PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844639

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844639

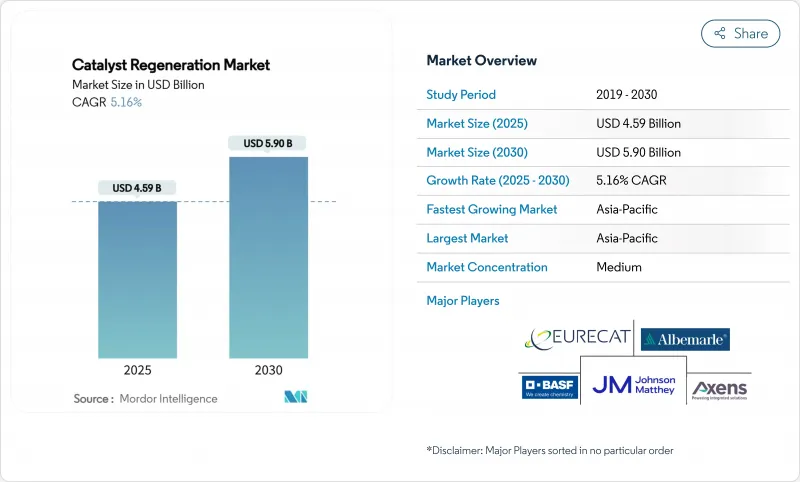

Catalyst Regeneration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Catalyst Regeneration Market size is estimated at USD 4.59 billion in 2025, and is expected to reach USD 5.90 billion by 2030, at a CAGR of 5.16% during the forecast period (2025-2030).

This steady trajectory is underpinned by increasingly stringent emission norms, the escalating cost of fresh catalysts, and expanding circular-economy mandates that reward lower-carbon production routes. In practice, refineries and petrochemical complexes are sharpening focus on end-of-life catalyst handling, while emerging applications in plastics pyrolysis and volatile organic compound (VOC) abatement broaden the customer base. Technology advances such as low-temperature ozone oxidation and predictive analytics further reduce downtime and enhance cost efficiency, reinforcing the momentum of the catalyst regeneration market across both mature and developing economies.

Global Catalyst Regeneration Market Trends and Insights

Strict Environmental Regulations on Refinery and Petrochemical Emissions

National and regional regulators are tightening allowable emission limits, changing the economics of catalyst reuse. The U.S. Environmental Protection Agency's updated hazardous-air-pollutant standards will cut toxic releases by 2,200 short tons a year and deliver monetized health benefits exceeding USD 100 million annually. California's Low Carbon Fuel Standard requires a 30% reduction in fuel-cycle carbon intensity by 2030 and 90% by 2045, elevating demand for regenerated catalysts to comply with lifecycle accounting rules. The EU's Industrial Emissions Directive embeds catalyst regeneration in Best Available Techniques for waste treatment, reinforcing a compliance-driven preference for regeneration over landfill. Across Asia, similar limits are being drafted, ensuring the driver's influence spreads rapidly.

Rising Cost Pressure of Fresh Catalysts

Volatile prices for palladium, platinum, and rhodium have turned fresh catalyst procurement into a high-risk budget item. Academic assessments show that regenerating lightly fouled hydroprocessing catalysts recovers more than 80% of baseline activity at less than half the cost of a new supply. Metal-recovery facilities operated by Gulf Chemical and Metallurgical Corporation routinely convert 99% of spent catalyst into sellable molybdenum and nickel streams, illustrating the circular-value upside for refiners. In volume-heavy APAC hubs, the savings multiply, prompting facility managers to lock in multi-year regeneration contracts.

Lower Recovery on Metal-Poisoned Catalysts

Vanadium, nickel, and iron from heavy crudes bind irreversibly to active sites, curtailing regeneration yields. Laboratory work shows vanadium loads above 5 wt.% slash hydrodesulfurization activity by more than half because of pore blockage and phase changes. Although modified demetallization treatments strip up to 89.2% of nickel, they often damage framework stability, limiting reuse cycles. Operators running resid feeds therefore weigh the cost of partial recovery against fresh catalyst outlay, sometimes opting for disposal.

Other drivers and restraints analyzed in the detailed report include:

- Carbon-Intensity Mandates Favouring Regenerated Catalysts

- On-Site Ozone-Oxidation Breakthroughs Cut Downtime

- Lack of Global Lab Test-Method Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ex-situ facilities captured 73.18% of the catalyst regeneration market share in 2024 on the strength of robust thermal and chemical treatment trains capable of restoring 80-90% of fresh activity. Leading service providers remove hydrocarbons, carbon, and sulfur in staged kilns before metal extraction, delivering regenerated volumes back to the site in road-approved drums that slot seamlessly into refining units.

In-situ regeneration, applied directly inside process equipment, is gaining 5.88% CAGR momentum as ozone-oxidation technology matures. Continuous catalytic reformer operators appreciate that low-temperature oxidation curbs metallurgical stress on reactors, extending vessel life while slashing downtime. Early adopters report 10-day turnaround savings compared with sending material off-site and cutting the catalyst regeneration market cost per tonne by nearly 15%.

The Catalyst Regeneration Report is Segmented by Method (Ex-Situ and In-Situ), Application (Refineries and Petrochemical Complexes, Environmental, Energy and Power, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific carried 42.54% of global demand in 2024 thanks to high refining capacity, deep petrochemical integration, and progressive recycling regulations. Regional growth of 5.67% CAGR through 2030 keeps the catalyst regeneration market firmly centered on APAC. Japanese recyclers run integrated facilities that convert fouled catalyst, spent batteries, and electronic scrap into high-purity palladium and vanadium, ensuring secure domestic raw-material flows. In India, greenfield integrated refineries earmark capex for on-site regeneration trains to avoid cross-border waste shipments.

North America benefits from regulatory certainty and digital leadership. Refineries on the U.S. Gulf Coast stream operating-data feeds to cloud-based algorithms that recommend optimal burn times, while Canadian hydrocrackers receive recycled Co-Mo systems delivered under closed-loop contracts that guarantee metals buy-back pricing. Carbon-tax credits add a second revenue line, nudging mid-continental independent refiners to schedule regeneration just before compliance reconciliation dates.

Europe balances stringent environmental oversight with process-technology exports. French and German licensors bundle supply-and-regeneration packages, allowing clients in the Middle East to receive cradle-to-cradle service routed through European hubs. EU funding for green hydrogen and e-fuels further boosts regional demand as specialty reactors switch to tailored catalyst grades that require precise regeneration cycles to maintain selectivity.

- Advanced Catalyst Systems

- Albemarle Corporation

- AMETEK Inc.

- Axens

- BASF

- CORMETECH

- EBINGER Katalysatorservice GmbH & Co. KG

- Eurecat

- EvoNik Industries AG

- Honeywell International Inc.

- Johnson Matthey

- NIPPON KETJEN Co. Ltd.

- Topsoe A/S

- W.R. Grace and Co.

- Yokogawa Cororation. of America

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strict Environmental Regulations on Refinery And Petrochemical Emissions

- 4.2.2 Rising Cost-Pressure of Fresh Catalysts

- 4.2.3 Carbon-Intensity Mandates Favouring Regenerated Catalysts

- 4.2.4 On-Site Ozone-Oxidation Breakthroughs Cut Downtime

- 4.2.5 Predictive Analytics Enabling Condition-Based Regeneration

- 4.3 Market Restraints

- 4.3.1 Lower Recovery on Metal-Poisoned Catalysts

- 4.3.2 Lack of Global Lab Test-Method Standards

- 4.3.3 Rise of Single-Use Nano-Catalysts in Select Processes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Method

- 5.1.1 Ex-Situ

- 5.1.2 In-Situ

- 5.2 By Application

- 5.2.1 Refineries and Petrochemical Complexes

- 5.2.2 Environmental

- 5.2.3 Energy and Power

- 5.2.4 Other Application (Plastics Pyrolysis, Speciality)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Advanced Catalyst Systems

- 6.4.2 Albemarle Corporation

- 6.4.3 AMETEK Inc.

- 6.4.4 Axens

- 6.4.5 BASF

- 6.4.6 CORMETECH

- 6.4.7 EBINGER Katalysatorservice GmbH & Co. KG

- 6.4.8 Eurecat

- 6.4.9 EvoNik Industries AG

- 6.4.10 Honeywell International Inc.

- 6.4.11 Johnson Matthey

- 6.4.12 NIPPON KETJEN Co. Ltd.

- 6.4.13 Topsoe A/S

- 6.4.14 W.R. Grace and Co.

- 6.4.15 Yokogawa Cororation. of America

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment