PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844705

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844705

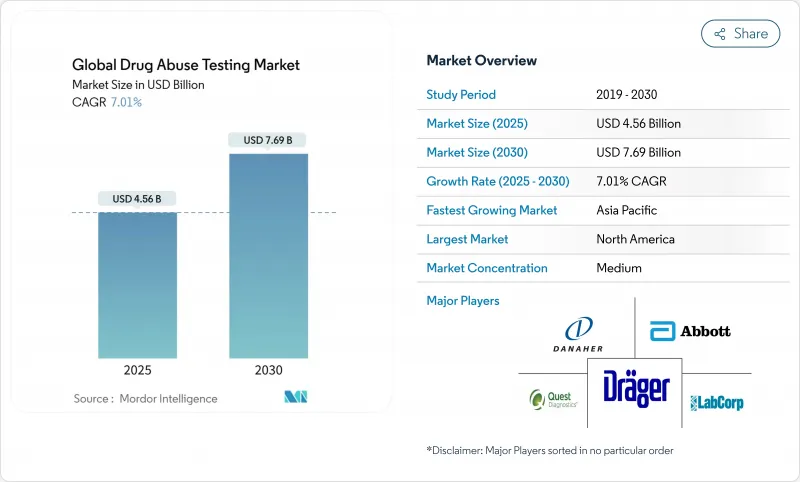

Global Drug Abuse Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The drugs of abuse testing market generated USD 5.46 billion in 2024 and is on track to reach USD 7.69 billion by 2030, advancing at a 7.01% CAGR from 2025 to 2030.

Growth is underpinned by lasting regulatory support, broader test-panel mandates, and rapid uptake of point-of-care (PoC) technologies that shorten result turnaround and cut administrative bottlenecks. A decisive inflection came in December 2024 when the U.S. Department of Transportation (DOT) cleared oral fluid testing, widening adoption in safety-sensitive industries and enhancing privacy for donors . Simultaneously, the fentanyl crisis keeps expanding the federal testing scope, driving recurring consumable demand and specialized lab services . Corporate policy shifts-such as the 9% of U.S. employers dropping marijuana screening to widen talent pools-introduce complexity and open new service niches for impairment-based analytics. Parallel progress in AI-enabled PoC analyzers and IoT-linked remote monitoring platforms is expanding the clinical utility of substance-use detection, especially in opioid treatment adherence programs.

Global Drug Abuse Testing Market Trends and Insights

Stringent Workplace & Traffic-Safety Regulations

Federal and state agencies are sustaining higher random-testing thresholds, keeping the DOT random rate at 50% for 2025 despite escalating compliance costs. Electronic custody-and-control forms trim paperwork, lower administrative error, and speed up reporting, giving labs a cost-effective compliance edge. Post-accident rules now trigger defined windows for specimen collection, elevating demand for rapid PoC systems able to meet narrow turnaround targets. The December 2024 oral-fluid rule offers a privacy-friendly pathway that is poised to rebalance sample-type preferences toward saliva collection.

Expansion of Forensic & Clinical Labs in Emerging Markets

Governments in Asia are accelerating accreditation reforms, attracting outsourced drug-testing work previously centered in the United States and Europe. SGS's Shanghai site achieved an FDA inspection with zero observations, signaling global-grade quality that can lure multinational customers. Fiscal incentives under 'Make in India' and expanded production-linked schemes offset capital costs for new laboratory setups. Together, these factors enhance sample-processing capacity, reduce turnaround times, and anchor regional growth through 2030.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Rapid PoC Immunoassays

- Direct-to-Consumer At-Home Test-Kit Boom

- Privacy & Ethical Push-Back on Workplace Testing

- High Costs & Confirmatory-Test Burden for False Results

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Laboratory services posted the fastest 8.02% CAGR outlook to 2030 as enterprises outsource complex confirmatory tasks that require mass-spectrometry and regulatory accreditation. Consumables retained 38.94% revenue in 2024, reflecting recurring panel-test volumes under expanded fentanyl and norfentanyl requirements.

The consumables engine remains powerful: each regulatory panel inclusion queues sustained orders for reagents, calibrators, and quality-control materials. Rapid test devices now include AI-guided strip readers that upload timestamped images for audit trails, bolstering employer defensibility. Analyzers are scaling throughput: Thermo Fisher's Stellar MS targets toxicology labs needing sub-minute full-scan runs, enhancing productivity per square foot. With sample numbers rising, the drugs of abuse testing market size attributable to outsourced services is projected to expand steadily, deepening vendor-client lock-in through integrated data-management portals.

Urine testing retained 42.16% of the drugs of abuse testing market share in 2024 thanks to entrenched lab protocols and broad legal acceptance. Nevertheless, saliva collections are slated for an 8.89% CAGR through 2030 after DOT endorsement narrowed privacy objections and shortened detection windows to within 2 days post-use. Automated LC-MS/MS assays now quantify 37 compounds in oral fluids with precision down to 1 ng/mL, meeting forensic evidentiary standards.

Hair testing continues serving 90-day lookback needs but faces budget constraints, making it a niche revenue contributor. Sweat sensing enters pilot stage via wearable patches that transmit cumulative exposure data to clinicians, though commercialization timelines remain uncertain. Breath analyzers, propelled by sub-ppm methanol sensors, preview expanded drug panels beyond alcohol. Market evolution demonstrates clear user preference for less-intrusive sampling modalities, setting a gradual but sustained shift away from traditional urine dominance.

The Drug of Abuse Testing Market Report Segments the Industry Into by Product & Service (Rapid Testing Devices, Urine Testiing Device and More), by Sample Type (Urine, Hair and More), by Technology (Immunoassay, Chromatography and More), by End User (Workplaces and Schools, Hospitals and Clinics and More), by Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America continued to supply 39.82% of 2024 revenue for the drugs of abuse testing market, sustained by DOT mandates, insurance payer policies, and the region's dense network of CLIA-certified labs. Employer compliance culture reinforces multi-panel testing, keeping per-employee screening budgets intact even as some companies modify marijuana panels. Federal encouragement of oral-fluid adoption is likely to reduce logistical cost per test, reinforcing U.S. leadership while opening slots for local device vendors. Canada follows a parallel trajectory under federal impairment rules for cannabis, promoting pilot deployments of roadside oral-fluid readers.

Europe enjoys harmonized workplace safety frameworks, but legal fragmentation over recreational cannabis creates varying test-demand intensity among member states. The European drugs of abuse testing market size is predicted to grow steadily on the back of traffic-safety programs and university campus pilots that deter psychoactive-substance use during academic activities who.int. Funding from Horizon-Europe fosters R&D partnerships that accelerate non-invasive biosensor platforms, giving regional SMEs export opportunities.

Asia-Pacific logs the quickest 9.23% CAGR as governments scale clinical-laboratory infrastructure and pharmaceutical outsourcing shifts away from Chinese suppliers under the U.S. Biosecure Act. India leverages PLI incentives to build toxicology capacities that attract multinational sponsors, while Japan pursues zero-tolerance traffic enforcement, expanding demand for roadside saliva units. China's first third-party lab with FDA clearance showcases maturing quality levels and positions the country as a future exporter of test reagents. Southeast Asian nations invest in port-of-entry narcotics screening, broadening customs agency orders.

Latin America's momentum stems from expanded forensic budgets in Brazil and Mexico, yet supply-chain volatility and budget cycles inject periodic uncertainty. Middle East and Africa progress unevenly: GCC health ministries actively deploy urine and saliva checkpoints at worksites linked to large infrastructure projects, whereas low-income nations rely on donor-funded pilot programs. Nonetheless, regional digital-health strategies that integrate tele-opioid therapy open future lanes for AI-assisted remote testing.

- Abbott Laboratories

- F. Hoffmann-La Roche AG (Roche Diagnostics)

- Thermo Fisher Scientific

- Quest Diagnostics

- LabCorp

- Dragerwerk

- Siemens Healthineers

- Danaher

- Bio-Rad Laboratories

- Orasure Technologies

- Premier Biotech Inc.

- Intoximeters

- Lion Laboratories Ltd.

- Omega Laboratories

- Psychemedics

- SureHire Inc.

- Alcolizer Technology

- Mindray

- MP Biomedicals LLC

- Shenzhen New Industries Biomedical Engineering Co., Ltd. (Snibe)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising drug & alcohol consumption globally

- 4.2.2 Stringent workplace & traffic-safety regulations

- 4.2.3 Technological advances in rapid PoC immunoassays

- 4.2.4 Expansion of forensic & clinical labs in emerging markets

- 4.2.5 Direct-to-consumer at-home test-kit boom

- 4.2.6 AI/IoT-enabled remote sample verification for tele-opioid therapy

- 4.3 Market Restraints

- 4.3.1 Privacy & ethical push-back on workplace testing

- 4.3.2 High costs & confirmatory-test burden for false results

- 4.3.3 Cannabis legalization dampening demand in specific states

- 4.3.4 Reagent supply-chain bottlenecks for antibodies & enzymes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Threat of New Entrants

- 4.7.3 Threat of Substitutes

- 4.7.4 Bargaining Power of Suppliers

- 4.7.5 Bargaining Power of Buyers

5 Market Size & Growth Forecasts

- 5.1 By Product & Service

- 5.1.1 Rapid Testing Devices

- 5.1.2 Urine Testing Devices

- 5.1.3 Oral Fluid Testing Devices

- 5.1.4 Analyzers

- 5.1.5 Consumables

- 5.1.6 Laboratory Services

- 5.2 By Sample Type

- 5.2.1 Urine

- 5.2.2 Oral Fluid (Saliva)

- 5.2.3 Hair

- 5.2.4 Breath

- 5.2.5 Blood

- 5.2.6 Sweat

- 5.3 By Technology

- 5.3.1 Immunoassay

- 5.3.2 Chromatography

- 5.3.3 Spectroscopy

- 5.3.4 Lateral Flow Assay

- 5.4 By End User

- 5.4.1 Workplaces & Schools

- 5.4.2 Law-Enforcement & Criminal Justice

- 5.4.3 Hospitals & Clinics

- 5.4.4 Drug Treatment Centers

- 5.4.5 At-Home & Personal Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC Countries

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level overview, Market level overview, Core segments, Financials as available, Strategic information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche AG (Roche Diagnostics)

- 6.3.3 Thermo Fisher Scientific Inc.

- 6.3.4 Quest Diagnostics Incorporated

- 6.3.5 Laboratory Corporation of America Holdings (LabCorp)

- 6.3.6 Dragerwerk AG & Co. KGaA

- 6.3.7 Siemens Healthineers AG

- 6.3.8 Danaher Corporation (Beckman Coulter)

- 6.3.9 Bio-Rad Laboratories Inc.

- 6.3.10 OraSure Technologies Inc.

- 6.3.11 Premier Biotech Inc.

- 6.3.12 Intoximeters Inc.

- 6.3.13 Lion Laboratories Ltd.

- 6.3.14 Omega Laboratories Inc.

- 6.3.15 Psychemedics Corporation

- 6.3.16 SureHire Inc.

- 6.3.17 Alcolizer Technology

- 6.3.18 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.19 MP Biomedicals LLC

- 6.3.20 Shenzhen New Industries Biomedical Engineering Co., Ltd. (Snibe)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment