PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844677

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844677

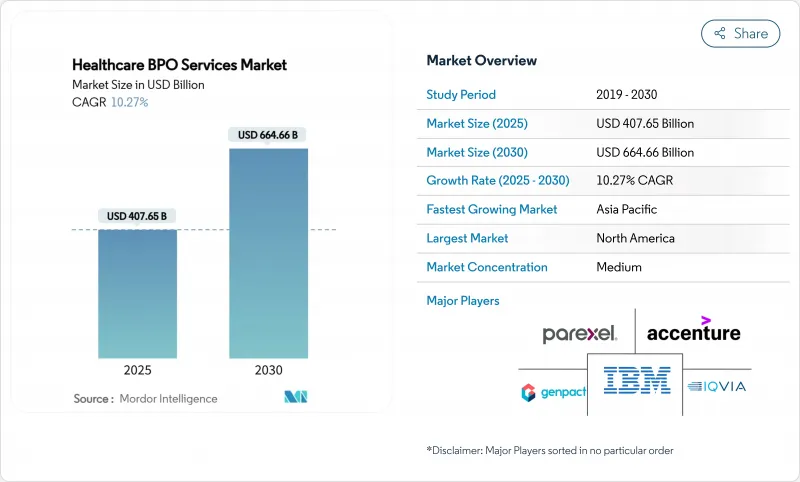

Healthcare BPO Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Healthcare Business Process Outsourcing (BPO) Services market size reached USD 407.65 billion in 2025 and is projected to advance to USD 664.66 billion by 2030, registering a 10.27% CAGR.

This expansion reflects a shift from labor-only contracts toward technology-enabled transformation platforms that address systemic clinical and administrative inefficiencies. Demand is rising as hospitals and insurers confront tighter reimbursement, persistent labor shortages, and stricter data-protection laws. Private-equity ownership is accelerating platform investments, and the combination of generative AI with domain expertise is reshaping price-value equations. Rising interest rates have not dampened investor appetite, largely because AI-driven productivity gains allow providers to commit to outcome-based pricing that protects margins in a turbulent funding environment.

Global Healthcare BPO Services Market Trends and Insights

Near-shore outsourcing enables real-time collaboration

Academic research shows that healthcare organizations shifting work to nearby countries reduce operational risk by 35% while still saving 20-30% compared with on-shore delivery. Heightened data-residency laws-such as Florida's requirement that electronic health records stay in the United States, its territories, or Canada-make proximate sites more attractive than far-shore hubs. Mexico's 10.5% annual rise in near-shore IT and business-services revenue further strengthens its position as a preferred location, particularly for revenue-cycle and clinical-documentation contracts. The USMCA's digital-trade chapter provides legal certainty around cross-border data flows and intellectual-property protection, giving payers and providers confidence to award multiyear deals to suppliers in the region. Stanford University findings add that proximity-based models improve compliance outcomes by 40% and cut communication errors by 25%. Together these factors accelerate a geographic shift that favors the healthcare BPO services market, especially for mid-cycle revenue functions.

Rapid uptake of clinical process outsourcing (CPO)

A five-year longitudinal study reported that sponsors using external partners short-ened clinical trials by 18 months without sacrificing compliance. Post-pandemic interest in decentralized studies increases the need for patient-engagement tools and data-integration platforms that specialized BPO firms already operate. Harvard Medical School researchers observed 22% higher enrollment and 15% better data-quality scores in outsourced trials versus in-house programs. As artificial-intelligence engines automate data capture and regulatory-submission tasks, vendors can layer value-added analytics on top of traditional monitoring. Outsourcing also frees biotech teams to focus on core R&D while accessing global patient pools and dedicated regulatory expertise. This combination positions CPO as the fastest-expanding slice of the healthcare BPO services market.

Complex Multi-Jurisdictional Regulations

Ever-evolving HIPAA clauses intersect with GDPR, forcing vendors to juggle encryption, multifactor authentication, and localized breach protocols. AskFeather guidance shows suppliers incurring legal reviews for every new cross-border hosting scenario. Florida's prohibition on non-domestic storage increases onboarding cost and delays for multistate systems. Smaller vendors struggle to fund parallel compliance teams, which tempers new-logo growth across the Healthcare Business Process Outsourcing (BPO) Services market.

Other drivers and restraints analyzed in the detailed report include:

- Healthcare reforms propel specialized outsourcing

- Generative-AI automation unlocks mid-cycle revenue deals

- Hidden Total Cost and Vendor Lock-in

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Claims Management retained 34.57% of 2024 revenue as payers prioritized error-free adjudication and prompt cash application. AI-enabled auto-adjudication flags anomalies in real time, curbing leakage and reserve risk. Provider Management, growing at 14.79% CAGR, supports network adequacy reviews and value-based contract modeling. Human-resource and customer-relationship functions use chatbots that cut call times without eroding member satisfaction. Care Management expands through population-health pilots aimed at chronic-care gaps. These developments keep the Healthcare Business Process Outsourcing (BPO) Services market responsive to payer roadmaps built around risk-score accuracy and medical-loss-ratio targets.

A second wave of change comes from payer-provider convergence. Integrated health plans insist on shared data lakes that harmonize claim edits with bedside order sets. Vendors with SMART-on-FHIR connectors outperform rivals still dependent on batch file transfers. Mid-tier insurers replicate UnitedHealth's AI roadmap by embedding generative models in appeals, subrogation, and out-of-network pricing. Competitive intensity is therefore migrating from unit cost to analytic sophistication within the Healthcare Business Process Outsourcing (BPO) Services market.

Revenue Cycle Management captured 46.27% revenue in 2024 and anchors hospital fiscal stability amid labor shortages. Automation triangulates clinical notes, charge capture, and payer edits, shrinking days-cash-on-hand volatility. Patient Care Services, expanding 15.03% CAGR, blends virtual nursing with contact-center triage to raise experience scores. Strategic Planning services track referral patterns and payer mix to shape service-line investments. These priorities explain why the Healthcare Business Process Outsourcing (BPO) Services market size for provider-facing workstreams is rising faster than in-house hiring budgets.

Cutting-edge providers integrate agentic AI into claims status and denial recovery. Ensemble Health, for instance, uses predictive algorithms to route complex invoices to senior coders only when rules engines cannot self-resolve. Hospitals therefore obtain higher net revenue without proportional headcount increases. The cascading productivity means C-suite leaders treat outsourcing as a revenue accelerant rather than a cost-cut lever, reinforcing high-value renewal momentum across the Healthcare Business Process Outsourcing (BPO) Services market.

The Healthcare BPO Services Market Report is Segmented by Payer Service (Claims Management, Care Management, and More), Provider Service (Patient Care Service, and More), Pharmaceutical Service (Research & Development, Manufacturing, and More), Service Delivery Model (Onshore and More), Technology Adoption Model (Traditional Lift-And-Shift BPO, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 48.69% of global revenue in 2024 as the region's complex reimbursement environment required extensive expert support. Hospitals continue to outsource mid-cycle operations to offset chronic staffing gaps. Optum's leadership reshuffle toward value-based care underscores growth in bundled outsourcing contracts that integrate clinical documentation with network steering. Canada's drive for pan-Canadian EHR interoperability and Mexico's rise as nearshore hub extend regional dynamism. The Healthcare Business Process Outsourcing (BPO) Services market therefore focuses on platform investments and regulatory depth in this geography rather than price competition alone.

Asia-Pacific records the fastest 13.04% CAGR, buoyed by population-health initiatives and digital-health funding in India, China, and Southeast Asia. Indian vendors add nearshore centers in Malaysia and the UAE to meet data-localization clauses. The Philippines expands patient-engagement centers, while China's private providers lean on domestic BPOs versed in new data-security law requirements. Talent supply remains a draw, yet escalating privacy expectations mean firms must invest in advanced cyber defenses. Consequently, the Healthcare Business Process Outsourcing (BPO) Services market adapts by distributing centers closer to end-markets and embedding multilingual compliance teams.

Europe maintains steady growth as GDPR limits offshore traffic. Germany and the United Kingdom favor domestic analytics partners able to manage NHS or Krankenkasse standards. Southern European countries modernize claims clearinghouses, outsourcing to regional integrators that understand cross-border reimbursement across the Schengen area. Vendors embed EU Cloud Code of Conduct principles, gaining premium pricing and long-term contracts. The Healthcare Business Process Outsourcing (BPO) Services market continues to mature through specialized offerings such as e-prescription auditing and outcome measurement aligned with the EU Pharmaceutical Strategy.

- Accenture

- United Health Group

- Cognizant

- Genpact

- Wipro

- Tata Consultancy Services

- IBM

- IQVIA

- Parexel International

- GeBBs Healthcare Solutions

- Sutherland Global Services

- R1 RCM

- Conifer Health Solutions

- Firstsource Solutions

- Omega Healthcare

- WNS Global Services

- NTT DATA

- Capgemini

- Optum

- EXL Service Holdings

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise of Near-shore Outsourcing & Access to Technology

- 4.2.2 Rapid Increase in Clinical Process Outsourcing (CPO)

- 4.2.3 Healthcare Reforms (PPACA / ICD-11 / Value-based Care) Spur Outsourcing

- 4.2.4 Generative-AI Coding Automation Unlocks Mid-RCM Deals

- 4.2.5 Payvider Convergence Driving Integrated BPaaS Models

- 4.2.6 PE-fuelled Roll-ups Creating Specialist Delivery Centers

- 4.3 Market Restraints

- 4.3.1 Complex Multi-jurisdictional Regulations

- 4.3.2 Hidden Total Cost & Vendor Lock-in

- 4.3.3 Sovereign Data-Residency Laws Fragment Delivery

- 4.3.4 Shortage of Medically-Trained Coders in Tier-2 Hubs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Payer Service

- 5.1.1 Human Resource Management

- 5.1.2 Claims Management

- 5.1.3 Customer Relationship Management (CRM)

- 5.1.4 Operational / Administrative Management

- 5.1.5 Care Management

- 5.1.6 Provider Management

- 5.1.7 Other Payer Services

- 5.2 By Provider Service

- 5.2.1 Patient Enrollment & Strategic Planning

- 5.2.2 Patient Care Service

- 5.2.3 Revenue Cycle Management

- 5.3 By Pharmaceutical Service

- 5.3.1 Research & Development

- 5.3.2 Manufacturing

- 5.3.3 Non-clinical Service

- 5.3.3.1 Supply-Chain Management & Logistics

- 5.3.3.2 Sales & Marketing Services

- 5.3.3.3 Other Non-clinical Services

- 5.4 By Service Delivery Model

- 5.4.1 Onshore

- 5.4.2 Nearshore

- 5.4.3 Offshore

- 5.4.4 Hybrid / Multishore

- 5.5 By Technology Adoption Model

- 5.5.1 Traditional Lift-and-Shift BPO

- 5.5.2 Platform-based BPaaS

- 5.5.3 Intelligent-Automation-led BPO

- 5.5.4 Generative-AI-embedded BPO

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Accenture

- 6.3.2 UnitedHealth Group

- 6.3.3 Cognizant Technology Solutions

- 6.3.4 Genpact

- 6.3.5 Wipro

- 6.3.6 Tata Consultancy Services

- 6.3.7 IBM Corporation

- 6.3.8 IQVIA

- 6.3.9 Parexel International Corporation

- 6.3.10 GeBBS Healthcare Solutions

- 6.3.11 Sutherland Global Services

- 6.3.12 R1 RCM Inc.

- 6.3.13 Conifer Health Solutions

- 6.3.14 Firstsource Solutions

- 6.3.15 Omega Healthcare

- 6.3.16 WNS Global Services

- 6.3.17 NTT DATA

- 6.3.18 Capgemini SE

- 6.3.19 Optum

- 6.3.20 EXL Service Holdings

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment