PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844723

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844723

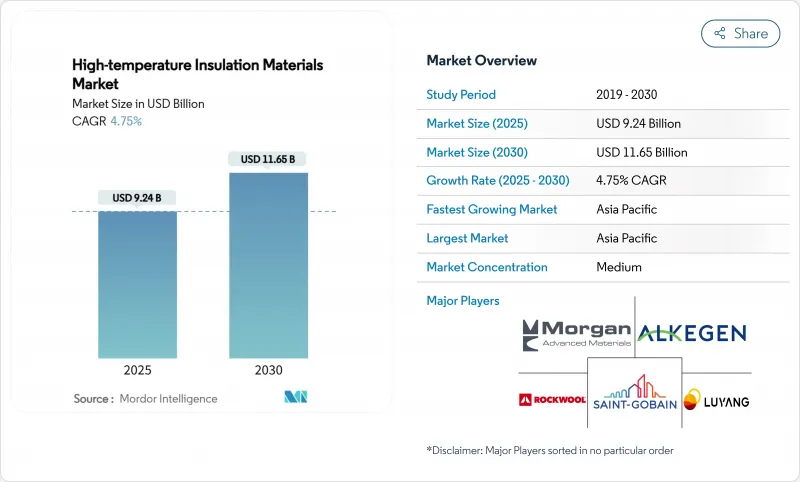

High-temperature Insulation Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The High-temperature Insulation Materials Market size is estimated at USD 9.24 Billion in 2025, and is expected to reach USD 11.65 Billion by 2030, at a CAGR of 4.75% during the forecast period (2025-2030).

The current market size reflects steady demand growth as energy-intensive industries pursue operational efficiency and lower emissions. Tight building-energy codes, rapid petrochemical and metals capacity additions in Asia-Pacific, and expanding green hydrogen electrolyser installations form the backbone of demand. Manufacturers continue to prioritize non-combustible and low-biopersistent alternatives that satisfy stricter occupational exposure limits. At the same time, vertical integration strategies and regional capacity expansions are helping large suppliers shield themselves from raw-material price swings and logistics bottlenecks. While alumina, silica, and zirconia pricing remains volatile, the economic payback from lower fuel use and maintenance costs keeps adoption on an upward trajectory.

Global High-temperature Insulation Materials Market Trends and Insights

Surging Demand for Energy-Efficient Industrial Furnaces

Industrial furnace builders face stricter energy-performance rules under the 2024 International Energy Conservation Code, which lowered allowable heat loss and tightened air-leakage rates. Operators specify ceramic fibre blankets and microporous panels that endure 1,000°C service without compromising fuel economy. Typical energy savings approach 30% over legacy linings, improving payback despite higher capital cost. Integrating smart thermal management systems with advanced insulation materials enables predictive maintenance and optimized energy consumption, positioning high-temperature insulation as a critical component in Industry 4.0 transformation strategies. .

Tightening Building-Energy Codes Requiring High-Temperature Insulation

The same 2024 International Energy Conservation Code (IECC) revision also sharpened commercial building shell requirements, magnifying interest in continuous insulation and thermal-bridge mitigation. European Union Fit-for-55 directives demand complementary heat- and fire-resistant solutions in industrial facilities, increasingly favoring materials that combine thermal performance with fire safety, driving demand for non-combustible options like mineral wool and ceramic fiber systems. Building owners face escalating energy costs and carbon pricing mechanisms that make high-performance insulation economically attractive over building lifecycles. The convergence of energy efficiency mandates and fire safety requirements creates a sweet spot for high-temperature insulation materials that can address both regulatory imperatives simultaneously.

Occupational Exposure Limits on Synthetic Vitreous Fibres

Regulatory authorities worldwide are tightening occupational exposure limits for synthetic vitreous fibers, with OSHA maintaining permissible exposure limits of 0.2 fibers per cubic centimeter for refractory ceramic fibers . The Health and Safety Executive in the UK has classified refractory ceramic fiber as a category 2 carcinogen, necessitating stringent control measures under COSHH regulations that increase handling costs and limit application flexibility. European legislation increasingly favors low-biopersistent alternatives, driving market share gains for alkaline earth silicate fibers despite their higher costs and slightly reduced temperature capabilities. The regulatory trend toward biosoluble fibers creates opportunities for innovative manufacturers while constraining traditional ceramic fiber applications. Compliance costs and liability concerns are pushing industrial users toward alternative materials, even when performance trade-offs exist. The long-term trajectory suggests continued regulatory pressure that will reshape the competitive landscape in favor of companies with strong low-biopersistent fiber portfolios.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Capacity Build-Out in Asian Petro-Chem and Metal Sectors

- Green-Hydrogen Electrolyser Adoption Needs High-Temperature Lining

- Volatile Alumina and Silica Prices Squeeze Converter Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ceramic fibre held 56.19% of 2024 revenue owing to its 1,260°C service limit, low density, and adaptability into blankets, modules, and boards. This leadership is anchored in asset-heavy industries, such as steel, non-ferrous metals, and petrochemicals, where downtime costs dwarf material prices. The high-temperature insulation materials market size for ceramic fibre is expected to post steady single-digit growth as new capacities in Asia-Pacific come on stream.

Other material types, such as aerogel composites and microporous panels, are the fastest-growing group at 6.18% CAGR. Weight-sensitive end uses value aerogels' sub-0.020 W/m*K (Watt per metre Kelvin) conductivity combined with fiber reinforcement that boosts handling strength. Regulatory-driven migration to low-biopersistent chemistries accelerates alkaline earth silicate wool uptake, especially in Europe. Polycrystalline wool supports specialized duties above 1,500°C, while vacuum-formed shapes address complex geometries that would require costly on-site gunning or ramming. The high-temperature insulation materials industry continues to refine sintering additives and fiber diameters to balance shot content, strength, and thermal shock resistance.

The High-Temperature Insulation Materials Market Report Segments the Industry Into Material Type (Fiberglass, Ceramic Fibre, Mineral Wool, Polyurethane Foam, and More), Application (Insulation, Industrial Eqipment, and Other Applications), End-User Industry (Petrochemicals, Construction, Transportation, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific had a 47.51% market share in 2024 and is projected to advance at a 5.66% CAGR. China's ongoing capacity additions in steel, aluminum, and chemicals sustain bulk demand, while India's National Infrastructure Pipeline and expanding hydrogen plans reinforce long-term growth. Southeast Asian nations add petrochemical and renewables assets that likewise require refractory linings. Policymakers increasingly enforce energy-efficiency norms, shifting purchasing toward low-conductivity fibre modules and aerogels.

North America ranks second by value. Federal clean energy credits and state-level carbon caps make retrofit insulation economically attractive in refineries, liquidated natural gas (LNG) terminals, and pulp mills. The region's reshoring of semiconductor and battery manufacturing raises consumption of ultra-clean insulation boards and fiber-reinforced aerogels. Robust industrial safety enforcement also accelerates adoption of alkaline earth silicate wool.

Europe remains technology-focused, leveraging its stringent environmental rules and carbon-border adjustments to champion low-biopersistent materials. European Union (EU) Green Deal investments spur renovation of existing industrial assets with multilayer linings that marry insulation and fire-containment. Innovative pilot projects in concentrated solar power and thermal energy storage adopt advanced ceramics, broadening application footprints.

- 3M

- Alkegen

- Almatis

- Aspen Aerogels, Inc.

- BNZ Materials,Inc.

- Cabot Corporation

- Carlisle Companies Inc.

- Dyson Technical Ceramics

- Etex Group

- ISOLITE

- Knauf Insulation

- Luyang Energy-saving Materials Co., Ltd.

- M.E. Schupp Industriekeramik Gmbh

- Morgan Advanced Materials

- NUTEC Incorporated

- Pacor Inc.

- Pyrotek

- Rath-Group

- ROCKWOOL A/S

- Saint-Gobain

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Energy-Efficient Industrial Furnaces

- 4.2.2 Tightening Building-Energy Codes Requiring High-Temperature Insulation

- 4.2.3 Rapid Capacity Build-Out in Asian Petro-Chem and Metal Sectors

- 4.2.4 Green-Hydrogen Electrolyser Adoption needs High Temperature Lining

- 4.2.5 Growing Lightweight, Durable Insulation Material Demand

- 4.3 Market Restraints

- 4.3.1 Occupational Exposure Limits on Synthetic Vitreous Fibres

- 4.3.2 Volatile Alumina and Silica Prices Squeeze Converter Margins

- 4.3.3 Supply-Chain Risk for High-Purity Zirconia Precursors

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Fiberglass

- 5.1.2 Ceramic Fibre

- 5.1.3 Mineral Wool

- 5.1.3.1 Alkaline Earth Silicate (AES)

- 5.1.3.2 Aluminum Silicate Wool (ASW) or Refractory Ceramic Fibre (RCF)

- 5.1.3.3 Polycrystalline Wool or Fibre (PCW)

- 5.1.3.4 Long Fibre

- 5.1.4 Vacuum-Formed Insulating Products

- 5.1.5 Polyurethane Foam

- 5.1.6 Polystyrene

- 5.1.7 Insulating Fire-Bricks (IFB)

- 5.1.8 Other Material Types (Aerogel Blankets, Microporous Panels, etc.)

- 5.2 By Application

- 5.2.1 Insulation

- 5.2.2 Industrial Eqipment

- 5.2.3 Other Applications (Building and Fire-Protection, etc.)

- 5.3 By End-use Industry

- 5.3.1 Petrochemicals

- 5.3.2 Industrial

- 5.3.3 Power Generation

- 5.3.4 Transportation

- 5.3.5 Electrical and Electronics

- 5.3.6 Construction

- 5.3.7 Other End-use Industries (Metal Processing, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Alkegen

- 6.4.3 Almatis

- 6.4.4 Aspen Aerogels, Inc.

- 6.4.5 BNZ Materials,Inc.

- 6.4.6 Cabot Corporation

- 6.4.7 Carlisle Companies Inc.

- 6.4.8 Dyson Technical Ceramics

- 6.4.9 Etex Group

- 6.4.10 ISOLITE

- 6.4.11 Knauf Insulation

- 6.4.12 Luyang Energy-saving Materials Co., Ltd.

- 6.4.13 M.E. Schupp Industriekeramik Gmbh

- 6.4.14 Morgan Advanced Materials

- 6.4.15 NUTEC Incorporated

- 6.4.16 Pacor Inc.

- 6.4.17 Pyrotek

- 6.4.18 Rath-Group

- 6.4.19 ROCKWOOL A/S

- 6.4.20 Saint-Gobain

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Lightweight Refractory Cements for Concentrated-Solar Receivers