PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844701

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844701

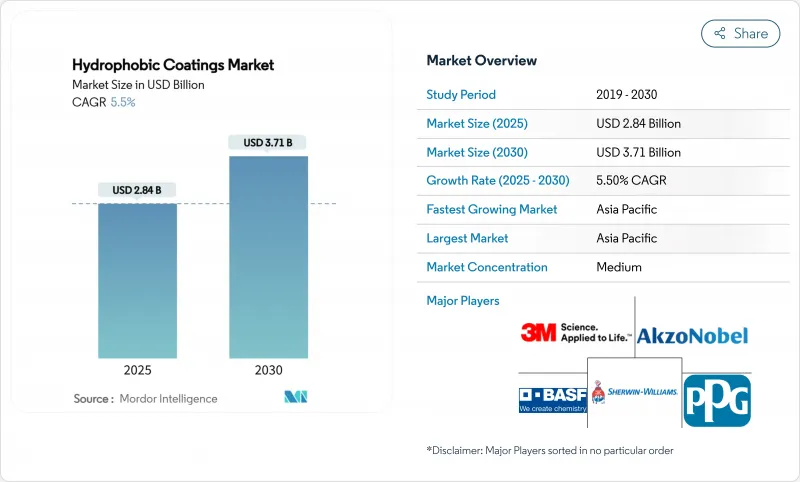

Hydrophobic Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Hydrophobic Coatings Market size is estimated at USD 2.84 billion in 2025, and is expected to reach USD 3.71 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Regulatory pressure has accelerated the transition toward fluorine-free chemistries, while sustained infrastructure investment, electronics miniaturization, and growing healthcare demand collectively reinforce volume growth. Technology differentiation now centers on silicone-, bio-based, and nanostructured solutions that match or exceed legacy fluoropolymer performance. Large buyers are prioritizing multifunctional products that combine water-repellency with anti-corrosion, antimicrobial, and anti-icing attributes, a trend that favors suppliers with broad formulation expertise. Competitive intensity is moderate as global chemical majors defend share against agile nanocoating specialists through divestment, strategic partnerships, and rapid patent filings.

Global Hydrophobic Coatings Market Trends and Insights

Robust Growth of Construction Sector

Sustained urbanization and infrastructure renewal continue to anchor demand in the hydrophobic coatings market. Silane- and siloxane-based concrete impregnation has become standard for chloride-ion protection of bridges, tunnels, and coastal structures, extending service life and lowering maintenance costs. Alignment with green-building certifications positions bio-based hydrophobic treatments as preferred solutions for public projects that emphasize sustainability. Asia-Pacific smart-city programs are amplifying volumes by specifying water-repellent barriers against climate-induced deterioration. The construction segment's 29.64% 2024 revenue share reflects the indispensability of protective coatings in large civil works, where asset longevity directly influences national infrastructure budgets.

Rising Demand from Automotive Industry

Automotive manufacturers have shifted toward hydrophobic multifunctional coatings that deliver paint protection, self-cleaning, and anti-corrosion benefits. Self-healing nanocomposites improve finish durability, an attribute valued by luxury car brands keen on residual-value preservation. Electrification adds new protection points as battery enclosures and power-electronics housings must resist moisture ingress and thermal cycling. Regulatory caps on VOC emissions accelerate water-borne hydrophobic chemistries, pressing suppliers to replicate solvent-based performance without sacrificing throughput. Integration of advanced driver-assistance sensors and infotainment displays further widens opportunities for ultra-thin, optically clear waterproof layers inside vehicles.

Complex Process and High Initial Investment Cost

Producing superhydrophobic layers demands precise control of surface roughness and chemistry, often involving multi-step texturing, functionalization, and curing in inert atmospheres. Capital expenditure on plasma reactors, laser patterning units, and sophisticated QC instrumentation strains the finances of small and mid-size enterprises. Down-line users also face learning curves: substrate cleaning, ambient humidity, and cure profiles must all be optimized to achieve published contact-angle specifications. These complexities restrict the pace at which new entrants can scale, limiting market competition and potentially slowing innovation diffusion in cost-sensitive end-use sectors.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption in Consumer Electronics

- 3-D Printed Retro-fit Superhydrophobic Surfaces

- Durability Challenges Under Abrasive Environments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anti-corrosion formulations maintained a 39.18% hydrophobic coatings market share in 2024, reflecting the perennial need to safeguard steel and aluminum assets in marine, oil-and-gas, and transport sectors. Robust demand from bridge refurbishment and offshore wind installation projects further anchored segment revenues. In contrast, self-cleaning and ice-phobic products within the "Other Product Types" cluster are forecast to post a 6.92% CAGR, buoyed by solar O&M firms that have validated up to 15% energy-yield gains after applying nanocoatings to PV modules. Aerospace OEMs likewise value low-ice-adhesion surfaces that cut anti-icing fluid usage.

The anti-corrosion sub-sector remains price competitive, yet regulatory pressure on zinc-rich primers and solvent-borne top-coats is shifting procurement toward water-borne hybrids with embedded graphene or ceramic flakes. Specialty self-cleaning products command higher margins due to their ability to reduce manual cleaning labor for solar farms located in arid regions. Meanwhile, the hydrophobic coatings industry is witnessing the emergence of photothermal ice-phobic layers that combine passive water repellence with active sunlight-driven heating, a hybrid approach that resonates with airlines pursuing fuel-saving de-icing strategies.

The Hydrophobic Coatings Market Report is Segmented by Product Type (Anti-Corrosion, Anti-Microbial, Anti-Fouling, Anti-Wetting, and More), Substrate (Metals, Ceramics, Glass, Concrete, and More), End-User Industry (Construction, Automotive, Aerospace, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 48.15% revenue share in 2024, driven by China's manufacturing scale, India's infrastructure pipeline, and Japan's material-science prowess. Government mandates that public buildings meet green-construction benchmarks have boosted uptake of low-VOC hydrophobic products. Electronics contract manufacturers across the region specify sub-micron waterproof layers to secure export contracts from global smartphone brands. Continued capacity additions in Southeast Asian solar module plants sustain demand for self-cleaning PV coatings that increase plant uptime.

North America stands as a technological bellwether. The United States cultivates high-performance aerospace and defense applications, where superhydrophobic anti-icing layers reduce operational costs for airlines and military fleets. Canada's phased PFAS prohibition elevates domestic demand for fluorine-free chemistries, compelling regional suppliers to accelerate the qualification of silicone and polyurethane alternatives. Mexico's automotive export hubs integrate hydrophobic treatments in electric-vehicle battery enclosures, reinforcing cross-border supply chains for raw materials and application equipment.

Europe balances strict environmental policy with industrial competitiveness. The European Chemicals Agency proposal to restrict over 10,000 PFAS substances has triggered a rush among formulators to validate bio-based replacements. Germany's automotive Tier-1 suppliers co-develop graphene-reinforced water-borne top-coats that satisfy both corrosion-resistance and paint-shop emission targets. Nordic nations' preference for circular-economy models stimulates demand for biodegradable hydrophobic barriers in packaging, pushing innovation toward cellulose-based solutions. The hydrophobic coatings market is thus experiencing geographically diverse pull factors that collectively sustain global growth momentum.

- 3M

- AccuCoat Inc.

- Aculon Inc.

- Advanced Nanotech Lab

- AkzoNobel N.V.

- Arkema

- Artekya Teknoloji

- BASF SE

- COTEC GmbH

- Cytonix, LLC

- Nanofilm

- NeverWet, LLC.

- Nukote Coating Systems International

- P2i Ltd.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- UltraTech International, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust growth of construction sector

- 4.2.2 Rising demand from automotive industry

- 4.2.3 Increasing adoption in consumer electronics

- 4.2.4 3-D printed retro-fit superhydrophobic surfaces

- 4.2.5 Increasing demand for anti-viral public-infrastructure coatings

- 4.3 Market Restraints

- 4.3.1 Complex process and high intial investment cost

- 4.3.2 Durability challenges under abrasive environments

- 4.3.3 Impending bans on long-chain fluoropolymers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Patent Analysis

- 4.7 Pricing Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Anti-corrosion

- 5.1.2 Anti-microbial

- 5.1.3 Anti-fouling

- 5.1.4 Anti-wetting

- 5.1.5 Other Product Types (Self-cleaning, Ice-phobic, etc.)

- 5.2 By Substrate

- 5.2.1 Metals

- 5.2.2 Ceramics

- 5.2.3 Glass

- 5.2.4 Concrete

- 5.2.5 Plastics and Polymers

- 5.2.6 Other Substrates (Textiles, Paper and Cardboard, etc.)

- 5.3 By End-user Industry

- 5.3.1 Construction

- 5.3.2 Automotive

- 5.3.3 Aerospace

- 5.3.4 Electronics

- 5.3.5 Healthcare

- 5.3.6 Marine

- 5.3.7 Other End-user Industries (Oil and Gas, Renewable Energy, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 AccuCoat Inc.

- 6.4.3 Aculon Inc.

- 6.4.4 Advanced Nanotech Lab

- 6.4.5 AkzoNobel N.V.

- 6.4.6 Arkema

- 6.4.7 Artekya Teknoloji

- 6.4.8 BASF SE

- 6.4.9 COTEC GmbH

- 6.4.10 Cytonix, LLC

- 6.4.11 Nanofilm

- 6.4.12 NeverWet, LLC.

- 6.4.13 Nukote Coating Systems International

- 6.4.14 P2i Ltd.

- 6.4.15 PPG Industries, Inc.

- 6.4.16 The Sherwin-Williams Company

- 6.4.17 UltraTech International, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment