PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844633

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844633

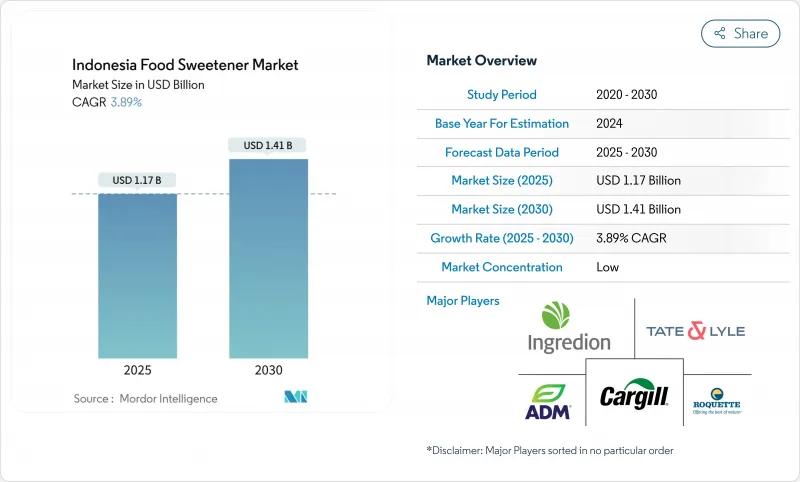

Indonesia Food Sweetener - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indonesia food sweetener market generated USD 1.17 billion in 2025 and is projected to reach a market size of USD 1.41 billion by 2030, advancing at a 3.89% CAGR.

This moderate expansion signals a sector in transition as health-conscious shoppers, fiscal measures on sugar, and mandatory halal labeling reshape purchase choices. A prolonged dependency on imported raw sugar continues to expose local supply to global price swings, yet broadening domestic cultivation of stevia, palm sugar, and coconut sugar offers a partial hedge against that exposure. Large beverage fillers have started to reformulate flagship products to cut taxable free-sugar content, while bakery producers are experimenting with sweetener blends that preserve texture at lower caloric loads. The gradual rise of middle-class households with higher discretionary income sustains overall demand for indulgent items, but spending is shifting toward "better-for-you" SKUs that rely on high-intensity or natural alternatives rather than bulk sucrose.

Indonesia Food Sweetener Market Trends and Insights

Processed-food boom elevating bulk sucrose demand

The growing processed food industry in Indonesia is significantly driving the demand for bulk sucrose. According to data from the Indonesian Ministry of Industry, the processed food sector has been expanding at a robust pace, contributing substantially to the country's GDP. World Bank data reveals that in 2023, urban areas in Indonesia housed approximately 59% of the nation's total population . As processed foods often require sucrose as a key ingredient for flavor enhancement, preservation, and texture improvement, the demand for bulk sucrose is witnessing a notable rise. Furthermore, government initiatives aimed at boosting the food and beverage industry, such as tax incentives and infrastructure development, are expected to further support the growth of the processed food sector. This, in turn, is likely to sustain the upward trajectory of bulk sucrose demand in the forecast period.

Booming demand for low-calorie beverage in urban regions

The increasing demand for low-calorie beverages in urban regions is a significant driver of the Indonesia Food Sweetener Market. This trend is fueled by growing health consciousness among urban consumers, who are actively seeking healthier alternatives to traditional sugary drinks. In 2024, the International Diabetes Federation reported a diabetes prevalence rate of 11.3% in the country . In response, the government has launched initiatives to encourage healthier eating habits, emphasizing the adoption of low-calorie products.The government has also introduced public awareness campaigns, such as the "Isi Piringku" program, which emphasizes balanced nutrition and reduced sugar intake. Additionally, the Indonesian Food and Beverage Association (GAPMMI) has reported a steady rise in the production and consumption of low-calorie beverages, reflecting a shift in consumer preferences. GAPMMI further highlights that urbanization and rising disposable incomes have contributed to the growing demand for premium and health-focused products, including beverages sweetened with innovative alternatives like stevia, sucralose, and erythritol.

Stringent regulatory scrutiny and labeling requirements

The Indonesia Food Sweetener Market faces significant restraint due to stringent regulatory scrutiny and labeling requirements. The government of Indonesia, through agencies such as the National Agency of Drug and Food Control (BPOM), enforces strict regulations to ensure food safety and consumer protection. These regulations mandate comprehensive labeling of food products, including detailed information on sweetener content, usage limits, and potential health impacts. Additionally, compliance with international standards, such as those set by the Codex Alimentarius Commission, further adds to the regulatory burden for manufacturers. Industry associations, including the Indonesian Food and Beverage Association (GAPMMI), have highlighted the challenges faced by producers in adhering to these evolving regulations. Such stringent requirements increase operational costs and can delay product launches, thereby restraining market growth during the forecast period.

Other drivers and restraints analyzed in the detailed report include:

- Increasing prevalence of diabetes and obesity

- Shift toward food personalization and controlled nutrition

- Health concerns over artificial sweeteners' carcinogenic properties

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sucrose accounted for 62.43% of Indonesia's food sweetener market. Its widespread use is attributed to its multi-functional properties, including its ability to act as a bulking agent, aid in crystallization, and enhance flavor. These characteristics make sucrose a preferred choice across various food and beverage applications in the country. Additionally, its cost-effectiveness and ease of availability further strengthen its position as a dominant sweetener in the market.

High-intensity sweeteners, including stevia, sucralose, neotame, and monk-fruit extracts, are gaining traction in the Indonesian market. These sweeteners are increasingly favored due to their low-calorie content and significantly higher sweetness levels compared to sucrose, which allows for smaller quantities to achieve the desired sweetness. The segment is growing at a CAGR of 4.76%, driven by rising consumer demand for healthier and low-calorie alternatives in food and beverage products. Furthermore, the growing awareness of health issues, such as obesity and diabetes, is encouraging manufacturers to incorporate these sweeteners into their product formulations.

In 2024, powdered variants dominated Indonesia's food sweetener market, capturing 72.44% of the market share. Their dominance can be attributed to several factors. Powdered sweeteners offer an extended shelf life, which is particularly advantageous in Indonesia's tropical climate with high humidity levels. This characteristic ensures that the product remains stable and usable over a longer period. Additionally, powdered formats are easier to package and transport, making them highly suitable for inter-island shipping, which is a critical logistical requirement in Indonesia's archipelagic geography. Furthermore, powdered sweeteners are widely used in various applications, including dry-mix sauces and instant noodles, due to their compatibility with these products.

Meanwhile, liquid formats are experiencing notable growth, advancing at a 4.64% CAGR. This growth is primarily driven by technological advancements and evolving consumer demands. Beverage companies in Indonesia are increasingly upgrading their production lines with aseptic PET technology, which enhances the safety and shelf life of liquid sweeteners. This technological shift has made liquid formats more appealing for use in beverages and other liquid-based applications. Additionally, liquid sweeteners are gaining traction due to their ability to provide precise metering during continuous syrup preparation, which is essential for maintaining consistency and quality in production processes.

The Indonesia Food Sweetener Market Report is Segmented by Type (Sucrose, Starch Sweeteners and Sugar Alcohols, and High Intensity Sweeteners), Form (Powder, Liquid, and Others), Source (Natural and Synthetic), and Application (Bakery and Confectionery, Dairy and Frozen Desserts, Beverage, Meat and Meat Products, Soups, Sauces and Dressings, and Others). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cargill, Incorporated

- Tate and Lyle PLC

- Archer Daniels Midland Company

- Roquette Freres

- Ingredion Incorporated

- PT Batang Alum Industrie

- PT Indesso Aroma

- Sungai Budi Group

- PT Barentz Indonesia

- Stevia Corp

- Ajinomoto Co. Inc.

- PT Megasurya Mas

- PT Indofood Sukses Makmur Tbk

- Wilmar International Ltd.

- PT Franco-Indonesian Mannitol

- PT Yakult Indonesia Persada

- PT Mayora Indah Tbk

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Processed-food boom elevating bulk sucrose demand

- 4.2.2 Booming demand for low-calorie beverage in urban regions

- 4.2.3 Increasing prevalance of diabetes and obesity

- 4.2.4 Shift toward food personalization and controlled nutrition

- 4.2.5 Strong demand for flavored dairy products reduces sugar

- 4.2.6 Consumer behaviour toward clean label products

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory scrutiny and labeling requirements

- 4.3.2 Rising demand for clean label and natural food products

- 4.3.3 Health concerns over artificial sweeteners' carcinogenic properties

- 4.3.4 Growing consumer preference for natural plant-based sweeteners

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Sucrose (Common Sugar)

- 5.1.2 Starch Sweeteners and Sugar Alcohols

- 5.1.2.1 Dextrose

- 5.1.2.2 High Fructose Corn Syrup (HFCS)

- 5.1.2.3 Maltodextrin

- 5.1.2.4 Sorbitol

- 5.1.2.5 Xylitol

- 5.1.2.6 Others

- 5.1.3 High Intensity Sweeteners (HIS)

- 5.1.3.1 Aspartame

- 5.1.3.2 Saccharin

- 5.1.3.3 Neotame

- 5.1.3.4 Stevia

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.2.3 Others

- 5.3 By Source

- 5.3.1 Natural

- 5.3.2 Synthetic

- 5.4 By Application

- 5.4.1 Bakery and Confectionary

- 5.4.2 Dairy and Frozen Desserts

- 5.4.3 Beverage

- 5.4.4 Meat and Meat Products

- 5.4.5 Soups, Sauces, and Dressings

- 5.4.6 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Cargill, Incorporated

- 6.4.2 Tate and Lyle PLC

- 6.4.3 Archer Daniels Midland Company

- 6.4.4 Roquette Freres

- 6.4.5 Ingredion Incorporated

- 6.4.6 PT Batang Alum Industrie

- 6.4.7 PT Indesso Aroma

- 6.4.8 Sungai Budi Group

- 6.4.9 PT Barentz Indonesia

- 6.4.10 Stevia Corp

- 6.4.11 Ajinomoto Co. Inc.

- 6.4.12 PT Megasurya Mas

- 6.4.13 PT Indofood Sukses Makmur Tbk

- 6.4.14 Wilmar International Ltd.

- 6.4.15 PT Franco-Indonesian Mannitol

- 6.4.16 PT Yakult Indonesia Persada

- 6.4.17 PT Mayora Indah Tbk

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK