PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844678

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844678

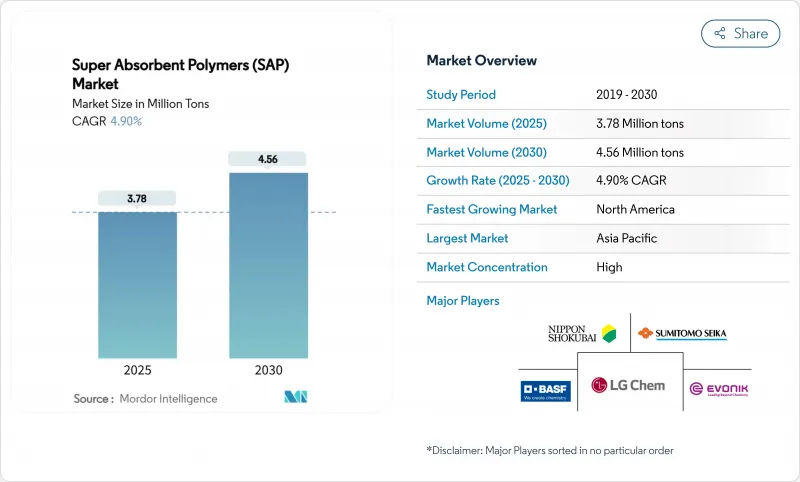

Super Absorbent Polymers (SAP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Super Absorbent Polymers Market size is estimated at 3.78 Million tons in 2025, and is expected to reach 4.56 Million tons by 2030, at a CAGR of 4.90% during the forecast period (2025-2030).

Enlarging demand in baby diapers, rapid uptake of high-SAP adult incontinence pads, and a widening set of industrial and agricultural applications are the core forces behind this steady expansion. Tightening European regulations that reward bio-based chemistries, together with higher per-capita diaper spend in China and India, are reshaping product portfolios toward premium, high-performance grades. Manufacturers continue to upgrade plants for energy efficiency and vertical integration to buffer acrylic acid price swings. At the same time, direct-to-consumer subscription models and e-commerce-driven cold-chain packaging unlock high-margin niches that compensate for margin pressure in standard hygiene volumes. Rising investment in cellulosic and starch-derived alternatives signals that sustainability now drives both brand value and process innovation in the super absorbent polymers market.

Global Super Absorbent Polymers (SAP) Market Trends and Insights

Rising Per-Capita Diaper Spend in China and India

Urban households in China lifted their average diaper outlay by 15% since 2022, aided by policy changes that support larger families and rising disposable income. In India, distribution build-out in tier-2 and tier-3 cities raised penetration, bringing advanced diaper formats within reach of first-time buyers. Premium SKUs contain higher-capacity SAP grades and reduced gel blocking, accelerating unit consumption and value growth across the super absorbent polymers market. Local converters increasingly lock supply via long-term offtake deals to secure quality and mitigate freight risks.

Rapid Adoption of High-SAP Adult Incontinence Pads

Demographic aging in Japan, South Korea, Germany, and Italy has elevated adult incontinence prevalence, while social acceptance campaigns reduce stigma. New pads integrate up to 40% more SAP, enabling thinner profiles that resemble regular underwear and encourage daytime use. Subscription e-commerce channels are growing, bundling discrete delivery, leakage guarantees, and mobility-specific SKUs. Producers respond with differentiated core-shell particle morphologies that boost absorption under load, creating a high-margin sub-segment within the super absorbent polymers market.

Volatile Raw Material Prices

Acrylic acid constitutes up to 70% of production cost, and quarterly swings as wide as 25% destabilize procurement budgets. Changhong Polymer's USD 1.6 billion propane-to-acrylic-acid plant, due in 2026, could lower variable cost curves and unsettle pricing parity among established Western suppliers. Interest in bio-routes and vertical integration rises as boards prioritize feedstock security.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Bio-Based SAP in EU Driven by Packaging Rules

- Expanding Agricultural Applications

- Safety Concerns Over Residual Monomers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acrylic fraction represented 72% of the super absorbent polymers market share in 2024, anchored by its proven reliability in baby diapers. To bolster safety perception, premium brands specify higher-purity acrylic SAPs with lower free monomer levels. In parallel, polyacrylamide grades are expanding at a 6.6% CAGR, propelled by their superior water retention in arid agriculture and industrial sealing. Within the super absorbent polymers market size context, polyacrylamide volumes are forecast to add 125 kilotons between 2025 and 2030, capturing incremental share from acrylic grades.

Product developers pursue hybrid networks that mix acrylic and polysaccharide backbones to marry cost and degradability. Nippon Shokubai's biomass-derived SAP line, certified Halal and produced in Indonesia, exemplifies such cross-chemistry innovation. Investment emphasis now tilts toward biomass sourcing logistics, impurity control, and scalable continuous reactor designs that ensure consistent polymer architecture.

Gel polymerization kept a 60% revenue share in 2024, with its reactor trains optimized for high throughput and uniform cross-link density. Energy recovery loops and continuous monomer recycling drive incremental cost competitiveness. Solution polymerization grows at 5% CAGR because it enables small-lot, specialty grades with tight molecular weight distribution and reduced energy load, aligning with sustainability targets.

Suspension and inverse-suspension routes persist in niche roles that require unique particle morphologies, such as core-shell microspheres for medical fluid management. Process engineers focus on precise cross-linker feed control and in-line spectroscopy to tune absorption under load, further segmenting supply within the super absorbent polymers market.

The Super Absorbent Polymer (SAP) Market Segments the Industry by Product Type (Polyacrylamide, Acrylic Acid Based, and Others), Polymerization Process (Solution Polymerization, and More), Application (Baby Diapers, Adult Incontinence Products, and More), End-User Industry (Personal Care and Hygiene Manufacturers, Agriculture Input Suppliers, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific held 42% of the super absorbent polymers market in 2024, powered by China's integrated acrylic acid-SAP clusters that minimize feedstock logistics. Government incentives, notably in Jiangsu and Shandong, support capacity debottlenecking and export-oriented expansions. India contributes volume growth through broader diaper penetration, while Japan retains a technology leadership niche in specialty and biomass-derived grades.

North America is projected to post the fastest 5.50% CAGR through 2030. Growth arises from premium diaper SKUs, high-SAP adult incontinence adoption among aging baby boomers, and specialized industrial uses such as fracking water blockers and cold-chain pads. Research consortia with land-grant universities pioneer cellulosic and protein-based networks, aligning corporate sustainability pledges with regulatory trends. The region also records early field use of hemp-based SAP in horticulture, reinforcing circular economy narratives within the superabsorbent polymers market.

Europe's stringent policy climate accelerates bio-based uptake and packaging recyclability. Germany leads production volume, whereas Nordic countries drive consumer preference for compostable diaper cores. Compliance costs spur alliances between polymer suppliers and waste-management firms to pilot closed-loop recovery schemes. EU standards increasingly influence export formulations, compelling global producers to harmonize product safety and labeling.

- ADM

- BASF

- Braskem

- Chase Corp.

- Chemtex Speciality Limited

- Evonik Industries AG

- Formosa Plastics Group

- LG Chem

- NIPPON SHOKUBAI CO., LTD.

- SANYO CHEMICAL INDUSTRIES, LTD.

- SAP SE

- Satellite Chemical

- SNF

- SONGWON

- SUMITOMO SEIKA CHEMICALS CO.,LTD.

- TOYO BOEKI Co.,Ltd.

- Wanhua

- Yixing Danson Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Per-Capita Diaper Spend in China and India

- 4.2.2 Rapid Adoption of High-SAP Adult Incontinence Pads Asia and Europe

- 4.2.3 Shift to Bio-based SAP in EU Driven by Single-Use Plastics Directive

- 4.2.4 E-Commerce-Led Demand Spike for Absorbent Packaging Pads (Cold Chain)

- 4.2.5 Expanding Agricultural Applications

- 4.3 Market Restraints

- 4.3.1 Volatile Raw Material Prices

- 4.3.2 Safety Concerns Over Residual Monomers in Infant Diapers

- 4.3.3 High Production Cost

- 4.4 Production Cost Overview

- 4.5 Value Supply-Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Polyacrylamide

- 5.1.2 Acrylic Acid Based

- 5.1.3 Others

- 5.2 By Polymerization Process

- 5.2.1 Solution Polymerization

- 5.2.2 Suspension/Inverse-Suspension Polymerization

- 5.2.3 Gel Polymerization

- 5.3 By Application

- 5.3.1 Baby Diapers

- 5.3.2 Adult Incontinence Products

- 5.3.3 Feminine Hygiene

- 5.3.4 Agriculture Support

- 5.3.5 Other Application

- 5.4 By End-User Industry

- 5.4.1 Personal Care and Hygiene Manufacturers

- 5.4.2 Agriculture Input Suppliers

- 5.4.3 Healthcare Providers

- 5.4.4 Other End-use Industries (Telecom and Power Cable Makers and Food and Pharmaceutical Cold-Chain Logistics)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Egypt

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ADM

- 6.4.2 BASF

- 6.4.3 Braskem

- 6.4.4 Chase Corp.

- 6.4.5 Chemtex Speciality Limited

- 6.4.6 Evonik Industries AG

- 6.4.7 Formosa Plastics Group

- 6.4.8 LG Chem

- 6.4.9 NIPPON SHOKUBAI CO., LTD.

- 6.4.10 SANYO CHEMICAL INDUSTRIES, LTD.

- 6.4.11 SAP SE

- 6.4.12 Satellite Chemical

- 6.4.13 SNF

- 6.4.14 SONGWON

- 6.4.15 SUMITOMO SEIKA CHEMICALS CO.,LTD.

- 6.4.16 TOYO BOEKI Co.,Ltd.

- 6.4.17 Wanhua

- 6.4.18 Yixing Danson Technology

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Commercial Scale-up of 100% Bio-Based SAP