PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844607

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844607

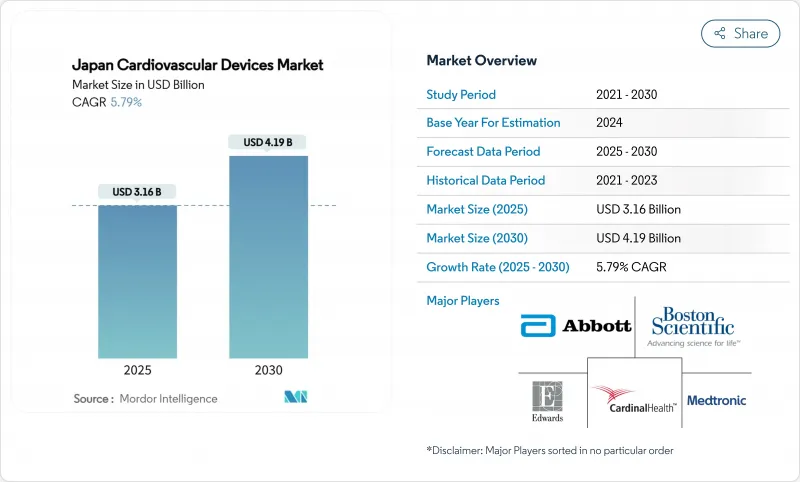

Japan Cardiovascular Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japan cardiovascular devices market size stands at USD 3.16 billion in 2025 and is forecast to reach USD 4.19 billion in 2030, registering a 5.79% CAGR over the period.

This expansion is powered by an aging population, nationwide reimbursement reforms that favor minimally invasive interventions, and rapid uptake of remote diagnostic technologies. Competition has intensified as international innovators use accelerated approval pathways such as SAKIGAKE to gain traction, while domestic companies leverage deep distribution networks. Price-cutting cycles under the National Health Insurance (NHI) apply continuous pressure on margins, forcing manufacturers to differentiate through smarter materials, AI integration, and miniaturization. Simultaneously, a shortage of electrophysiology specialists caps growth for complex arrhythmia therapies, but it also accelerates investment in automated mapping systems and simplified workflows. Overall, the Japan cardiovascular devices market continues to grow even as the national population shrinks because the pace of age-linked cardiovascular disease outstrips demographic decline [meti.go.jp].

Japan Cardiovascular Devices Market Trends and Insights

Ageing population intensifies cardiac disease burden

Nearly 29.1% of Japanese citizens are now above 65 years, the highest proportion globally. That demographic trend correlates with rising prevalence of atrial fibrillation, heart failure, and aortic stenosis, boosting long-term demand for stents, valves, pacemakers, and diagnostic monitors. Sudden cardiac death already claims more than 80,000 Japanese lives each year. Cohort data involving 3.5 million working-age adults shows a 96% jump in adverse cardiovascular outcomes among individuals with significant ECG abnormalities. Those statistics strengthen government resolve to fund preventive screening programs and device-based therapies nationwide.

Nationwide reimbursement codes for TAVI & PCI

Since 2021 Japan's Ministry of Health, Labour and Welfare (MHLW) has consistently upgraded reimbursement schedules for transcatheter aortic valve implantation (TAVI) and percutaneous coronary intervention (PCI). Cost-effectiveness models indicate TAVI is economically dominant for intermediate-risk patients and cost-effective for low-risk cohorts, with incremental ratios well below the ¥5 million per quality-adjusted life-year benchmark. The broadened codes enlarge the eligible patient pool and incentivize hospitals to invest in imaging, fractional-flow reserve systems, and next-gen stent platforms.

Price revision policies under NHI reduce device ASPs

Japan's biennial NHI price review slashed balloon catheter reimbursement from JPY 300,000 to JPY 32,000 and drug-eluting stents from JPY 421,000 to JPY 136,000 between 2022 and 2024. The Central Social Insurance Medical Council forecasts an additional 4% cut in 2025 after detecting a 6% divergence between invoice prices and real-world purchasing costs. Continuous price erosion forces manufacturers to launch value-added upgrades just to maintain revenue trajectories.

Other drivers and restraints analyzed in the detailed report include:

- High penetration of ECG screening in community clinics

- Preference for minimally invasive valve repairs

- Talent shortage in electrophysiology subspecialty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutic & surgical devices generated 76.24% of 2024 revenue. Coronary stents, rhythm-management implants, and heart valves lead the pack, even though biennial price cuts challenge legacy platforms. Emerging trends include drug-coated balloons for complex lesions and polymer-free stents aimed at speeding endothelial healing.

Diagnostic & monitoring devices presently account for 23.76% of value but will outpace therapeutics with a 6.98% CAGR. Remote cardiac monitors, AI-enhanced ECG analyzers, and home-based hemodynamic sensors headline growth. The 2025 relaxation of direct-to-consumer advertising rules has already boosted retail sales of wearable ECG patches. Community clinics connect those devices to cloud platforms, allowing cardiologists in urban centers to interpret rural patient data in real time.

The Japan Cardiovascular Devices Market Report is Segmented by Device Type (Diagnostic & Monitoring Devices, Therapeutic & Surgical Devices), Application (Coronary Artery Disease, Arrhythmia & Conduction Disorders, Heart Failure & Cardiomyopathy, and More), and End User (Hospitals & Cardiac Centres, Ambulatory Surgical Centres, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Terumo

- Abbott Laboratories

- Medtronic

- Boston Scientific

- Nihon Kohden

- Nipro

- Edward Lifesciences

- Johnson & Johnson (Biosense Webster & Cordis)

- Koninklijke Philips

- Siemens Healthineers

- Fukuda Denshi Co., Ltd.

- Asahi Intecc Co., Ltd.

- Shockwave Medical Inc.

- Canon

- Maquet Cardiopulmonary GmbH

- LivaNova

- W. L. Gore & Associates

- Merit Medical Systems

- Zoll Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing Population Intensifies Cardiac Disease Burden in Japan

- 4.2.2 Nationwide Implementation of Advanced Reimbursement Codes for TAVI and PCI

- 4.2.3 High Penetration of Screening Programs using ECG & Holter in Community Clinics

- 4.2.4 Government Grants Supporting Domestic R&D in Catheter-based Therapies

- 4.2.5 Surge in Private Cath Lab Infrastructure across Secondary Cities

- 4.2.6 Preference for Minimally Invasive Valve Repairs among Elderly Cohorts

- 4.3 Market Restraints

- 4.3.1 Shrinking Overall Procedure Volumes due to COVID-Related Deferrals

- 4.3.2 Stringent Post-Market Surveillance by PMDA Raising Compliance Costs

- 4.3.3 Price Revision Policies under NHI Driving Down Device ASPs

- 4.3.4 Talent Shortage in Electrophysiology Subspecialty Limits Ablation Adoption

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Device Type

- 5.1.1 Diagnostics Devices

- 5.1.1.1 ECG Systems

- 5.1.1.2 Remote Cardiac Monitor

- 5.1.1.3 Cardiac MRI

- 5.1.1.4 Cardiac CT

- 5.1.1.5 Echocardiography / Ultrasound

- 5.1.1.6 Fractional Flow Reserve (FFR) Systems

- 5.1.2 Therapeutic & Surgical Devices

- 5.1.2.1 Coronary Stents

- 5.1.2.1.1 Drug-Eluting Stents

- 5.1.2.1.2 Bare-Metal Stents

- 5.1.2.1.3 Bioresorbable Stents

- 5.1.2.2 Catheters

- 5.1.2.2.1 PTCA Balloon Catheters

- 5.1.2.2.2 IVUS/OCT Catheters

- 5.1.2.3 Cardiac Rhythm Management

- 5.1.2.3.1 Pacemakers

- 5.1.2.3.2 Implantable Cardioverter Defibrillators

- 5.1.2.3.3 Cardiac Resynchronization Therapy Devices

- 5.1.2.4 Heart Valves

- 5.1.2.4.1 TAVR/TAVI

- 5.1.2.4.2 Mechanical Valves

- 5.1.2.4.3 Tissue/Bioprosthetic Valves

- 5.1.2.5 Ventricular Assist Devices

- 5.1.2.6 Artificial Hearts

- 5.1.2.7 Grafts & Patches

- 5.1.2.8 Other Cardiovascular Surgical Devices

- 5.1.1 Diagnostics Devices

- 5.2 By Application

- 5.2.1 Coronary Artery Disease

- 5.2.2 Arrhythmia & Conduction Disorders

- 5.2.3 Heart Failure & Cardiomyopathy

- 5.2.4 Structural & Congenital Heart Defects

- 5.2.5 Peripheral Vascular Disease

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Terumo Corporation

- 6.3.2 Abbott Laboratories

- 6.3.3 Medtronic plc

- 6.3.4 Boston Scientific Corporation

- 6.3.5 Nihon Kohden Corporation

- 6.3.6 Nipro Corporation

- 6.3.7 Edwards Lifesciences Corporation

- 6.3.8 Johnson & Johnson (Biosense Webster & Cordis)

- 6.3.9 Philips Healthcare

- 6.3.10 Siemens Healthineers

- 6.3.11 Fukuda Denshi Co., Ltd.

- 6.3.12 Asahi Intecc Co., Ltd.

- 6.3.13 Shockwave Medical Inc.

- 6.3.14 Canon Medical Systems Corporation

- 6.3.15 Maquet Cardiopulmonary GmbH

- 6.3.16 LivaNova PLC

- 6.3.17 W. L. Gore & Associates

- 6.3.18 Merit Medical Systems

- 6.3.19 Zoll Medical Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment