PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844681

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844681

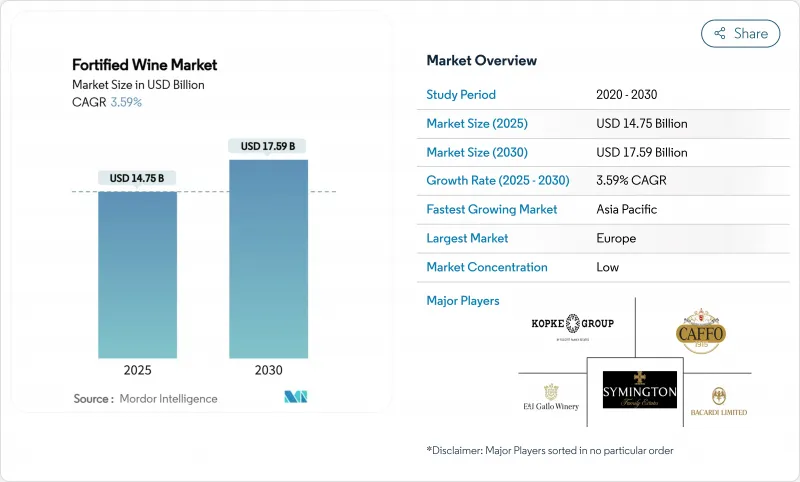

Fortified Wine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The fortified wine market size is valued at USD 14.75 billion in 2025 and is expected to grow to USD 17.59 billion by 2030, with a steady annual growth rate of 3.59% (CAGR) during this period.

The growing demand for premium fortified wines is driving up average prices, even as traditional drinking habits change. This trend helps producers manage slower sales volumes in older, more established markets. Europe remains the largest market for fortified wines, owing to its strong cultural ties and the familiarity of consumers with these products. Meanwhile, the Asia-Pacific region is experiencing rapid growth due to urbanization, rising incomes, and the increasing influence of Western lifestyles. Innovations such as creative cocktail recipes, environmentally friendly wine production, and digital marketing are helping to create new opportunities for consumption and making brands more appealing to consumers. The market is fragmented, meaning there is significant potential for companies to merge or acquire others. Leading producers from countries like Portugal, Spain, and Italy are using their long-standing traditions, ownership of vineyards, and extensive global distribution networks to maintain their competitive edge and grow their presence in the market.

Global Fortified Wine Market Trends and Insights

Surge in demand for premium wine

The global fortified wine market is experiencing significant growth, driven by the increasing demand for premium products. Consumers, especially younger generations, are showing a preference for wines that emphasize quality, origin transparency, and sustainable practices. For example, Constellation Brands has shifted its focus to premium wines priced between USD 30-80 by selling off its mass-market labels. New EU regulations, as of 2024, requiring QR code-based ingredient and nutrition disclosures are helping to build trust and enhance product traceability . Recent innovations in the market highlight this trend, such as Taylor's limited-edition Historical Collection Reserve Tawny, launched in 2024, and Sandeman's organic-certified Apitiv White Port. These products reflect a growing interest in heritage-rich and eco-friendly fortified wines. According to the International Organisation of Vine and Wine (OIV), the global wine export value in 2024 is estimated at EUR 35.9 billion, largely driven by the demand for premium wines in regions like Europe and North America .

Strong demand during festive seasons and social gatherings

Fortified wine sales see a significant rise during festive seasons and social gatherings, as these occasions encourage higher consumption in key markets. In Europe and North America, holidays like Christmas and New Year's consistently drive demand, while in China, the Lunar New Year celebrations lead to a noticeable increase in purchases. Similarly, weddings and other celebrations in South Asia contribute to seasonal spikes in demand. The hospitality sector's recovery after the pandemic has further fueled this trend, with consumers increasingly seeking premium and unique dining experiences. To meet this growing interest, many brands have introduced special promotions and limited-edition products. For instance, in December 2024, Gonzalez Byass launched a holiday gift set featuring its Nectar Pedro Ximenez and Alfonso Oloroso sherries, catering to festive buyers. Symington Family Estates released a zodiac-themed collector's edition of Graham's Six Grapes Reserve Port for Lunar New Year 2025, appealing to tradition and cultural significance.

Stringent government regulations

Strict government regulations are creating significant hurdles for the fortified wine market, particularly for smaller and mid-sized producers. Regulatory authorities in major markets are enforcing tighter compliance measures, such as container size restrictions and new allergen disclosure requirements, as outlined by the Alcohol and Tobacco Tax and Trade Bureau. In the United States, California's updated Bottle Bill has added further challenges by introducing Container Recycling Value (CRV) fees and specific labeling requirements. These changes are hitting boutique wineries and artisanal fortified wine producers the hardest. The increasing compliance demands are driving up production and packaging costs while complicating distribution processes. This could limit market access and reduce product variety, especially for niche producers focused on exports, making it harder for them to compete in an already challenging market environment.

Other drivers and restraints analyzed in the detailed report include:

- Growing use in mixology and cocktails

- Growing interest in low-alcohol and digestif drinks

- Rising consumer inclination towards other alcoholic beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Port remains the leading product type in 2024, which accounts for 39.45% of the market's total value. This dominance is largely attributed to Portugal's protected designation of origin system, which ensures consistent quality and fosters consumer trust. Strong trade ties with the United Kingdom have historically supported steady demand. Port is widely available in both retail (off-trade) and hospitality (on-trade) channels, making it accessible to a broad audience. To appeal to premium consumers, producers are focusing on offerings like single-quinta bottlings and age-stated expressions, which emphasize the heritage and craftsmanship of their products.

Meanwhile, Vermouth is emerging as the fastest-growing segment, with a projected CAGR of 4.29% through 2030. This growth is fueled by Vermouth's integral role in modern cocktail culture, particularly in major cities like Tokyo, New York, and London, where it has become a key ingredient in high-end bars. Producers are innovating by incorporating local botanicals to create terroir-driven products, which are gaining popularity in premium on-trade venues. The fortified wine industry is experimenting with hybrid styles that combine elements of aperitifs, digestifs, and cocktail ingredients, further expanding its appeal.

In 2024, the mass segment is becoming the leading category in the fortified wine market, with a growth rate of 58.53%. This growth is mainly driven by the increasing demand from cost-conscious consumers who are looking for affordable wine options, especially in developing countries. Companies in the mass-market segment are taking advantage of this trend by offering attractive deals like multipacks, in-store discounts, and ensuring their products are widely available in supermarkets. Although these wines may not have the same level of craftsmanship or storytelling as premium wines, they are crucial for expanding the market and introducing new consumers to fortified wines.

On the other hand, premium wines are expected to grow at a steady CAGR of 4.52% through 2030. This growth reflects the strong demand for high-quality wines in wealthy urban areas across Asia and North America. Consumers in this segment are increasingly focusing on factors like quality, origin, and sustainability. They prefer wines that are vintage-dated, cask-finished, or have unique characteristics. To meet these preferences, producers are emphasizing features such as organic certifications, vineyard-specific labels, and eco-friendly packaging. Digital tools like virtual wine tastings and QR codes for product traceability are helping brands build trust and loyalty among consumers.

The Fortified Wine Market Report is Segmented by Product Type (Port, Vermouth, and More), Category (Mass and Premium), End User (Men and Women), Distribution Channel (On-Trade and Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Value (USD).

Geography Analysis

Europe accounted for 57.64% of the fortified wine market value in 2024, driven by the strong presence of PDO (Protected Designation of Origin) systems in countries like Portugal, Spain, and Italy. These systems ensure product authenticity and help maintain premium price points. Producers in the region are increasingly focusing on sustainability by converting vineyards to organic practices and adopting energy-efficient technologies in their cellars to comply with stricter EU environmental regulations. While household wine consumption in countries like Germany and France has seen slight declines, the region continues to benefit from high-margin sales through duty-free shops and fine dining establishments, supported by a steady influx of tourists.

The Asia-Pacific region is experiencing the fastest growth in the fortified wine market, with a projected CAGR of 5.21% through 2030. In China, the market shows a dual trend: ultra-premium imports are thriving in tier-one cities, while price sensitivity dominates in volume-driven provinces. Japan's consumers, known for their appreciation of authenticity and tradition, continue to support steady imports of Sherry and Port. Emerging markets like India, South Korea, and Thailand are witnessing rapid growth, driven by rising disposable incomes and the increasing popularity of Western dining habits.

In North America, the fortified wine market faces challenges with declining volumes but shows resilience in the premium segment. The United States remains a significant market highlighting opportunities for recovery through targeted premium strategies. Recent regulatory changes in Ontario, Canada, allowing wine sales in grocery stores, have expanded retail access and created new opportunities for imported fortified wines. Meanwhile, the growing craft cocktail culture in cities like New York, Chicago, and Los Angeles has increased consumer awareness, with fortified wines like Port and Sherry being featured in innovative cocktails and tasting flights.

- Symington Family Estates Vinhos S.A.

- Caffo Group

- E. & J. Gallo Winery

- Kopke Group Fine Wines, SA

- Mxn Wines Ltd

- Bacardi Limited

- Pernod Ricard

- Constellation Brands Inc.

- Sogrape SGPS, S.A.

- ALVEAR SA

- Vinhos Barbeito

- BODEGAS REY FERNANDO DE CASTILLA, SL.

- Bon Coeur Fine Wines Ltd.

- Vinbros and Co.

- Mazuran's Vineyards Ltd

- Bodegas Barbadillo SL

- Niepoort Vinhos S.A.

- Emilio Lustau S.A.

- The Fladgate Partnership Group

- Botta di Cru

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancement in Terms of Production

- 4.2.2 Surge in Demand for Premium Wine

- 4.2.3 Product Diffrentiation in Terms of Raw Material

- 4.2.4 Strong Demand During Festive Seasons and Social Gatherings

- 4.2.5 Growing Use in Mixology and Cocktails

- 4.2.6 Growing Interest in Low-Alcohol and Digestif Drinks

- 4.3 Market Restraints

- 4.3.1 Stringent Government Regulations

- 4.3.2 Rising Consumer Inclination Towards Other Alcoholic Beverages

- 4.3.3 Short Shelf Life After Opening

- 4.3.4 Limited Consumer Awareness and Education

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Port

- 5.1.2 Vermouth

- 5.1.3 Sherry

- 5.1.4 Others

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Specialty/Liquor Stores

- 5.4.2.2 Others Off Trade Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Norway

- 5.5.2.9 Russia

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Vietnam

- 5.5.3.7 Indonesia

- 5.5.3.8 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Symington Family Estates Vinhos S.A.

- 6.4.2 Caffo Group

- 6.4.3 E. & J. Gallo Winery

- 6.4.4 Kopke Group Fine Wines, SA

- 6.4.5 Mxn Wines Ltd

- 6.4.6 Bacardi Limited

- 6.4.7 Pernod Ricard

- 6.4.8 Constellation Brands Inc.

- 6.4.9 Sogrape SGPS, S.A.

- 6.4.10 ALVEAR SA

- 6.4.11 Vinhos Barbeito

- 6.4.12 BODEGAS REY FERNANDO DE CASTILLA, SL.

- 6.4.13 Bon Coeur Fine Wines Ltd.

- 6.4.14 Vinbros and Co.

- 6.4.15 Mazuran's Vineyards Ltd

- 6.4.16 Bodegas Barbadillo SL

- 6.4.17 Niepoort Vinhos S.A.

- 6.4.18 Emilio Lustau S.A.

- 6.4.19 The Fladgate Partnership Group

- 6.4.20 Botta di Cru

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK