PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844687

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844687

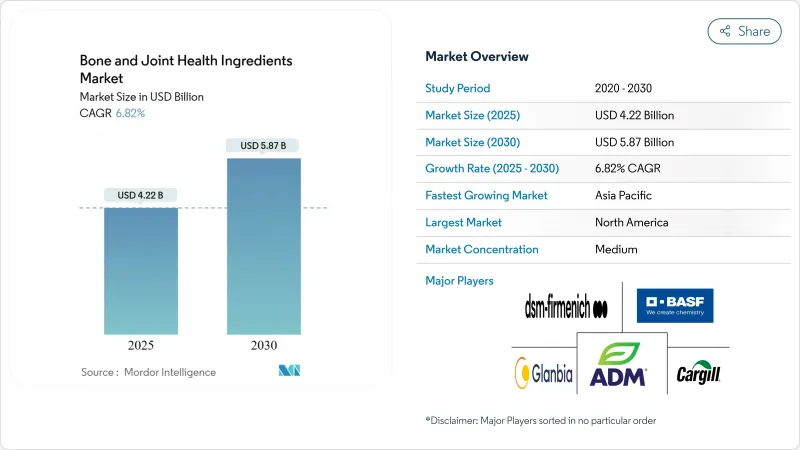

Bone And Joint Health Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bone joint health ingredients market size is valued at USD 4.22 billion in 2025 and is projected to reach USD 5.87 billion by 2030, registering a CAGR of 6.82% during the forecast period.

This growth trajectory reflects the convergence of demographic shifts, regulatory evolution, and technological innovation that positions joint health ingredients as critical components in preventive healthcare strategies. The market's expansion is fundamentally driven by the rising prevalence of osteoarthritis and osteoporosis, with scientific claims indicating that higher omega-3 intake reduces osteoporosis risk by ~30% among consumers. Regulatory frameworks across key markets are creating unprecedented opportunities for market expansion, particularly in Asia-Pacific, where China's State Administration of Market Regulation is drafting regulations to allow health foods to make joint health support claims, including benefits for alleviating joint pain and maintaining joint cartilage health.

Global Bone And Joint Health Ingredients Market Trends and Insights

Rising Prevalence of Osteoarthritis and Osteoporosis

The rising prevalence of musculoskeletal disorders is changing healthcare priorities globally. Current projections indicate that a substantial portion of the global population will develop arthritis within the coming decades, highlighting a critical healthcare challenge. This trend affects not only the elderly but also younger populations due to lifestyle factors and work-related stress. The high molecular weight hyaluronic acid can restore trabecular bone parameters to normal levels by increasing osteoblast growth and reducing osteoclast activity through decreased RANKL expression. The treatment approach is shifting from symptom management to disease-modifying osteoarthritis drugs (DMOADs) that address cartilage deterioration and synovial inflammation. This change creates significant market opportunities for ingredients that can alter disease progression instead of providing temporary symptom relief. Market participants require comprehensive business intelligence to navigate this evolving landscape, identify emerging treatment patterns, assess competitive dynamics, and make informed investment decisions in response to changing therapeutic approaches and consumer demands.

Growing Consumer Awareness of Preventive Joint Health and Self-Medication

The COVID-19 pandemic has shifted consumer behavior toward preventive healthcare and proactive health management. The Asia-Pacific nutraceutical market expanded significantly, driven by increased consumption during the pandemic. Market growth stems from rising demand for scientifically validated formulations and clean-label products with transparent ingredient sourcing. Taiwan's Food and Drug Administration (FDA) updated its bone health functional claim regulations by eliminating animal testing requirements and establishing minimum participant requirements for bone quality studies. This regulatory change aligns with consumer demand for ethical and evidence-based products. Younger consumers, in particular, are adopting self-medication practices, emphasizing convenience and personalized health management solutions. These market dynamics present opportunities for businesses to develop targeted strategies and product innovations that meet evolving consumer preferences and regulatory requirements.

Price Volatility of Key Raw Materials

Raw material cost fluctuations affect profit margins across the bone and joint health ingredients value chain, particularly in collagen and marine-derived compounds where supply chains face sustainability and scalability limitations. Marine collagen production continues to experience challenges in sensory characteristics and manufacturing costs, despite technological improvements in yield and quality optimization. These challenges include off-flavors, texture inconsistencies, and high processing expenses that impact final product quality and market competitiveness. The price volatility extends to plant-based alternatives, as agricultural commodity price variations directly influence ingredient costs, creating uncertain pricing conditions for manufacturers. Weather patterns, crop yields, and global demand fluctuations contribute to this market uncertainty. Supply chain disruptions have led companies to explore vertical integration and alternative sourcing strategies, though these solutions require significant capital investment and long-term planning. Integration efforts often involve establishing direct relationships with raw material suppliers, investing in processing facilities, and developing proprietary extraction technologies. In response, the market has developed synthetic alternatives and fermentation-based production methods to achieve better cost stability and supply reliability. These innovative approaches include laboratory-produced compounds and bioengineered solutions that reduce dependency on traditional raw material sources.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand from Athletes and Fitness Professionals for Joint-Support Products

- Rising Obesity Rates Increasing Joint Stress and Osteoarthritis Risk

- High Manufacturing Costs Impacting Product Pricing and Accessibility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The vitamin group anchored 32.15% of the bone and joint health ingredients market share in 2024, underpinned by broad clinical validation for vitamins D3, K2, and C in mineralization and collagen synthesis. Emerging formulation advances keep this portfolio relevant, yet calcium is racing ahead with an 8.65% CAGR on the back of chelation technologies and prebiotic co-administration systems that raise fractional absorption. Collagen maintains steady growth through marine-derived alternatives that offer superior bioavailability compared to mammalian sources, while glucosamine benefits from regulatory recognition in markets like China, where health products containing glucosamine have received approval for increasing bone density.

Magnesium demonstrates consistent performance through its established role in bone mineral density regulation and osteoblast/osteoclast activity modulation. Omega-3 segments are experiencing renewed interest following research demonstrating a 32% reduction in osteoporosis odds among the highest intake quartiles, driving innovation in specialized delivery systems that address oxidation challenges and improve bioavailability. Hyaluronic acid represents an emerging growth segment, supported by clinical evidence of its effectiveness in alleviating ovariectomy-induced bone loss through osteoblast proliferation promotion and osteoclast activity inhibition.

Plant-derived sources are rapidly gaining market traction at 10.61% CAGR through 2030, despite animal-derived ingredients maintaining 55.66% market share in 2024. This shift reflects consumer preferences for sustainable, allergen-free alternatives and regulatory support for plant-based innovations. Traditional Chinese medicine flavonoids are emerging as significant contributors to plant-derived growth, offering advantages including fewer side effects and cost-effectiveness for long-term use compared to conventional drugs.

Animal-derived sources maintain their dominance through established supply chains and proven efficacy profiles, particularly in collagen and chondroitin sulfate applications where molecular structure and bioactivity are well-characterized. The segment benefits from regulatory clarity, with established Generally Recognized as Safe (GRAS) notices for ingredients like hydrolyzed porcine trachea cartilage containing type II collagen and chondroitin sulfate. However, sustainability concerns and ethical considerations are driving innovation toward fermentation-based production methods that can replicate animal-derived compound structures while addressing supply chain vulnerabilities. Other sources, including synthetic and fermentation-derived alternatives, represent emerging opportunities for manufacturers seeking to balance efficacy, sustainability, and cost considerations in their product portfolios.

The Bone and Joint Health Ingredients Market Report Segments the Industry Into by Type (Vitamin, Calcium, Collagen, Magnesium, and More), by Source (Plant-Derived, Animal-Derived, and Others), by Form (Powder, Liquid, and Others), by Application (Dietary Supplement, Functional Food and Beverage, and Others) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains its position as the dominant regional market with a 35.15% share in 2024, driven by established healthcare infrastructure, regulatory clarity, and high consumer awareness of preventive health strategies. The region benefits from well-developed distribution channels and premium pricing acceptance for scientifically validated products. Regulatory frameworks in the United States provide clear pathways for ingredient approval, with established Generally Recognized as Safe (GRAS) notice procedures that enable market entry for novel compounds like olive leaf extract containing at least 50% polyphenols and 40% oleuropein. The region's growth is supported by increasing integration of joint health ingredients into functional foods and beverages, with manufacturers leveraging advanced processing technologies to address taste and stability challenges.

The Asia-Pacific market is expected to grow at a CAGR of 8.96% during 2025-2030, making it the fastest-growing region. This growth stems from increasing disposable incomes, urbanization, and health awareness, especially in China and India. The region's consumers are focusing more on preventive healthcare, increasing the demand for functional foods and supplements that support bone and joint health. Government programs supporting healthy aging and investments in food processing technologies enable manufacturers to develop products aligned with local preferences, supporting continued growth in the bone and joint health ingredients market.

Europe demonstrates steady market performance through stringent regulatory standards that ensure product quality and safety while creating barriers to entry for lower-quality alternatives. The European Food Safety Authority's rigorous health claim evaluation process, while challenging for manufacturers, ultimately supports premium market positioning for approved products. EFSA's scientific opinions on ingredients like collagen hydrolysate and glucosamine provide regulatory clarity that enables informed product development decisions. European manufacturers benefit from advanced processing technologies and established supply chains that enable efficient production and distribution across diverse national markets with varying regulatory requirements.

- DSM-Firmenich AG

- BASF SE

- Archer-Daniels-Midland Company

- Glanbia plc

- Cargill, Incorporated

- Darling Ingredients Inc.

- Gelita AG

- Lonza Group AG

- Kerry Group plc

- Kappa Bioscience

- Synutra Ingredients

- Balchem Corp.

- Givaudan SA

- Martin Bauer Group

- BioCell Technology, LLC

- Bioiberica S.A.U.

- Titan Biotech Ltd

- Collagen Life Sciences

- Symrise AG

- Chr. Hansen A/S

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Osteoarthritis and Osteoporosis

- 4.2.2 Growing consumer awareness of preventive joint health and self-medication

- 4.2.3 Increasing demand from athletes and fitness professionals for joint-support products

- 4.2.4 Rising obesity rates increasing joint stress and osteoarthritis risk

- 4.2.5 Growing demand for personalized joint health solutions

- 4.2.6 Increasing integration of joint health ingredients in functional foods and beverages

- 4.3 Market Restraints

- 4.3.1 Price volatility of key raw materials

- 4.3.2 High manufacturing costs impacting product pricing and accessibility

- 4.3.3 Competition from conventional pharmaceutical products

- 4.3.4 Inconsistent regional regulations for health claims and product approvals.

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Vitamin

- 5.1.2 Calcium

- 5.1.3 Collagen

- 5.1.4 Magnesium

- 5.1.5 Glucosamine

- 5.1.6 Omega-3

- 5.1.7 Hyaluronic Acid

- 5.1.8 Others

- 5.2 By Source

- 5.2.1 Plant-derived

- 5.2.2 Animal-derived

- 5.2.3 Others

- 5.3 By Form

- 5.3.1 Powder

- 5.3.2 Liquid

- 5.3.3 Others

- 5.4 By Application

- 5.4.1 Dietary Supplements

- 5.4.2 Functional Food and Beverage

- 5.4.3 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 DSM-Firmenich AG

- 6.4.2 BASF SE

- 6.4.3 Archer-Daniels-Midland Company

- 6.4.4 Glanbia plc

- 6.4.5 Cargill, Incorporated

- 6.4.6 Darling Ingredients Inc.

- 6.4.7 Gelita AG

- 6.4.8 Lonza Group AG

- 6.4.9 Kerry Group plc

- 6.4.10 Kappa Bioscience

- 6.4.11 Synutra Ingredients

- 6.4.12 Balchem Corp.

- 6.4.13 Givaudan SA

- 6.4.14 Martin Bauer Group

- 6.4.15 BioCell Technology, LLC

- 6.4.16 Bioiberica S.A.U.

- 6.4.17 Titan Biotech Ltd

- 6.4.18 Collagen Life Sciences

- 6.4.19 Symrise AG

- 6.4.20 Chr. Hansen A/S

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK