PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844720

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844720

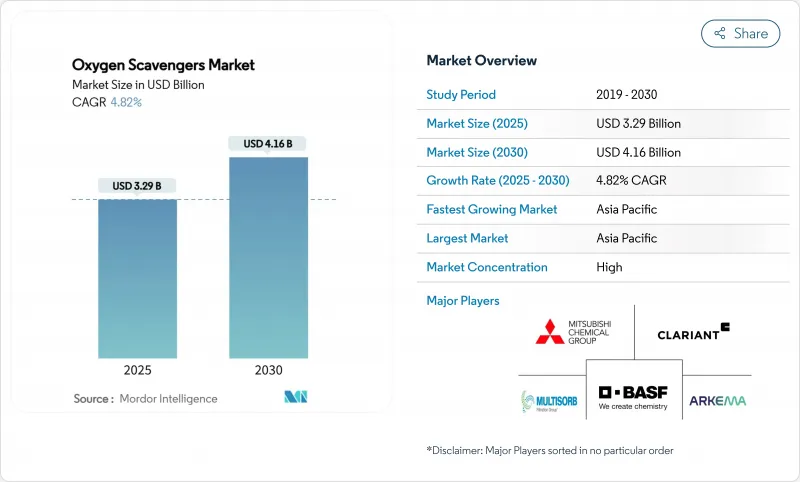

Oxygen Scavengers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Oxygen Scavengers Market size is estimated at USD 3.29 billion in 2025, and is expected to reach USD 4.16 billion by 2030, at a CAGR of 4.82% during the forecast period (2025-2030).

Demand pivots from conventional iron powders toward polymer-integrated and enzyme-based systems that help brand owners satisfy stricter shelf-life, purity and recyclability targets. Asia-Pacific represents the core production base for multilayer packaging films while North America drives high-value pharmaceutical applications, and both regions influence raw-material sourcing strategies for global suppliers. Regulations such as the FDA's Human Foods Program and EU Regulation 2025/40 are amplifying the shift toward non-metallic formulations that avoid metal-ion migration. Across end-uses, the e-commerce boom forces brand owners to choose oxygen management technologies that remain effective during weeks-long journeys through complex fulfilment networks, sustaining medium-term growth for the oxygen scavengers market.

Global Oxygen Scavengers Market Trends and Insights

Rapid Growth in Fresh-Ready & Chilled Packaged Meals

Shifts in consumer habits toward convenience foods have widened deployment of active oxygen management across meat, seafood and deli categories. Brand owners integrate sachet-free scavenging layers into thermoformed trays so products remain color-stable throughout extended chilled storage and retail display. Regional supermarket chains cite reduced waste and improved merchandising flexibility as key benefits, prompting co-packers to specify solutions that activate rapidly at low temperatures. Equipment suppliers are therefore adapting high-speed tray-sealing lines to accommodate multilayer films pre-loaded with scavenging resins that do not compromise seal integrity. This adoption dynamic feeds a steady order pipeline for film extruders located in the United States and Germany, reinforcing baseline growth for the oxygen scavengers market.

Stricter Pharmacopeia Limits on Residual Oxygen in Drug Packs

The latest USP and EMA guidelines cap residual oxygen in parenteral and solid-dose packs, urging drug makers to validate barrier systems that sustain <=0.5% oxygen throughout the stated shelf life. Polymer-based scavengers such as Colorcon's PharmaKeep series can function across 10-90% relative humidity, addressing drug-product moisture sensitivity while avoiding metal-ion risks. the European regulations are following similar trajectories, with the EU's revised food contact material regulations effective March 2025 introducing enhanced purity requirements and migration limits that affect pharmaceutical packaging materials .Contract development organizations embed such additives directly into polyolefin blisters, which simplifies line qualification versus separate sachets. These advances are most visible in biologics, where trace oxygen can catalyze protein degradation, and in moisture-reactive small-molecule therapies that require multi-year stability data.

Metal-Ion Contamination & Sensory-Taint Concerns

Iron-based sachets release trace ions that can catalyze oxidative reactions in sensitive nutraceuticals and lead to metallic off-notes in premium teas and coffees. Regulatory auditors now require migration testing under worst-case humidity, prompting some brand owners to exclude ferrous systems entirely for high-value SKUs. Polymer encapsulation methods lower direct contact risk, yet they raise raw-material costs that smaller manufacturers struggle to absorb. This trade-off tempers near-term penetration of traditional sachets in pharmaceutical and specialty-food channels, restraining a portion of the oxygen scavengers market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Aseptic Cold-Chain Meal-Kit Logistics

- Commercialization of Nanocomposite Polymer Scavengers

- Cost-Effective and High-Barrier Film Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metallic formulations retained 57.89% oxygen scavengers market share in 2024 thanks to established supply chains, rapid absorption kinetics and low unit cost. The segment's scale advantage translates into volume contracts with global meat processors and snack producers, anchoring the oxygen scavengers market size for entry-level applications. However, non-metallic systems are growing at an 8.60% CAGR, the fastest among all material groups. Polymer-integrated variants eliminate the need for end-of-line sachet insertion, which shortens changeover time on high-speed fill-and-seal lines. Enzyme and ascorbic-acid formulations further widen options for halal, kosher and clean-label brands that restrict metallic additives. Pharmaceutical audits increasingly cite polymer systems' compatibility with humidity-controlled warehouses, encouraging blister-film extruders to adopt Amosorb and PharmaKeep concentrates. Continuous R-&D around nanocomposite catalysts suggests non-metallic solutions could erode iron's lead beyond 2030, especially if unit prices align with mainstream snack food budgets. Collectively, these dynamics reinforce material-segment diversity within the oxygen scavengers market.

Second-generation chemistries also align with recycling mandates because they embed scavenging capacity in mono-material PET or PP structures rather than laminated foil, an approach that supports circular-economy targets under EU Regulation 2025/40. Resin suppliers have demonstrated bottle-to-bottle recyclability with minimal haze increase, satisfying beverage-brand commitments to 30% recycled content by 2030. Meanwhile, metallic sachet makers counter by optimizing powder particle size and adding moisture-absorbing buffers that delay premature activation during ocean transit. Competition across material platforms therefore centers on balancing activation control, unit economics and downstream recycling performance, a contest that will shape procurement decisions for both converters and global CPG buyers in the oxygen scavengers market.

The Global Oxygen Scavenger Market Reports Segments the Industry by Type (Metallic Oxygen Scavengers and Non-Metallic Oxygen Scavengers), End-User Industry (Food and Beverage, Pharmaceutical, Oil and Gas, Power and More), and Geography (Asia-Pacific, North America, South America, Europe, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 38.05% of 2024 demand and is projected to deliver a 7.50% CAGR to 2030, underpinned by China's expanding pharmaceutical export base and India's rapid capacity additions in flexible-film conversion. Governments across the region continue to subsidize cold-chain logistics and set national targets for food-waste reduction, stimulating adoption of active barrier solutions. The region benefits from established supply chains for raw materials and growing demand from food processing industries that serve both domestic and export markets. Mitsubishi Gas Chemical's strong presence in the region through subsidiaries like MGC AGELESS Co., Ltd. in Japan and AGLESS (THAILAND) CO., LTD. demonstrates the established infrastructure supporting oxygen scavenger production and distribution.

North America represents a mature but technically advanced arena for the oxygen scavengers market. Stringent FDA oversight mandates exhaustive migration testing and drives demand for fully documented polymer formulations. Brand owners prioritize solutions compatible with mechanical recycling targets under state-level extended producer responsibility rules. Canadian meat processors, dealing with export voyages toward Asia, specify high-capacity sachets and automated insertion equipment, sustaining steady replacement demand. Mexico's rising convenience-food sector further supports regional growth, although cost pressures favour a mix of passive and active barriers.

Europe mirrors North American regulatory drivers but layers additional circular-economy ambitions. EU Regulation 2025/40 will require all packaging to be recyclable by 2030, spurring investments in mono-material structures with embedded scavenging capability. Large beverage groups in France and Germany pilot PET bottle preforms containing non-metallic additives, aligning oxygen protection with deposit-return systems. Eastern European film extruders increasingly import polymer concentrates from Western suppliers, bridging technology gaps and spreading adoption. The Middle East & Africa and South America trail in absolute volume yet show accelerating interest as modern grocery retail formats expand. Across these emerging regions, demonstration projects funded by development banks illustrate the spoilage-reduction benefits of active oxygen management, pointing toward steady medium-term demand inflows for the oxygen scavengers market.

- Accepta Water Treatment

- Arkema

- Avient Corporation

- BASF

- Clariant

- Desiccare Inc.

- Ecolab

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Multisorb

- Solenis

- Veolia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Growth in Fresh-Ready and Chilled Packaged Meals

- 4.2.2 Stricter Pharmacopeia Limits on Residual Oxygen in Drug Packs

- 4.2.3 Expansion of Aseptic Cold-Chain Mealkit Logistics

- 4.2.4 Commercialisation of Nanocomposite Polymer Scavengers

- 4.2.5 E-commerce Demand for Longer Transit Shelf-Life

- 4.3 Market Restraints

- 4.3.1 Metal-Ion Contamination & Sensory-Taint Concerns

- 4.3.2 Cost-Fffective and High-Barrier Film Substitutes

- 4.3.3 Volatile Iron-Ore and Specialty Catalyst Price Swings

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Metallic Oxygen Scavengers

- 5.1.2 Non-metallic Oxygen Scavengers

- 5.2 By End-user Industry

- 5.2.1 Food and Beverage

- 5.2.2 Pharmaceutical

- 5.2.3 Oil and Gas

- 5.2.4 Power

- 5.2.5 Chemical

- 5.2.6 Pulp and Paper

- 5.2.7 Other End-user Industries (Water and Waste-Water Treatment, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Indonesia

- 5.3.1.7 Vietnam

- 5.3.1.8 Malaysia

- 5.3.1.9 Philippines

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 South Africa

- 5.3.5.5 Nigeria

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Accepta Water Treatment

- 6.4.2 Arkema

- 6.4.3 Avient Corporation

- 6.4.4 BASF

- 6.4.5 Clariant

- 6.4.6 Desiccare Inc.

- 6.4.7 Ecolab

- 6.4.8 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.9 Multisorb

- 6.4.10 Solenis

- 6.4.11 Veolia

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment