PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907306

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907306

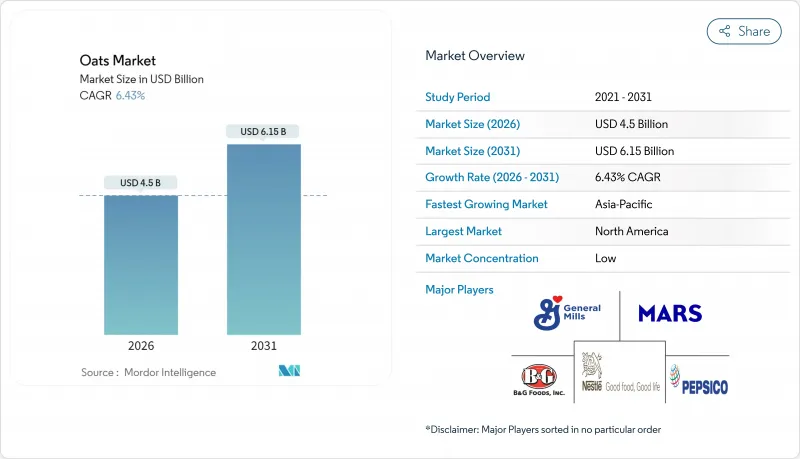

Oats - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Oats market is expected to grow from USD 4.23 billion in 2025 to USD 4.5 billion in 2026 and is forecast to reach USD 6.15 billion by 2031 at 6.43% CAGR over 2026-2031.

This growth is primarily driven by increasing consumer demand for nutrient-dense, gluten-free grains, supported by regulatory clarity from the U.S. Food and Drug Administration (FDA) on the <= 20 ppm gluten threshold for food labeling. This regulation enables manufacturers to confidently address the needs of celiac and gluten-sensitive consumers, further strengthening market opportunities. North America continues to exhibit steady growth, underpinned by well-established breakfast cereal consumption habits. However, the Asia-Pacific region is emerging as the fastest-growing market, fueled by rising health awareness among urban middle-class households and a shift toward healthier dietary choices. Innovations in oat processing, which enhance shelf life while preserving taste and nutritional value, are facilitating the introduction of premium products. Additionally, the rapid expansion of online grocery platforms is reducing entry barriers for new and emerging brands, allowing them to target niche consumer segments with unique value propositions. Despite these positive trends, climate-induced yield volatility poses a significant challenge to the market. To mitigate this risk, companies are increasingly diversifying their sourcing strategies and investing in resilient supply chains to ensure consistent production and supply. These efforts are expected to play a crucial role in sustaining market growth during the forecast period.

Global Oats Market Trends and Insights

Increasing Consumer Preference for Nutritious and Gluten-Free Food Options Drives Growth

The regulatory framework supporting gluten-free oats has generated an annual health benefit valued at USD 110 million, as per an FDA impact analysis. This benefit stems from reduced search costs for individuals with celiac disease and an expanded range of dietary options for the approximately 1% of the population affected by this condition. By establishing clear guidelines, the framework allows food manufacturers to confidently label oats as gluten-free when they meet the 20 ppm threshold, resolving prior uncertainties that hindered market growth. Additionally, the U.S. Department of Agriculture (USDA) inclusion of various whole grains, including oats, in its WIC program highlights institutional support for oat consumption. This initiative provides participants with access to a wider selection of nutritious food options, positioning oats as a naturally gluten-free alternative. In response to these developments, companies have introduced specialized product lines designed for celiac disease patients and gluten-sensitive consumers. These products comply with FDA standards through stringent certification and testing protocols, ensuring safety and quality. The combination of regulatory clarity and growing consumer health awareness has created sustainable demand drivers for gluten-free oats. This demand extends beyond temporary dietary trends, firmly establishing oats as a gluten-free food product and reinforcing their long-term relevance in the industry.

Expansion of Clean-Label Trends Promoting Minimally Processed Oat Products.

Clean-label positioning has become a critical strategic differentiator as consumers increasingly scrutinize ingredient lists and demand transparency. The USDA's Summer Food Service Program guidelines emphasize the incorporation of whole grains, such as oats, into meal planning strategies that prioritize minimally processed foods. This shift particularly benefits steel-cut and whole oat products, which undergo less processing compared to instant varieties, aligning with consumer preferences for authenticity, nutritional integrity, and clean-label attributes. Furthermore, the clean-label movement intersects with organic certification requirements, creating opportunities for manufacturers to command premium pricing by demonstrating both minimal processing and sustainable sourcing practices. Advanced food preservation technologies further support this trend by extending shelf life while preserving nutritional quality, meeting consumer expectations for convenience and health benefits without compromising clean-label standards. Companies that effectively address these dual demands are well-positioned to capture a growing segment of consumers willing to pay a premium for products that align with their values of health, transparency, and environmental stewardship.

Competitive Pressure From Alternative Grains Such as Quinoa and Barley

The competitive landscape is complicated by the growing popularity of alternative grains like quinoa, which command premium pricing due to their complete amino acid profiles. This shift pressures oat producers to differentiate by emphasizing their unique benefits, such as beta-glucan content and well-established supply chains, to maintain relevance. The USDA emphasizes the increasing consumer preference for organic vegetables and pulse crops, which achieve significant price premiums in the market. This trend demonstrates how alternative grains can capture market share through premium positioning strategies. To remain competitive, companies must focus on processing innovations and functional applications for oats, rather than relying solely on nutritional claims. This approach is critical as alternative grains continue to expand their presence in health-focused retail channels, reshaping the competitive dynamics of the oats market.

Other drivers and restraints analyzed in the detailed report include:

- Enhanced Convenience Through Ready-To-Cook Product Offerings Increases Viability

- Increasing Adoption of Oats in Weight Management and Fitness Diets.

- Shelf Life and Storage Challenges Limits Growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, rolled oats secured a commanding 34.98% share of the market, bolstered by their established consumer familiarity, versatile preparation methods, and broad retail availability. The USDA's dietary guidelines highlight rolled oats as a readily accessible whole grain, meeting daily intake recommendations while delivering essential nutrients and fiber. Decades of consumer education and marketing have positioned rolled oats as the go-to breakfast choice, with cooking times and textures tailored to mainstream preferences. The FDA's gluten-free labeling regulations, accommodating rolled oats meeting contamination thresholds, empower manufacturers to target celiac disease patients and those sensitive to gluten. Rolled oats lead the market due to their blend of convenience, nutritional benefits, and culinary adaptability, whether in traditional oatmeal, baked goods, or homemade granola and energy bars.

Oat flour is on a growth trajectory, boasting a projected 9.22% CAGR through 2031. This surge indicates a shift in focus, with consumers increasingly turning to oat flour for its functional and nutritional advantages, moving beyond its traditional role in breakfast cereals. USDA data shows Americans averaging 6.7 ounce-equivalents of daily grain consumption, underscoring the push for heightened whole grain intake. This positions oat flour as a prime choice for manufacturers aiming to bolster nutritional profiles. Riding the wave of the clean-label movement and gluten-free baking at home trends, oat flour is enhancing texture and nutritional value in breads, pastries, and other baked food. Furthermore, the USDA's Summer Food Service Program advocates for whole grain inclusion, spurring institutional demand for oat flour in foodservice settings prioritizing nutrition.

In 2025, conventional oats maintain a dominant 67.92% market share, driven by well-established supply chains, affordability for price-sensitive consumers, and extensive availability across retail. According to USDA food availability data, grain consumption has risen significantly over the decades, with conventional production methods enabling the scalability and cost efficiency required to meet the demands of mainstream consumers. This segment benefits from mature agricultural practices, advanced processing infrastructure, and reliable distribution networks, ensuring consistent quality and competitive pricing for mass-market consumption. Conventional oats market dominance highlights their accessibility for budget-conscious consumers.

Organic oats are projected to grow at a 4.48% CAGR through 2031, reflecting their resilience despite higher production costs and stringent certification requirements. This growth is supported by increasing consumer willingness to pay premiums for products perceived as healthier and more environmentally friendly. Organic oat producers benefit from established certification systems and growing acceptance in retail channels, aligning with broader consumer trends favoring transparency and sustainability. The segment's expansion is particularly pronounced in developed markets, where consumers prioritize health and environmental considerations over price sensitivity. This creates opportunities for premium positioning and brand differentiation through a genuine commitment to organic principles, catering to a growing demand for sustainable and health-conscious products.

The Global Oats Market Report is Segmented by Product Type (Whole Oats, Oat Groats, and More), Nature (Conventional and Organic), Category (Raw Oats and Processed Oats), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America commands a dominant 34.31% share of the oat market, a position bolstered by its long-standing oat cultivation, advanced processing facilities, and a strong consumer preference for oat-based breakfast items. The USDA's dietary guidelines, which advocate for whole grains to constitute at least half of grain consumption, further bolster the demand for oats in retail sectors. Instead of focusing on volume growth, the region's mature market leans towards premium positioning and innovative value additions, backed by reliable supply chains and processing capabilities that ensure consistent quality and competitive pricing. The USDA's expansion of its WIC program to encompass a variety of whole grains underscores institutional backing for oat consumption. This initiative enables participants to access a range of healthy food choices, highlighting oats as naturally gluten-free alternatives.

Asia-Pacific is set to be the fastest-growing region, boasting an 8.05% CAGR through 2031. This growth is fueled by swift urbanization, rising disposable incomes, and heightened health awareness in key markets like China, India, and Japan. The region's growth trajectory is underpinned by demographic shifts, with urbanization spurring demand for convenient breakfast options and a growing health consciousness amplifying the appeal of oats' nutritional benefits.

Europe, the Middle East and Africa (MEA), and South America together offer a varied growth landscape for the global oats market. In Europe, heightened health awareness and a surge in demand for plant-based, fiber-rich foods are propelling the popularity of both organic and processed oat products. This trend is especially pronounced in staple-loving nations like Germany, the UK, and the Nordic region. In South America, countries like Brazil and Argentina are not only bolstering local oat production but also witnessing a steady rise in oats' incorporation into traditional diets and breakfast routines. Meanwhile, the MEA region, though still in its infancy regarding oat consumption, is observing urban centers gradually gravitating towards convenient and nutritious food choices. Across these diverse regions, trends like clean-label preferences, an expanding retail framework, and the growing sway of Western breakfast customs are collectively amplifying the demand for oats across a myriad of product categories and sales channels.

- PepsiCo, Inc.

- Mars, Incorporated

- General Mills, Inc.

- Nestle S.A.

- B&G Foods, Inc.

- Bob's Red Mill

- Nature's Path Foods

- Post Holdings, Inc.

- Marico

- Blue Lake Milling

- Avena Foods Limited

- Grain Millers

- Richardson International Limited

- Swedish Oat Fiber AB

- Unigrain Pty Ltd

- The Hain Celestial Group, Inc.

- Fazer

- Bagrrys India Private Limited

- Rude Health

- Bennett's Seed

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Consumer Preference for Nutritious and Gluten-Free Food Options Drives Growth

- 4.2.2 Expansion of Clean-Label Trends Promoting Minimally Processed Oat Products

- 4.2.3 Enhanced Convenience Through Ready-To-Cook Product Offerings Increases Viability

- 4.2.4 Increasing Adoption of Oats in Weight Management and Fitness Diets

- 4.2.5 Rising Consumer Willingness to Pay a Premium for Organic and Non-GMO Oat Products

- 4.2.6 Growth In Online Retail Channels Enhancing Oats Product Accessibility

- 4.3 Market Restraints

- 4.3.1 Competitive Pressure from Alternative Grains Such as Quinoa and Barley

- 4.3.2 Shelf Life and Storage Challenges Limits Growth

- 4.3.3 Logistical Barriers in Cold Chain and Storage Facilities for Oat-Based Perishable Products

- 4.3.4 Supply Variability Influenced by Climatic Fluctuations Impacting Raw Material Availability

- 4.4 Supply Chain Analysis

- 4.5 Consumer Behavior Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD)

- 5.1 By Product Type

- 5.1.1 Whole Oats

- 5.1.2 Oat Groats

- 5.1.3 Steel-Cut Oats

- 5.1.4 Rolled Oats

- 5.1.5 Oat Flour

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Category

- 5.3.1 Raw Oats

- 5.3.2 Processed Oats

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience/Grocery Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PepsiCo, Inc.

- 6.4.2 Mars, Incorporated

- 6.4.3 General Mills, Inc.

- 6.4.4 Nestle S.A.

- 6.4.5 B&G Foods, Inc.

- 6.4.6 Bob's Red Mill

- 6.4.7 Nature's Path Foods

- 6.4.8 Post Holdings, Inc.

- 6.4.9 Marico

- 6.4.10 Blue Lake Milling

- 6.4.11 Avena Foods Limited

- 6.4.12 Grain Millers

- 6.4.13 Richardson International Limited

- 6.4.14 Swedish Oat Fiber AB

- 6.4.15 Unigrain Pty Ltd

- 6.4.16 The Hain Celestial Group, Inc.

- 6.4.17 Fazer

- 6.4.18 Bagrrys India Private Limited

- 6.4.19 Rude Health

- 6.4.20 Bennett's Seed

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK