PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844702

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844702

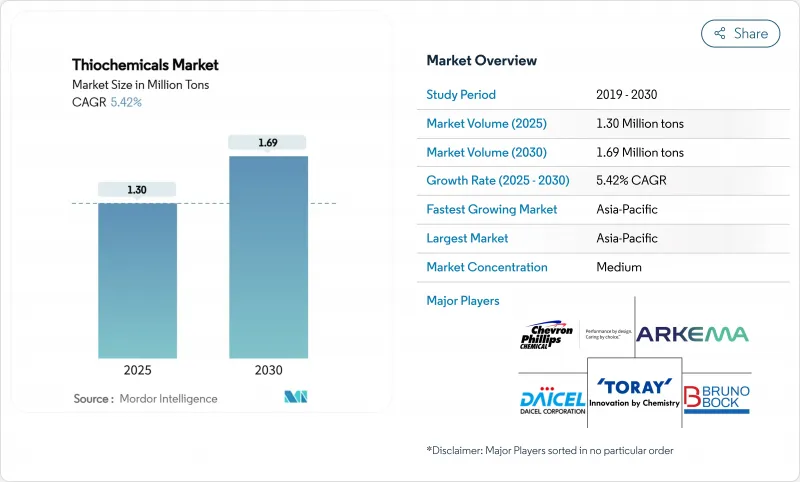

Thiochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Thiochemicals Market size is estimated at 1.30 million tons in 2025, and is expected to reach 1.69 million tons by 2030, at a CAGR of 5.42% during the forecast period (2025-2030).

Strong protein consumption, steady refinery catalyst demand, and emerging battery-grade solvent applications are the principal growth vectors sustaining the thiochemicals market. Intensifying livestock modernization in Asia-Pacific, refinery upgrades aimed at ultra-low-sulfur diesel compliance, and rising adoption of high-purity dimethyl sulfoxide in electronic fabrication jointly anchor the market's positive trajectory. Integrated producers deploy proprietary technologies and expand regional capacities to secure sulfur feedstock, optimize costs, and deepen customer engagement across animal nutrition, refining, and electronics domains. Regulatory pressures for safer sulfiding agents, coupled with innovation in bio-based pathways, are opening new opportunities while simultaneously elevating compliance expenditures. Supply chain resilience, especially in elemental sulfur procurement, has therefore become a decisive differentiator for long-term success within the thiochemicals market.

Global Thiochemicals Market Trends and Insights

Surging Methionine Demand From Industrial-Scale Animal Feed Producers

Global poultry and aquaculture producers are scaling premium feed formulations that rely on methionine derived from thiochemicals, thereby stimulating additional capacity investments across the thiochemicals market. Evonik Industries operates integrated hubs in Antwerp, Mobile, and Singapore with aggregate output surpassing 700,000 t per year, underscoring the capital intensity tied to this demand surge. Consumption growth remains most pronounced in Asia-Pacific where incomes and protein uptake are climbing in tandem with commercial farm consolidation. Scientific assessments reveal DL-methionine improves liver metabolism and oxidative stress, while L-methionine accelerates weight gain in broilers, creating differentiated additive niches that support premium pricing. Integrated thiochemical-to-methionine complexes reduce logistics costs, lower sulfur input volatility, and protect margins, prompting leading producers to reinforce backward integration strategies. Consequently, sustained methionine pull-through ensures the thiochemicals market maintains a robust baseline of demand as feed industries upscale.

Expanding Use of Dimethyl Disulfide as a Refinery Catalyst Sulfiding Agent

Refineries increasingly prefer dimethyl disulfide (DMDS) to activate hydrotreating catalysts because it volumetrically delivers more sulfur with fewer safety concerns than hydrogen sulfide, aligning with worker protection norms and continuous operation imperatives. Technical evaluations show that DMDS-based Exact-S grades raise catalytic activity quickly while minimizing hazardous handling, enabling refineries to comply with stricter fuel sulfur limits. The global shift toward ultra-low-sulfur diesel accelerates this substitution trend, especially in North America, the Middle East, and emerging Asian refining hubs undergoing capacity expansions. Research published on ScienceDirect validates that DMDS-sulfided catalysts meet or exceed performance achieved with H2S presulfiding under deep desulfurization conditions. Renewable diesel co-processing is further bolstering DMDS uptake because mixed feedstocks require versatile sulfiding agents capable of stabilizing catalysts exposed to oxygenated compounds. Collectively, these operational advantages ensure persistent DMDS volume growth within the broader thiochemicals market.

High Toxicity and Odor Management Costs

Thiochemicals possess strong odors and toxicity profiles that oblige producers to invest in containment, scrubbers, and specialized handling infrastructure, thereby elevating operating costs. The 2024 U.S. EPA Risk Management Program amendments boost annual compliance spending for synthetic organic chemical plants by USD 256.9 million at a 3% discount rate, a burden borne by several thiochemical facilities. Patented odor-adsorbent cartridges and membrane bioreactors targeting 100% DMSO removal demonstrate available solutions, yet these technologies require meaningful capital outlays and technical oversight. Semiconductor fabs in Taiwan and South Korea apply aerobic membrane reactors tailored to DMSO-laden wastewater streams, showing that end-markets also pass stricter discharge criteria down the supply chain. Elevated environmental scrutiny may accelerate the shift toward low-odor formulations but will likely restrain short-term output expansion in legacy facilities, tempering near-term growth for the thiochemicals market.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Thiochemicals in Advanced Batteries

- Growing Usage of Thiochemicals in Methionine Production

- Volatility in Elemental Sulfur Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mercaptans captured 71.19% of thiochemicals market share in 2024 owing to their centrality in dimethyl disulfide synthesis and methionine manufacturing. The segment expanded alongside new Asian refineries and feed mills that demand reliable supplies of methyl mercaptan and ethanethiol. DMDS remains the benchmark sulfiding agent because it safely delivers high sulfur content per unit mass, reducing turnaround times during catalyst activation. Customers in Middle Eastern mega-refineries place bulk orders years in advance, ensuring predictable throughput for integrated mercaptan-DMDS producers. Advancements in continuous mercaptan oxidation reactors have also improved yields, lowering variable costs and supporting a 5.71% CAGR outlook for mercaptans through 2030. Further upside could arise from bio-mercaptan initiatives that promise to shrink carbon intensity while giving suppliers a marketing edge in jurisdictions with emerging carbon-border adjustment mechanisms.

Dimethyl sulfoxide holds a significant share in the thiochemicals market by volume. Consumer electronics assemblers now demand higher purity ranges that limit metal ions to below 100 ppt, spurring producers to install double-distillation columns and stainless-steel systems that inhibit contamination. Secure sourcing of pharmaceutical-grade DMSO for cryopreservation and oncology formulations is also rising in Europe, widening application diversity. Thioglycolic acid and esters maintain stable though niche roles in hair-care cosmetics, PVC heat stabilizers, and microelectronic photoresist stripping. Other minor chemistries such as polysulfides and thiazoles address rubber vulcanization and oilfield H2S scavenging, providing supplemental, high-margin revenue streams for innovators willing to engage in custom synthesis.

The Thiochemicals Market Report is Segmented by Type (Mercaptans, Dimethyl Sulfoxide, Thioglycolic Acid and Esters, Other Types), End-Use Industry (Animal Nutrition, Oil and Gas, Polymers and Chemicals, Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific held 38.42% of thiochemicals market share in 2024 and is projected to expand at a 6.41% CAGR through 2030, powered by manufacturing scale and downstream demand diversity. China's refinery build-out combined with surging poultry output secures steady mercaptan liftings, while local electronics assemblers consume premium DMSO grades for LCD and memory fabrication. India's speciality chemical segment benefits from global "China + 1" sourcing models, accelerating investment in integrated methionine and DMDS capabilities. Malaysia and Thailand attract advanced-material multinationals who value free-trade access and supportive policy frameworks, thereby expanding regional demand nodes for thiochemicals.

Strict environmental standards in North America, which mandate ultra-low-sulfur fuels and advanced odor controls, strengthen the region's market position. The American Chemistry Council anticipates 15% domestic chemical demand growth by 2033, but capacity additions lag, implying heavier import reliance and opportunity for incremental thiochemical expansions. The Gulf Coast hosts vertically integrated thiochemical parks that feed into regional methionine and DMDS production, benefiting from abundant shale-derived hydrogen and robust logistics. Canada's sulfur output renders local refineries strategic suppliers to mercaptan producers, yet rail congestion and port limitations occasionally disrupt flows, prompting inventory stockpiling strategies.

Europe remains technologically mature and environmentally progressive, promoting bio-based thiochemical research while penalizing emissions. Arkema, based in France, innovates Vultac sulfur donors catering to specialty rubber markets that service premium tire brands. German chemical clusters channel funding into circular-economy projects focusing on waste-to-sulfur and carbon-neutral process heat, initiatives that could reshape regional supply structures. South America and the Middle East & Africa collectively account for less than 10% of global trade today, yet refinery upgrades in Brazil and petrochemical diversification in Saudi Arabia hint at future thiochemicals market opportunities as localized supply chains mature and environmental policies tighten.

List of Companies Covered in this Report:

- Arkema

- BRUNO BOCK

- Chevron Phillips Chemical Company LLC.

- Daicel Corporation

- Dr. Spiess Chemische Fabrik

- Hebei Yanuo Bioscience

- KIP Chemicals

- Merck KGaA

- Taizhou Sunny Chemical Co., Ltd.

- TCI Chemicals

- Toray Fine Chemicals

- WEIFANG YI HUA CHEMICAL CO., LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging methionine demand from industrial-scale animal feed producers

- 4.2.2 Expanding use of Dimethyl Disulfide as a refinery catalyst sulfiding agent

- 4.2.3 Adoption of thiochemicals in advanced batteries

- 4.2.4 Growing usage of thiochemcials in methionine production

- 4.2.5 Growth in ultra-low-sulfur diesel desulfurisation campaigns

- 4.3 Market Restraints

- 4.3.1 High toxicity and odour management costs

- 4.3.2 Volatility in elemental sulfur prices

- 4.3.3 Producer concentration risk causing supply shocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Mercaptans

- 5.1.2 Dimethyl Sulfoxide (DMSO)

- 5.1.3 Thioglycolic Acid and Esters

- 5.1.4 Other Types (Hydrogen-Sulfide Scavengers, etc.)

- 5.2 By End-Use Industry

- 5.2.1 Animal Nutrition

- 5.2.2 Oil and Gas

- 5.2.3 Polymers and Chemicals

- 5.2.4 Other End-user Industries (Electronics and Semiconductor Cleaning, Agrochemicals, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arkema

- 6.4.2 BRUNO BOCK

- 6.4.3 Chevron Phillips Chemical Company LLC.

- 6.4.4 Daicel Corporation

- 6.4.5 Dr. Spiess Chemische Fabrik

- 6.4.6 Hebei Yanuo Bioscience

- 6.4.7 KIP Chemicals

- 6.4.8 Merck KGaA

- 6.4.9 Taizhou Sunny Chemical Co., Ltd.

- 6.4.10 TCI Chemicals

- 6.4.11 Toray Fine Chemicals

- 6.4.12 WEIFANG YI HUA CHEMICAL CO., LTD.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment