PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844624

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844624

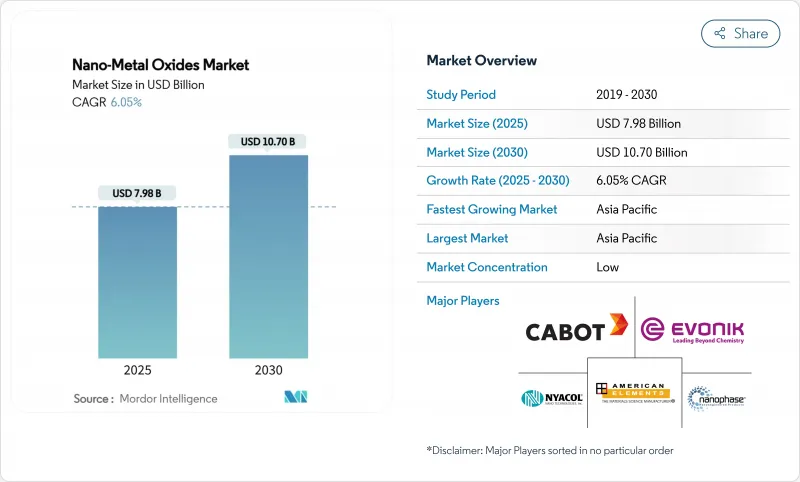

Nano-Metal Oxides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Nano-Metal Oxides Market size is estimated at USD 7.98 billion in 2025, and is expected to reach USD 10.70 billion by 2030, at a CAGR of 6.05% during the forecast period (2025-2030), underpinned by the distinct surface area, reactivity and functional tunability that nanostructuring unlocks.

Industries are intensifying the use of these materials to enhance energy storage electrodes, develop self-cleaning surfaces and raise the performance ceiling of aerospace super-alloys. Demand also accelerates as formulators replace organic biocides with nano-oxide antimicrobial agents, while green bio-synthesis trims energy use by 30% and slashes production costs 40% relative to conventional routes. Competition is fragmenting as global chemical majors integrate backward into precursor supply and smaller specialists carve niches through application-specific particle design. Asia-Pacific's manufacturing scale, combined with sustained public research spending, secures the region's lead in pilot adoption and high-volume output.

Global Nano-Metal Oxides Market Trends and Insights

Nanomaterials Adoption in Aerospace Super-Alloys

Aerospace programmes are embedding oxide-dispersion-strengthened alloys that deliver stable mechanical properties up to 500 °C, a 40% improvement on legacy aluminum systems. High-entropy nickel alloys fortified with nanoscale L12 precipitates keep tensile strength constant from -196 °C to 600 °C, removing temperature-sensitivity roadblocks for hypersonic vehicles. Composite fuselage sections on Boeing 787 and Airbus A350 platforms already demonstrate 20% weight savings while preserving structural integrity through nano-oxide fillers. Beyond load-bearing gains, embedded nanoparticles offer electromagnetic shielding that safeguards avionics from external interference. These combined benefits accelerate qualification cycles and ignite procurement contracts across Tier-1 suppliers.

Anti-Microbial Demand in Personal Care Formulations

Consumer preference for preservative-free cosmetics is raising interest in zinc oxide nanoparticles that achieve 90% bacterial growth reduction without cytotoxicity. Multifunctional titanium dioxide particles deliver simultaneous UV protection and photo-activated pathogen kill, reducing additive loading per formulation. Copper oxide offers premium antifungal activity and supports luxury skin-care launches targeting resistant dermatophytes. The swift pivot toward metal-based actives shortens ingredient lists and supports clean-label claims, particularly in Asia-Pacific where regulatory clearance is rapid. Suppliers scaling cosmetic-grade dispersions gain first-mover advantage as brand owners re-formulate global SKU portfolios.

Environmental Implications of Using Metal Powder

Lifecycle assessments reveal that both chemically and bio-synthesised nano-oxides can induce oxidative stress and DNA damage in aquatic species, prompting regulatory scrutiny. The European Food Safety Authority and the FDA now enforce tighter exposure thresholds for consumer products, lifting compliance costs for smaller producers. Recycling protocols and closed-loop wastewater systems are becoming prerequisites for permits, adding capital expenditure to greenfield projects. Market entrants must therefore balance innovation with stringent environmental stewardship to gain market access.

Other drivers and restraints analyzed in the detailed report include:

- Energy Storage Electrode Enhancements

- Growing Demand from Paints and Coatings Industry

- Price Volatility of Precursor Metals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Titanium oxide commanded 33.28% of the nano-metal oxides market share in 2024 as its photocatalytic strength and dielectric stability secured usage from self-cleaning facades to high-k transistors. Segment expansion continues as green routes employ plant extracts to yield biocompatible particles with similar band gaps yet lower carbon footprints. Cerium oxide is projected to outpace peers with a 7.96% CAGR as dual Ce3+/Ce4+ states drive CMP slurries vital for semiconductor planarisation. Silica and zinc oxide remain dependable for barrier films and dermatological creams, while iron oxide nanostructures penetrate remediation systems via 89% dye degradation efficiency.

Market momentum benefits suppliers that align particle engineering with end-use certification. Titanium dioxide makers capitalise on broad regulatory acceptance in food contact and cosmetics, whereas ceria suppliers focus on wafer-scale purity. Integrated firms leverage shared precursor networks to cut logistic costs, reinforcing competitive moats in this slice of the nano-metal oxides market.

The 20-80 nm band represented 46.25% in 2024 and is forecast to lead with a 7.85% CAGR. The interval balances quantum surface reactivity and process stability, offering easy dispersion in inks and polymers while avoiding the agglomeration typical below 20 nm. Sub-20 nm particles deliver superior catalytic rates but raise filtration and dust-safety issues that lift handling costs. Sizes above 80 nm serve niche optical or abrasion-resistant roles yet cede mass-market volumes to the mid-range. Advances in sol-gel and hydrothermal reactors now hold +-5 nm tolerances, giving formulators confidence in batch-to-batch consistency.

Adopters value this sweet spot for tunable band gaps in photocatalysts and predictable rheology in paints. Continued reactor optimisation coupled with inline spectroscopy promises to lift throughput, cementing the 20-80 nm window as the workhorse segment of the nano-metal oxides market.

The Nano-Metal Oxides Market Report is Segmented by Product Type (Alumina, Silica, and More), Particle Size (Less Than 20 Nm, 20-80 Nm, and More), Synthesis Method (Sol-Gel, Flame Spray Pyrolysis, and More), End-User Industry (Transportation, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 46.05% share in 2024 and is projected to record an 8.01% CAGR, anchored by China's 67.8% share of global silicon-anode materials and Japan's 21.5% cut of advanced material patents. Vertical integration compresses costs and quickens pilot-to-mass-production transitions. Government funding exceeding USD 30 billion since 2001 finances university-industry consortia that raise technology readiness and workforce skills.

North America ranks second, supported by aerospace supply chains that require oxide-strengthened alloys and advanced semiconductors. Producers such as American Elements and Evonik invested in ultra-high-purity colloidal silica plants to serve chip fabs.

Europe emphasises eco-design. Strict REACH directives motivate early adoption of green bio-synthesis, and construction retrofits absorb NIR-reflective coatings to meet energy-efficiency mandates. Emerging regions like South America and the Middle East tap nano-oxide facades for climate-resilient infrastructure, gradually lifting their consumption as local regulations mature.

- Advanced Nano Products Co., Ltd.

- American Elements

- Baikowski SA

- Cabot Corporation

- Cerion Nanomaterials

- Chengyin Technology

- Diamon-Fusion International Inc.

- Evonik Industries AG

- MATEXCEL

- Meliorum Technologies, Inc.

- Merck KGaA

- NaBond Technologies Co., Ltd.

- NanoComposix (Fortis Life Sciences)

- Nano-Oxides Inc.

- Nanophase Technologies Corporation

- Nanoshel LLC

- Nissan Chemical Corporation

- NYACOL Nano Technologies, Inc.

- Reinste Nano Ventures

- SkySpring Nanomaterials Inc.

- US Research Nanomaterials, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Nanomaterials adoption in aerospace super-alloys

- 4.2.2 Anti-microbial demand in personal care formulations

- 4.2.3 Energy storage electrode enhancements

- 4.2.4 Growing demand for nano metal oxides from paints and coatings industry

- 4.2.5 Increasing technology of 3D-printing Process

- 4.3 Market Restraints

- 4.3.1 Environmental Implications of Using Metal Powder

- 4.3.2 Price volatility of precursor metals

- 4.3.3 High Production Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Alumina

- 5.1.2 Silica

- 5.1.3 Titanium Oxide

- 5.1.4 Zinc Oxide

- 5.1.5 Iron Oxide

- 5.1.6 Other Product Types (Copper Oxide, etc.)

- 5.2 By Particle Size

- 5.2.1 Less than 20 nm

- 5.2.2 20 - 80 nm

- 5.2.3 Greater than 80 nm

- 5.3 By Synthesis Method

- 5.3.1 Sol-gel

- 5.3.2 Flame Spray Pyrolysis

- 5.3.3 Hydrothermal/ Solvothermal

- 5.3.4 Chemical Vapor Deposition

- 5.3.5 Green/ Bio-synthesis

- 5.4 By End-user Industry

- 5.4.1 Transportation

- 5.4.2 Electronics

- 5.4.3 Energy

- 5.4.4 Construction

- 5.4.5 Personal Care

- 5.4.6 Healthcare

- 5.4.7 Other End-user Industries (Chemicals and Catalysts, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Advanced Nano Products Co., Ltd.

- 6.4.2 American Elements

- 6.4.3 Baikowski SA

- 6.4.4 Cabot Corporation

- 6.4.5 Cerion Nanomaterials

- 6.4.6 Chengyin Technology

- 6.4.7 Diamon-Fusion International Inc.

- 6.4.8 Evonik Industries AG

- 6.4.9 MATEXCEL

- 6.4.10 Meliorum Technologies, Inc.

- 6.4.11 Merck KGaA

- 6.4.12 NaBond Technologies Co., Ltd.

- 6.4.13 NanoComposix (Fortis Life Sciences)

- 6.4.14 Nano-Oxides Inc.

- 6.4.15 Nanophase Technologies Corporation

- 6.4.16 Nanoshel LLC

- 6.4.17 Nissan Chemical Corporation

- 6.4.18 NYACOL Nano Technologies, Inc.

- 6.4.19 Reinste Nano Ventures

- 6.4.20 SkySpring Nanomaterials Inc.

- 6.4.21 US Research Nanomaterials, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment