PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844708

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844708

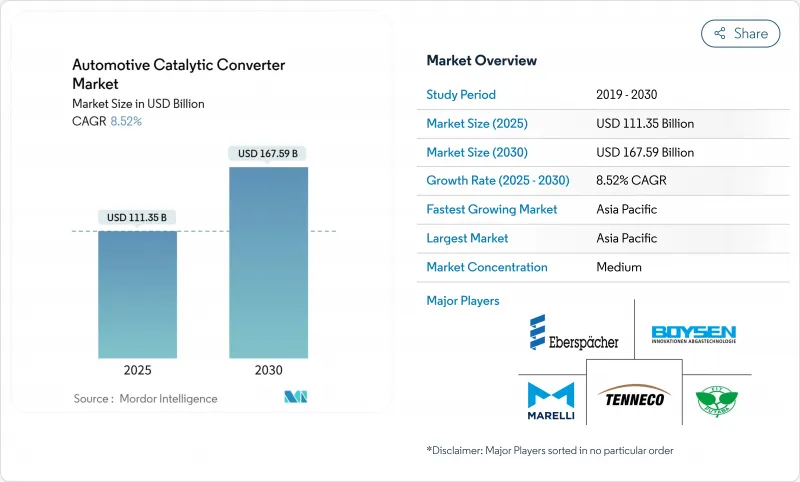

Automotive Catalytic Converter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The catalytic converters market generated USD 111.35 billion in 2025 and is forecast to reach USD 167.59 billion by 2030, advancing at an 8.52% CAGR.

The expansion reflects consistent regulatory tightening after 2025, including Euro 7, China 7, and updated United States standards, all of which mandate higher precious-metal loadings and advanced wash-coat chemistries. Further momentum comes from the rebound in global internal-combustion and hybrid vehicle production, precious-metal substitution strategies that cut cost risk, and retrofit activity in non-road machinery fleets. Supply chain resilience, new hydrogen internal-combustion projects, and promising single-material catalysts round out the opportunity set for the catalytic converters market.

Global Automotive Catalytic Converter Market Trends and Insights

Stringent Post-2025 Emission Legislation Drives Technology Upgrades

Euro 7 begins phasing in from July 2025 and extends compliance durability to eight years/160,000 km, forcing automakers to specify thicker precious-metal layers and sophisticated gasoline particulate filters. China 7 mirrors and, in several respects, exceeds Euro 7, requiring particulate-number limits and real-driving emissions testing across platforms. In the United States, tougher off-road and light-vehicle rules close historical regulatory gaps. Unified global thresholds remove the lag-time cushion OEMs once used, accelerating design cycles for advanced three- and four-way systems.

Rebound in Global ICE and Hybrid Production Volume Post-COVID

Worldwide light-vehicle output witnessed volume restoration across gasoline, diesel, and hybrid lines. Commercial trucks added volume on the back of logistics demand, while infrastructure stimulus in Asia-Pacific kept heavy-duty assembly lines active. Hybrids represented approximately 10% of production and need larger catalyst volumes to control cold-start emissions during frequent stop-start cycling. the China Association of Automobile Manufacturers is implementing a three-step development strategy targeting 20% carbon emissions reduction by 2035 through enhanced thermal efficiency and advanced emission control systems. Normalized factory utilization raises near-term unit shipments for the catalytic converters market despite longer-term electrification pressure.

Extreme Platinum-Group-Metal Price Volatility

Palladium's fall from more than USD 3,000/oz in 2022 to under USD 1,000/oz in early 2025, and platinum's swings between USD 900-1,100/oz, complicate sourcing budgets and encourage substitution. Suppliers hedge, but small participants struggle to offset price moves, reducing short-term margin visibility and delaying orders when cost shocks hit. Planned reductions in South African mine capex threaten to tighten supply later in the decade..

Other drivers and restraints analyzed in the detailed report include:

- Higher Precious-Metal Loadings in GDI and Mild Hybrid Engines

- OEM Retrofit Demand from Non-Road/Mobile Machinery ESG Pressure

- Accelerated BEV Penetration Reducing Long-Term Unit Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Three-way converters retained a 66.78% share of the catalytic converters market in 2024, reflecting their universal fit for stoichiometric gasoline engines. Tightening particulate-number and durability rules keep this format central to compliance, though metal loading and wash-coat formulations continue to evolve. The catalytic converters market size for three-way units is forecast to rise in line with overall vehicle production through 2030, underpinned by hybridization that magnifies cold-start events.

A new wave of four-way converters, lean-NOx traps, and combined selective catalytic-reduction systems clusters in the "other types" category, which is projected to grow at 11.83% CAGR. Laboratory work at Washington State University shows that nano-scale ceria clustering induced by high exhaust heat boosts activity tenfold while using less precious metal, a discovery that may reshape cost curves. Parallel research into self-regenerating perovskite catalysts aims to cut PGM content by up to 90%, setting the stage for broader adoption once production scale and durability benchmarks are met.

Passenger cars dominated the 2024 volume with 63.60% catalytic converters market share, driven by their absolute production scale. Despite the portion declining modestly as electrification grows, passenger-car catalysts remain a staple due to long fleet lives, late-cycle hybrid launches, and emerging diesel-downsize gasoline strategies.

Medium and heavy commercial vehicles provide the fastest 9.08% CAGR. Logistics expansion, infrastructure spending, and stricter heavy-duty NOx ceilings push fleet managers toward higher-capacity catalyst bricks and longer warranties. Developers are already validating hydrogen-ICE systems for long-haul trucking, opening a fresh avenue for three-way catalysts that must tolerate 100% hydrogen streams at high exhaust temperatures while still curbing NOx. Off-road machinery, though niche, prolongs growth by tapping Stage V retrofit packages with bespoke pipe-fabricated housings.

The Catalytic Converter Market Report is Segmented by Converter Type (Two-Way Catalytic Converters, Three-Way Catalytic Converters, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Fuel Type (Gasoline, Diesel, and Hybrid), Substrate Material (Platinum, Palladium, and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 49.82% of the catalytic converters market revenue in 2024 and is expected to expand at a 7.85% CAGR through 2030. China anchors regional growth on the back of China 7 standards that embed particulate-number and real-driving protocols exceeding European thresholds. India adds volume as automotive production ramps up to meet both domestic mobility demand and export orders. Regional heavy-duty output benefits from infrastructure pipelines that stimulate truck and off-road equipment sales. Futures contracts for platinum and palladium listed on a new Guangzhou exchange further professionalize metal procurement, lessening price-shock exposure for local manufacturers.

North America is forecast to grow at 5.10% CAGR. Updated federal rules demand 50% NMOG + NOx cuts by 2032 and force gasoline particulate-filter adoption. Texas, Michigan, and Ontario remain key production clusters for light-vehicle converters, while Tier 5 off-road proposals in California pull through advanced SCR systems for construction machinery. Investments in hydrogen-ICE testing labs illustrate the region's commitment to alternative propulsion while still relying on after-treatment for NOx abatement.

Europe's 4.80% CAGR reflects a mature vehicle base under pressure from mandated zero-emission sales after 2035. Near-term catalyst demand rises as Euro 7 introduces eight-year durability and extended temperature compliance windows. Leading suppliers focus on higher density wash-coats, electrically heated bricks, and combined NOx/particulate regeneration algorithms to meet the stringent Euro 7 limits. Retrofit activity in non-road fleets sustains aftermarket volumes once new-car demand flattens.

- Marelli Holdings Co., Ltd.

- Tenneco Inc. (Walker Emissions Control)

- HELLA GmbH and Co. KGaA

- Eberspacher Group

- Yutaka Giken Company Limited

- Futaba Industrial Co. Ltd.

- Boysen Group

- BOSAL International

- Katcon S.A. de C.V.

- Sejong Industrial Co., Ltd.

- Hanwoo Industrial Co. Ltd.

- Sango Co. Ltd.

- Benteler International AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Post-2025 Emission Legislation Drives Technology Upgrades

- 4.2.2 Rebound in global ICE and hybrid production volumes post-COVID

- 4.2.3 Higher precious-metal loadings in GDI and mild-hybrid engines

- 4.2.4 OEM retrofit demand from non-road/mobile machinery ESG pressure

- 4.2.5 Supply-chain gaps caused by converter-theft recycling boom

- 4.2.6 Growing incentives for hydrogen-ICE vehicles needing three-way converters

- 4.3 Market Restraints

- 4.3.1 Extreme platinum-group metal (PGM) price volatility

- 4.3.2 Accelerated BEV penetration reducing long-term unit demand

- 4.3.3 Crack-down on illicit PGM sourcing raising compliance cost

- 4.3.4 Early-stage commercialisation of single-material catalysts (vanadium, perovskite)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value in USD)

- 5.1 By Converter Type

- 5.1.1 Two-Way Catalytic Converters

- 5.1.2 Three-Way Catalytic Converters

- 5.1.3 Other Types

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Off-Road and Non-Road Equipment

- 5.2.5 Motorcycles and Powersports

- 5.3 By Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Hybrid (MHEV, HEV, and PHEV)

- 5.4 By Substrate Material

- 5.4.1 Platinum

- 5.4.2 Palladium

- 5.4.3 Rhodium

- 5.4.4 Others (Cerium, Vanadium, and Perovskites)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, JV, capacity, and recycling initiatives)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Marelli Holdings Co., Ltd.

- 6.4.2 Tenneco Inc. (Walker Emissions Control)

- 6.4.3 HELLA GmbH and Co. KGaA

- 6.4.4 Eberspacher Group

- 6.4.5 Yutaka Giken Company Limited

- 6.4.6 Futaba Industrial Co. Ltd.

- 6.4.7 Boysen Group

- 6.4.8 BOSAL International

- 6.4.9 Katcon S.A. de C.V.

- 6.4.10 Sejong Industrial Co., Ltd.

- 6.4.11 Hanwoo Industrial Co. Ltd.

- 6.4.12 Sango Co. Ltd.

- 6.4.13 Benteler International AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment