PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907345

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907345

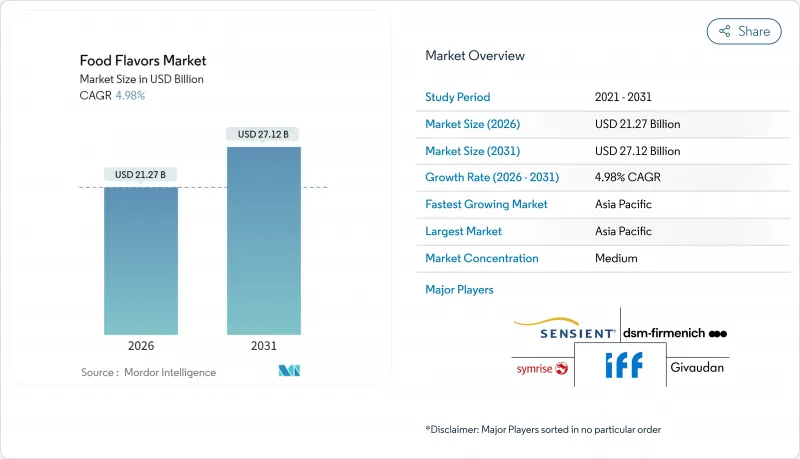

Food Flavors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

In 2025, the food flavors market size is valued at USD 20.26 billion. food flavors market size in 2026 is estimated at USD 21.27 billion, growing from 2025 value of USD 20.26 billion with 2031 projections showing USD 27.12 billion, growing at 4.98% CAGR over 2026-2031.

This growth reflects the industry's ability to adapt to evolving regulatory landscapes, such as the United States' initiative to phase out petroleum-based colorants, which has prompted companies to innovate and stay competitive. Businesses are leveraging cutting-edge technologies like precision fermentation, spray-drying, and AI-guided formulations to enhance product development and meet market demands. Additionally, modern sourcing strategies are proving effective in overcoming supply chain challenges for essential ingredients like vanilla, cocoa, and citrus, ensuring consistent availability and quality. At the same time, manufacturers are focusing on clean-label reformulations, balancing cost efficiency with the growing consumer preference for natural and sustainable alternatives. This dual approach of innovation and responsiveness positions the industry for sustained growth and relevance in the coming years.

Global Food Flavors Market Trends and Insights

Rising Demand for Processed Foods Accelerates Global Food Flavors Market Growth

The demand for plant-based flavors is transforming ingredient sourcing as manufacturers move away from synthetic alternatives due to regulatory requirements and changing consumer preferences. The FDA's GRAS rule modifications now require comprehensive safety documentation for new ingredients, benefiting established natural flavor producers while creating entry barriers for synthetic alternatives. Companies like Perfect Day and TurtleTree use precision fermentation technologies to produce cost-effective natural flavors, specifically focusing on animal-free dairy proteins that deliver authentic taste profiles without traditional supply chain limitations. The application of biocatalysts in flavor synthesis addresses sustainability challenges through microbial biotransformation, producing natural compounds that comply with regulations while providing better stability and scalability than plant-extracted alternatives.

Technological Advancements Revolutionize Flavor Production and Delivery

The food industry uses encapsulation technology for product formulations through microencapsulation and spray-drying techniques. These methods maintain high volatile retention rates and protect flavor compounds from degradation. Food manufacturers use cyclodextrins as encapsulation agents to stabilize anthocyanins and carotenoids while masking undesirable flavors .With FDA and EU approval as safe food additives, cyclodextrins have gained wider commercial use. Companies are utilizing genetically engineered microorganisms in food production through precision fermentation, which enables sustainable ingredient development that helps address global food security and minimize environmental effects.

Changing Regulatory Landscape Creates Market Uncertainty

Regulatory changes are reshaping the landscape across major markets, creating both challenges and opportunities for businesses. The FDA's decision to phase out petroleum-based synthetic dyes by 2026 is pushing companies to innovate and reformulate their products to meet the new standards. Similarly, the upcoming implementation of California's Food Safety Act in 2027 is driving a wave of product reformulations to ensure compliance with stricter safety requirements. In China, the finalized National Food Safety Standard (GB2760-2024), effective February 2025, introduces a fresh set of compliance obligations. These changes are particularly significant for international flavor suppliers, as they navigate the complexities of operating in the world's largest and most dynamic consumer market .

Other drivers and restraints analyzed in the detailed report include:

- RTD Cocktail Innovation Transforms Alcoholic Beverage Flavoring

- Sustainability Initiatives Drive Innovation in Flavor Manufacturing

- Supply Chain Disruptions Challenge Ingredient Availability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The food industry continues to rely heavily on synthetic flavors, which command a substantial 61.22% market share in 2025. Food manufacturers find these synthetic options particularly valuable due to their reliability in production processes and ability to maintain consistent profit margins. While synthetic flavors remain the preferred choice, natural flavors are gaining momentum with an impressive 6.94% CAGR through 2031, primarily because of stricter regulations on synthetic dyes and growing consumer interest in clean-label products.

The industry is undergoing a significant transformation. According to the International Food Information Council, in 2024, 26% of respondents in the United States indicated that "Natural" best defines healthy food, while "Non-GMO" represented 14% . The FDA moves forward with its plan to eliminate petroleum-based synthetic dyes by 2026. In response, manufacturers are actively exploring alternatives, with companies like Spero Renewables introducing innovative solutions such as corn fiber-based vanillin. This shift has opened new opportunities in precision fermentation technologies, where manufacturers are developing natural flavors that not only meet regulatory standards but also offer enhanced stability compared to traditional plant extracts, all while remaining cost-competitive.

The Food Flavors Market Report is Segmented by Flavor Type (Natural Flavor, Synthetic Flavor, Nature Identical Flavoring), by Application (Dairy, Bakery, Confectionery, Savory Snack, Meat, Beverage, Other Applications), by Form (Powder, Liquid, Others) and by Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region leads the global food flavors market with a 31.94% market share in 2025 and is projected to grow at a CAGR of 5.69% through 2031. This market dominance is driven by urbanization, middle-class population growth, and increased processed food consumption across the region's diverse markets. China's National Food Safety Standard (GB2760-2024), set for implementation in February 2025, creates opportunities for international flavor suppliers while establishing stricter regulatory frameworks.

Similarly, regulatory changes in North America and Europe, including the FDA's synthetic dye elimination by 2026 and the California Food Safety Act, are prompting major food manufacturers to reformulate their flavor compositions. South America represents a high-potential growth market, evidenced by Givaudan's substantial 27.3% like-for-like growth in 2024. This performance reflects the region's increasingly sophisticated consumer preferences and strengthening food processing infrastructure, establishing it as a key focus area for flavor manufacturers.

The Middle East and Africa markets show promising development trajectories, supported by steady urbanization and economic growth. While these regions offer considerable expansion opportunities, successful market penetration requires carefully crafted strategies to address supply chain complexities and navigate diverse regulatory frameworks. The strategic partnership between Symrise and Shan Foods in Pakistan exemplifies successful market adaptation, effectively balancing global flavor innovation with local taste preferences.

- Givaudan SA

- DSM-Firmenich AG

- Sensient Technologies Corporation

- International Flavors & Fragrances Inc.

- Symrise AG

- Kerry Group plc

- Archer Daniels Midland Co.

- Takasago International Corp.

- Aquila Organics Ltd.

- Fab Flavours

- Mane SA

- T. Hasegawa Co. Ltd.

- Keva Flavours

- McCormick & Company Inc.

- Treatt plc

- Oriental Aromatics

- Dohler GmbH

- Bell Flavors & Fragrances Inc.

- Synergy Flavors Inc.

- Blue Pacific Flavors

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Plant-Based Flavor to Boost the Market Growth

- 4.2.2 Increasing Preference for Processed Food Surges in Demand for Food Flavors

- 4.2.3 Advancements In Technology for Flavor Synthesis, Encapsulation, and Extraction Induce Varied Flavors

- 4.2.4 Consumer Preference for International and Ethnic Cuisines

- 4.2.5 Sustainability and Upcycled Ingredients in Flavor Manufacturing

- 4.2.6 Flavor Innovation in Alcoholic Beverage and RTD Cocktails

- 4.3 Market Restraints

- 4.3.1 Changing Regulatory Landscape

- 4.3.2 Inconsistent Flavor Performance Impact the Market Growth

- 4.3.3 Supply Chain Disruption in Flavor Ingredient Sourcing

- 4.3.4 Counterfeit and Low-Quality Flavor Products

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Flavor Type

- 5.1.1 Natural Flavor

- 5.1.2 Synthetic Flavor

- 5.1.3 Nature Identical Flavoring

- 5.2 By Application

- 5.2.1 Dairy

- 5.2.2 Bakery

- 5.2.3 Confectionery

- 5.2.4 Savory Snack

- 5.2.5 Meat

- 5.2.6 Beverage

- 5.2.7 Other Applications

- 5.3 By Form

- 5.3.1 Powder

- 5.3.2 Liquid

- 5.3.3 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Givaudan SA

- 6.4.2 DSM-Firmenich AG

- 6.4.3 Sensient Technologies Corporation

- 6.4.4 International Flavors & Fragrances Inc.

- 6.4.5 Symrise AG

- 6.4.6 Kerry Group plc

- 6.4.7 Archer Daniels Midland Co.

- 6.4.8 Takasago International Corp.

- 6.4.9 Aquila Organics Ltd.

- 6.4.10 Fab Flavours

- 6.4.11 Mane SA

- 6.4.12 T. Hasegawa Co. Ltd.

- 6.4.13 Keva Flavours

- 6.4.14 McCormick & Company Inc.

- 6.4.15 Treatt plc

- 6.4.16 Oriental Aromatics

- 6.4.17 Dohler GmbH

- 6.4.18 Bell Flavors & Fragrances Inc.

- 6.4.19 Synergy Flavors Inc.

- 6.4.20 Blue Pacific Flavors

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK