PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844693

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844693

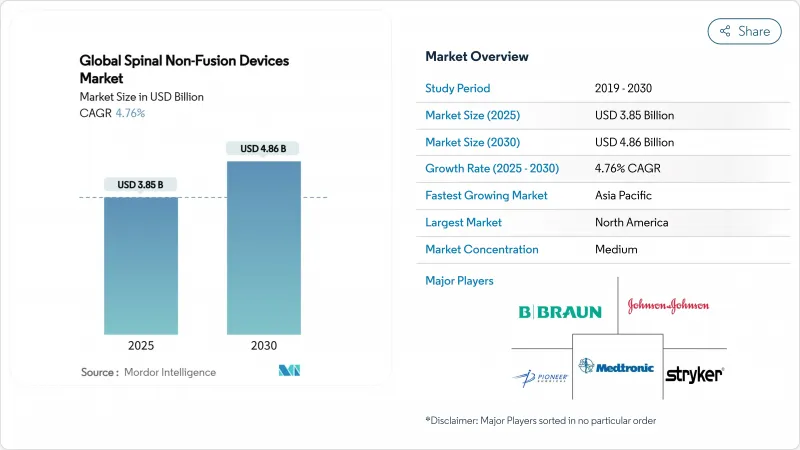

Global Spinal Non-Fusion Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The spinal non-fusion devices market size is USD 3.85 billion in 2025 and is projected to reach USD 4.86 billion by 2030, expanding at a 4.76% CAGR.

This measured trajectory reflects a decisive transition from experimental implants to validated motion-preservation technologies that address the long-term limitations of conventional fusion. Artificial intelligence now optimizes patient-specific implant geometry, streamlining pre-operative planning and cutting operating-room time, a shift that amplifies surgeon confidence in the spinal non-fusion devices market. North America currently anchors revenue, yet multi-layer policy reforms and infrastructure investment across Asia-Pacific are positioning that region as the next growth engine for the spinal non-fusion devices market. Hospitals remain the dominant purchasers, but ambulatory surgical centers (ASCs) are rapidly expanding demand as reimbursement policies move spine surgery to outpatient settings, reshaping procurement priorities throughout the spinal non-fusion devices market. Intensifying consolidation-illustrated by the Globus-NuVasive merger-confers scale advantages that accelerate development of AI-enabled surgical ecosystems, further redefining competitive dynamics within the spinal non-fusion devices market.

Global Spinal Non-Fusion Devices Market Trends and Insights

Shift toward motion-preserving spinal surgeries

Clinical practice is moving decisively from fusion-first protocols to motion-preservation pathways. Prospective evidence shows anterior cervical hybrid constructs preserve 16.3° of segmental motion versus 4.7° in multilevel fusion, a functional edge that correlates with lower revision rates. Facet arthroplasty devices such as TOPS reported 93% patient satisfaction in FDA trials, reinforcing economic value despite higher up-front cost. Surgeon preference for physiologic kinematics is therefore translating into robust purchasing momentum across the spinal non-fusion devices market.

Rising prevalence of degenerative disc diseases

An aging global population is driving sustained procedural volume, with Medicare data predicting significant expansion in spinal instrumentation demand through 2050. Earlier imaging-driven diagnosis favors motion-preserving interventions before irreversible damage, enlarging the spinal non-fusion devices market. Younger cohorts also value implants that minimize the need for later revision, intensifying long-run demand.

High device cost & limited hospital budgets

Hospitals face 20% jumps in shipping, labor and raw-material expenses, leading to tighter capital allocation that slows premium implant adoption. France's reimbursement cuts for orthopedic hardware underscore mounting price pressure, dampening near-term volume in the spinal non-fusion devices market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of minimally invasive dynamic stabilizers

- Reimbursement expansion for artificial disc replacement

- Stringent multi-region regulatory approval timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Artificial cervical discs captured 35.19% revenue in 2024 and remain the anchor of the spinal non-fusion devices market. Long-term data on Mobi-C show lower adjacent-segment pathology compared with fusion, reinforcing surgeon preference. The spinal non-fusion devices market size for artificial cervical discs stood at USD 1.35 billion in 2024 and is expanding steadily at a mid-single-digit rate.

Nucleus and annulus repair implants are on track for a 6.78% CAGR through 2030, reflecting regenerative-medicine traction and growing funding. Their share of the spinal non-fusion devices market size is set to rise as clinical trials confirm sustained disc-height restoration. Dynamic stabilization systems hold notable share through biomechanical superiority, whereas interspinous spacers lag amid mixed coverage decisions. Facet joint replacements and other emerging devices contribute incrementally but hold long-run upside as evidence builds.

The Motion Preservation Devices Market Report is Segmented by Product (Artificial Cervical Disc, Artificial Lumbar Disc, Dynamic Stabilization Devices, and More), End User (Hospitals, Ambulatory Surgical Centers, and More), Surgery Type (Open Spine Surgery, Minimally-Invasive Surgery), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 42.23% revenue in 2024 on the back of mature reimbursement and high surgeon training density. FDA clearances, such as the VELYS Spine platform, highlight continual integration of implants with navigation and robotics ecosystems. Coverage refinements around cervical disc replacement further secure volume growth, keeping the spinal non-fusion devices market buoyant.

Asia-Pacific is poised for the fastest regional CAGR of 5.94% through 2030, propelled by demographic aging and infrastructure upgrades. China's streamlined device-registration catalogue accelerates time-to-market, enlarging the spinal non-fusion devices market in a nation where hospital build-outs remain strong. Japan's adoption of advanced robotics and its super-aged society create robust demand, though clinical-evidence expectations remain rigorous.

Europe faces intensified cost-containment but continues to drive steady, evidence-based uptake. CE pathways for regenerative implants demonstrate regulatory openness, yet national budget caps may slow early-stage adoption. South America and Middle East & Africa present long-term opportunities as private hospital chains invest in advanced spine suites, although current volumes remain modest due to affordability and workforce constraints.

List of Companies Covered in this Report:

- Medtronic

- Stryker

- Johnson & Johnson

- NuVasive

- Globus Medical

- Centinel Spine

- B. Braun (Aesculap)

- Spineart

- RTI Surgical

- Exactech

- Stryker

- Orthofix

- Zimmer Biomet

- Alphatec Spine

- Boston Scientific

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward motion-preserving spinal surgeries

- 4.2.2 Rising prevalence of degenerative disc diseases

- 4.2.3 Rapid adoption of minimally-invasive dynamic stabilizers

- 4.2.4 Reimbursement expansion for artificial disc replacement

- 4.2.5 Growing venture funding for nucleus & annulus repair start-ups

- 4.2.6 AI-guided patient-specific implant design breakthroughs

- 4.3 Market Restraints

- 4.3.1 High device cost & limited hospital budgets

- 4.3.2 Stringent multi-region regulatory approval timelines

- 4.3.3 Payer reluctance toward lumbar disc replacement reimbursement

- 4.3.4 Supply-chain dependence on specialty Nitinol alloys

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Artificial Cervical Disc

- 5.1.2 Artificial Lumbar Disc

- 5.1.3 Dynamic Stabilization Devices (Pedicle Screw/Rod)

- 5.1.4 Interspinous Process Spacers

- 5.1.5 Facet Joint Replacement

- 5.1.6 Nucleus & Annulus Repair Implants

- 5.1.7 Other Motion-Preservation Devices

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centers

- 5.2.3 Specialty Spine Clinics

- 5.3 By Surgery Type

- 5.3.1 Open Spine Surgery

- 5.3.2 Minimally-Invasive Surgery

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic

- 6.3.2 Stryker Corporation

- 6.3.3 DePuy Synthes (Johnson & Johnson)

- 6.3.4 NuVasive

- 6.3.5 Globus Medical

- 6.3.6 Centinel Spine

- 6.3.7 B. Braun (Aesculap)

- 6.3.8 Spineart

- 6.3.9 RTI Surgical

- 6.3.10 Exactech

- 6.3.11 Stryker

- 6.3.12 Orthofix

- 6.3.13 Zimmer Biomet

- 6.3.14 Alphatec Spine

- 6.3.15 Boston Scientific

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment