PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910456

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910456

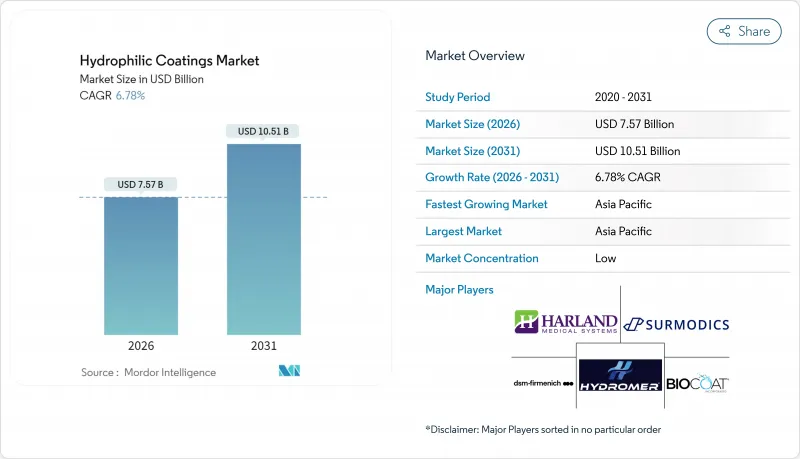

Hydrophilic Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Hydrophilic Coatings Market was valued at USD 7.09 billion in 2025 and estimated to grow from USD 7.57 billion in 2026 to reach USD 10.51 billion by 2031, at a CAGR of 6.78% during the forecast period (2026-2031).

Surging adoption across medical, optical and automotive applications, coupled with stricter sustainability mandates, underpins this growth. Polymer substrates still dominate but nanoparticle-enabled surfaces are eroding that lead, while Asia-Pacific delivers a geographic flywheel effect that is redrawing global supply chains. Intensifying price pressure on medical devices, tightening PFAS regulations and durability concerns continue to temper expansion; nevertheless, continuous materials innovation, streamlined deposition techniques and an expanding eco-system of PFAS-free solutions are widening commercial opportunities.

Global Hydrophilic Coatings Market Trends and Insights

Rising Demand in Healthcare Applications

Medical device designers rely on hydrophilic coatings to lower insertion forces and mitigate thrombosis in minimally invasive procedures. Clinical evidence shows up to 70% reduction in catheter friction, enabling smoother vascular navigation and shorter procedure times. Coatings that blend lubricity with antimicrobial or antithrombotic agents are gaining traction, especially for neurovascular stents, where surface-modified flow diverters reduce platelet adhesion and may lessen dual-antiplatelet therapy requirements. Hospitals now prioritize devices with such multifunctional layers because they shorten recovery and curb infection risk. In parallel, academic-industry collaborations are accelerating pre-clinical validation, further lifting adoption.

Technological Innovations in Coating Materials

Nanoparticle-enabled substrates redefine performance ceilings by combining high hydrophilicity, abrasion resistance, and controlled-release capability. Silica-poly(acrylic-acid) formulations retain super-hydrophilicity under mild wear, tackling a long-standing durability gap. Responsive hydrogels such as starPEG-heparin withstand shear forces during catheter deployment while delivering on-demand anticoagulation. These advances open new product architectures where coatings deliver dual roles-surface lubricity plus therapeutic functionality-without compromising mechanical integrity.

High Production Costs

Multi-step synthesis, clean-room deposition and intensive quality testing add 30-40% to manufacturing costs versus standard coatings, squeezing margins in price-sensitive catheter and guidewire lines. Specialized know-how remains concentrated among a handful of suppliers, limiting economies of scale and elevating switching costs for OEMs. Although process automation and roll-to-roll UV-cure systems are trimming cycle times, capital requirements deter smaller entrants.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Optical and Electronics Industries

- Regulatory Support for Sustainable Coatings

- Durability and Performance Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nanoparticle-enabled substrates posted 7.45% CAGR and are eroding polymer's 47.25% revenue stronghold. Halloysite nanotube-reinforced epoxy acrylate emulsions showed zero rusting after 16 days of salt-spray exposure compared with 9 days for conventional polymers, signalling a clear durability leap. Superhydrophobic silica coatings with 162° contact angles on glass illustrate cross-substrate migration of nanotechnology benefits.

Manufacturers continue to favor polymers for cost-effective volume output, but hybrid designs that embed nano-silica or layered silicates within polymer matrices are reshaping the substrate hierarchy. These hybrids merge flexible processing windows with enhanced abrasion resistance, blurring category lines. Metal and glass substrates retain niche roles where biocompatibility or optical clarity are critical, yet even here, nanoscale interlayers are elevating adhesion and corrosion performance.

Dip-coating retained 41.35% revenue share in 2025. However, plasma and UV-graft routes, growing 7.38% annually, increasingly allow tailor-made surface chemistries on complex geometries without solvent carryover. Initiated Chemical Vapor Deposition (iCVD) creates gradient polymer layers that improve ice-phobicity and maintain hydrophilicity across temperature swings.

Spray and slot-die lines shrink cycle times, meeting rising catheter output targets. Chemical vapor deposition methods enable co-deposition of synergistic components, driving water contact angles down to 43.2°, thereby boosting coating uniformity and lifecycle stability.

The Hydrophilic Coatings Market Report Segments the Industry by Substrate (Polymer, Glass/Ceramic, and More), Deposition Technology (Dip-Coating, Spray and Slot-Die, and More), Application (Catheters and Guidewires, Stents and Implantables, and More), End-User Industry (Medical Devices, Optics and Photonics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 32.35% of global revenue in 2025 and will accelerate at 7.55% a year. Government healthcare spending and mid- to high-end catheter manufacturing expansion in China underpin robust device demand. Japanese firms refine precision deposition, and Korean electronics giants deploy hydrophilic coatings in image sensors, cementing regional leadership.

North America has a significant position in the market, buoyed by deep medical-device pipelines and strict FDA performance expectations that reward premium coatings. EPA's PFAS classification forces rapid reformulation; domestic suppliers that secure compliant, high-lubricity chemistries gain early mover status.

Europe's market centres on sustainability mandates. Imminent REACH curbs on PFAS accelerate migration toward water-borne and UV-cure systems, fostering innovation in low-VOC polyurethane and epoxy dispersions. Local OEMs partner with materials specialists to validate contact-angle and cytotoxicity performance ahead of compliance deadlines.

Latin America and the Middle East & Africa remain nascent but rising. Brazil's catheter producers incorporate turnkey coating modules as they scale exports, while Saudi Arabia invests in advanced materials under Vision 2030, nurturing regional demand for medically approved coating technologies.

- Aculon

- Applied Medical Coatings

- AST Products Inc.

- Biocoat Incorporated

- Coatings2Go

- dsm-firmenich

- Formacoat

- Harland Medical Systems, Inc.

- Hydromer

- Mitsubishi Chemical America, Inc.

- PPG Industries Inc.

- Specialty Coating Systems Inc.

- Surface Solutions Group LLC

- Surmodics Inc.

- Teleflex Incorporated

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand in Healthcare Applications

- 4.2.2 Technological Innovations in Coating Materials

- 4.2.3 Advancements in Optical and Electronics Industries

- 4.2.4 Regulatory Support for Sustainable Coatings

- 4.2.5 VOC-Compliant Water-borne and UV-Cure Formulations in Europe

- 4.3 Market Restraints

- 4.3.1 High Production Costs

- 4.3.2 Durability and Performance Concerns

- 4.3.3 Volatility in Raw Material Prices

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Value )

- 5.1 By Substrate

- 5.1.1 Polymer

- 5.1.2 Glass / Ceramic

- 5.1.3 Metal

- 5.1.4 Nanoparticle-Enabled

- 5.2 By Deposition Technology

- 5.2.1 Dip-Coating

- 5.2.2 Spray and Slot-Die

- 5.2.3 Plasma and UV-Graft

- 5.2.4 Chemical Vapor Deposition

- 5.2.5 Other Technologies

- 5.3 By Application

- 5.3.1 Catheters and Guidewires

- 5.3.2 Stents and Implantables

- 5.3.3 Optical and Eyewear Lenses

- 5.3.4 Automotive Sensors and Cameras

- 5.3.5 Architectural and Solar Glass

- 5.3.6 Others (Marine, Textile, Aerospace)

- 5.4 By End-User Industry

- 5.4.1 Medical Devices

- 5.4.2 Optics and Photonics

- 5.4.3 Automotive

- 5.4.4 Transportation and Marine

- 5.4.5 Other Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Aculon

- 6.4.2 Applied Medical Coatings

- 6.4.3 AST Products Inc.

- 6.4.4 Biocoat Incorporated

- 6.4.5 Coatings2Go

- 6.4.6 dsm-firmenich

- 6.4.7 Formacoat

- 6.4.8 Harland Medical Systems, Inc.

- 6.4.9 Hydromer

- 6.4.10 Mitsubishi Chemical America, Inc.

- 6.4.11 PPG Industries Inc.

- 6.4.12 Specialty Coating Systems Inc.

- 6.4.13 Surface Solutions Group LLC

- 6.4.14 Surmodics Inc.

- 6.4.15 Teleflex Incorporated

7 Market Opportunities and Future Outlook

- 7.1 Development of Eco-Friendly Coatings

- 7.2 White-space and Unmet-need Assessment