PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844659

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844659

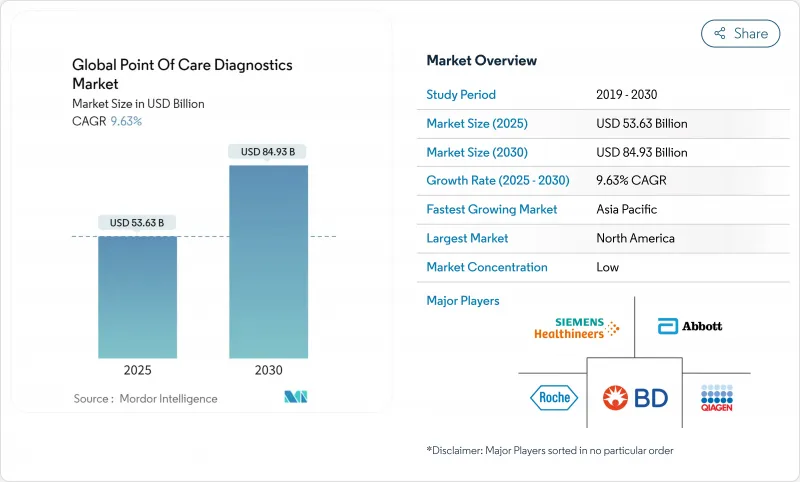

Global Point Of Care Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Point Of Care Diagnostics Market size is estimated at USD 53.63 billion in 2025, and is expected to reach USD 84.93 billion by 2030, at a CAGR of 9.63% during the forecast period (2025-2030).

The steady growth reflects an industry shift toward immediate, near-patient testing that trims time-to-treatment and lowers overall care costs. Decentralized testing, miniaturized electronics, and smartphone connectivity are converging to drive adoption across both clinical and home settings. Market leaders continue to invest in four-in-one molecular respiratory panels, Bluetooth-enabled glucose sensors, and handheld cardiac biomarker readers-all technologies that improve decision speed and broaden access. Regional performance varies: North America leverages mature reimbursement and robust R&D, whereas Asia-Pacific benefits from expanding health coverage and a rising chronic disease burden. Competitive intensity is accelerating as approvals for multiplex molecular cartridges shorten development cycles, while phased Laboratory Developed Test (LDT) rules favor firms with strong quality systems.

Global Point Of Care Diagnostics Market Trends and Insights

Glucose Self-Management Becoming a Standard of Care in Diabetes

Continuous glucose monitoring is moving from clinic to consumer wearables as leading systems pair real-time data with GLP-1 therapy to enhance glycemic control. Abbott's FreeStyle Libre portfolio, when used with GLP-1 drugs, delivered an additional 1.5% HbA1c reduction over six months, demonstrating the clinical benefit of integrated monitoring. Academic groups are fast-tracking non-invasive optics; RMIT University's infrared sensor pinpoints glucose across four discrete wavelengths, eliminating fingersticks . Early-stage trials in Raman spectroscopy, in-ear PPG, and magnetohydrodynamic fluidics reaffirm strong correlation to capillary values, signaling a move toward painless, always-on monitoring that boosts adherence and supports population-level diabetes management.

Surge in CLIA-Waived Molecular POC Platforms for Respiratory Pathogens

Syndromic PCR cartridges that detect SARS-CoV-2, Influenza A/B, and RSV in 20 minutes are reshaping triage workflows. Roche's cobas liat quad-plex panel received EUA and cut antiviral initiation delays, with 99% of influenza-positive patients treated at first encounter. Interfacing these devices with cloud dashboards turns once-isolated tests into networked infection-surveillance nodes, improving bed management during peak respiratory seasons.

Product Recalls

In 2024 Abbott identified three FreeStyle Libre 3 sensor lots that over-reported high glucose values, prompting a voluntary correction and temporary market disruption. Recall visibility influences prescribers' brand trust and forces contingency testing, muting near-term growth despite overall demand.

Other drivers and restraints analyzed in the detailed report include:

- Rising Prevalence of Chronic and Infectious Diseases

- Increasing Number of Regulatory Approvals for Novel Immunoassay Techniques

- Stringent Regulatory Policies and Reimbursement Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Blood Glucose Monitoring Kits retained 39.87% of point-of-care diagnostics market share in 2024, buoyed by the worldwide diabetes epidemic. Continuous sensors and connected meters keep sales resilient, with the point-of-care diagnostics market size for glucose monitoring expected to expand steadily alongside type 2 diabetes incidence. Infectious Disease Testing Kits posted the fastest 10.1% CAGR outlook for 2025-2030, propelled by four-pathogen respiratory panels and at-home syphilis antibody tests. The FDA authorization of the First to Know Syphilis Test underscores regulatory support for consumer infectious-disease self-screening, accelerating segment momentum.

Demand is also diversifying: multiplex molecular strips now blend bacterial, viral, and fungal targets, letting primary-care clinics manage differential diagnoses on-site. Product pipelines show convergence, with companies integrating cardiac troponin, HbA1c, and CRP into comprehensive metabolic and sepsis panels that fit the same palm-sized reader, extending lifetime value per instrument.

Lateral Flow Assays captured 32.4% revenue in 2024 thanks to low unit cost and easy distribution, yet their market weight is gradually ceding ground. Molecular platforms-projected at 11.8% CAGR-extend sensitivity, vital for variant-prone viruses and low-copy pathogens. The point-of-care diagnostics market size for molecular cartridges is forecast to double this decade as pharmacies adopt CLIA-waived analyzers.

Manufacturers focus on higher multiplex density without compromising run-time. QuidelOrtho's Savanna console delivers PCR-grade accuracy from a single swab in 25 minutes, matching clinic cycle times. Meanwhile, cloud-linked analyzers push auto-result posting into electronic medical records, creating fertile ground for population-level antimicrobial stewardship dashboards.

The Point of Care Diagnostics Market Report Segments the Industry Into by Product (Glucose Monitoring Kit, Cardio-Metabolic Monitoring Kit, and More), by Platform (Lateral Flow Assays and More), by Sample Type (Blood, Urine and More), by Mode of Purhcase (Over-The-Counter and Prescription-Based), by End User (Hospital and Critical Care Setting, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America commands 43.6% of 2024 revenue, underpinned by policy initiatives, robust venture backing, and early-adopter health systems. The final LDT rule reshapes investment calculus; firms that already handle Medical Device Reporting glide through phase-in stages, consolidating competitive advantage. Strategic M&A-BD's USD 4.2 billion Critical Care acquisition-adds AI-enabled monitors that feed real-time alerts to intensivists, marrying analytics with bedside diagnostics.

Asia-Pacific is the fastest climber, forecast at a 10.67% CAGR. Health ministries in India, China, and Southeast Asia are scaling remote vital-sign hubs to offset clinician shortages. Investment projections of USD 138 billion by 2027 in regional life-sciences infrastructure spur local cartridge manufacturing, reducing import dependency. Public-private collaborations-such as BD's cervical cancer partnership with Kenya's Ministry of Health-show how multinationals tailor solutions for resource-limited environments, often leapfrogging legacy lab models.

Europe balances stringent regulation with technological depth. CE-marked cobas 6800/8800 2.0 systems boost throughput by optimizing walk-away times, letting central labs handle surges without staff increases. Additionally, CE approvals for Bluetooth-enabled cardiac monitors extend arrhythmia surveillance for six years, aligning with EU digital-health reimbursement frameworks. In the Middle East and Africa, infection diagnostics dominate donor funding, while South America sees rising awareness of early cancer screening. Supply-chain cold-chain gaps persist, but rooftop solar refrigeration pilots in Nigeria indicate pathways to stabilize PCR reagent logistics.

- Abbott Laboratories

- Roche

- Siemens Healthineers

- Danaher Corporation (Cepheid & Beckman Coulter)

- QuidelOrtho

- Beckton Dickinson

- Johnson & Johnson

- bioMerieux

- Bio-Rad Laboratories

- Chembio Diagnostics Inc.

- Trinity Biotech plc

- Nova Biomedical

- Werfen (Instrumentation Laboratory)

- PTS Diagnostics

- Sekisui Diagnostics

- Orasure Technologies

- Accubiotech Co. Ltd.

- HemoCue AB

- Radiometer Medical ApS

- EKF Diagnostics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Glucose Self-Management Becoming a Standard of Care in diabetes

- 4.2.2 Surge in CLIA-Waived Molecular POC Platforms for Respiratory Pathogens

- 4.2.3 Rising Prevalence of Chronic and Infectious Diseases

- 4.2.4 Increasing Number of Regulatory Approvals for Novel Immunoassay Techniques

- 4.2.5 Technological Advancements and Rising Usage of Home-based POC Devices

- 4.2.6 National Newborn Screening Mandates Accelerating Bedside Bilirubin Testing in Europe

- 4.3 Market Restraints

- 4.3.1 Product Recalls

- 4.3.2 Stringent Regulatory Policies and Reimbursement Issues

- 4.3.3 Quality-Control Non-Compliance Penalties in US Physician-Office Labs

- 4.3.4 Supply-Chain Cold-Chain Gaps for Molecular Cartridges in Africa

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Glucose Monitoring Kits

- 5.1.2 Infectious Disease Testing Kits

- 5.1.3 Cardiometabolic (Cardiac Marker) Testing Kits

- 5.1.4 Coagulation Monitoring Kits

- 5.1.5 Pregnancy & Fertility Testing Kits

- 5.1.6 Blood Gas / Electrolyte & Metabolite Testing Kits

- 5.1.7 Hematology Testing Kits

- 5.1.8 Tumor / Cancer Marker Testing Kits

- 5.1.9 Urinalysis Testing Kits

- 5.1.10 Cholesterol Test Strips

- 5.2 By Platform

- 5.2.1 Lateral Flow Assays

- 5.2.2 Dipsticks & Test Strips

- 5.2.3 Microfluidics-Based Platforms

- 5.2.4 Immunoassays (CLIA & FIA)

- 5.2.5 Molecular Diagnostics (PCR, INAAT)

- 5.3 By Sample Type

- 5.3.1 Blood

- 5.3.2 Urine

- 5.3.3 Saliva

- 5.3.4 Nasal / Throat Swab

- 5.3.5 Other Specimens (Sweat, Tear, CSF)

- 5.4 By Mode of Purchase

- 5.4.1 Over-the-Counter (OTC)

- 5.4.2 Prescription-Based

- 5.5 By End User

- 5.5.1 Hospitals & Clinics

- 5.5.2 Home-Care Settings

- 5.5.3 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Abbott Laboratories

- 6.4.2 F. Hoffmann-La Roche Ltd.

- 6.4.3 Siemens Healthineers AG

- 6.4.4 Danaher Corporation (Cepheid & Beckman Coulter)

- 6.4.5 QuidelOrtho Corporation

- 6.4.6 Becton, Dickinson and Company

- 6.4.7 Johnson & Johnson (LifeScan)

- 6.4.8 bioMerieux SA

- 6.4.9 Bio-Rad Laboratories Inc.

- 6.4.10 Chembio Diagnostics Inc.

- 6.4.11 Trinity Biotech plc

- 6.4.12 Nova Biomedical Corporation

- 6.4.13 Werfen (Instrumentation Laboratory)

- 6.4.14 PTS Diagnostics

- 6.4.15 Sekisui Diagnostics

- 6.4.16 OraSure Technologies Inc.

- 6.4.17 Accubiotech Co. Ltd.

- 6.4.18 HemoCue AB

- 6.4.19 Radiometer Medical ApS

- 6.4.20 EKF Diagnostics

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment