrainStorm Cell

- Osiris Therapeutics

- Stem Cell Technologies

- Miltenyi Biotec

- AlloSource

- Organogenesis Holdings

- Gamida Cell Ltd.

- Pluristem Therapeutics

- Cynata Therapeutics

- Takara Bio

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated FDA Fast-Track and RMAT Designations

- 4.2.2 Surge in Private Equity Funding for off-the-shelf MSC Platforms

- 4.2.3 Expansion of Hospital-Affiliated Stem-Cell Centers across the U.S.

- 4.2.4 Integration of CRISPR with iPSC Pipelines

- 4.2.5 Pentagon & VA Grants for War-Injury Regenerative Programs

- 4.2.6 Corporate Decarbonization Policies Boosting "Green Bioprocessing" Demand

- 4.3 Market Restraints

- 4.3.1 High COGS of GMP-Scale Allogeneic Manufacturing

- 4.3.2 Patchwork State-Level Reimbursement Rules

- 4.3.3 Donor-Shortage Risk in Autologous Supply Chains

- 4.3.4 Tumorigenicity Concerns Slowing Pluripotent Approvals

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Adult Stem Cells

- 5.1.2 Induced Pluripotent Stem Cells

- 5.1.3 Human Embryonic Stem Cells

- 5.1.4 Other Product Types

- 5.2 By Application

- 5.2.1 Neurological Disorders

- 5.2.2 Orthopedic Treatments

- 5.2.3 Oncology Disorders

- 5.2.4 Cardiovascular Disorders

- 5.2.5 Injuries and Wounds

- 5.2.6 Other Applications

- 5.3 By Treatment Type

- 5.3.1 Allogeneic Therapy

- 5.3.2 Autologous Therapy

- 5.3.3 Syngeneic Therapy

- 5.4 By End User

- 5.4.1 Hospitals & Specialty Clinics

- 5.4.2 Academic and Research Institutes

- 5.4.3 Biopharma and Biotech Firms

- 5.4.4 Stem-Cell Banks

- 5.4.5 Other End Users

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Becton, Dickinson & Company

- 6.3.3 Merck KGaA (Sigma-Aldrich)

- 6.3.4 Lonza Group AG

- 6.3.5 Mesoblast Ltd.

- 6.3.6 Fate Therapeutics Inc.

- 6.3.7 Bristol-Myers Squibb (Bluebird Bio)

- 6.3.8 Lineage Cell Therapeutics

- 6.3.9 BrainStorm Cell Therapeutics

- 6.3.10 Osiris Therapeutics

- 6.3.11 STEMCELL Technologies Inc.

- 6.3.12 Miltenyi Biotec

- 6.3.13 AlloSource

- 6.3.14 Organogenesis Holdings

- 6.3.15 Gamida Cell Ltd.

- 6.3.16 Pluristem Therapeutics

- 6.3.17 Cynata Therapeutics

- 6.3.18 Takara Bio Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment