PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844650

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844650

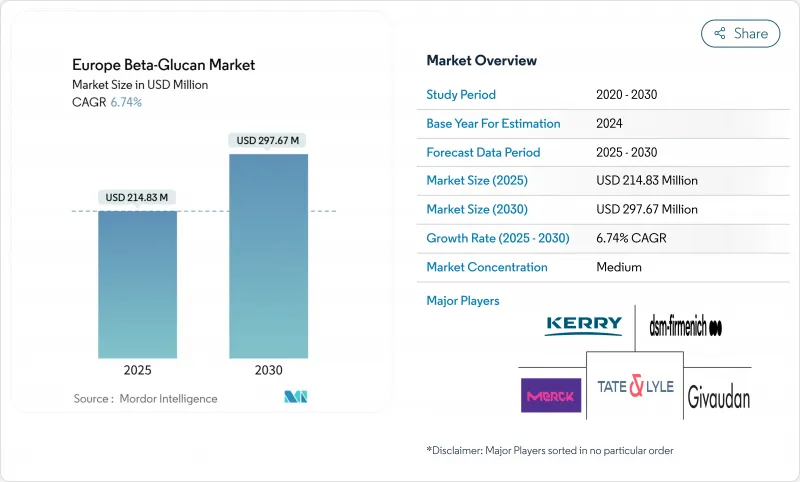

Europe Beta-Glucan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe beta-glucan market size is estimated at USD 214.83 million in 2025 and is expected to reach USD 297.67 million by 2030 at a steady 6.74% CAGR, underscoring a transition from niche nutraceutical ingredient to mainstream functional component across multiple end-use sectors.

Regulatory clarity from the European Food Safety Authority (EFSA), exemplified by the April 2024 approval of microalgae-derived beta-glucan, is lowering entry barriers for novel sources while widening application scope beyond cereal and yeast origins. Consumer demand for immunity, cardiovascular, and skin-health benefits is deepening penetration in foods, supplements, and personal-care items, allowing formulators to command premium shelf prices in a competitive retail environment. Mid-sized biotechnology firms are using proprietary extraction and purification technologies to create product differentiation, while large multinationals are scaling production lines through advanced automation to drive cost efficiencies and resilient supply chains. Although inconsistent raw-material quality and lengthy novel-food approvals continue to challenge smaller entrants, industry-wide investment in standardized analytical methods is improving batch-to-batch performance, thereby sustaining long-term market momentum.

Europe Beta-Glucan Market Trends and Insights

Growing Consumer Interest in Immunity-Enhancing Functional Foods

Post-pandemic health priorities have pivoted toward proactive immune support, with 58% of European shoppers buying functional products primarily for immunity benefits. Beta-glucan brands are capitalizing by integrating clinically backed ingredients into snack bars, powders, and ready-to-drink beverages, especially in Northern Europe, where the willingness to pay premium prices is highest. EFSA-approved health claims grant marketing confidence, while specialized yeast and oat fractions enable clean-label positioning across multiple food matrices. Ingredient suppliers have intensified consumer-education campaigns in retail and e-commerce channels, translating academic research into approachable messaging that resonates with health-conscious audiences. The trend is expected to sustain revenue growth in the European beta-glucan market as household penetration widens in both mass and specialty retail formats.

Increasing Pharmaceutical Applications of Fungal and Yeast Beta-Glucans

Drug developers are leveraging beta-glucan's immunomodulatory and controlled-release properties to improve bioavailability in oncology, antifungal, and vaccine-adjuvant therapies. The European Medicines Agency'sorphan-drug designation for ibrexafungerp illustrates regulatory support for glucan-based therapeutics. German and Swiss firms are spearheading the scale-up of pharmaceutical-grade production, commanding price premiums that outstrip food-grade equivalents. The segment's key characteristics include standardized dosing, high purity levels, and thorough clinical validation. These attributes ensure consistent product quality and reliable therapeutic outcomes. The rigorous scientific approach and proven efficacy attract substantial venture capital funding and public-sector grants focused on addressing antimicrobial resistance and chronic diseases. The successful commercialization of products increases ingredient demand across pharmaceutical and nutraceutical applications. This market growth strengthens the position of fungi- and yeast-derived molecules in the European beta-glucan market, particularly in therapeutic and preventive healthcare solutions.

Regulatory Hurdles and Ingredient-Approval Delays

While EFSA approvals provide a safety net, average 38-month review times burden innovators with high dossier-preparation costs, particularly for microalgae and bacterial sources. Post-Brexit divergence adds complexity, as the UK's Nutrition and Health Claims Committee applies different evidence thresholds, creating fragmented market rules, according to the Government of UK. Small biotechnology companies experience significant financial constraints and operational challenges during the lengthy regulatory approval process, giving larger competitors with substantial compliance budgets and established resources a distinct competitive advantage in the market. Companies that successfully receive regulatory approval gain valuable multi-year market exclusivity rights, as demonstrated by Kemin's five-year protection period for its Euglena-based BetaVia product. This exclusivity period enabled Kemin to establish early market leadership and maintain a strong position in the European beta-glucan segment, highlighting the importance of securing regulatory approvals in the biotechnology industry.

Other drivers and restraints analyzed in the detailed report include:

- Adoption in Dairy Alternatives and Plant-Based Beverages

- Expanding Consumer Focus on Heart-Health Products

- Inconsistent Performance Among Different Ingredient Sources

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cereal and grains commanded 40.19% of the Europe beta-glucan market share in 2024 due to entrenched oat and barley supply chains and strong consumer familiarity with grain-based nutrition. Fungal beta-glucans, though smaller in scale, are on track for 8.75% CAGR growth as controlled indoor cultivation delivers predictable yields with elevated purity. The Europe beta-glucan market size for fungal sources is projected to expand materially as pharmacopoeia-grade demand gains traction in Germany and Switzerland. Yeast sources benefit from pharmaceutical validation and consistent fermentation outputs, reinforcing interest from pharma ingredient buyers. Meanwhile, microalgae have begun to commercialize following EFSA's 2024 nod, signaling further diversification and supply-chain resilience. Extraction innovation, like ultrasound-assisted autolysis, achieving 41.34% yield from winery yeast lees, exemplifies circular-economy potential that appeals to ESG-conscious manufacturers.

Competitive intensity within cereal supply is rising as the BARLEYboost consortium refines milling methods that could lift barley consumption by 100,000 t annually in the EU, thereby safeguarding beta-glucan supply amid climate variability. Concurrently, biotechnology startups are exploring Agrobacterium pusense and other bacterial candidates, anticipating novel-food status and opening new revenue streams. The interplay between tradition and innovation therefore defines the source landscape and will continue to shape procurement strategies in the Europe beta-glucan market.

The Europe Beta-Glucan Market Report is Segmented by Source (Cereals and Grains, Fungi, Yeast, Seaweed and Microalgae, and Others), Category (Soluble and Insoluble), Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Animal Feed, and Others), and Geography (United Kingdom, Germany, Spain, France, Italy, Russia, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tate & Lyle PLC

- Kerry Group PLC

- The Merck Group

- DSM-Firmenich AG

- Givaudan S.A.

- Lesaffre Group

- Kemin Industries Inc.

- Angel Yeast Co., Ltd.

- Novonesis Group

- BENEO GmbH

- Fazer Group

- Leiber GmbH

- Lallemand Inc.

- Solabia Group

- Immudyne Nutritional PureMune,

- Super Beta Glucan (SBG) Inc

- Nutraceuticals International Group

- Oat Services Ltd.

- Glanbia PLC

- COSCIENS, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing consumer interest in immunity-enhancing functional foods

- 4.2.2 Increasing pharmaceutical applications of fungal and yeast beta-glucans

- 4.2.3 Adoption in dairy alternatives and plant-based beverage

- 4.2.4 Expanding consumer focus on heart health products

- 4.2.5 Rising demand for plant-based ingredients drives market growth

- 4.2.6 Higher research and development investment to improve drug solubility and bioavailability

- 4.3 Market Restraints

- 4.3.1 Regulatory hurdles and ingredient approval delays

- 4.3.2 Inconsistent performance among different ingredient sources

- 4.3.3 Raw material supply chain challenges impact market growth

- 4.3.4 Quality control challenges in product manufacturing

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Cereals and Grains

- 5.1.2 Fungi

- 5.1.3 Yeast

- 5.1.4 Seaweed and Microalgae

- 5.1.5 Others

- 5.2 By Category

- 5.2.1 Soluble

- 5.2.2 Insoluble

- 5.3 By Application

- 5.3.1 Food and Beverage

- 5.3.1.1 Bakery and Confectionary

- 5.3.1.2 Beverage

- 5.3.1.3 Snacks

- 5.3.1.4 Dairy and Dairy Products

- 5.3.1.5 Others

- 5.3.2 Personal Care and Cosmetics

- 5.3.3 Pharmaceuticals

- 5.3.4 Animal Feed

- 5.3.5 Others

- 5.3.1 Food and Beverage

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 Spain

- 5.4.4 France

- 5.4.5 Italy

- 5.4.6 Russia

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Tate & Lyle PLC

- 6.4.2 Kerry Group PLC

- 6.4.3 The Merck Group

- 6.4.4 DSM-Firmenich AG

- 6.4.5 Givaudan S.A.

- 6.4.6 Lesaffre Group

- 6.4.7 Kemin Industries Inc.

- 6.4.8 Angel Yeast Co., Ltd.

- 6.4.9 Novonesis Group

- 6.4.10 BENEO GmbH

- 6.4.11 Fazer Group

- 6.4.12 Leiber GmbH

- 6.4.13 Lallemand Inc.

- 6.4.14 Solabia Group

- 6.4.15 Immudyne Nutritional PureMune,

- 6.4.16 Super Beta Glucan (SBG) Inc

- 6.4.17 Nutraceuticals International Group

- 6.4.18 Oat Services Ltd.

- 6.4.19 Glanbia PLC

- 6.4.20 COSCIENS, Inc.

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK