PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844651

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844651

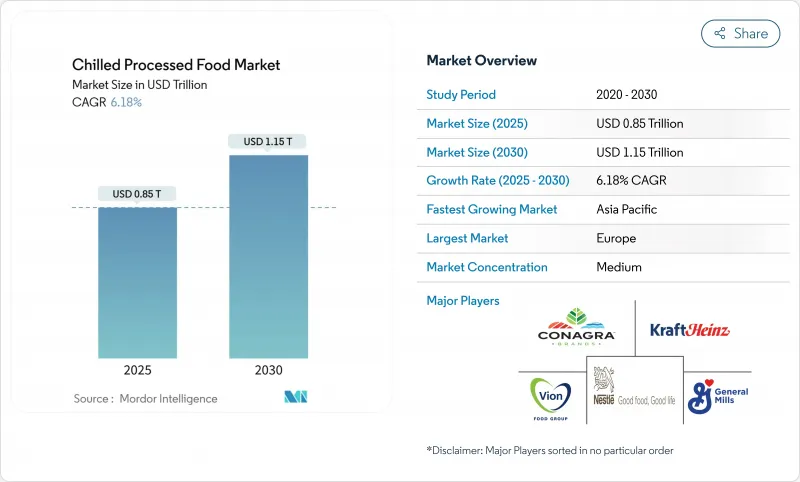

Chilled Processed Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The chilled and frozen processed food market size stood at USD 0.85 trillion in 2025 and is forecast to reach USD 1.15 trillion by 2030, advancing at a 6.18% CAGR.

The widespread adoption of advanced cold chain systems, coupled with the accelerating pace of urban migration and consistent investments in innovative product preservation technologies, is collectively driving this market expansion. Consumers with limited time increasingly prefer convenient ready-to-eat and ready-to-cook product formats, while the growing demand for protein-rich options, such as poultry and seafood, continues to support volume growth. In response to stringent sustainability regulations in key economies, companies are redesigning packaging solutions to achieve a balance between environmental responsibility and maintaining optimal shelf-life performance. Although the competitive intensity remains moderate, leading global players are leveraging strategies such as vertical integration and the implementation of digital traceability systems to safeguard their profit margins. These efforts align with the preferences of health-conscious consumers who value products that retain nutrients and minimize waste.

Global Chilled Processed Food Market Trends and Insights

Urbanization and hectic lifestyles fuel demand for ready meals

Urban population growth is driving significant changes in food consumption patterns, with ready meals experiencing rapid adoption as time-constrained consumers increasingly prioritize convenience over traditional meal preparation. The rise in dual-income households is a key factor propelling this demand. According to the Bureau of Labor Statistics, in 2024, 49.6% of married-couple families in the United States had both spouses employed, highlighting the growing dependence on Ready-to-Eat foods as efficient meal solutions for busy households. The USDA's livestock and poultry outlook forecasts beef production to reach 25.790 billion pounds by 2025, ensuring a stable supply of processed meats to meet the rising demand for ready meal applications. This demographic shift is driving consistent demand for portion-controlled, shelf-stable products tailored to the constraints of urban lifestyles. The convergence of urbanization and the increase in dual-income households is further accelerating this trend, as available time for meal preparation continues to decline. Regulatory frameworks are evolving to address these changes. For instance, Canada's upcoming front-of-package nutrition labeling requirements, effective January 2026, will mandate clearer nutritional information on prepackaged foods exceeding specified thresholds for sodium, saturated fat, and sugar, ensuring greater transparency for consumers.

Advances in preservation technologies surge demand for processed food

Advancements in freezing and preservation technologies are transforming product quality and shelf life. Individually quick-frozen (IQF) methods effectively reduce ice crystal formation, ensuring the retention of texture and nutritional value. The American Frozen Food Institute has identified that increasing standard frozen storage temperatures can significantly lower energy consumption without compromising food safety, signaling potential efficiency gains across the industry. Innovations in packaging materials, such as ethylene-vinyl acetate-vinyl alcohol copolymers regulated under 21 CFR 177.1360, support extended shelf life while adhering to food contact safety regulations. These technological improvements not only minimize food waste but also enhance distribution reach, particularly in emerging markets with underdeveloped cold chain infrastructure. Additionally, the FDA's draft guidance on hazard analysis and risk-based preventive controls highlights the critical role of technology in maintaining food safety throughout the supply chain.

Competition from fresh alternatives hinders growth

Fresh food alternatives are intensifying competitive dynamics by capitalizing on perceived quality and health benefits. Consumer preferences are shifting toward minimally processed options, even at the expense of convenience. The growing local food movement is disrupting the positioning of processed foods, particularly in developed markets where shorter supply chains facilitate access to fresh products. The 2024 UK Food Security Report highlights the alignment of global food production with population growth, ensuring a steady supply of fresh foods that directly compete with processed alternatives. Seasonal price volatility in fresh produce creates periodic margin pressures for processed food manufacturers, especially during peak harvest seasons. The USDA's initiatives to minimize food loss and waste through enhanced fresh food handling are expected to extend product shelf life, further intensifying competition with processed foods. Consumer education campaigns promoting fresh food consumption are eroding the market share of processed foods, compelling manufacturers to innovate in areas such as convenience and nutritional value to sustain their competitive edge.

Other drivers and restraints analyzed in the detailed report include:

- Increased awareness boosts demand for protein-rich chilled meats

- Expansion of cold chain logistics infrastructure globally

- Strict food safety regulations restricts growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Processed poultry maintained the largest 24.43% slice of the chilled and frozen processed food market share in 2024, underpinned by efficient feed-to-protein conversion and broad recipe versatility. However, ready meals are leading the growth trajectory with a 7.87% CAGR, as urban consumers increasingly demand convenient, heat-and-eat solutions that deliver balanced nutrition. Robust livestock production in North America and consistent global vegetable supplies ensure a stable ingredient pipeline, essential for large-scale entree manufacturing. Companies are differentiating their offerings through ethnic flavor innovations and portion-controlled packaging designed for single-person households.

The chilled and frozen processed food market is enhancing its value proposition by integrating premium nutritional features, such as high-fiber grain blends and reduced-sodium sauces. Seafood ready meals are experiencing strong growth, supported by government initiatives promoting omega-3 consumption, including the UK's Seafood Fund grant for freezing technology upgrades at Denholm Seafoods. Additionally, products like pizza, soup, and noodles are leveraging their comfort-food positioning to maintain demand, even as consumers adjust their discretionary spending amid economic uncertainties.

In 2024, pouches accounted for 41.04% of market revenue, driven by cost efficiencies associated with lightweight freight. However, boxes are anticipated to grow at a 6.45% CAGR as retailers increasingly adopt fiber-based packaging formats aligned with circular economy objectives. The market for chilled and frozen processed foods is expected to witness significant growth in recyclable carton solutions, contingent on the implementation of standardized on-pack labeling schemes that simplify household sorting. Leading converters are integrating moisture-resistant coatings, enabling freezer-ready packaging without compromising structural integrity.

Adoption of monomaterial pouches and paper-based trays is accelerating as companies work to meet the 2026 European packaging waste compliance thresholds. Meanwhile, boxes offer large printable surfaces ideal for nutritional graphics that align with Canada's forthcoming front-of-package labeling requirements, making them a preferred choice for premium SKUs targeting health-conscious consumers. Manufacturers are evaluating investments in carton-line automation against potential long-term cost savings from reduced extended producer responsibility fees. Over the forecast period, packaging innovation will prioritize balancing barrier functionality with recyclability at the end of the product lifecycle.

The Chilled Processed Food Market Report is Segmented by Product Type (Processed Red Meat, Processed Poultry, and More), Packaging (Pouches, Boxes, and Others), Form (Ready-To-Eat and Ready-To-Cook), Distribution Channel (Off-Trade and On-Trade), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe held 33.45% of 2024 revenue, underlining its long-established cold-chain reach and diverse consumer base. EU sustainability regulations are driving brands to deliver measurable waste reduction and recyclable packaging solutions, creating a premium segment with higher average selling prices. According to Eurostat, slight declines in bovine and pig herds have tightened the regional supply of chilled meats, supporting price stability for value-added products. Innovation efforts are now focused on fortified, convenient meal solutions tailored to the ageing population while maintaining authentic regional flavors.

Asia-Pacific is the fastest-growing region, with an 8.11% CAGR projected through 2030, driven by urbanization and rising disposable incomes. Government initiatives, such as subsidies aimed at upgrading cold-storage infrastructure, are playing a pivotal role in accelerating the rural electrification of refrigerated depots. These efforts are expanding the availability of frozen protein products, particularly in tier-three cities, thereby addressing growing consumer demand. Additionally, the customization of flavors and portion sizes remains a strategic priority for businesses to effectively meet the diverse and dynamic culinary preferences across the Asia-Pacific markets.

North America continues to exert significant influence, supported by robust supply chains and a consumer base familiar with freezer categories. The USDA projects sufficient beef production to meet both domestic and export demands, ensuring stable raw material inputs for meal manufacturers. In Canada, the upcoming 2026 nutrition labeling regulations are prompting reformulations and clearer front-panel communication. The market's growth will depend on balancing indulgence with the increasing demand for clean-label products, as retailers emphasize plant-based frozen options alongside traditional proteins.

- Nestle SA

- Kraft Heinz Company

- Vion Food Group

- Conagra Brands, Inc.

- General Mills, Inc.

- Hormel Foods Corporation

- Grupo Bimbo SAB de CV

- Mondelez International Inc.

- Tyson Foods Inc.

- WH Group Ltd.

- JBS S.A.

- Sigma Alimentos S.A. de C.V

- Maple Leaf Foods Inc.

- Ajinomoto Co. Inc.

- Nomad Foods Ltd.

- Smithfield Foods Inc.

- Baiersbronn Frischfaser Karton GmbH

- TS Foods Limited

- Midland Chilled Foods

- Signature International Foods India Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urbanization and hectic lifestyles fuel demand for ready meals

- 4.2.2 Advances in preservation technologies surge demand for processed food

- 4.2.3 Increased awareness boosts demand for protein-rich chilled meats

- 4.2.4 Retail and online food distribution expansion bolsters product supply

- 4.2.5 Innovation in packaging extends product shelf life

- 4.2.6 Expansion of cold chain logistics infrastructure globally

- 4.3 Market Restraints

- 4.3.1 Competition from fresh alternatives hinders growth

- 4.3.2 Strict food safety regulations restricts growth

- 4.3.3 High capital investment requirements increases the cost of final product

- 4.3.4 Short shelf life of chilled foods lessens demand

- 4.4 Supply Chain Analysis

- 4.5 Consumer Behavior Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Processed Red Meat

- 5.1.2 Processed Poultry

- 5.1.3 Processed Fish and Seafood

- 5.1.4 Processed Vegetables and Potatoes

- 5.1.5 Bakery Products

- 5.1.6 Ready Meals

- 5.1.7 Pizza, Soup and Noodles

- 5.2 By Packaging

- 5.2.1 Pouches

- 5.2.2 Boxes

- 5.2.3 Others

- 5.3 By Form

- 5.3.1 Ready-to-Eat (RTE)

- 5.3.2 Ready-to-Cook (RTC)

- 5.4 By Distribution Channel

- 5.4.1 Off-Trade

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Convenience/Grocery Stores

- 5.4.1.3 Online Retail Stores

- 5.4.1.4 Other Distribution Channels

- 5.4.2 On-Trade

- 5.4.1 Off-Trade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle SA

- 6.4.2 Kraft Heinz Company

- 6.4.3 Vion Food Group

- 6.4.4 Conagra Brands, Inc.

- 6.4.5 General Mills, Inc.

- 6.4.6 Hormel Foods Corporation

- 6.4.7 Grupo Bimbo SAB de CV

- 6.4.8 Mondelez International Inc.

- 6.4.9 Tyson Foods Inc.

- 6.4.10 WH Group Ltd.

- 6.4.11 JBS S.A.

- 6.4.12 Sigma Alimentos S.A. de C.V

- 6.4.13 Maple Leaf Foods Inc.

- 6.4.14 Ajinomoto Co. Inc.

- 6.4.15 Nomad Foods Ltd.

- 6.4.16 Smithfield Foods Inc.

- 6.4.17 Baiersbronn Frischfaser Karton GmbH

- 6.4.18 TS Foods Limited

- 6.4.19 Midland Chilled Foods

- 6.4.20 Signature International Foods India Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK