PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844634

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844634

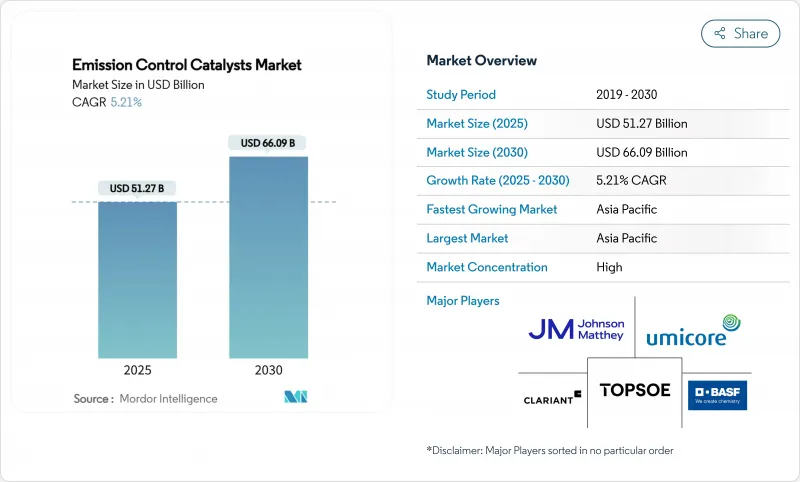

Emission Control Catalysts - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The emission control catalysts market size is valued at USD 51.27 billion in 2025 and is set to reach USD 66.09 billion by 2030, advancing at a 5.21% CAGR.

Heightened global emission standards, resilient internal-combustion demand in emerging economies, and continuous catalyst innovation sustain this expansion. Regulatory bodies in the EU, the US, China, and India have tightened particulate and NOx limits, spurring near-universal adoption of advanced after-treatment technologies in new vehicles. Automakers are simultaneously refining catalyst formulations to lower precious-metal loadings, offset price volatility, and accelerate platinum substitution without compromising performance. Industrial and power-generation customers are also adopting similar technologies as air-quality rules broaden to cover stationary sources. The emission control catalysts market therefore benefits from a dual growth engine-persistent automotive volumes and widening industrial uptake-underpinning its robust outlook.

Global Emission Control Catalysts Market Trends and Insights

Stringent tightening of on-road & off-road emission norms

Euro 7 rules lower permissible particulate levels and require real-world driving tests, compelling universal use of gasoline particulate filters and upgraded Three-Way Catalysts. Similar ambitions shape China VI and India BS VI regulations, which drive widespread SCR and GPF deployment across Asia's vehicle fleets. Tier 4 off-road standards in North America extend comparable stringency to construction and agricultural machinery, broadening catalyst demand. Together, these frameworks ensure the emission control catalysts market maintains growth momentum, especially as developing economies replicate best-practice legislation.

Rapid rebound of light-duty & heavy-duty vehicle production

Global light-vehicle output climbed 8% in 2024, while commercial-vehicle production recovered strongly in infrastructure-focused economies, translating directly into higher catalyst unit shipments. The upturn coincides with new regulatory phases, forcing OEMs to install more sophisticated after-treatment even as production volumes rise. Electrification progress in heavy-duty fleets remains modest, meaning diesel SCR and DOC solutions will stay essential through 2030. This interplay between volume rebound and tightening standards supports a healthy order pipeline for catalyst suppliers.

Price volatility & looming surplus of palladium depressing OEM purchasing

World Platinum Investment Council forecasts a swing from deficit to a surplus of nearly 900 koz of palladium by 2025 as recycling expands and mining supply stays firm. Automakers respond by intensifying platinum substitution and lowering overall PGM loadings through nano-engineered surfaces, trimming catalyst costs. Short-term volatility still complicates procurement, nudging OEMs toward long-term contracts and diversified sourcing strategies.

Other drivers and restraints analyzed in the detailed report include:

- Growing concern for air quality and public health

- Increasing adoption by industrial and power sector

- Accelerated BEV penetration eroding autocatalyst demand growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Palladium held 48.16% of the emission control catalysts market in 2024, underpinning its primacy in gasoline Three-Way Catalysts. Platinum followed at nearly 35% on the back of rising substitution, while rhodium's unique NOx selectivity kept its 12% niche. The combined segment represented roughly USD 24.7 billion of emission control catalysts market size in 2024. Looking ahead, platinum's 6.71% CAGR makes it the fastest riser as OEMs rebalance metal mixes to mitigate palladium surplus risk. Emerging applications such as liquid-gallium palladium alloys and nano-structured clusters promise equivalent conversion at far lower loadings, widening cost headroom.

Manufacturers increasingly deploy closed-loop recycling to reclaim PGMs, smoothing supply and lowering cash exposure. South African miners reevaluate capex, yet long-term catalyst research indicates continued palladium relevance in lean-burn and methanol engines. The emission control catalysts market therefore retains a multi-metal foundation even as relative shares shift through the decade.

Three-Way Catalysts controlled 55.19% revenue in 2024, reflecting their near-universal fitment on global gasoline vehicles. Diesel Oxidation Catalysts, Diesel/GPF filters, and SCR systems collectively equaled about one-third of revenues, their growth tied to heavy-duty and off-road sectors. Emerging nano-structured designs now grow at 6.96% CAGR, reaching critical commercial scale in petrochemical and low-temperature applications. Within this mix, emission control catalysts market share is expected to tilt progressively toward hybrid-optimized TWCs integrating gasoline particulate filters in response to Euro 7 and China VII legislation.

Additive manufacturing is another inflection point: BASF's X3D printing enables complex channel geometries that raise surface area and cut back-pressure, improving efficiency by 1% in commercial trials. AI-driven copper-zeolite formulations enhance low-temperature SCR conversion, a crucial requirement for Euro 7 compliance in urban delivery trucks. Such advances safeguard the emission control catalysts market from commoditization, as performance differentiation continues to command pricing power.

The Emission Control Catalysts Market Report is Segmented by Metal (Platinum, Palladium, and More), Technology (Three-Way Catalysts, Diesel Oxidation Catalysts, and More), Application (Mobile Emission Control and Stationary Emission Control), End-User Industry (Automotive, Industrial, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the emission control catalysts market with 36.52% share in 2024, exceeding USD 18.7 billion in sales. The region's 7.02% CAGR is propelled by robust vehicle production, rapid industrialization, and the implementation of China VI-B norms that demand low-temperature SCR and universal GPF usage. India's BS VI regime similarly boosts catalyst loading per vehicle, while fuel-quality upgrades reduce sulfur-related poisoning. Japan and South Korea contribute research leadership, backing breakthrough nano-catalyst projects with academic-industry consortia. ASEAN nations, following UN-level equivalence, represent an incremental volume tailwind as their standards tighten toward Euro 6 parity.

North America and Europe together held 53% of 2024 revenues, their markets defined by advanced technology rather than raw unit growth. The US EPA's 2027-plus light-vehicle rules target a 50% fleet-average GHG cut, compelling widespread hybridization and elevated PGM use in cold-start scenarios. Euro 7's real-world testing extension to brake and tire wear triggers R&D for secondary filtration systems, broadening supplier portfolios. Both regions also lead industrial catalyst replacement cycles, with utilities retrofitting aged coal assets to curb NOx peaks and petrochemical outfits trialing additive-manufactured lattice catalysts.

South America and the Middle East & Africa combined accounted for 10.48% of the emission control catalysts market in 2024 but present the highest catch-up potential. Brazil's ethanol-diesel blends cut particulate output by 44%, yet still require oxidation catalysts to manage aldehyde slip. Gulf Cooperation Council states move to align fuel standards with Euro 5, prompting fresh demand for high-sulfur-resistant formulations. Diesel genset adoption across Sub-Saharan Africa adds incremental stationary catalyst volumes once local air-quality legislation matures. Overall, rising regulatory convergence guides steady long-term uptake across developing regions.

- Aerinox Inc.

- ANAND Group

- BASF

- CATALER CORPORATION

- CDTi Advanced Materials Inc.

- Clariant

- CORMETECH

- Cummins Inc.,

- DCL International Inc.

- Evonik Industries AG

- Haldor Topsoe A/S

- Heraeus Precious Metals

- IBIDEN

- Johnson Matthey

- Kanadevia Corporation

- NEO

- NGK INSULATORS, LTD.

- Nikki-Universal Co., Ltd.

- SINOTECH Company Limited

- Umicore

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent tightening of on-road & off-road emission norms

- 4.2.2 Rapid rebound of light-duty & heavy-duty vehicle production

- 4.2.3 Growing concern for air quality and public health

- 4.2.4 Increasing adoption by industrial and power sector

- 4.2.5 Expansion of the automotive sector

- 4.3 Market Restraints

- 4.3.1 Price volatility & looming surplus of palladium depressing OEM purchasing

- 4.3.2 Accelerated BEV penetration eroding autocatalyst demand growth

- 4.3.3 Catalyst poisoning from higher-sulfur alternative fuels in developing regions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Metal

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Other Metals (Vanadium, Cu-Zn, etc.)

- 5.2 By Technology

- 5.2.1 Three-Way Catalysts (TWC)

- 5.2.2 Diesel Oxidation Catalysts (DOC)

- 5.2.3 Diesel/GPF Particulate Filters (DPF/GPF)

- 5.2.4 Selective Catalytic Reduction (SCR)

- 5.2.5 Lean NOx Traps & NSC

- 5.2.6 Emerging Nano-Structured Catalysts

- 5.3 By Application

- 5.3.1 Mobile Emission Control

- 5.3.2 Stationary Emission Control

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Industrial

- 5.4.3 Other End user Industries (Aerospace, Power Generation, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Aerinox Inc.

- 6.4.2 ANAND Group

- 6.4.3 BASF

- 6.4.4 CATALER CORPORATION

- 6.4.5 CDTi Advanced Materials Inc.

- 6.4.6 Clariant

- 6.4.7 CORMETECH

- 6.4.8 Cummins Inc.,

- 6.4.9 DCL International Inc.

- 6.4.10 Evonik Industries AG

- 6.4.11 Haldor Topsoe A/S

- 6.4.12 Heraeus Precious Metals

- 6.4.13 IBIDEN

- 6.4.14 Johnson Matthey

- 6.4.15 Kanadevia Corporation

- 6.4.16 NEO

- 6.4.17 NGK INSULATORS, LTD.

- 6.4.18 Nikki-Universal Co., Ltd.

- 6.4.19 SINOTECH Company Limited

- 6.4.20 Umicore

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment