PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844684

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844684

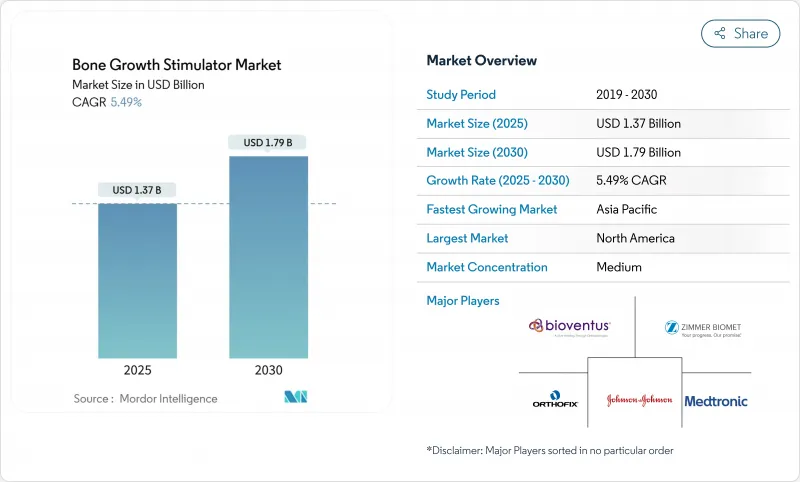

Bone Growth Stimulator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bone growth stimulator market size is USD 1.37 billion in 2025 and is forecast to reach USD 1.79 billion by 2030, advancing at a 5.49% CAGR.

Demand expansion is rooted in the steady rise of musculoskeletal disorders, longer life expectancy, and higher obesity prevalence, all of which increase the clinical need for accelerated fracture healing therapies. Technology is moving beyond stand-alone external stimulators into smart, sensor-rich implants that transmit healing data in real time and into biologically active agents that complement mechanical stimulation. Payer policy in the United States is moving from broad coverage to prior-authorization triage, signaling both market maturity and a call for stronger evidence packages. Similar scrutiny is starting in Europe, while large emerging economies are rolling out fast-track approvals for innovative devices to expand domestic access. These shifts collectively build a supportive environment for device makers that can supply robust clinical data and cost-of-care arguments.

Global Bone Growth Stimulator Market Trends and Insights

Rising Prevalence of Musculoskeletal Disorders

Non-union fractures still occur in as many as 10% of all long-bone breaks, keeping clinical demand for non-surgical healing adjuncts high . Clinical literature shows that mesenchymal stem cell therapy combined with electromagnetic stimulation yields healing rates above 90% at nine months, outpacing conventional fixation approaches. Pulsed electromagnetic field devices deliver 73-91% consolidation in difficult fractures, which translates into fewer revision surgeries and shorter rehabilitation courses. These outcomes reinforce hospital protocols and payer coverage rationales, further enlarging the bone growth stimulator market.

Growing Preference for Non/Minimally-Invasive Orthopedic Interventions

Capacitively coupled and combined magnetic field stimulators avoid surgical implantation and thereby reduce perioperative risks. FDA approval of a low-energy spine fusion stimulator in 2024 exemplifies this shift and demonstrated 79% fusion success versus 61% for placebo in a randomized study . Insurers such as Cigna now reimburse specific protocols for high-risk fractures, which encourages outpatient centers to adopt the technology and lifts patient acceptance. The trend supports the development of wearable systems that sync with clinician dashboards for adherence monitoring-a capability that further widens the bone growth stimulator market.

High Device Cost & Limited Reimbursement Outside the US

Advanced stimulators can exceed USD 5,000 per unit, putting them beyond reach for many health systems without robust insurance. Global harmonization of device regulations is also lengthening approval times and raising compliance costs, pushing small innovators out of price-sensitive markets. China's fast-track pathway mitigates this barrier somewhat, yet reimbursement remains sparse, delaying broad uptake. Over time, cost curves should bend downward as production scales and more clinical-outcome evidence convinces payers to cover the technology.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Geriatric & Obese Population with Delayed Bone Healing

- Expansion of Reimbursed Spinal-Fusion Indications

- Safety & Efficacy Concerns Around BMP/PRP Biologics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Revenue from stimulation devices captured 67.81% of bone growth stimulator market share in 2024. Combined magnetic field, pulsed electromagnetic field, and capacitive coupling technologies dominate because they align with outpatient workflows and deliver robust fusion rates across fracture classes. Embedded sensor packages now report compliance metrics, thereby supporting reimbursement documentation and strengthening provider confidence. Internal stimulators occupy niche indications where external fields cannot penetrate, such as deep-pelvic fractures, and are benefiting from miniaturized battery systems that extend service life.

Biologic stimulation agents represent the fastest growing cohort, expanding at a 6.21% CAGR. Formulations that blend recombinant growth factors with mesenchymal stem cells and scaffold matrices promise synergistic osteoinduction. Recent clinical trials recorded 91% radiographic union at 12 months in recalcitrant non-union cases, surpassing historical benchmarks. Artificial intelligence now guides donor-cell selection and dose scheduling, improving consistency and accelerating regulatory review. The combined momentum positions the biologic segment to command a larger slice of the bone growth stimulator market size over the next decade.

Spinal fusion accounted for 57.45% of bone growth stimulator market demand in 2024 because solid arthrodesis remains critical to pain relief and neural decompression success. Surgeons increasingly prescribe adjunct stimulators for multi-level cervical and high-risk lumbar cases, confident in randomized evidence showing 30-point gains in radiographic fusion scores relative to controls. Hospitals are embedding stimulation protocols into enhanced recovery pathways, trimming length of stay and lowering readmissions, which raises the perceived value of the therapy.

Oral and maxillofacial indications register the highest forward CAGR at 6.34%. Dental implantology leans on low-intensity ultrasound and capacitive coupling to maintain crestal bone height, reducing implant failure in smokers and diabetic patients. Platelet-rich fibrin matrices are advancing alveolar ridge preservation, producing a 12 percentage-point increase in vital bone volume versus conventional grafting. These gains spur adoption among periodontists and oral surgeons and enlarge the bone growth stimulator market in office-based dentistry.

The Bone Growth Stimulator Market is Segmented by Product (Bone Growth Stimulation Devices [External Bone Growth Stimulators and More] and Biologic Stimulation Agents), Application (Spinal Fusion Surgeries, Delayed & Non-Union Bone Fractures, and More), End User (Hospitals and Orthopedic Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 44.43% of global revenue in 2024. Medicare coverage, broad commercial insurance adoption, and a dense roster of level-I trauma centers support high procedural volumes and rapid technology refresh cycles. The Defense Health Agency has earmarked USD 40 million for regenerative medicine platforms, creating an innovation flywheel that benefits domestic suppliers. Regulatory tightening, such as the 2024 nationwide prior-authorization mandate for osteogenesis stimulators, introduces documentation burdens but also codifies long-term reimbursement certainty, sustaining the bone growth stimulator market.

Europe remains a mature but opportunity-rich region. Medical Device Regulation transition periods run until December 2027, allowing incumbents to market legacy products while updating clinical dossiers for future certificates. Germany, France, and Italy anchor regional demand thanks to well-established orthopedic infrastructures, while Scandinavian payers pilot outcome-based contracts that reimburse stimulators only when union is confirmed radiographically. The approach encourages vendors to supply connectivity modules that feed fusion progress automatically into insurer dashboards, enhancing transparency and patient engagement.

Asia-Pacific is on the steepest expansion path at a 6.49% CAGR through 2030. China's National Medical Products Administration has accelerated device approvals and is drafting separate guidelines for electromagnetic field exposure limits, creating clarity for importers. Japan's PMDA classification for regenerative therapies allows expedited filing for cell-enhanced biomaterials that pair with external stimulators, lifting launch activity. India's growing trauma caseload and burgeoning private insurance sector propel hospital procurement of mid-range stimulators, while Australia and South Korea continue to adopt top-tier devices through public-hospital tender cycles. These dynamics collectively expand the bone growth stimulator market size across diverse healthcare spending brackets.

- Medtronic

- Bioventus

- Orthofix

- Stryker

- Zimmer Biomet

- Smiths Group

- Johnson & Johnson

- DJO Global (Colfax)

- Arthrex

- IGEA S.p.A.

- Ito Co., Ltd.

- Terumo

- Altis Biologics

- Bone Therapeutics

- Stimwave Technologies Inc.

- Theragen Inc.

- Welte Medical B.V. (Ossatec)

- Isto Biologics

- Wright Medical Group

- Elizur

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Musculoskeletal Disorders

- 4.2.2 Growing Preference for Non/Minimally-Invasive Orthopedic Interventions

- 4.2.3 Increasing Geriatric & Obese Population with Delayed Bone Healing

- 4.2.4 Expansion of Reimbursed Spinal?Fusion Indications

- 4.2.5 Wearable, App-Linked Stimulators Enabling Remote Compliance Monitoring

- 4.2.6 Military & Elite-Sports Funding for Accelerated Recovery Technologies

- 4.3 Market Restraints

- 4.3.1 High Device Cost & Limited Reimbursement Outside The US

- 4.3.2 Safety & Efficacy Concerns Around BMP/PRP Biologics

- 4.3.3 Low Patient Adherence to Long-Duration Stimulation Protocols

- 4.3.4 Emerging EMF-Exposure Limits Constraining Device Field Strength

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Bone Growth Stimulation Devices

- 5.1.1.1 External Bone Growth Stimulators

- 5.1.1.1.1 Combined Magnetic Field (CMF) Devices

- 5.1.1.1.2 Capacitive Coupling (CC) Devices

- 5.1.1.1.3 Pulsed Electromagnetic Field (PEMF) Devices

- 5.1.1.2 Implanted Bone Growth Stimulators

- 5.1.1.3 Ultrasonic Bone Growth Stimulators

- 5.1.2 Biologic Stimulation Agents

- 5.1.2.1 Bone Morphogenetic Proteins (BMP)

- 5.1.2.2 Platelet-Rich Plasma (PRP)

- 5.1.2.3 Cell-based Osteogenic Matrices

- 5.1.1 Bone Growth Stimulation Devices

- 5.2 By Application

- 5.2.1 Spinal Fusion Surgeries

- 5.2.2 Delayed & Non-union Fractures

- 5.2.3 Oral & Maxillofacial Procedures

- 5.2.4 Trauma Surgeries

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals and Orthopedic Centers

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Home Care Settings

- 5.3.4 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Bioventus LLC

- 6.3.3 Orthofix Medical Inc.

- 6.3.4 Stryker Corporation

- 6.3.5 Zimmer Biomet Holdings Inc.

- 6.3.6 Smith & Nephew plc

- 6.3.7 Johnson & Johnson (DePuy Synthes)

- 6.3.8 DJO Global (Colfax)

- 6.3.9 Arthrex Inc.

- 6.3.10 IGEA S.p.A.

- 6.3.11 Ito Co., Ltd.

- 6.3.12 Terumo BCT Inc.

- 6.3.13 Altis Biologics Pty Ltd

- 6.3.14 Bone Therapeutics SA

- 6.3.15 Stimwave Technologies Inc.

- 6.3.16 Theragen Inc.

- 6.3.17 Welte Medical B.V. (Ossatec)

- 6.3.18 Isto Biologics

- 6.3.19 Wright Medical Group N.V.

- 6.3.20 Elizur Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment