PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844631

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844631

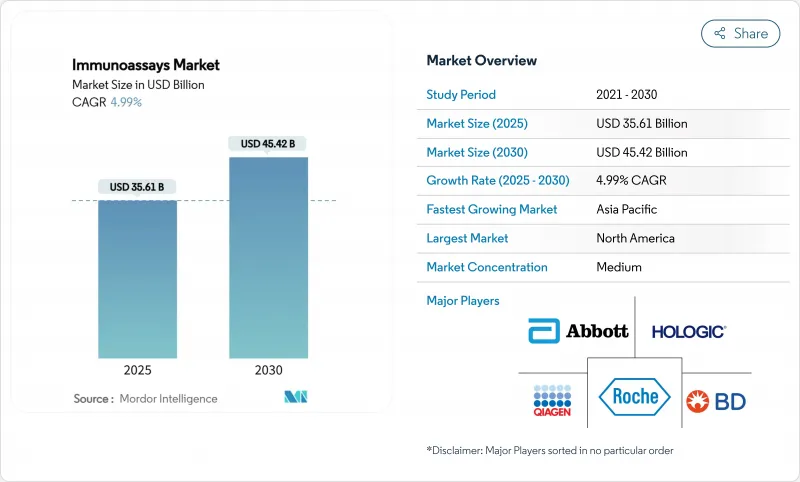

Immunoassays - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The immunoassays market is valued at USD 35.61 billion in 2025 and is projected to reach USD 45.42 billion by 2030, advancing at a 4.99% CAGR.

The forward trajectory reflects a mature yet steadily expanding space, underpinned by accelerating demand for oncology biomarkers, artificial-intelligence-enabled platforms, and real-time bioprocess monitoring. AI-enhanced devices now push immunoassay detection limits down to femtomolar ranges, as seen in Rice University's flow-cytometry instrument that delivers laboratory-grade accuracy in community clinics. Market growth also benefits from chemiluminescence immunoassay (CLIA) uptake in therapeutic drug monitoring and from heightened infectious-disease surveillance programs across emerging economies. Meanwhile, consolidation among diagnostics majors and venture funding in niche innovators intensify competitive dynamics, even as cross-reactivity issues, high capital costs, and stringent multi-region regulations temper adoption.

Global Immunoassays Market Trends and Insights

Rising Prevalence of Chronic & Infectious Diseases

Escalating cancer, cardiovascular, and infectious-disease burdens continue to redefine testing volumes worldwide. Multi-parameter panels that combine circulating tumor DNA with traditional protein biomarkers are improving early diagnosis and therapy selection, as evidenced by research identifying CA724, ferritin, and B2-microglobulin as thoracic cancer indicators. Cardiometabolic care has embraced advanced lipoprotein(a) assays, with Roche's Tina-quant test delivering the first molar-based Lp(a) measurement cleared by the FDA. Communicable-disease surveillance, supported by WHO quality-assurance networks, further accelerates reagent consumption and instrument installations.

Rapid Technological Advances in High-Throughput Analyzers

Automation and machine learning now underpin daily laboratory workflows. The Mayo Clinic's AI model for kidney-stone spectral analysis cut per-sample review time while preserving accuracy. CLIA platforms from Revvity deliver 60 tests per hour with 48-minute turnaround and monoclonal antibody specificity, a combination essential for precision oncology and endocrinology. Microfluidic biosensors integrate fluid control and optical detection on a single chip, shrinking assay footprints and permitting true walk-away operation.

Stringent Multi-Jurisdictional Regulatory Approvals

Developers face divergent evidence expectations across the FDA, European IVDR, and multiple Asian frameworks, inflating timelines and budgets. Companion diagnostics add layers of inter-agency coordination, while guidance for AI-enabled or multiplex assays remains fragmented. Lack of global harmonization compels parallel validation studies and onsite audits, draining resources from R&D pipelines and product launches.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Point-of-Care/Home-Based Rapid Tests

- Government-Funded Global Surveillance & Immunization Programs

- High Capital Cost of Multiplex & Automated Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents and kits generated USD 22.9 billion in revenue in 2024, translating into the single largest slice of the immunoassays market and providing predictable, recurring income streams for suppliers. Volume growth comes from routine infectious-disease panels, chronic-disease monitoring, and expanding global surveillance programs that require validated, lot-consistent consumables. Reagent interoperability across multiple analyzer platforms is increasingly important, prompting manufacturers to invest in universal chemistries and CE-marked bulk packs that support lean-lab initiatives.

Analyzers and instruments, the fastest-expanding category at a 5.34% CAGR, reflect laboratory moves toward full automation and high-throughput operations. AI-enabled scheduling modules now optimize run order and maintenance cycles, easing technician shortages. Meanwhile, middleware connects immunoassay data with LIS and hospital EHRs, driving integrated clinical decision support. As a result, the immunoassays market size for instruments is projected to rise from USD 7.6 billion in 2025 to USD 9.9 billion in 2030.

ELISA occupied 55.34% revenue share in 2024, anchored by standardized protocols, low consumable cost, and decades of accumulated performance evidence. Academic and community laboratories alike continue to rely on ELISA for cytokine panels, endocrine markers, and autoimmune screening, sustaining strong base demand. Yet sensitivity ceilings and relatively long incubation times limit ELISA's suitability for emerging ultra-low-analyte applications.

Chemiluminescence immunoassays, growing at a 5.41% CAGR, offer higher analytical sensitivity and wider dynamic range, making them the method of choice for therapeutic drug monitoring and tumor-marker quantification. Multiplex microarray platforms add throughput by simultaneously detecting dozens of analytes, a capability now indispensable in translational oncology programs. Consequently, the immunoassays market share commanded by CLIA is forecast to climb toward 30% by decade-end, even as ELISA retains a sizeable installed base.

The Immunoassays Market Report is Segmented by Product & Service (Reagents & Kits, Analyzers & Instruments, and More), Technology (ELISA, CLIA, and More), Application (Infectious Diseases, Oncology, and More), Specimen Type (Blood & Serum, Saliva, and More), End User (Hospitals, Clinical Laboratories, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 41.12% revenue share in 2024, supported by strong reimbursement frameworks, NIH funding, and rapid FDA review pathways for breakthrough diagnostics. Recent clearances such as Roche's B-cell lymphoma assay illustrate the region's innovation cadence. Collaboration between Biogen, Beckman Coulter, and Fujirebio on Alzheimer's markers further demonstrates the value placed on immunoassay-based companion diagnostics. The United States continues to replace aging analyzers with fully automated lines integrating sample prep, while Canada emphasizes universal access and Mexico channels public-sector tenders toward high-sensitivity infectious-disease platforms.

Asia-Pacific is the fastest-growing region at 5.54% CAGR through 2030. China's Made-in-China 2025 plan accelerates diagnostic self-sufficiency, with Chemclin's automated systems moving from pilot to national rollout. India's organized diagnostics sector is expanding beyond metropolitan hubs into tier-3 and tier-4 cities, aided by wellness packages and price transparency. Japan incentivizes regenerative-medicine and oncology companion tests via fast-track approval programs, while South Korea supports start-ups through tax credits and hospital test beds. Southeast Asian nations benefit from multilateral funding aimed at tuberculosis and dengue surveillance, creating first-time buyer opportunities for bench-top platforms.

Europe remains a major revenue contributor, although IVDR transition challenges extend launch timelines. Germany and France anchor centralized testing demand, the United Kingdom prioritizes early cancer detection via NHS funding, and Spain expands point-of-care programs in primary-care clinics. Meanwhile, the Middle East and Africa, though smaller today, show double-digit test-volume growth thanks to Gulf state hospital construction and African CDC procurement initiatives. South America leverages Brazil's unified health-service upgrades to expand neonatal and prenatal screening, while Argentina pushes for local reagent production amid import restrictions.

- Abbott Laboratories

- Roche

- Siemens Healthineers

- Danaher

- Thermo Fisher Scientific

- Beckton Dickinson

- Bio-Rad Laboratories

- Hologic

- Luminex

- QIAGEN

- Sysmex

- Agilent Technologies

- PerkinElmer

- bioMerieux

- DiaSorin

- Ortho Clinical Diagnostics

- Tosoh

- Mindray

- Merck

- QuidelOrtho

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic and Infectious Diseases

- 4.2.2 Rapid Technological Advances in High-throughput Analyzers

- 4.2.3 Expansion of Point-of-care/Home-based Rapid Tests

- 4.2.4 Government-funded Global Surveillance & Immunization Programs

- 4.2.5 AI/ML-enabled Ultra-low-analyte Detection Platforms

- 4.2.6 PAT Immunoassays for Real-time Bioprocess Monitoring

- 4.3 Market Restraints

- 4.3.1 Stringent Multi-jurisdictional Regulatory Approvals

- 4.3.2 High Capital Cost of Multiplex & Automated Systems

- 4.3.3 Cross-reactivity & Matrix Interferences in Novel Assays

- 4.3.4 Supply-chain Bottlenecks for High-purity Antibodies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value - USD million)

- 5.1 By Product & Service

- 5.1.1 Reagents & Kits

- 5.1.2 Analyzers & Instruments

- 5.1.3 Software & Services

- 5.2 By Technology

- 5.2.1 Enzyme-Linked Immunosorbent Assay (ELISA)

- 5.2.2 Chemiluminescence Immunoassay (CLIA)

- 5.2.3 Fluorescence Immunoassay (FIA)

- 5.2.4 Radioimmunoassay (RIA)

- 5.2.5 Lateral Flow Immunoassay (LFIA)

- 5.2.6 Multiplex & Microarray Immunoassays

- 5.2.7 Others (Western Blot, Immuno-PCR)

- 5.3 By Application

- 5.3.1 Infectious Diseases

- 5.3.2 Oncology

- 5.3.3 Cardiology

- 5.3.4 Endocrinology

- 5.3.5 Autoimmune Disorders

- 5.3.6 Therapeutic Drug Monitoring

- 5.3.7 Drug Discovery & Development

- 5.3.8 Others

- 5.4 By Specimen Type

- 5.4.1 Blood & Serum

- 5.4.2 Saliva

- 5.4.3 Urine

- 5.4.4 Other Body Fluids

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Clinical Laboratories

- 5.5.3 Pharmaceutical & Biotechnology Companies

- 5.5.4 Academic & Research Institutes

- 5.5.5 Point-of-Care / Home-Care Settings

- 5.5.6 Others

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Siemens Healthineers AG

- 6.3.4 Danaher Corporation (Beckman Coulter)

- 6.3.5 Thermo Fisher Scientific Inc.

- 6.3.6 Becton, Dickinson and Company

- 6.3.7 Bio-Rad Laboratories Inc.

- 6.3.8 Hologic Inc.

- 6.3.9 Luminex Corporation

- 6.3.10 Qiagen N.V.

- 6.3.11 Sysmex Corporation

- 6.3.12 Agilent Technologies Inc.

- 6.3.13 PerkinElmer Inc.

- 6.3.14 bioMerieux SA

- 6.3.15 DiaSorin S.p.A.

- 6.3.16 Ortho Clinical Diagnostics

- 6.3.17 Tosoh Bioscience

- 6.3.18 Mindray Medical International

- 6.3.19 Merck KGaA (Millipore Sigma)

- 6.3.20 QuidelOrtho Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment