PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844707

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844707

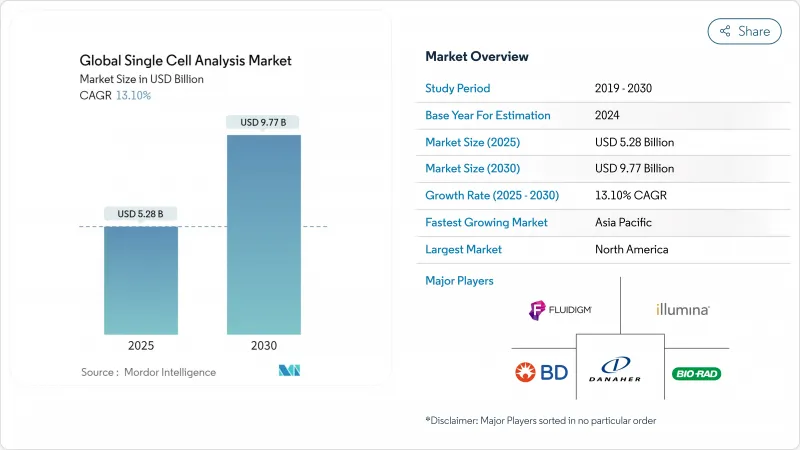

Global Single Cell Analysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The single cell analysis market is valued at USD 5.28 billion in 2025 and is forecast to climb to USD 9.77 billion by 2030, registering a 13.10% CAGR over the period.

Expanding precision-medicine programs, a widening cancer and autoimmune disease burden, and active government and venture capital funding are sustaining double-digit growth. Rapid advances in single-cell multi-omics, AI-enabled bioinformatics, and spatial transcriptomics are opening new clinical and research use cases, while recurring consumables sales maintain predictable cash flows for suppliers. Strategic consolidation among large instrumentation firms and focused innovators is accelerating integrated workflow rollouts, and region-specific regulatory frameworks are beginning to accommodate diagnostic assays based on single-cell readouts.

Global Single Cell Analysis Market Trends and Insights

Expanding Adoption of Precision and Personalized Medicine

Clinical programs increasingly rely on single-cell technologies to resolve cellular heterogeneity that limits bulk-omics approaches. Oncology illustrates the shift: single-cell RNA sequencing is identifying resistant tumor clones and refining immunotherapy selection, driving 35% gains in response-prediction accuracy . Growing integration into routine workflows across major cancer centers positions the single cell analysis market for sustained long-term demand.

Surge in Single-Cell Multi-Omics Funding for Precision Oncology

Venture investment in startups that combine genomic, transcriptomic, and proteomic readouts at single-cell resolution surpassed USD 50 billion in 2024. Platforms delivering simultaneous DNA, RNA, and protein panels from a single cell are accelerating biomarker discovery and patient-stratification pipelines, reinforcing near-term commercial uptake.

High Upfront Capital Expenditure and Maintenance Costs

Advanced spatial-omics instruments often list above USD 500,000, with annual service contracts adding 10-15% of ownership cost. High consumable prices, ranging USD 500-2,000 per sample, limit adoption outside well-funded centers, especially in Latin America, Africa, and parts of Southeast Asia .

Other drivers and restraints analyzed in the detailed report include:

- Increasing Prevalence of Cancer and Immune-Mediated Disorders

- Escalating Government and Venture-Capital Funding

- Introduction of AI-Enabled Bioinformatics Platforms

- Emergence of Spatial Transcriptomics Platforms Integrating Imaging + RNA-seq

- Shortage of Trained Bioinformaticians for Giga-Scale Datasets

- Data-Management, Storage, and Cybersecurity Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The consumables segment accounted for 58.12% of 2024 revenue as laboratories repeatedly purchase reagents, chips, and assay kits essential for routine workflows. Continuous demand for library-prep reagents anchors predictable income and lowers sensitivity to macroeconomic swings in instrumentation budgets. Instrument sales, although a smaller base, are projected to grow 14.50% CAGR owing to launches that combine multi-omic readouts in single runs. Automated liquid-handling and robotics modules that streamline high-throughput processing are also raising capital-equipment appeal.

Consumable manufacturers are pivoting toward integrated workflow bundles that pair reagents with software and technical support, deepening customer lock-in. Broad-portfolio firms capture cross-selling advantages, whereas niche reagent suppliers seek partnerships for full-solution offerings. The single cell analysis market size for instruments is set to expand rapidly as spatial-omics and combined DNA-RNA-protein analyzers move from prototype to commercial release.

Flow cytometry retained 34.45% revenue share in 2024 on the strength of established adoption in clinical immunology, transplantation, and blood-cancer labs. Continuous detector and fluorophore upgrades permit 40-plus-parameter panels, bolstering utility. Next-generation sequencing is the fastest-growing technique, forecast at 13.70% CAGR, as falling per-gigabase costs and cell-barcoding chemistries unlock high-content transcriptomic profiling. The single cell analysis market sees PCR, microscopy, mass spectrometry, microfluidics, and RNA-FISH occupying specialized niches. Mass-spectrometry-based single-cell proteomics is bridging transcript-to-protein gaps, while spatial transcriptomics combines imaging with sequencing to add microenvironment insights.

The Single Cell Analysis Market Report Segments the Industry Into by Product (Consumables and Instruments), Technique (Flow Cytometry, and More), Cell Type (Human Cells and More), Workflow Step (Sample Preparation, and More), Application (Research Applications, Medical Applications), End User (Academic and Research Laboratories, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 42.19% revenue in 2024, supported by NIH funding, a dense network of cancer centers, and headquarters of global market leaders such as Thermo Fisher Scientific, Illumina, and 10x Genomics. FDA engagement with lab-developed single-cell diagnostics is fostering regulatory clarity. Regional collaborations between academic health systems and industry accelerate translational pipelines. The single cell analysis market size in North America is expected to keep expanding as reimbursements for molecular diagnostics broaden.

Asia-Pacific is forecast to post the fastest 14.50% CAGR through 2030. China's precision-medicine initiatives, Japan's engineering strengths, and India's expanding biotech sector underpin demand. National research grants and favorable approval pathways for in-vitro tests are catalyzing local production of consumables and instruments. Regional governments are also investing in cloud infrastructure to cope with data-management demands.

Europe maintains a sizeable share led by Germany, the United Kingdom, and France. Horizon Europe grants fuel multi-center research, while the In-Vitro Diagnostic Regulation tightens performance-evidence requirements, influencing product designs. Smaller but growing adoption in the Middle East and South America reflects increasing healthcare modernization and genome-surveillance programs. Addressing cost barriers and workforce gaps will determine uptake pace across these emerging territories.

- Thermo Fisher Scientific

- Beckton Dickinson

- Illumina

- Beckton Dickinson

- 10x Genomics Inc.

- Agilent Technologies

- Bio-Rad Laboratories

- QIAGEN

- Merck KGaA (MilliporeSigma)

- Fluidigm Corp. (Standard BioTools)

- GE HealthCare Technologies Inc.

- Promega

- Takara Bio

- Oxford Nanopore Technologies plc

- PerkinElmer Inc. (Revvity)

- Cytek Biosciences Inc.

- Sartorius AG (Cellenion)

- Parse Biosciences

- Mission Bio Inc.

- BGI Genomics Co. Ltd.

- Dolomite Bio (Blacktrace)

- Menarini

- Sysmex

- NanoString Technologies Inc.

- BioSkryb Genomics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Adoption of Precision and Personalized Medicine

- 4.2.2 Surge in single-cell multi-omics funding for precision oncology

- 4.2.3 Increasing Prevalence of Cancer and Immune-Mediated Disorders

- 4.2.4 Escalating Government and Venture-Capital Funding

- 4.2.5 Introduction of AI-Enbaled Bioinformatics Platforms

- 4.2.6 Emergence of spatial transcriptomics platforms integrating imaging + RNA-seq

- 4.3 Market Restraints

- 4.3.1 High upfront capital expenditure and maintenance costs for advanced cytometry, NGS, and spatial-omics instruments

- 4.3.2 Shortage of trained bioinformaticians for giga-scale single-cell datasets

- 4.3.3 Data-management, storage, and cybersecurity challenges posed by tera-scale single-cell datasets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product

- 5.1.1 Consumables

- 5.1.2 Instruments

- 5.2 By Technique

- 5.2.1 Flow Cytometry

- 5.2.2 Next-Generation Sequencing

- 5.2.3 Polymerase Chain Reaction (PCR)

- 5.2.4 Microscopy

- 5.2.5 Mass Spectrometry

- 5.2.6 Microfluidics

- 5.2.7 RNA-FISH

- 5.2.8 Other Techniques

- 5.3 By Cell Type

- 5.3.1 Human Cells

- 5.3.2 Animal Cells

- 5.3.3 Microbial Cells

- 5.3.4 Plant Cells

- 5.4 By Workflow Step

- 5.4.1 Sample Preparation

- 5.4.2 Cell Isolation & Sorting

- 5.4.3 Single-Cell Analysis

- 5.4.4 Data Analysis & Management

- 5.5 By Application

- 5.5.1 Research Applications

- 5.5.1.1 Stem Cell Research

- 5.5.1.2 Neuroscience

- 5.5.1.3 Immunology

- 5.5.1.4 Oncology

- 5.5.1.5 Microbiology

- 5.5.1.6 Other Research Applications

- 5.5.2 Medical / Clinical Applications

- 5.5.2.1 Prenatal Testing

- 5.5.2.2 In Vitro Fertilization

- 5.5.2.3 Infectious Disease Diagnostics

- 5.5.2.4 Oncology Diagnostics

- 5.5.1 Research Applications

- 5.6 By End User

- 5.6.1 Academic & Research Laboratories

- 5.6.2 Biotechnology & Pharmaceutical Companies

- 5.6.3 Hospital & Diagnostic Laboratories

- 5.6.4 Contract Research Organizations (CROs)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Australia

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Becton, Dickinson and Company

- 6.3.3 Illumina Inc.

- 6.3.4 Beckman Coulter Inc. (Danaher)

- 6.3.5 10x Genomics Inc.

- 6.3.6 Agilent Technologies Inc.

- 6.3.7 Bio-Rad Laboratories Inc.

- 6.3.8 Qiagen NV

- 6.3.9 Merck KGaA (MilliporeSigma)

- 6.3.10 Fluidigm Corp. (Standard BioTools)

- 6.3.11 GE HealthCare Technologies Inc.

- 6.3.12 Promega Corporation

- 6.3.13 Takara Bio Inc.

- 6.3.14 Oxford Nanopore Technologies plc

- 6.3.15 PerkinElmer Inc. (Revvity)

- 6.3.16 Cytek Biosciences Inc.

- 6.3.17 Sartorius AG (Cellenion)

- 6.3.18 Parse Biosciences

- 6.3.19 Mission Bio Inc.

- 6.3.20 BGI Genomics Co. Ltd.

- 6.3.21 Dolomite Bio (Blacktrace)

- 6.3.22 Menarini Silicon Biosystems

- 6.3.23 Sysmex Corporation

- 6.3.24 NanoString Technologies Inc.

- 6.3.25 BioSkryb Genomics

7 Market Opportunities & Future Outlook