PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844694

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844694

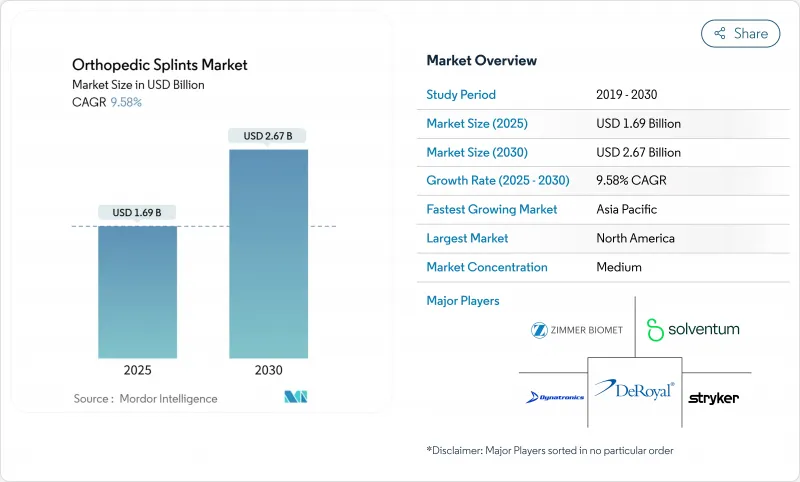

Orthopedic Splints - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The orthopedic splints market size reached USD 1.69 billion in 2025 and is forecast to climb to USD 2.67 billion by 2030, reflecting a solid 9.58% CAGR over the period.

Demand expands as populations age, sports participation rises, and care delivery shifts toward outpatient settings. Material advances, notably the move from plaster to lighter composites and 3-D printed forms, shorten application times and improve patient comfort, encouraging faster provider uptake. Regulatory agencies now pilot lifecycle-based review pathways that reward clinically validated innovation while reimbursement schedules push providers to favor cost-efficient, outcomes-oriented products. Together, these dynamics keep pricing disciplined and stimulate continual product refresh cycles, sustaining momentum in the orthopedic splints market.

Global Orthopedic Splints Market Trends and Insights

Rising Musculoskeletal Disorder Burden

Global osteoarthritis cases hit 607 million in 2021 and are still climbing, making splints a first-line, non-surgical solution for joint stabilization. Low back pain alone could reach 253 million incident cases by 2029, reinforcing the need for cost-effective immobilization devices. Occupational studies note cervical pain in 88.8% of office workers and lower-back pain in 83.8%, underscoring widespread, chronic demand . Splints mitigate pain and limit further joint deterioration, especially for patients seeking to delay or avoid surgery. As payers emphasize conservative management before approving invasive procedures, the orthopedic splints market gains steady procedural volume.

Growing Geriatric Population

Age-standardized osteoarthritis prevalence rose significantly . Fracture susceptibility grows alongside reductions in bone density, particularly among post-menopausal women, who often require vertebral or hip stabilization. Providers increasingly opt for splints to preserve mobility in elderly patients not suited for operating room exposure. Longer treatment timelines and repeat device replacement needs add a predictable revenue stream for suppliers. In wealthier nations, universal coverage ensures consistent device reimbursement, cementing the orthopedic splints market as a pillar of geriatric musculoskeletal care.

Negligence Toward Minor Injuries

Socioeconomic disparities mean many sprains and hairline fractures never reach orthopedic clinics. Under-insured groups disproportionately use emergency departments or forego care altogether, cutting directly into unit volumes. Rural hospitals face staffing shortages; only 30% employ orthopedic surgeons, delaying definitive treatment and occasionally shifting demand toward home remedies. In emerging economies, reliance on traditional bone setters leads to delayed presentations in 28% of pediatric cases, representing unrealized market potential. The gap illustrates how broader health-access initiatives could unlock new volumes for the orthopedic splints market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Sports & Traffic-Related Fractures

- Material Innovations in Lightweight Composites

- Availability of Functional Braces & Walking Boots

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiberglass splints held 45.42% of the orthopedic splints market in 2024, anchored by their low cost, broad clinical familiarity, and established reimbursement pathways. Providers value fiberglass for predictable rigidity and quick setting, making it a go-to in trauma bays. Yet 3-D printed custom splints, expanding at 10.34% CAGR, are redrawing competitive boundaries. Randomized trials document lower pain, improved satisfaction, and fewer pressure sores when additive-manufactured designs replace bulkier polymers. Hospitals experimenting with in-house printers reduce turnaround from multi-day outsource cycles to same-day fittings, raising patient throughput while trimming inventory risk.

Growth in 3-D printing ripples through accessory markets such as scanning devices, design software, and consumable filaments, creating new revenue chains for suppliers that pivot early. Hybrid items mixing printed frameworks with traditional wrap materials cater to price-sensitive buyers yet preserve customization benefits. Plaster casts, although declining, retain a foothold in austere settings where technology budgets remain tight. Overall, diversified offerings allow manufacturers to segment by acuity and price point, supporting sustained value capture across the orthopedic splints market.

Fiberglass accounted for 44.43% of the orthopedic splints market in 2024, but thermoplastics are expanding fastest at 10.22% CAGR through 2030. Remoldable at moderate heat, thermoplastic sheets let clinicians fine-tune alignment during follow-up visits, curbing revision rates. Breathability and waterproof attributes also translate into higher patient compliance, a key driver in pediatric and sports cohorts. Regulatory bodies now encourage greener healthcare, prompting providers to explore biodegradable polymer alternatives that degrade without micro-plastic residue.

Carbon-fiber composites occupy the premium tier, validated by dedicated reimbursement codes that recognize their tensile strength-to-weight advantage for ankle-foot immobilization. Unit prices exceed mainstream fiberglass by a wide margin, yet elite athletes and postoperative cases justify the premium. Plaster of Paris persists where moldability and ultra-low cost dominate buying criteria, particularly in low-resource markets. As sustainability agendas intensify, suppliers investing in recyclable resin technologies may seize an early branding advantage in the orthopedic splints market.

The Orthopedic Splints Market is Segmented by Product (Fiberglass Splints, Plaster Splints, and More), Material (Fiberglass, Plaster of Paris, and More), Application (Lower Extremity [Hip, Knee, and More], Upper Extremity, and Spinal), End-User (Hospitals and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.44% share of the orthopedic splints market in 2024 thanks to advanced trauma infrastructure, high elective procedure rates, and early adoption of material and manufacturing innovation. Provider consolidation has improved purchasing power, prompting suppliers to bundle value-added services such as digitized inventory tracking and in-service training. Regulatory pilots like the Total Product Life Cycle Advisory Program for orthopedic devices aim to shorten innovation cycles but simultaneously push manufacturers to supply post-market safety data, raising compliance costs.

Asia-Pacific represents the fastest expansion corridor with a 10.59% CAGR projected to 2030. Urbanization, expanding insurance coverage, and increasing disposable income translate into higher musculoskeletal injury treatment rates. Governments in China, India, and South Korea now subsidize domestic additive-manufacturing lines, lessening import dependence and fostering region-specific product variants tailored to local anthropometry. Large patient pools allow quick scaling of production volumes, reinforcing supplier interest in localized joint ventures. Rising sports participation and traffic-related fractures further enlarge the addressable base for the orthopedic splints market.

Europe maintains moderate growth underpinned by aging demographics and universal health systems that guarantee device reimbursement. Environmental stewardship directives compel hospitals to set procurement targets for recyclable or biodegradable materials, stimulating supplier investment in green formulations. Middle East and Africa markets expand from a small base, with gulf states importing premium devices for expatriate workforces and domestic populations alike. South America shows momentum in Brazil and Argentina, where public-private healthcare partnerships improve device availability and clinician training. Collectively, geographical breadth cushions the orthopedic splints market against single-region downturns and underwrites sustained global revenues.

- Solventum

- Essity

- Zimmer Biomet

- Stryker

- Orthofix

- Ottobock

- DeRoyal Industries

- medi

- Dynatronics (Bird & Cronin)

- Patterson Medical Holdings

- Tynor Orthotics

- Plasti Surge Industries

- Ossur

- Breg

- Bauerfeind

- Enovis

- DePuy Synthes

- Smiths Group

- Alimed Inc.

- Sam Medical Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Musculoskeletal Disorder Burden

- 4.2.2 Growing Geriatric Population

- 4.2.3 Increasing Sports & Traffic?Related Fractures

- 4.2.4 Material Innovations Including Water-Proof and Lightweight Composites

- 4.2.5 Rapid Adoption Of 3-D Printed Custom Splints

- 4.2.6 Home-Based & OTC Splinting Via E-Commerce and Tele-Rehab

- 4.3 Market Restraints

- 4.3.1 Negligence Toward Minor Injuries

- 4.3.2 Availability Of Functional Braces & Walking Boots

- 4.3.3 Reimbursement Gaps for OTC Splints in Ems

- 4.3.4 Environmental Disposal Concerns for Fiberglass/Plastics

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Fiberglass Splints

- 5.1.2 Plaster Splints

- 5.1.3 Thermoplastic Splints

- 5.1.4 3-D Printed Custom Splints

- 5.1.5 Splinting Tools & Accessories

- 5.1.6 Other Products

- 5.2 By Material

- 5.2.1 Fiberglass

- 5.2.2 Plaster of Paris

- 5.2.3 Thermoplastics

- 5.2.4 Carbon-Fiber Composites

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Lower Extremity

- 5.3.1.1 Ankle & Foot

- 5.3.1.2 Hip

- 5.3.1.3 Knee

- 5.3.2 Upper Extremity

- 5.3.2.1 Elbow

- 5.3.2.2 Hand & Wrist

- 5.3.2.3 Neck

- 5.3.2.4 Shoulder

- 5.3.3 Spinal

- 5.3.1 Lower Extremity

- 5.4 By End-user

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Orthopedic Clinics

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Solventum

- 6.3.2 Essity (BSN Medical)

- 6.3.3 Zimmer Biomet

- 6.3.4 Stryker Corporation

- 6.3.5 Orthofix Medical Inc.

- 6.3.6 Otto Bock Healthcare GmbH

- 6.3.7 DeRoyal Industries Inc.

- 6.3.8 Medi GmbH & Co. KG

- 6.3.9 Dynatronics (Bird & Cronin)

- 6.3.10 Patterson Medical Holdings

- 6.3.11 Tynor Orthotics

- 6.3.12 Plasti Surge Industries

- 6.3.13 Ossur hf

- 6.3.14 Breg Inc.

- 6.3.15 Bauerfeind AG

- 6.3.16 Enovis (DJO Global)

- 6.3.17 DePuy Synthes

- 6.3.18 Smith & Nephew plc

- 6.3.19 Alimed Inc.

- 6.3.20 Sam Medical Products

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment