PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844632

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844632

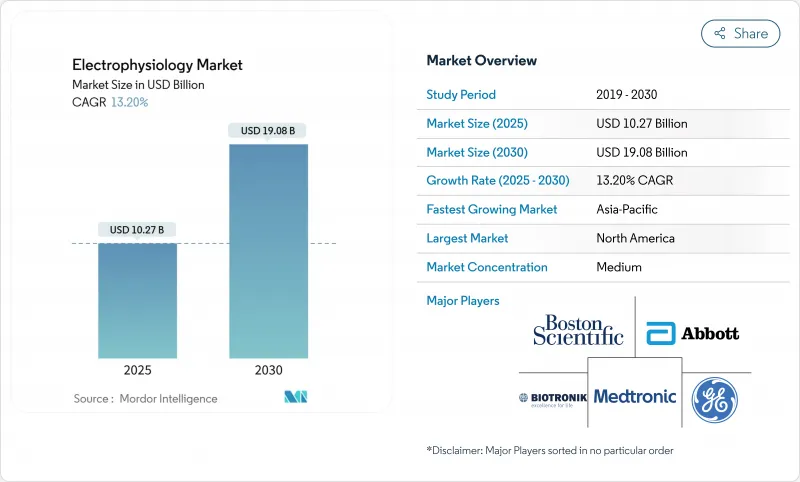

Electrophysiology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Electrophysiology Market size is estimated at USD 10.27 billion in 2025, and is expected to reach USD 19.08 billion by 2030, at a CAGR of 13.20% during the forecast period (2025-2030).

This growth rests on swift adoption of pulsed field ablation (PFA) technologies, rising procedural volumes tied to aging populations, and the steady shift of atrial fibrillation cases to outpatient settings. Broader reimbursement, especially from Medicare, is sustaining capital investment in advanced laboratories while industry consolidation concentrates intellectual property in the hands of a few large device makers. Asia-Pacific is adding new capacity at a faster pace than any other region, but North America still delivers the largest revenue pool. Collectively, these factors position the electrophysiology market to outpace many other cardiovascular device categories through 2030.

Global Electrophysiology Market Trends and Insights

Rising Prevalence of Atrial Fibrillation

Atrial fibrillation incidence is climbing as populations age, with European prevalence expected to double over the next three decades. Younger cohorts in emerging countries are now presenting with arrhythmias tied to sedentary lifestyles, expanding the candidate pool beyond traditional demographics. Persistent forms of the disease are driving demand for sophisticated mapping and dual-energy systems that shorten procedure time and improve lesion quality. Government-funded screening programs in Asia-Pacific detect more undiagnosed cases, adding volume to already strained electrophysiology laboratories. Stroke prevention costs of more than USD 45,000 per patient per year provide payers with a strong financial rationale to approve early ablation interventions.

Rapid Innovation in Ablation & Mapping Systems

PFA is the most disruptive modality since radiofrequency ablation. Its tissue-selective properties avoid thermal injury, improving safety margins and boosting operator confidence. Artificial-intelligence-guided mapping software reduces planning time and raises first-pass isolation rates.Dual-energy catheters now permit single-session treatment of complex arrhythmias, lowering repeat ablation incidence below 10%. Leadless pacing developments, such as left bundle branch area pacing, remove hardware complications and open new procedural pathways. Together, these advances expand the electrophysiology market by reducing barriers to physician adoption.

Shortage of Trained Electrophysiologists and EP Nurses

Fellowship programs accommodate 3-4 trainees annually when 8-10 graduates are needed, constraining growth. New PFA technologies still require 50-100 supervised cases to reach competence. Hospitals are piloting cross-training curricula that shorten onboarding to eight months, but unfilled positions can reduce departmental revenue by up to USD 3 million per year. Professional societies propose two-plus-two training models to accelerate certification. Meanwhile, AI-driven automation of documentation tasks frees existing specialists to handle more procedures.

Other drivers and restraints analyzed in the detailed report include:

- Growing Preference for Minimally-Invasive Catheter Procedures

- Accelerated Adoption of Pulsed Field Ablation Systems

- High Capital Cost of State-of-the-Art EP Labs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The ablation catheter segment retained 44.62% electrophysiology market share in 2024, but pulsed field ablation catheters are expanding at a 17.89% CAGR and will reshape category leadership by 2030. Clinical evidence confirming PFA's superior safety is diverting capital budgets away from legacy radiofrequency and cryo platforms. Mapping and navigation systems gain momentum because AI integration delivers faster point-by-point guidance, boosting procedure efficiency. Recording systems shift to cloud-based formats, allowing off-site interpretation and lowering staffing needs. Diagnostic catheters grow slowly as they bundle into full-service platforms rather than independent devices. Laboratory imaging hardware rises in tandem with hybrid operating room installations, anchoring hospital investment cycles in the electrophysiology industry.

Competitive differentiation is moving from individual devices to system-level integration. Suppliers that offer seamless software-hardware ecosystems lock in hospital preferences and create recurring revenue from consumables. Access devices remain necessary but mostly commoditized; suppliers leverage them to complete portfolios rather than drive profit. Overall, the electrophysiology market benefits from product convergence that simplifies purchasing decisions and accelerates technology refresh.

The Electrophysiology Market Report Segments the Industry Into by Product Type (Ablation Catheters, Diagnostic Catheters, Laboratory Devices, Mapping & Navigation Systems, and More), Indication (Atrial Fibrillation, Atrial Flutter, and More ), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 36.85% revenue in 2024, supported by broad insurance coverage and high device adoption. Physician fee-schedule cuts of 2.93% in 2025 temper growth, yet procedure volumes stay resilient due to rising atrial fibrillation incidence. Europe follows a mature pattern, with standardization under the Medical Device Regulation easing technology migration across member states. Hospital consolidation concentrates purchasing power, encouraging volume-based discounts but also accelerating refresh cycles for mapping systems.

Asia-Pacific records the fastest 14.23% CAGR, as China's Healthy China 2030 initiative subsidizes catheter-laboratory construction and reimburses advanced ablation procedures. India's private sector invests heavily in catheter labs, with one leading chain adding 2,200 beds and AI-enabled EP suites. Japan maintains high per-capita procedure rates and recently cleared Boston Scientific's FARAPULSE, signaling quick regulatory acceptance for new PFA systems.

The Middle East targets medical tourism, with the United Arab Emirates increasing healthcare spending from 5% to 5.4% of GDP, bolstering demand for complex ablations. Latin America offers selective promise: Brazil's economic rebound lifts capital budgets, but import duties and licensing requirements slow roll-outs of newer platforms. Local manufacturing partnerships and flexible financing mitigate these hurdles, keeping the electrophysiology market on a steady upward trajectory across diverse regions.

- Abbott Laboratories

- Acutus Medical

- AngioDynamics

- AtriCure

- BIOTRONIK

- Boston Scientific

- CardioFocus Inc.

- CathVision ApS

- GE HealthCare Technologies Inc.

- Imricor Medical Systems

- Johnson & Johnson

- Kardium

- Koninklijke Philips

- Lepu Medical

- Medtronic

- MicroPort

- OSYPKA

- Siemens Healthineers

- Stereotaxis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Atrial Fibrillation & Other Arrhythmias

- 4.2.2 Rapid Technology Innovation in Ablation & Mapping Systems

- 4.2.3 Growing Preference for Minimally Invasive Catheter Procedures

- 4.2.4 Accelerated Adoption of Pulsed Field Ablation (PFA) Systems

- 4.2.5 Broader Reimbursement & EP-Lab Build-Outs in Emerging Markets

- 4.2.6 Hybrid "One-Stop" EP-OR Centers Lifting Procedure Throughput

- 4.3 Market Restraints

- 4.3.1 Shortage of Trained Electrophysiologists and EP Nurses

- 4.3.2 High Capital Cost of State-Of-The-Art EP Labs

- 4.3.3 Payer Caution Over Long-Term PFA Safety/Efficacy Evidence

- 4.3.4 Radiation-Dose Scrutiny Delaying Fluoroscopy-Based Installs

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Ablation Catheters

- 5.1.2 Diagnostic Catheters

- 5.1.3 Laboratory Devices

- 5.1.4 Mapping & Navigation Systems

- 5.1.5 EP Recording Systems

- 5.1.6 Access Devices

- 5.1.7 Other Products

- 5.2 By Indication

- 5.2.1 Atrial Fibrillation

- 5.2.2 Atrial Flutter

- 5.2.3 AV Nodal Re-entry Tachycardia (AVNRT)

- 5.2.4 Ventricular Tachycardia

- 5.2.5 Other Arrhythmias

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Cardiac Centers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Acutus Medical

- 6.3.3 AngioDynamics

- 6.3.4 AtriCure Inc.

- 6.3.5 Biotronik SE & Co. KG

- 6.3.6 Boston Scientific Corporation

- 6.3.7 CardioFocus Inc.

- 6.3.8 CathVision ApS

- 6.3.9 GE HealthCare Technologies Inc.

- 6.3.10 Imricor Medical Systems

- 6.3.11 Johnson & Johnson (Biosense Webster)

- 6.3.12 Kardium Inc.

- 6.3.13 Koninklijke Philips N.V.

- 6.3.14 Lepu Medical Technology

- 6.3.15 Medtronic

- 6.3.16 MicroPort Scientific Corporation

- 6.3.17 OSYPKA AG

- 6.3.18 Siemens Healthineers

- 6.3.19 Stereotaxis Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment