PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844618

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844618

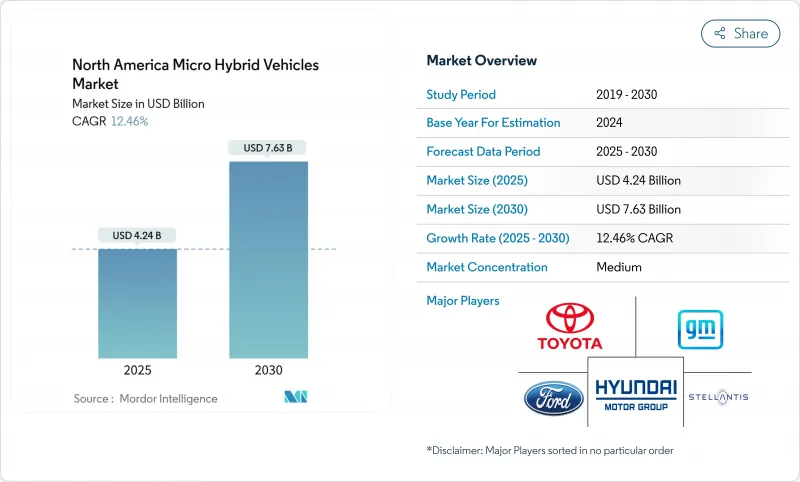

North America Micro Hybrid Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America micro-hybrid vehicles market size was valued at USD 4.24 billion in 2025 and is forecast to reach USD 7.63 billion by 2030, registering 12.46% CAGR.

Rising regulatory pressure, aggressive fleet electrification targets, and the automotive industry's strategic preference for cost-effective 48V architectures underpin this outlook. Technology delivers 10-15% fuel-efficiency gains at nearly one-third the cost of full hybrids, so it offers a pragmatic bridge between conventional powertrains and high-voltage electrification. A decisive move toward 48 V platforms also satisfies growing ADAS power loads without subjecting vehicles to safety regimes exceeding 60 V, further strengthening momentum.

North America Micro Hybrid Vehicles Market Trends and Insights

Stricter CAFE and GHG standards drive micro-hybrid adoption

The Environmental Protection Agency's Multi-Pollutant Emissions Standards require fleet CO2 emissions to fall to 85 g/mi by 2032, nearly halving 2026 levels, while NHTSA's CAFE rules demand roughly 50.4 mpg by 2031 . Automakers view 48V mild-hybrids as an immediate route to compliance because they deliver double-digit efficiency gains, integrate with existing ICE platforms, and maintain profitability. Ford plans hybrid variants across all remaining ICE nameplates by 2030, and GM has announced plug-in hybrids starting in 2027 after earlier EV-only ambitions. Program timing aligns well with the 2027-2032 phase-in schedule, letting OEMs spread investment over normal model updates.

Rapid OEM rollout of 48 V mild-hybrid architectures

The speed at which automakers are adopting 48 V systems reflects a confluence of technology readiness and regulatory necessity. Tesla's decision to eliminate 12 V components in favor of 48 V wiring exemplifies the shift toward lighter harnesses and lower resistive losses. Continental notes that a 48 V belt-starter generator can trim tailpipe CO2 by up to 15% and power electric turbochargers and regenerative braking. Tier-1 suppliers such as BorgWarner and Valeo have secured multi-year contracts for 48 V e-motors and power electronics on platforms launching through 2028, indicating that OEMs favor a modular strategy that scales from basic stop-start to ADAS support.

High incremental cost vs. legacy 12 V stop-start

A 48 V mild-hybrid adds roughly USD 800-1,500 per vehicle over a standard 12 V stop-start system, equal to 2-4% of an average U.S. transaction price. Forty percent of surveyed buyers cite upfront cost as the biggest barrier, even though lifetime fuel savings can exceed USD 600. Economies of scale and broader parts commonality are expected to trim system costs 20-30% by 2027, but short-term price sensitivity still curbs uptake.

Other drivers and restraints analyzed in the detailed report include:

- 48 V power net enables ADAS power loads without HV packs

- Consumer shift to fuel-efficient pickups and SUVs

- Tightening lithium-ion supply may crowd R&D budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 48 V class represented 64.15% of the North America micro-hybrid vehicles market share in 2024 and is projected to record a 13.62% CAGR through 2030. Because a 48 V belt-starter generator delivers 10-20 kW without triggering high-voltage safety rules, OEMs view it as the sweet spot for quick efficiency gains. Tesla's blueprint to retire 12 V wiring reinforces a likely standardization path, while the Low-Voltage Connector Standard removes cross-platform headaches. The 12 V segment still appeals to value-oriented models, especially in aftermarket retrofits. Meanwhile, 24 V solutions serve specialized commercial assets that need slightly higher power but cannot justify a 48 V architecture.

The 48 V pathway also future-proofs vehicles for additional ADAS content because it can power electric superchargers, active suspension, and steering boosts without major redesign. Parts commonality across ICE, MHEV, and future PHEV platforms lets suppliers amortize tooling costs and reach volume quicker. As more OEMs unify electrical backbones, price parity with 12 V stop-start is likely within the forecast horizon, strengthening the segment's leadership in the North America micro-hybrid vehicles market.

Lead-acid technologies held a 73.41% share in 2024, underpinned by mature recycling systems and a low cost per kilowatt-hour. AGM and EFB variants offer enhanced charge acceptance and life-cycle stability suited to high-frequency start-stop cycles. Lithium-ion's 15.99% CAGR signals a swift shift for more power-intensive 48 V functions as cell prices continue to moderate, but supply security concerns and raw-material volatility temper short-term penetration.

Hybrid capacitor projects that blend supercapacitors with lead-acid are under evaluation, promising rapid charge delivery that supports regenerative braking. Clarios and other suppliers are piloting these chemistries to keep lead-acid relevant even as lithium-ion matures. The net result is a diversified battery landscape that balances cost, energy density, and sourcing risk across the North America micro-hybrid vehicles market size.

The North America Micro-Hybrid Vehicles Market Report is Segmented by Capacity Type (12 V Micro-Hybrid, 24 V Micro-Hybrid, and More), Battery Type (Lead-Acid, Lithium-Ion, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), by End-User (OEM-Fitted Vehicles and Aftermarket/Fleet Retrofit), and Country (United States and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Toyota Motor Corporation

- Ford Motor Company

- Stellantis N.V.

- General Motors Company

- Hyundai Motor Group (Hyundai, Kia)

- BMW Group

- Daimler AG (Mercedes-Benz)

- Volkswagen AG

- Nissan Motor Co.

- Honda Motor Co.

- Kia Motors Corporation

- Subaru Corporation

- Mazda Motor Corporation

- Magna International Inc.

- BorgWarner Inc.

- Valeo SA

- Continental AG

- Robert Bosch GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter CAFE and GHG standards

- 4.2.2 Rapid OEM rollout of 48 V mild-hybrid architectures

- 4.2.3 48 V power net enables ADAS power loads without HV packs

- 4.2.4 Consumer shift to fuel-efficient pick-ups and SUVs

- 4.2.5 Cost-down curve of advanced AGM/EFB lead-acid batteries

- 4.2.6 US-Mexico battery-supply incentives shorten lead-times

- 4.3 Market Restraints

- 4.3.1 High incremental cost vs. legacy 12 V stop-start

- 4.3.2 Tightening lithium-ion supply may crowd R&D budgets

- 4.3.3 Limited consumer awareness of "micro-hybrid" value proposition

- 4.3.4 Absence of US-wide 48 V component repair/after-sales ecosystem

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Capacity Type

- 5.1.1 12 V Micro-hybrid

- 5.1.2 24 V Micro-hybrid

- 5.1.3 48 V Micro-hybrid

- 5.2 By Battery Type

- 5.2.1 Lead-acid (AGM/EFB)

- 5.2.2 Lithium-ion (LFP, LTO, NMC)

- 5.2.3 Others

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By End-User

- 5.4.1 OEM-fitted Vehicles

- 5.4.2 Aftermarket/Fleet Retrofit

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Toyota Motor Corporation

- 6.4.2 Ford Motor Company

- 6.4.3 Stellantis N.V.

- 6.4.4 General Motors Company

- 6.4.5 Hyundai Motor Group (Hyundai, Kia)

- 6.4.6 BMW Group

- 6.4.7 Daimler AG (Mercedes-Benz)

- 6.4.8 Volkswagen AG

- 6.4.9 Nissan Motor Co.

- 6.4.10 Honda Motor Co.

- 6.4.11 Kia Motors Corporation

- 6.4.12 Subaru Corporation

- 6.4.13 Mazda Motor Corporation

- 6.4.14 Magna International Inc.

- 6.4.15 BorgWarner Inc.

- 6.4.16 Valeo SA

- 6.4.17 Continental AG

- 6.4.18 Robert Bosch GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment