PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844647

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844647

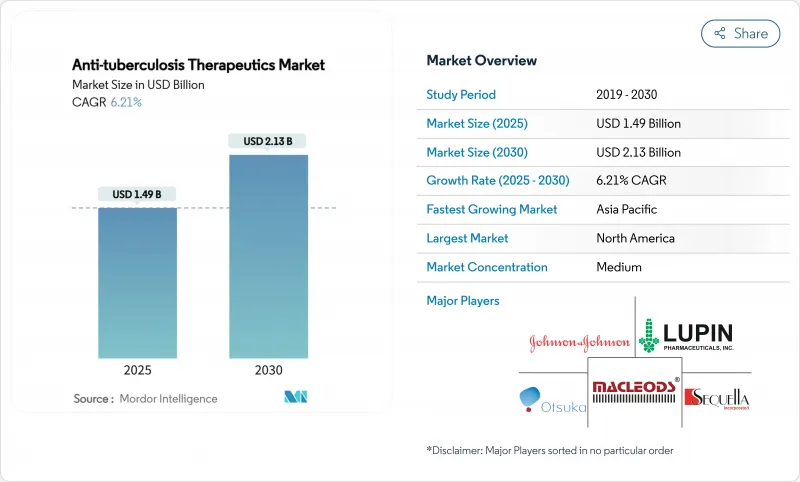

Anti-tuberculosis Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The anti-tuberculosis drugs market size stood at USD 1.49 billion in 2025 and is projected to reach USD 2.13 billion by 2030, advancing at a 6.21% CAGR.

Strengthening public-sector funding, surging multidrug-resistant infections and rapid uptake of shorter all-oral regimens are keeping demand resilient despite lingering supply chain disruptions. North America preserves a dominant revenue position thanks to established stockpiles and reimbursement frameworks, yet expanded procurement in Asia-Pacific - led by India's National TB Elimination Program and China's stepped-up screening - is accelerating geographic diversification. Drug-class dynamics are shifting toward novel agents such as bedaquiline and pretomanid as resistance to legacy first-line therapies rises, while digital ordering channels broaden patient access in low-resource environments. Company strategies increasingly revolve around strategic alliances that link innovative molecules with artificial-intelligence diagnostics to secure integrated care offerings, a trend that helps temper fragmentation and lift the overall anti-tuberculosis drugs market trajectory.

Global Anti-tuberculosis Therapeutics Market Trends and Insights

Rising Prevalence of Tuberculosis

Worldwide incidence reached 10.8 million new cases in 2023, the highest since formal monitoring began and outpacing COVID-19 fatalities. India, Indonesia and the Philippines experienced severe notification gaps during pandemic years that now translate into intensified community transmission. Southeast Asia alone carries 46% of global infections, a burden magnified by poverty-related crowding in rapidly urbanizing districts. Across such settings, case backlogs elevate demand for first- and second-line medicines, preserving volume growth for the anti-tuberculosis drugs market even where health budgets remain constrained.

Incidence Surge of MDR & XDR Strains

MDR-TB constitutes roughly 5% of all cases yet accounts for up to 20% of TB mortality, and genomic surveillance shows 28% of resistant strains spread person-to-person rather than arising de novo. Eastern Europe and parts of sub-Saharan Africa post the world's highest MDR and XDR burden, while pre-XDR incidence is rising in Asia. Only 44% of diagnosed MDR-TB patients receive adequate therapy, underscoring the urgent need for pipeline innovation that keeps the anti-tuberculosis drugs market geared toward novel mechanisms of action.

Adverse Drug-Related Side-Effects

First-line regimens trigger hepatotoxicity rates of up to 27% in children, with pyrazinamide and isoniazid most implicated. Serious events such as rifampicin-induced acute kidney injury complicate management in chronic kidney disease patients. These safety concerns lead to regimen switches that undermine adherence and press innovators to pursue safer formulations, including early studies on rectal suppositories for severe digestive intolerance. Persistent toxicity risks cap uptake pace and weigh on the anti-tuberculosis drugs market growth potential.

Other drivers and restraints analyzed in the detailed report include:

- Short-Course All-Oral Regimen Breakthroughs

- AI-Enabled Radiology Screening Adoption

- High Cost of MDR/XDR Treatment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The anti-tuberculosis drugs market size for rifampin reached USD 468 million in 2024, translating into a 31.51% share that confirms its front-line status. Bedaquiline, however, is advancing at a 13.25% CAGR as clinicians pivot toward regimens that withstand resistance. Isoniazid and ethambutol retain therapeutic relevance yet face flat revenue prospects because of saturation and intolerance issues. Pretomanid accelerates through inclusion in WHO-backed BPaL protocols, while fluoroquinolone use decelerates in response to documented resistance patterns. Pipeline candidates such as TBAJ-876 and ganfeborole illustrate how next-generation compounds are shaping competitive hierarchies within the anti-tuberculosis drugs market. The WHO counts 28 active investigational agents, of which 18 are new chemical entities, highlighting a robust but still risk-laden discovery landscape.

Continued clinical progress underscores commercial opportunity. Johnson & Johnson's JNJ-6640, a PurF inhibitor, demonstrates first-in-class potential. TB Alliance's five-country Phase 2 evaluation of TBAJ-876 seeks to mitigate emerging bedaquiline resistance. As efficacy data matures, pricing negotiations with procurement facilities could unlock sizeable incremental volumes, especially in price-sensitive Middle-Income settings where anti-tuberculosis drugs market adoption historically trailed need.

Hospitals and clinics generated USD 680 million in anti-tuberculosis drugs revenue in 2024, equal to 45.53% share aided by centralised procurement and on-site diagnostics. Non-profit organisations, fuelled by Global Fund disbursements and Gates Foundation grants, are forecast to grow 10.15% annually through 2030, the fastest among end users. Public-private engagement models like Kerala's STEPS and India's Ni-kshay Mitras demonstrate how philanthropic partners augment last-mile delivery in underserved districts. Private diagnostic centres maintain mid-single-digit expansion as advanced molecular testing broadens customer mix, while mobile clinics extend service reach into conflict zones and nomadic communities, deepening the overall anti-tuberculosis drugs market penetration.

Strategically, NGOs now wield outsize influence over formulary choices, often insisting on BPaL/BPaLM procurement that favours newer agents. Their funding leverage pressures manufacturers to accept tiered pricing and spurs volume-based agreements through mechanisms such as the Global Drug Facility. For developers, tailored access programmes can yield reputational and market-share gains, but only if supply security is guaranteed amid sporadic active-pharmaceutical-ingredient shortages.

The Anti-Tuberculosis Therapeutics Market Report is Segmented by Drug Class (Isoniazid, Rifampin, Ethambutol, Pyrazinamide, Fluoroquinolones, and More), End User (Hospitals and Clinics, Non-Profit Organizations, and More), Route of Administration (Oral and Injectable), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributes 42.32% of global revenue, reflecting advanced surveillance infrastructure, insurance reimbursement and the presence of contingency stockpiles to buffer shortages. The region's elimination push among US-born populations targets incidence below 0.4 per 100,000 by 2025, fuelling uptake of preventive rifapentine regimens and high-specificity diagnostics. Yet supply-chain fragility persists: California's 2023 stock-out of first-line orals prompted emergency central buffer deployment while Canada grappled with rifampin interruptions that risk underserving Indigenous communities. Mitigation protocols drive steady replenishment contracts that stabilise demand within the anti-tuberculosis drugs market.

Asia-Pacific is the fastest-growing cluster at 9.61% CAGR. India's introduction of BPaLM for 75,000 patients and community sponsorship via more than 82,000 registered Ni-kshay Mitras illustrate public mobilization at scale. China's spatio-temporal modelling foresees localised mortality rises by 2030 without intensified intervention. Indonesia participates in Phase 3 trials for the M72/AS01E vaccine candidate, cementing its status as a front-line innovation hub [WHO.INT]. Southeast Asia's heavy 46% infection share plus uneven health access make the region pivotal to future anti-tuberculosis drugs market expansion.

Europe shows moderate growth but contends with rising paediatric incidence, up 10% to 38,993 cases across 29 EU/EEA countries in 2023. Treatment success remains at 67.9%, far below the 90% target, while MDR completion sits at 56%, sustaining latent demand for new regimens. Romania's AI-assisted outreach and consortiums such as ERA4TB exemplify regional investment in next-generation regimens. Middle East and Africa markets are shaped by high drug-resistant burden and fragmented funding, yet price cuts for bedaquiline are improving affordability. South America, led by Brazil's inter-ministerial TB elimination committee, displays rising procurement of oral combinations, creating fresh pull for the anti-tuberculosis drugs market.

- Johnson & Johnson

- Otsuka

- Lupin

- Macleods Pharmaceuticals Ltd.

- Viatris

- Novartis

- Sanofi

- Pfizer

- Cadila Healthcare (Zydus)

- Cipla

- Hetero Labs Ltd.

- Sandoz Group

- Strides Pharma Science Ltd.

- Shanghai Fosun Pharmaceutical Group

- Hikma Pharmaceuticals

- Sequella

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Tuberculosis

- 4.2.2 Incidence Surge Of MDR & XDR Strains

- 4.2.3 WHO End-TB Funding Momentum

- 4.2.4 Government-Led Awareness Initiatives

- 4.2.5 Short-Course All-Oral Regimen Breakthroughs

- 4.2.6 AI-Enabled Radiology Screening Adoption

- 4.3 Market Restraints

- 4.3.1 Adverse Drug-Related Side-Effects

- 4.3.2 High Cost Of MDR/XDR Treatment

- 4.3.3 Lengthy Treatment & Poor Adherence

- 4.3.4 API Supply-Chain Fragility (Rifapentine)

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Class

- 5.1.1 Isoniazid

- 5.1.2 Rifampin

- 5.1.3 Ethambutol

- 5.1.4 Pyrazinamide

- 5.1.5 Fluoroquinolones

- 5.1.6 Bedaquiline

- 5.1.7 Pretomanid

- 5.1.8 Delamanid

- 5.1.9 Aminoglycosides

- 5.1.10 Thioamides

- 5.1.11 Cyclic Peptides

- 5.1.12 Other Drug Classes

- 5.2 By End User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Non-Profit Organizations

- 5.2.3 Private Diagnostic Centers

- 5.2.4 Others

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Injectable

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.4.4 Others (NGO & Donation Channels, Public Procurement & DOTS Programs)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Johnson & Johnson (Janssen)

- 6.3.2 Otsuka Pharmaceutical Co., Ltd.

- 6.3.3 Lupin Limited

- 6.3.4 Macleods Pharmaceuticals Ltd.

- 6.3.5 Viatris Inc.

- 6.3.6 Novartis AG

- 6.3.7 Sanofi

- 6.3.8 Pfizer Inc.

- 6.3.9 Cadila Healthcare (Zydus)

- 6.3.10 Cipla Ltd.

- 6.3.11 Hetero Labs Ltd.

- 6.3.12 Sandoz AG

- 6.3.13 Strides Pharma Science Ltd.

- 6.3.14 Shanghai Fosun Pharmaceutical Group

- 6.3.15 Hikma Pharmaceuticals

- 6.3.16 Sequella, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment