PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844611

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844611

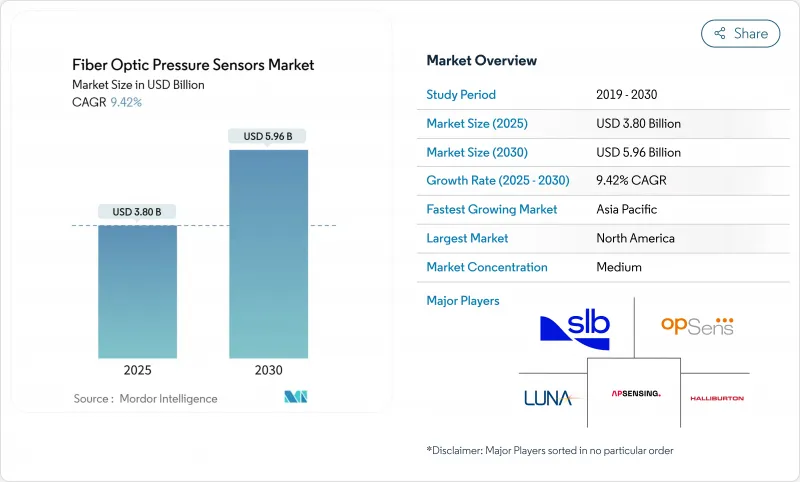

Fiber Optic Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The fiber optic pressure sensors market size is valued at USD 3.8 billion in 2025 and is forecast to rise to USD 5.96 billion by 2030, advancing at a 9.42% CAGR.

Robust demand stems from the technology's suitability for real-time monitoring in harsh environments such as downhole oil wells and electric-vehicle battery packs. Ongoing miniaturization of Fabry-Perot micro-cavities and a 60% fall in interrogation-unit costs since 2020 have broadened adoption across industrial automation, healthcare, and mobility. Multiplexing gains have lifted Fiber Bragg Grating (FBG) uptake, while edge analytics integration in smart factories and implantable devices underscores new avenues of growth. Despite a 2-3 X cost premium over piezo-resistive sensors, rising total-cost-of-ownership advantages, workforce upskilling, and connector standardization initiatives continue to mitigate adoption barriers.

Global Fiber Optic Pressure Sensors Market Trends and Insights

Rapid Miniaturization of Fabry-Perot MEMS Cavities

Mass-production lithography now delivers cavity dimensions below 10 µm while preserving +-0.01% full-scale accuracy. This leap enables pressure detection as low as 2 kPa in space-constrained medical devices, outperforming conventional polymer sensors by 80% sensitivity. Smaller cavities shorten response times and lower unit cost through wafer-level integration that follows silicon-photonics process flows. Miniature sensors now support catheter-based cardiovascular monitoring, high-speed aerospace actuation feedback, and embedded battery-cell diagnostics without compromising structural integrity. As production volumes climb, the wired and wireless segments of the fiber optic pressure sensors market both benefit from higher performance at reduced price per channel.

Cost-Down of Distributed Fiber-Optic Interrogation Units

The integration of silicon photonics has trimmed interrogation-unit pricing by roughly 60% since 2020, placing sub-nanometer wavelength resolution within reach of routine industrial budgets. Low-cost units now achieve 2.5 µε accuracy and sub-1 s response time, accelerating structural-health-monitoring adoption in bridges, tunnels, and pipelines. China leads global deployments with 11.3% share, validating cost competitiveness in large-scale smart-factory rollouts. Edge-analytics firmware further reduces data-backhaul needs, strengthening the value proposition in remote assets and boosting overall uptake of the fiber optic pressure sensors market.

High ASP Versus Piezo-Resistive Sensors

A 2-3 X unit-price premium persists, particularly in multi-sensor industrial automation projects where budget ceilings remain strict. Specialized interrogation hardware inflates capital cost compared to simple strain-gauge conditioners. Yet maintenance savings in corrosive or high-temperature sites offset initial spend over asset life cycles, encouraging gradual substitution. Silicon-photonics scale-up is expected to shrink the gap to near parity in high-volume lines by 2028, easing this restraint on the fiber optic pressure sensors market.

Other drivers and restraints analyzed in the detailed report include:

- OEM Integration in EV Battery-Pack Thermal-Runaway Safety

- Mandatory Down-Hole Digitalization Targets in Oil & Gas

- Connector Standardization Lag in Subsea Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wired devices represented 73% of revenue in 2024, cementing their role in high-integrity assets such as downhole completions, pipeline corridors, and industrial furnaces. The fiber optic pressure sensors market size for wired units is projected to rise steadily alongside refinery upgrades and LNG terminal expansions. Physical connectivity guarantees signal integrity across kilometers of fiber in environments where wireless propagation is unreliable.

Wireless nodes, growing at a 12% CAGR, address installations where cabling adds weight, complexity, or safety risk. Implantable medical devices, battery cells, and rotating machinery capitalize on battery-free passive tags interrogated asynchronously. Continuous cost declines in ultra-low-power optical interrogators widen the addressable base beyond early adopters, lifting overall demand within the broader fiber optic pressure sensors market.[3]

Fabry-Perot sensors held 47% revenue share thanks to sub-milli-bar resolution and robustness at 200 °C. Their micro-cavity designs, now below 10 µm, allow integration in hypodermic needles and narrow geological perforations, reinforcing leadership within the fiber optic pressure sensors market share.

FBG arrays, however, will expand the fastest at 13.5% CAGR. A single fiber multiplexes hundreds of gratings, trimming per-point cost for structural-health-monitoring and long-haul pipeline projects. High-speed demodulators achieve +-1 pm stability, enhancing earthquake-resilient building surveillance and high-rise wind-load analysis. As interrogation costs fall, FBG uptake moderates Fabry-Perot dominance while enlarging total addressable revenue for the fiber optic pressure sensors market.

The Fiber Optic Pressure Sensors Market Report is Segmented by Type (Wired, Wireless), Technology (Fabry-Perot, Fiber Bragg Grating, and More), Application (Oil & Gas, Industrial Automation, Healthcare & Medical Devices, and More), Installation Environment (Down-hole/Sub-surface, Industrial Surface Plants, In-vivo/Biomedical, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 38% revenue in 2024, supported by rigorous safety codes across shale plays and expanding EV battery plants. Federal incentives for advanced manufacturing and the presence of oilfield service majors foster rapid prototyping and early commercial launches. Aerospace programs also adopt optical gauges for flight-critical systems, reinforcing the region's innovation edge within the fiber optic pressure sensors market.

Asia-Pacific posts the strongest 12.2% CAGR to 2030. China's 11.3% share of global distributed sensing deployments evidences government-driven smart-factory rollouts. Japan's precision automotive giants integrate optical sensors in battery cooling loops, while India's refinery expansions demand high-temperature gauging. Regional cost advantages in silicon photonics accelerate interrogation-unit output, broadening domestic availability and stimulating overall growth in the fiber optic pressure sensors market.

Europe records stable uptake anchored in automotive manufacturing, petrochemical processing, and offshore wind. Germany's 9.4% share of global optical deployments reflects long-standing leadership in industrial automation. United Kingdom subsea operators embrace wet-mate optical connectors for a new wave of North Sea life-extension projects. France's aerospace sector increasingly favors optical arrays for real-time structural diagnostics, adding to steady momentum across the fiber optic pressure sensors market.

- AP Sensing GmbH

- Baker Hughes Company

- Halliburton Company

- Honeywell International Inc.

- Infineon Technologies AG

- Luna Innovations Incorporated (incl. FISO Technologies)

- NXP Semiconductors N.V.

- Omron Corporation

- Opsens Inc.

- Panasonic Holdings Corporation

- Pressure Profile Systems Inc.

- Robert Bosch GmbH

- Schlumberger Limited (SLB)

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Yokogawa Electric Corporation

- ABB Ltd.

- Broadcom Inc.

- Rockwell Automation Inc.

- Sumitomo Electric Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid miniaturisation of Fabry-Perot MEMS cavities

- 4.2.2 Cost-down of distributed fiber-optic interrogation units

- 4.2.3 OEM integration in EV battery-pack thermal-runaway safety

- 4.2.4 Mandatory down-hole digitalisation targets (OandG)

- 4.2.5 Edge-analytics in smart factories (under-reported)

- 4.2.6 Implantable smart-catheter RandD funding spike (under-reported)

- 4.3 Market Restraints

- 4.3.1 High ASP vs piezo-resistive sensors

- 4.3.2 Connector standard-isation lag in subsea systems

- 4.3.3 Scarcity of opto-qualified technicians (under-reported)

- 4.3.4 IP fragmentation around micro-cavity designs (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Technology

- 5.2.1 Fabry-Perot

- 5.2.2 Fiber Bragg Grating

- 5.2.3 Intensity-Based

- 5.2.4 Other Technologies

- 5.3 By Application

- 5.3.1 Oil and Gas

- 5.3.2 Industrial Automation

- 5.3.3 Healthcare and Medical Devices

- 5.3.4 Automotive and Mobility

- 5.3.5 Consumer Electronics

- 5.3.6 Petrochemical

- 5.3.7 Other Applications

- 5.4 By Installation Environment

- 5.4.1 Down-hole / Sub-surface

- 5.4.2 Industrial Surface Plants

- 5.4.3 In-vivo / Biomedical

- 5.4.4 Aerospace and UAV

- 5.4.5 Marine and Subsea Structures

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC Countries

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AP Sensing GmbH

- 6.4.2 Baker Hughes Company

- 6.4.3 Halliburton Company

- 6.4.4 Honeywell International Inc.

- 6.4.5 Infineon Technologies AG

- 6.4.6 Luna Innovations Incorporated (incl. FISO Technologies)

- 6.4.7 NXP Semiconductors N.V.

- 6.4.8 Omron Corporation

- 6.4.9 Opsens Inc.

- 6.4.10 Panasonic Holdings Corporation

- 6.4.11 Pressure Profile Systems Inc.

- 6.4.12 Robert Bosch GmbH

- 6.4.13 Schlumberger Limited (SLB)

- 6.4.14 STMicroelectronics N.V.

- 6.4.15 Texas Instruments Incorporated

- 6.4.16 Yokogawa Electric Corporation

- 6.4.17 ABB Ltd.

- 6.4.18 Broadcom Inc.

- 6.4.19 Rockwell Automation Inc.

- 6.4.20 Sumitomo Electric Industries Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment