PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844680

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844680

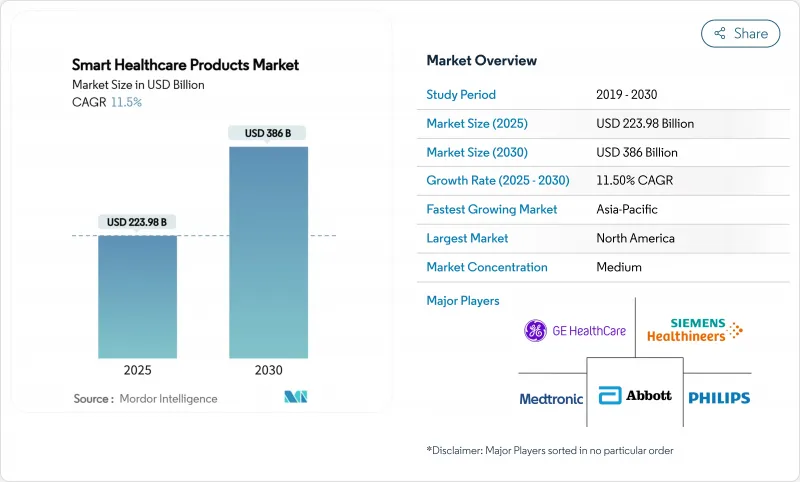

Smart Healthcare Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart healthcare products market size is valued at USD 223.98 billion in 2025 and is forecast to reach USD 386.00 billion by 2030, expanding at an 11.5% CAGR through the period.

Rising deployment of IoT-enabled devices, the convergence of artificial intelligence with clinical workflows, and reimbursement models that now cover remote monitoring solutions are accelerating adoption. Government incentives such as Singapore's USD 150 million GenAI programme and the European Health Data Space Regulation are standardising data exchange, reducing integration costs, and stimulating supplier investment. Strategic partnerships among device makers, cloud providers, and hospital systems are reshaping competitive strategies, while cybersecurity regulations tighten compliance requirements. Taken together, these forces propel the smart healthcare products market, even as capital-intensive infrastructure and data-privacy concerns temper the growth trajectory.

Global Smart Healthcare Products Market Trends and Insights

Rising Adoption of IoT-Enabled Medical Devices

The proliferation of connected devices is reshaping clinical practice by capturing patient data in real time and delivering actionable insights at the point of care. Remote patient monitoring users in the United States are expected to surpass 71 million by 2025 as 5G networks lower transmission latency to 110 milliseconds, reducing packet loss to 0.07%. Healthcare provider spending on edge computing is forecast to reach USD 10.3 billion in 2025, supporting predictive analytics for early-stage intervention. Asia-Pacific suppliers are rolling out AI-driven wearables that detect arrhythmia and glucose anomalies, creating new revenue pools and raising interoperability requirements. Device makers are embedding secure chipsets that consume 30% less power, extending battery life for long-term monitoring. Collectively, these factors improve clinical outcomes and drive volume growth across the smart healthcare products market.

Escalating Chronic-Disease Burden & Ageing Demographics

Chronic diseases accounted for 74% of global deaths in 2024, with the highest burden in Asia-Pacific economies. Continuous monitoring solutions reduce hospital readmissions by 85%, generating tangible savings for payers while enhancing patient satisfaction scores to 97%. An ageing population requires long-term care, triggering demand for smart beds, fall-detection sensors, and AI-enabled imaging. The economic upside is considerable, with AI projected to save up to USD 360 billion annually by trimming diagnostic errors and administrative overhead. Countries with universal healthcare systems are integrating smart healthcare products into chronic-disease programmes, accelerating volume deployment and standardising data exchange protocols.

High Capital Cost of Smart Healthcare Ecosystems

Deploying IoT platforms, edge servers, and cybersecurity layers requires sizable upfront outlays that smaller providers struggle to finance. Proposed HIPAA revisions could cost regulated entities USD 9.3 billion in the first year, covering encryption, multifactor authentication, and training mandates. Legislators introduced the Health Infrastructure Security and Accountability Act, which budgets USD 1.3 billion for standards compliance but still leaves hospitals funding the bulk of upgrades. Capital intensity slows rollouts in emerging markets where reimbursement remains fee-for-service and margins are thinner. Vendors are responding with device-as-a-service contracts that spread costs over multi-year terms. Yet adoption timelines remain contingent on financing availability, weighing on near-term units shipped in the smart healthcare products market.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Digital-Health Infrastructure

- Broader Reimbursement for Telemedicine Services

- Cyber-Security & Data-Privacy Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electronic Health Records contributed 28.51% to overall revenue in 2024, underlining their position as the data backbone of clinical workflows. National programmes such as Vietnam's hospital-wide digitisation of 32 million patient files reaffirm government support, ensuring sustained licensing income for platform vendors. Oracle's USD 3.5 billion budget application for the Veterans Affairs rollout further demonstrates institutional commitment to enterprise-scale implementations. Continuous user-experience upgrades and HL7 FHIR compliance solidify switching costs. The smart healthcare products market size for EHRs is projected to expand steadily, albeit at a single-digit rate, as penetration in primary care settings plateaus in developed economies.

Smart Wearable Devices, forecast to record a 19.25% CAGR, are capturing unmet needs in ambulatory monitoring. FDA-cleared innovations such as cuffless blood-pressure monitors and wrist-based pulse detection broaden clinical acceptability. Start-ups leverage cloud connectivity and AI algorithms to offer subscription-based analytics, reducing reliance on hardware margins. Device makers embed over-the-air update pipelines that keep software current, extending product life and service revenue. The smart healthcare products market size for wearables is therefore positioned for outsized expansion relative to other device classes.

Parallel segments play supporting roles. Telemedicine Platforms integrate wearables into virtual-care visits, while Smart Pills gain traction in gastrointestinal diagnostics following FDA De Novo clearance for blood detection. Smart RFID Cabinets protect high-value consumables, cutting inventory shrinkage by up to 15% and improving compliance with chain-of-custody mandates. Investments in smart hospital infrastructure, such as Siemens' deployment of 7,000 IoT sensors at Kantonsspital Baden, illustrate growing end-to-end integration across the smart healthcare products market.

The Smart Healthcare Products Market Report is Segmented by Product Type (Telemedicine, Electronic Health Records, Mhealth Solutions, Smart Pills, Smart Syringes, Smart RFID Cabinets, and More), Application (Storage and Inventory Management, Remote Monitoring, and More), End User (Hospitals, Home Care Settings, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.82% revenue share in 2024, buoyed by sophisticated payer systems, advanced infrastructure, and sizeable venture capital flows. Federal initiatives such as the ARPA-H Women's Health Sprint, which committed more than USD 100 million to digital health research, strengthen the innovation pipeline. Medicare's extension of telehealth flexibilities through 2025 further entrenches remote monitoring usage and stabilises supplier demand. Canada complements the region's dynamism by launching the Infoway Centre for Clinical Innovation to foster standards-based interoperability. Strong cybersecurity oversight in both countries ensures continued investment despite breach headlines.

Asia-Pacific delivers the fastest CAGR at 17.31% thanks to coordinated national strategies, expanding middle-class populations, and unmet clinical demand in rural areas. Singapore's five-year USD 150 million GenAI plan fast-tracks imaging AI and automated record transcription across public hospitals. South Korea allocates USD 830 million for AI-enabled emergency systems, setting benchmarks for real-time patient transfer management. Southeast Asia's digital health revenue is poised to reach USD 6.1 billion in 2024, with investors attracted to high smartphone penetration and supply-demand gaps. Australia's Health Connect platform promotes seamless data sharing, accelerating provider onboarding.

Europe benefits from the European Health Data Space Regulation, effective March 2025, setting a single market for digital health services and supporting projects such as Xt-EHR and EUVAC. Unified rules reduce vendor fragmentation and encourage cross-border telemedicine. National health systems in Germany and France have rolled out e-prescription mandates, underlining commitment to digitalisation. In the Middle East and Africa, South Africa pilots national e-health strategies, while Gulf Cooperation Council states invest in smart hospital builds. South America shows momentum, particularly in Brazil where urbanisation and private insurance uptake fuel demand, although macroeconomic volatility moderates growth. Overall, geographic diversification balances expansion risks and underpins sustained growth across the smart healthcare products market.

- Abbott Laboratories

- Medtronic

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips

- Samsung Medison Co. Ltd.

- Mckesson

- Oracle

- NextGen Healthcare

- Olympus

- Capsule Technologies

- Omron Healthcare Co. Ltd.

- Teladoc Health

- Dexcom

- Apple

- Allscripts

- IBM Corporation (Watson Health)

- Cisco Systems

- Boston Scientific

- iRhythm Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption Of Iot-Enabled Medical Devices

- 4.2.2 Escalating Chronic-Disease Burden & Ageing Demographics

- 4.2.3 Government Incentives For Digital-Health Infrastructure

- 4.2.4 Broader Reimbursement For Telemedicine Services

- 4.2.5 Wearable Ultrasound & Smart Textiles For Continuous Care

- 4.2.6 Energy-Efficient Lightweight Cryptography Unlocking Ultra-Low-Power Sensors

- 4.3 Market Restraints

- 4.3.1 High Capital Cost Of Smart Healthcare Ecosystems

- 4.3.2 Cyber-Security & Data-Privacy Concerns

- 4.3.3 BLE Protocol Vulnerabilities Triggering Compliance Delays

- 4.3.4 Supply-Chain Fragility For Advanced Mini-Sensors

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers / Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Telemedicine

- 5.1.2 Electronic Health Records

- 5.1.3 mHealth Solutions

- 5.1.4 Smart Pills

- 5.1.5 Smart Syringes

- 5.1.6 Smart RFID Cabinets

- 5.1.7 Smart Wearable Devices

- 5.1.8 Smart Hospital Infrastructure

- 5.2 By Application

- 5.2.1 Storage & Inventory Management

- 5.2.2 Remote Monitoring

- 5.2.3 Diagnostics

- 5.2.4 Treatment & Drug-Delivery

- 5.2.5 Wellness & Preventive Care

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Home-Care Settings

- 5.3.3 Specialty Clinics

- 5.3.4 Ambulatory Surgical Centers

- 5.3.5 Long-Term Care Facilities

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.4.3.1 Saudi Arabia

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Medtronic plc

- 6.3.3 GE Healthcare

- 6.3.4 Siemens Healthineers AG

- 6.3.5 Koninklijke Philips N.V.

- 6.3.6 Samsung Medison Co. Ltd.

- 6.3.7 McKesson Corporation

- 6.3.8 Oracle Corporation (Cerner)

- 6.3.9 NextGen Healthcare Inc.

- 6.3.10 Olympus Corporation

- 6.3.11 Capsule Technologies Inc.

- 6.3.12 Omron Healthcare Co. Ltd.

- 6.3.13 Teladoc Health Inc.

- 6.3.14 DexCom Inc.

- 6.3.15 Apple Inc.

- 6.3.16 Allscripts Healthcare Solutions Inc.

- 6.3.17 IBM Corporation (Watson Health)

- 6.3.18 Cisco Systems Inc.

- 6.3.19 Boston Scientific Corporation

- 6.3.20 iRhythm Technologies Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment