PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844625

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844625

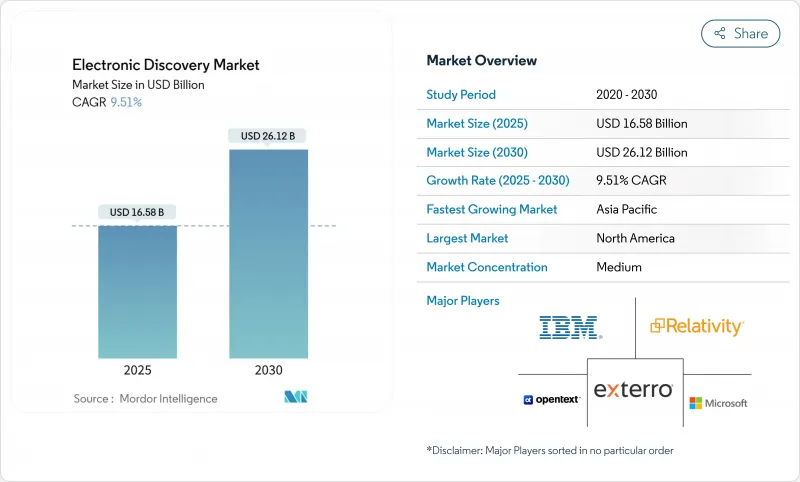

Electronic Discovery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The electronic discovery market size stood at USD 16.58 billion in 2025 and is projected to reach USD 26.12 billion in 2030, reflecting a 9.51% CAGR over the forecast period.

Heightened digitization of legal processes, the rapid rise in multi-format data, and mounting regulatory complexity are pushing legal departments to modernize discovery workflows and adopt AI-enabled review tools. Large enterprises view advanced analytics as a hedge against spiraling litigation costs, while small and mid-sized firms outsource to managed-service specialists to access comparable capabilities without bearing full infrastructure costs. Deployment preferences continue to swing toward cloud-first architectures, encouraged by pay-as-you-go economics and by heightened collaboration needs in hybrid work settings. North America retains scale advantages in platform innovation and case-law maturity, yet Asia-Pacific's double-digit expansion underscores how local enforcement regimes and cross-border commerce are converging to create fresh revenue pools for vendors. Competitive intensity is rising as cloud-native entrants challenge incumbents with transparent pricing, streamlined user experiences, and explainable AI features that address emerging admissibility standards.

Global Electronic Discovery Market Trends and Insights

AI/ML Integration Improving Review Efficiency

Generative AI and large-language-model tooling now slash human review hours by up to 70%, enabling law firms to redeploy staff toward higher-value advocacy. CS Disco's Cecilia assistant illustrates how conversational analytics curtail repetitive tagging while preserving audit trails . Courts are concurrently tightening evidentiary standards: proposed U.S. Rule 707 amendments will oblige counsel to demonstrate reliability, not just accuracy, before AI outputs become admissible. Vendors are therefore investing in transparent model governance frameworks-explainable ranking, calibration metrics, and chain-of-custody logging-to sustain adoption momentum without jeopardizing admissibility. As these assurance layers mature, electronic discovery market participants that marry efficiency with defensibility will widen their competitive moat.

Proliferation of Mobile and Cloud Data Sources

Microsoft Teams alone processes more than 1 trillion pages annually, underscoring the scale challenge facing discovery teams. Hybrid work patterns extend evidence repositories into personal devices and consumer apps, compelling enterprises to revisit information-governance baselines. Cloud-native vendors are countering complexity through API-driven connectors that pull data directly from Slack, Google Vault, and Microsoft 365, automating legal hold and collection workflows. Yet every new data pipe expands the attack surface for privacy breaches, so clients demand zero-knowledge encryption and region-specific data-residency controls. The electronic discovery market is therefore gravitating toward platforms that integrate policy enforcement, federated search, and AI-powered entity extraction under a single user interface.

Escalating Total Cost of Ownership for SMEs

Entry-level processing fees of USD 15-30 per GB intersect with rising data volumes, pushing overall project spend beyond many small-firm budgets. While cloud licensing reduces upfront capital outlay, downstream expenses-storage, advanced analytics, specialist review talent-remain material. Debt-laden service providers such as KLDiscovery illustrate how margin pressure can ripple through pricing as vendors seek to shore up balance sheets. Affordable automation, transparent subscription tiers, and community-based training resources could blunt the restraint, but market bifurcation persists, with enterprise clients gravitating to full-service platforms and cost-sensitive users defaulting to rudimentary keyword searches.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Data-Privacy Regulations (GDPR, CCPA, etc.)

- Growth in Corporate Internal Investigations

- AI Model Transparency Concerns Affecting Legal Admissibility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Managed services accounted for a 46.30% electronic discovery market share in 2024, reflecting corporate preference for outsourcing labor-intensive tasks such as processing, hosting, and AI model tuning. Providers achieve economies of scale by centralizing infrastructure and talent, letting clients convert fixed costs into variable spend. Advisory and post-implementation services, forecast at a 10.15% CAGR, attract organizations that need governance roadmaps to tame multicloud sprawl and to embed AI responsibly. As discovery requests span mobile chat, cloud archives, and social feeds, enterprises value end-to-end accountability-legal hold, collection, analytics, and production-under a single service-level agreement. The electronic discovery industry therefore rewards vendors that market outcome-based service bundles over piecemeal task pricing.

Managed specialists also integrate investigation accelerators such as data-minimization playbooks and privilege-screening models. These differentiators shorten review cycles and bolster defensibility in an era of stricter admissibility scrutiny. Providers expanding into high-growth geographies, exemplified by Exterro's new forensics lab in Chennai, leverage local talent pools to scale 24/7 support and lower delivery costs.

E-discovery and early case-assessment suites led the software category with 34% revenue share in 2024, yet AI-driven review and analytics is projected to rise at 10.40% CAGR, the fastest within the segment. Customers are shifting procurement criteria from raw processing horsepower toward insight velocity-how quickly a platform can surface custodial hot spots, sentiment pivots, or privilege anomalies. Relativity's move to a 75% cloud adoption ratio illustrates how SaaS delivery accelerates feature rollout and scales compute for intensive machine-learning workloads. Meanwhile, point-solution vendors that specialize in legal hold or production are embedding API gateways to integrate seamlessly into broader case-management stacks, preserving niche relevance even as platforms consolidate.

The electronic discovery market size attached to AI analytics is increasingly defended by explainability dashboards and bias-testing protocols. Buyers demand configurable confidence thresholds and narrative summaries that support courtroom presentation. Vendors that package transparent AI with granular cost-tracking tools differentiate on both risk and financial stewardship, appealing to corporate counsel under budget oversight.

The Electronic Discovery Market Report is Segmented by Service (Professional Services, Managed Services, Advisory & Post-Implementation Services), Software (E-Discovery and Early Case Assessment, Legal Hold and Preservation, and More), Deployment (SaaS/Cloud, On-Premise, Hosted/Hybrid), End User (Government and Public Sector, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 41.20% revenue in 2024 on the strength of established case law, prolific litigation, and a dense ecosystem of service providers. Market leaders headquartered in the region-Microsoft, IBM, OpenText, and Relativity-set product roadmaps that ripple globally. Growth, however, is moderating as cloud adoption approaches saturation and law firms finalize AI rollouts. Providers now emphasize value-add modules such as predictive outcome modeling and automated privilege screening to defend wallet share.

Asia-Pacific is forecast to grow at 11.40% CAGR through 2030, buoyed by expanding corporate-liability statutes and increasing cross-border deal activity. Japan's limited discovery provisions and absence of attorney-client privilege create demand for hybrid workflows that blend local data processing with offshore analytics hubs. Australia, India, and Singapore spearhead regulatory harmonization that aligns local disclosure norms with global best practices, accelerating platform uptake. Vendors succeeding in APAC localize user interfaces, offer regional data centers, and cultivate in-country incident-response teams to satisfy sovereignty concerns.

Europe continues steady adoption while navigating GDPR-driven constraints on data transfer. Providers offering in-region hosting, fine-grained consent management, and automated PII redaction earn preference in competitive bids. Post-Brexit divergence in UK rules demands modular compliance engines capable of toggling retention and deletion policies per jurisdiction. Latin America and Middle East and Africa remain nascent, yet rising regulatory cooperation with U.S. agencies is tipping multinational corporations to pre-deploy discovery infrastructure before enforcement actions materialize.

- IBM Corporation

- Microsoft Corporation

- OpenText Corporation

- Relativity ODA LLC

- Exterro Inc.

- Nuix Pty Ltd

- Micro Focus International plc

- Veritas Technologies LLC

- Logikcull.com Inc.

- CloudNine Discovery

- DISCO Inc.

- Everlaw Inc.

- ZyLAB Inc.

- FTI Consulting Inc.

- Deloitte Touche Tohmatsu Ltd.

- Kroll Ontrack LLC

- Xerox Holdings Corporation

- Catalyst Repository Systems Inc.

- Driven Inc.

- AccessData Group Inc.

- Guidance Software (OpenText)

- HaystackID LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of mobile and cloud data sources

- 4.2.2 Stringent data-privacy regulations (GDPR, CCPA, etc.)

- 4.2.3 Growth in corporate internal investigations

- 4.2.4 AI/ML integration improving review efficiency

- 4.2.5 Rise of collaborative platforms (Slack, Teams) driving data complexity

- 4.2.6 Increasing cross-border litigation requiring multi-jurisdictional discovery

- 4.3 Market Restraints

- 4.3.1 Escalating total cost of ownership for SMEs

- 4.3.2 Shortage of skilled e-discovery professionals

- 4.3.3 Cross-border data-transfer restrictions

- 4.3.4 AI model transparency concerns affecting legal admissibility

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service

- 5.1.1 Professional Services

- 5.1.2 Managed Services

- 5.1.3 Advisory and Post-Implementation Services

- 5.2 By Software

- 5.2.1 E-discovery and Early Case Assessment

- 5.2.2 Legal Hold and Preservation

- 5.2.3 Data Processing and Culling

- 5.2.4 Document Review and Analysis

- 5.2.5 Production and Presentation

- 5.3 By Deployment

- 5.3.1 SaaS / Cloud

- 5.3.2 On-premise

- 5.3.3 Hosted / Hybrid

- 5.4 By End User

- 5.4.1 Government and Public Sector

- 5.4.2 BFSI

- 5.4.3 IT and Telecommunication

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Energy and Utilities

- 5.4.6 Transportation and Logistics

- 5.4.7 Media and Entertainment

- 5.4.8 Retail and E-commerce

- 5.4.9 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 OpenText Corporation

- 6.4.4 Relativity ODA LLC

- 6.4.5 Exterro Inc.

- 6.4.6 Nuix Pty Ltd

- 6.4.7 Micro Focus International plc

- 6.4.8 Veritas Technologies LLC

- 6.4.9 Logikcull.com Inc.

- 6.4.10 CloudNine Discovery

- 6.4.11 DISCO Inc.

- 6.4.12 Everlaw Inc.

- 6.4.13 ZyLAB Inc.

- 6.4.14 FTI Consulting Inc.

- 6.4.15 Deloitte Touche Tohmatsu Ltd.

- 6.4.16 Kroll Ontrack LLC

- 6.4.17 Xerox Holdings Corporation

- 6.4.18 Catalyst Repository Systems Inc.

- 6.4.19 Driven Inc.

- 6.4.20 AccessData Group Inc.

- 6.4.21 Guidance Software (OpenText)

- 6.4.22 HaystackID LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment