PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910426

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910426

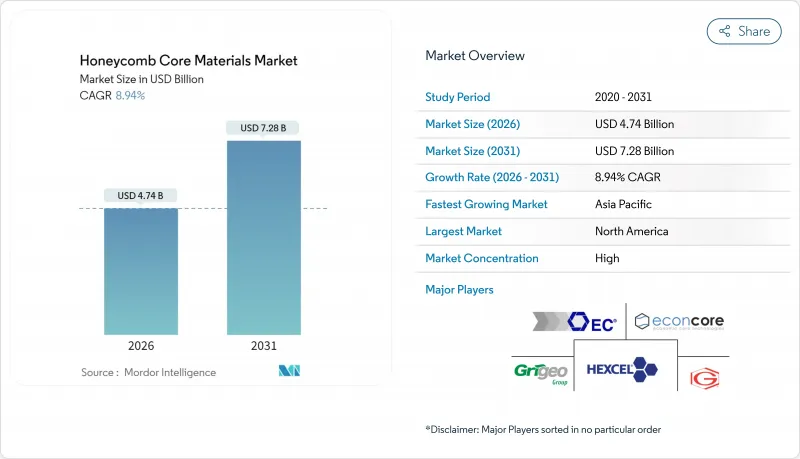

Honeycomb Core Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Honeycomb Core Materials market is expected to grow from USD 4.35 billion in 2025 to USD 4.74 billion in 2026 and is forecast to reach USD 7.28 billion by 2031 at 8.94% CAGR over 2026-2031.

This outlook reflects sustained substitution of solid metals with lightweight sandwich structures in next-generation aircraft, hypersonic vehicles, electric cars, high-speed rail coaches, and emerging mobility platforms. Advances in core chemistries, continuous manufacturing, and out-of-autoclave processing have expanded honeycomb use beyond aerospace while preserving the superior strength-to-weight ratios engineers require. Competitive strategies now center on thermoplastic, bio-based, and high-temperature super-alloy cores that meet tougher recycling, thermal, and crash-energy criteria across major end markets. Expanded partnerships between core producers and OEMs shorten qualification cycles, improve supply security, and open new revenue opportunities in propulsion exhaust areas, battery packs, and rail interiors. Aggressive decarbonization goals and volatile fuel prices further amplify the appeal of honeycomb sandwich solutions, positioning the honeycomb core materials market for resilient mid-term growth.

Global Honeycomb Core Materials Market Trends and Insights

Growing Demand for Lightweighting in Next-Gen Single-Aisle Aircraft

Single-aisle programs targeting 20-30% weight reduction over current jets are reshaping specifications for the honeycomb core materials market. Airbus research prioritizes natural fibers, biomass-sourced carbon fiber, and recyclable thermoplastics, enabling lower life-cycle emissions without compromising stiffness. Boeing's High-rate Composite Aircraft Manufacturing project demonstrates how high-speed lay-up technologies integrate honeycomb to maintain rate capability and cost targets. German Aerospace Center studies confirm that sandwich wings achieve up to 30% lower mass than monolithic laminates while retaining buckling resistance. Collins Aerospace prototypes now embed acoustic and thermal functions within the core to provide multi-functional benefits. Continuous production lines further cut touch-labor, strengthening the business case for wider adoption across future aircraft families.

Shift to Composite Sandwich Panels in Airframes

Airframe designers are broadening composite sandwich use from interiors into primary fuselage and control-surface structures. NASA's collaboration with Toray under the HiCAM program refines thermoset and thermoplastic prepregs for improved bonding with honeycomb cores, ensuring dimensional accuracy during high-rate builds. Automated fiber placement and resin transfer molding reduce complexity penalties once associated with sandwich panels. Hexcel's HRH-302 aluminum core withstands high exhaust temperatures, expanding use into nacelle and auxiliary power unit zones. Advanced nondestructive inspection, including thermography and guided-wave ultrasonics, boosts confidence by detecting early debonds that once limited sandwich panels in fatigue-loaded areas.

Moisture Ingress and Out-of-Plane Strength Loss

Water uptake in aramid honeycomb can depress mechanical performance by 35% and promote freeze-thaw damage in aircraft operating from tropical or coastal bases. Tests reveal faster penetration along ribbon directions and in lower-density cores. Fiber-optic Brillouin systems now provide early detection of internal moisture, aiding predictive maintenance. Barrier coatings help but add cost and mass. Thermoplastic honeycomb exhibits lower moisture absorption, accelerating its share within the honeycomb core materials market despite higher resin cost.

Other drivers and restraints analyzed in the detailed report include:

- Weight Reduction Mandates in Inter-City High-Speed Rail Coaches

- Adoption of Polypropylene Cores in EV Battery Enclosures

- Persistent Price Volatility in Aramid Paper Supply Chain

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aluminum cores captured 37.62% of the honeycomb core materials market share in 2025 due to decades of qualification in commercial aircraft, naval vessels, and rolling stock. Hexcel's HexWeb range remains the reference for wing leading edges, floors, and control surfaces, balancing stiffness, corrosion resistance, and cost. The aluminum segment underpins a significant portion of the global honeycomb core materials market size, especially where conductivity and heat spread are desirable.

Thermoplastic cores post the fastest 10.73% CAGR because polypropylene and polyetheretherketone variants meet circular-economy targets and withstand automated thermoforming. EconCore licenses continuous production that integrates skin lamination, lowering scrap and permitting large panels for EV battery enclosures. Automotive adoption is accelerating as brands look to reduce life-cycle emissions.

Expansion processes delivered 54.68% of output in 2025, sustaining leadership with proven throughput, tight tolerances, and established Part-21 certifications. Hexcel and Plascore operate global expansion lines for aluminum and aramid cores that feed OEM supply chains. Corrugation and extrusion fill custom niches where cell geometry or continuous sheets are critical.

Additive techniques record an 11.48% CAGR and unlock bespoke lattice topologies beyond the capacity of mechanical expansion. Selective laser melting builds nickel or titanium honeycomb for hypersonic skins requiring complex cell gradients. Fused deposition modeling allows rapid sampling of thermoplastic cores for prototype EV enclosures. The honeycomb core materials market share for 3-D printing remains small today, yet it illustrates where future design freedom and on-demand spares will converge.

The Honeycomb Core Materials Report is Segmented by Product Type (Nomex, Aluminum, Thermoplastic, and Other Product Types), Manufacturing Technology (Expansion, Corrugation, and More), Application (Composite Sandwich Panels and Non-Composite Inserts and Spacers), End-User Industry (Aerospace, Defense, Marine, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

North America commanded 34.72% of 2025 revenue owing to an entrenched aerospace cluster anchored by Boeing, Lockheed Martin, and major Tier-1 suppliers. US defense spending on hypersonic glide vehicles and space launch systems adds demand for nickel and titanium cores capable of extreme environments, strengthening the regional honeycomb core materials market.

Asia-Pacific is forecast to expand at an 10.78% CAGR, the fastest globally, propelled by Chinese narrow-body programs, Japanese EV battery growth, and South Korean UAV development. License agreements, such as Kokobukiya Fronte's adoption of EconCore's ThermHex process, show local manufacturers scaling capacity to meet automotive and industrial needs.

Europe remains a mature yet innovative arena. Airbus and a dense Tier-1 network sustain steady aerospace consumption while the continent's extensive high-speed rail grid mandates fire-safe lightweight panels. Automotive OEMs in Germany, France, and Italy integrate polypropylene honeycomb into electric platforms to offset battery mass. Environmental directives accelerate bio-based core research and development, and regional recyclers explore closed-loop take-back schemes to enhance the sustainability profile of the honeycomb core materials industry.

- Alucoil

- Argosy International Inc.

- Axiom Materials.

- Corex Honeycomb

- Corint Group

- EconCore

- Euro-Composites

- Grigeo Group AB

- Hangzhou Holycore Composite Material Co.,Ltd

- Hexcel Corporation

- Plascore

- Schutz GmbH & Co. KGaA.

- The Gill Corporation

- TORAY INDUSTRIES, INC.

- Tubus Bauer GmbH

- Yamaton Honicore B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Lightweighting in Next-Gen Single-Aisle Aircraft

- 4.2.2 Shift To Composite Sandwich Panels in Airframes

- 4.2.3 Weight Reduction Mandates in Inter-City High-Speed Rail Coaches

- 4.2.4 Adoption of Polypropylene Cores in EV Battery Enclosures

- 4.2.5 Defense Push for High-Temperature Super-Alloy Honeycomb in Hypersonics

- 4.3 Market Restraints

- 4.3.1 Moisture Ingress and Out-of-Plane Strength Loss

- 4.3.2 Persistent Price Volatility in the Aramid Paper Supply Chain

- 4.3.3 Limited Large-Format 3-D Printing Capacity for Complex Cores

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Nomen

- 5.1.2 Aluminum

- 5.1.3 Thermoplastic

- 5.1.4 Other Product Types (Paper, Super-alloy)

- 5.2 By Manufacturing Technology

- 5.2.1 Expansion

- 5.2.2 Corrugation

- 5.2.3 Extrusion/Lamination

- 5.2.4 3-D Printing / Additive Core Building

- 5.3 By Application

- 5.3.1 Composite Sandwich Panels

- 5.3.2 Non-Composite Inserts and Spacers

- 5.4 By End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Defense

- 5.4.3 Marine

- 5.4.4 Other End-user Industries (Transportation, Packaging, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alucoil

- 6.4.2 Argosy International Inc.

- 6.4.3 Axiom Materials.

- 6.4.4 Corex Honeycomb

- 6.4.5 Corint Group

- 6.4.6 EconCore

- 6.4.7 Euro-Composites

- 6.4.8 Grigeo Group AB

- 6.4.9 Hangzhou Holycore Composite Material Co.,Ltd

- 6.4.10 Hexcel Corporation

- 6.4.11 Plascore

- 6.4.12 Schutz GmbH & Co. KGaA.

- 6.4.13 The Gill Corporation

- 6.4.14 TORAY INDUSTRIES, INC.

- 6.4.15 Tubus Bauer GmbH

- 6.4.16 Yamaton Honicore B.V.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Bio-based and Fully Recyclable Thermoplastic Cores