PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844653

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844653

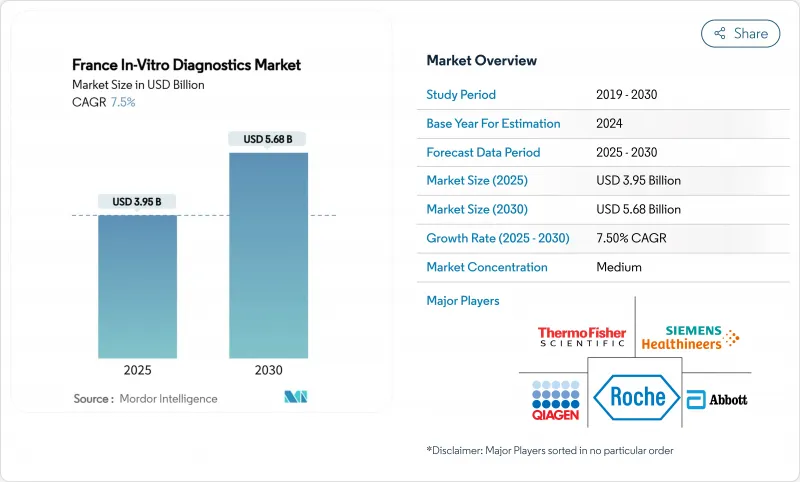

France In-Vitro Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The France in vitro diagnostics market size stands at USD 3.95 billion in 2025 and is projected to reach USD 5.68 billion by 2030, translating to a 7.5% CAGR over the forecast period.

Diagnostic testing underpins roughly 70% of clinical decisions and continues to gain relevance as chronic disease cases rise and preventive-care models expand. Regulatory tightening under the European Union's In Vitro Diagnostic Regulation (IVDR) is lengthening approval cycles yet driving demonstrable quality gains. Laboratory consolidation, especially among investor-backed chains, is steering volumes toward high-throughput hubs while home-based testing platforms widen patient access. Technology convergence-automation, artificial intelligence, and digital connectivity-remains the pivotal competitive lever as suppliers look to improve turnaround time, accuracy, and data integration.

France In-Vitro Diagnostics Market Trends and Insights

Escalating chronic and infectious disease burden expanding test volumes

France's aging profile and rising multimorbidity are enlarging test menus across chemistry, immunoassay, and molecular panels. The share of citizens aged >=65 is projected to reach 29% by 2050, sustaining high diagnostic demand. Infectious disease panels still represent 30.2% of application revenues, reflecting vigilance after the COVID-19 crisis. Antimicrobial-resistance surveillance is accelerating the uptake of rapid molecular assays that identify pathogens and resistance markers in hours rather than days. Preventive screening programs embed testing into routine care pathways, further lifting volumes across national laboratories and community settings.

National health insurance reimbursement expansion for high-value diagnostics

Policy makers are moving toward 'coverage-with-evidence' schemes that reward assays delivering clear clinical utility. Companion diagnostics benefit first, aligning with precision oncology regimens that require biomarker confirmation before targeted therapy initiation. Government reimbursement also extends to select digital diagnostics, incentivizing interoperability between test platforms and electronic health records. This environment encourages innovation while nudging suppliers to prove real-world outcome gains.

Stringent IVDR compliance increasing time-to-market

The IVDR imposes a risk-based device classification and robust clinical-evidence dossier, stretching approval cycles for innovative assays. July 2024 amendments added mandatory supply-shortage notifications and phased Eudamed registration, further intensifying administrative load. More than 70% of manufacturers have redirected resources to regulatory functions, delaying product launches and potentially limiting test availability during the transition period.

Other drivers and restraints analyzed in the detailed report include:

- Rapid laboratory automation and digital workflow adoption enhancing throughput

- Rising consumer preference for near-patient and home-based testing solutions

- Shortage of qualified medical biologists and technicians limiting capacity expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Immuno Diagnostics secured 28% of the France in vitro diagnostics market share in 2024, supported by its role in routine hormone, autoimmune, and infectious-disease panels. Large installed analyzer bases and reagent tie-ins ensure stable demand. Molecular Diagnostics, projected to expand at a 9.5% CAGR between 2025 and 2030, increasingly permeates oncology, infectious disease, and hereditary-disease management. Platform trends favor multiplex PCR and next-generation sequencing, shrinking turnaround time from days to hours. Integrated devices such as BIOFIRE SPOTFIRE consolidate multiple respiratory targets into a single cartridge, underscoring the shift toward syndromic panels. Clinical Chemistry, Hematology, and Coagulation continue to provide core hospital metrics, though revenue growth trails molecular assays because of commoditized pricing. Point-of-care cartridges address decentralized needs, broadening access in emergency and outpatient contexts.

Growing emphasis on precision medicine propels companion diagnostics that identify actionable genomic alterations. Laboratories adopt automated extraction and library-prep stations to handle rising sample numbers without proportionate staff increases. This adoption cements molecular testing's trajectory toward mainstream use, even for conditions historically monitored by immunoassay or microscopy. As a result, the France in vitro diagnostics market expects a rebalanced revenue mix, with molecular diagnostics capturing a progressively larger slice of overall spending.

Reagents & Kits captured 65.5% of the France in vitro diagnostics market in 2024, reflecting the consumables-based economics of clinical testing. Proprietary chemistries with demonstrated sensitivity improvements preserve premium pricing, especially in viral-load and oncology panels. Instruments deliver lower share yet underpin long-term customer lock-in, as analyzer selection dictates future reagent pipelines. Software & Services, growing at 12.1% CAGR to 2030, provide laboratories with analytics, quality-control dashboards, and AI-driven decision support. Healthcare networks allocate capital toward interoperable middleware that bridges analyzer outputs and hospital information systems, reinforcing vendor relationships beyond physical hardware supply.

Service contracts now bundle remote monitoring, predictive maintenance, and workflow optimization consulting. This shift positions solution providers as partners in cost containment and regulatory compliance rather than mere equipment vendors. Consequently, software revenues buffer cyclical capital spending, smoothing supplier cash flows and elevating overall customer lifetime value within the France in vitro diagnostics market.

The France In-Vitro Diagnostics Market Report is Segmented by Test Type (Clinical Chemistry, Molecular Diagnostics, and More), Product & Service (Instrument, and More), Specimen (Blood, Urine, and More), Test Setting (Centralised Laboratory Testing, and More), Application (Infectious Disease, Diabetes and More), and End-Users (Independent Diagnostic Laboratories, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbott Laboratories

- Beckton Dickinson

- bioMerieux

- Bio-Rad Laboratories

- Danaher Corp. (Beckman Coulter)

- Roche

- QIAGEN

- Siemens Healthineers

- Sysmex

- Thermo Fisher Scientific

- Eurofins

- Cerba HealthCare

- Sebia

- DiaSorin

- Werfen (Instrumentation Lab)

- Novacyt Group

- Hologic

- Illumina

- Randox Laboratories

- Sebia

- Theradiag

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Chronic & Infectious Disease Burden Expanding Test Volumes

- 4.2.2 National Health Insurance Reimbursement Expansion for High-Value Diagnostics

- 4.2.3 Rapid Laboratory Automation & Digital Workflow Adoption Enhancing Throughput

- 4.2.4 Consolidation of Private Lab Chains Driving Centralized High-Throughput Testing

- 4.2.5 Rising Consumer Preference for Near-Patient & Home-Based Testing Solutions

- 4.3 Market Restraints

- 4.3.1 Stringent IVDR Compliance Increasing Time-to-Market

- 4.3.2 Shortage of Qualified Medical Biologists & Technicians Limiting Capacity Expansion

- 4.3.3 Low-Cost Self-Testing Alternatives Cannibalising Central-Lab Revenues

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Test Type

- 5.1.1 Clinical Chemistry

- 5.1.2 Molecular Diagnostics

- 5.1.3 Immuno Diagnostics

- 5.1.4 Hematology

- 5.1.5 Coagulation

- 5.1.6 Microbiology

- 5.1.7 Point-of-Care Testing

- 5.1.8 Other Test Types

- 5.2 By Product & Service

- 5.2.1 Instruments

- 5.2.2 Reagents & Kits

- 5.2.3 Software & Services

- 5.3 By Specimen

- 5.3.1 Blood

- 5.3.2 Urine

- 5.3.3 Saliva

- 5.3.4 Tissue & Biopsy

- 5.3.5 Stool

- 5.3.6 Other Specimens

- 5.4 By Test Setting

- 5.4.1 Centralised Laboratory Testing

- 5.4.2 Point-of-Care Testing

- 5.4.3 Self-Testing / Home Care

- 5.5 By Application

- 5.5.1 Infectious Disease

- 5.5.2 Diabetes

- 5.5.3 Cancer / Oncology

- 5.5.4 Cardiology

- 5.5.5 Autoimmune Disorders

- 5.5.6 Prenatal & Newborn Screening

- 5.5.7 Other Applications

- 5.6 By End User

- 5.6.1 Independent Diagnostic Laboratories

- 5.6.2 Hospital-based Laboratories

- 5.6.3 Physician Office Laboratories

- 5.6.4 Academic & Research Institutes

- 5.6.5 Home Care & Self-Testing Users

- 5.6.6 Other End Users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Becton, Dickinson & Company

- 6.3.3 bioMerieux SA

- 6.3.4 Bio-Rad Laboratories, Inc.

- 6.3.5 Danaher Corp. (Beckman Coulter)

- 6.3.6 F. Hoffmann-La Roche AG

- 6.3.7 QIAGEN N.V.

- 6.3.8 Siemens Healthineers

- 6.3.9 Sysmex Corporation

- 6.3.10 Thermo Fisher Scientific Inc.

- 6.3.11 Eurofins Scientific SE

- 6.3.12 Cerba HealthCare

- 6.3.13 Sebia

- 6.3.14 DiaSorin S.p.A.

- 6.3.15 Werfen (Instrumentation Lab)

- 6.3.16 Novacyt Group

- 6.3.17 Hologic, Inc.

- 6.3.18 Illumina, Inc.

- 6.3.19 Randox Laboratories Ltd.

- 6.3.20 Sebia

- 6.3.21 Theradiag

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment