PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844730

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844730

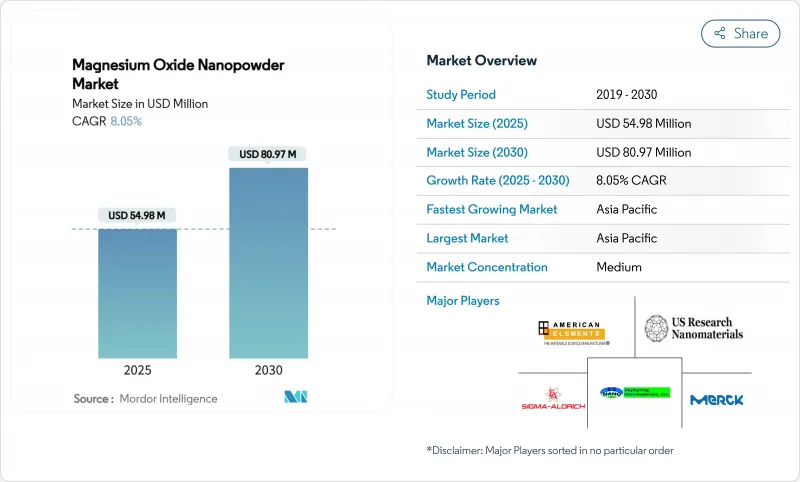

Magnesium Oxide Nanopowder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Magnesium Oxide Nanopowder Market size is estimated at USD 54.98 Million in 2025, and is expected to reach USD 80.97 Million by 2030, at a CAGR of 8.05% during the forecast period (2025-2030).

Most revenue still flows from legacy refractory demand, yet momentum is clearly shifting toward high-value applications in fuel additives, electrical insulation, flame-retardant polymer compounds and early solid-state battery prototypes. Supply security is shaped by China's 52% share of primary magnesium production in 2024, which delivers cost advantages for Asian processors but exposes global buyers to policy-driven volatility. Competitive positioning increasingly depends on proprietary synthesis routes that deliver narrow particle-size distributions and functionalized surfaces needed in advanced composites and electrolytes. Finally, tightening workplace-exposure limits for engineered nanomaterials in North America and the EU are raising compliance costs, but they also favour established producers with certified quality systems.

Global Magnesium Oxide Nanopowder Market Trends and Insights

Rising Demand from Refractory Industry

Magnesia-carbon bricks incorporating nanoscale magnesium oxide show higher densification that lowers porosity-induced failure in basic oxygen and electric arc furnaces. Steelmakers in China, Japan and South Korea have standardised nanopowder grades in ladle, tundish and continuous-caster linings to withstand rapid thermal cycling. Consolidation among integrated steel producers means fewer buyers wield greater purchasing power, but they pay premiums for reliability that avoids unplanned shutdowns. As electric arc furnace capacity expands across Asia-Pacific, magnesium oxide nanopowder market demand remains closely correlated with rising scrap-based steel output. Suppliers with vertically integrated production and refractory formulation expertise can capture long-term contracts anchored in joint R&D agreements.

Growth in Electrical Insulation Applications

Epoxy systems loaded with 1 wt% magnesium oxide nanoparticles maintain a dielectric constant of 13 at 230 °C and double the thermal conductivity versus neat resin. These attributes solve the chronic trade-off between heat dissipation and electrical resistivity in silicon carbide power modules and traction inverters. Electric-vehicle drive-train voltages above 800 V, combined with miniaturised form factors, amplify the need for high-temperature insulation fillers that stay chemically inert under partial discharge. Asia-Pacific cable makers are scaling polyethylene compounds filled with freeze-dried magnesium oxide foams that suppress space-charge accumulation. As wind-turbine inverters grow in capacity, European utilities are also specifying nanoparticle-filled potting compounds for offshore substations.

High Production and Purification Costs

Sol-gel plants capable of 1,425 kg day-1 output require capital spending above USD 45,000 and return on investment stretches beyond three years under today's price structure. Energy-intensive hydrothermal and calcination steps heighten sensitivity to carbon-pricing trajectories in the EU and selected US states. Purity specifications tighter than 99.8 wt% raise reagent and filtration costs that cannot be amortised across commodity volumes. Smaller producers outside Asia-Pacific face scale disadvantages, which limits their ability to bid for large refractory tenders or automotive additive supply contracts.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Use as Fuel Additive

- Expanding Adoption in Flame-Retardant Polymer Composites

- Aggregation and Agglomeration Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refractory materials generated 42.65% of the magnesium oxide nanopowder market size in 2024, anchored in magnesia-carbon bricks and tundish linings for steel and aluminium melt processing. Technical upgrades in electric arc furnaces favour finer particle distributions that densify brick microstructures. As scrap-based steel makes deeper inroads across Asia, energy-efficient linings remain critical for productivity. Market leadership is expected to persist through 2030, though its proportional share will slip as newer uses scale.

The fuel-additive category shows an 8.86% CAGR to 2030, reflecting unprecedented regulatory pressure to cut particulate and NOx emissions in both on-road and off-road fleets. Nanoparticle dispersions improve atomisation, raise flame temperature uniformity and reduce soot precursors without compromising engine hardware warranties. Pilot fleet tests in the EU and China report fuel-economy gains above 2%. Although the segment starts from a small baseline, its growth pace makes it a focal point for producers targeting automotive clients seeking drop-in solutions.

The Magnesium Oxide Nanopowder Market Report is Segmented by Application (Refractory Materials, Electric Insulation, Fuel Additive and More), Synthesis Method (Physical Method, Chemical Precipitation, and More), End-User Industry (Auto Metallurgy, Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific owned 52.18% of 2024 revenue in the magnesium oxide nanopowder market and is forecast to advance at an 8.76% CAGR through 2030, underpinned by integrated supply chains, cost-advantaged feedstock and dense clusters of steel, electronics and battery manufacturers. China anchors regional demand, yet Japan's ceramics expertise and South Korea's semiconductor ecosystem provide incremental pull for ultra-high-purity grades. Government stimulus aimed at energy-transition hardware drives additional volume in electric-vehicle thermal management and solid-state battery pilot lines.

North America is a smaller but technologically rich arena in which aerospace, defence and advanced power electronics consume high-spec powders. The United States requisitioned domestic supply security measures, and start-ups such as Magrathea are piloting carbon-neutral magnesium extraction from seawater, which could de-risk feedstock procurement and reinforce local value chains by the late 2020s. Canada's critical-minerals strategy includes grants that lower capital hurdles for nanopowder finishing lines, potentially repositioning the region as an exporter of specialty grades rather than an importer.

Europe maintains steady growth as building codes tighten flame-retardancy thresholds and automakers adopt magnesium-rich e-mobility components. Germany leads consumption due to its automotive and chemical base, whereas the United Kingdom taps aerospace and defence projects requiring high-temperature insulation. EU circular-economy regulations encourage mineral-based fire-retardant fillers over halogenated alternatives, offering regulatory tailwinds for magnesium oxide nanopowder market expansion. The bloc's energy-strategy directives also channel funds into solid-state battery consortia where MgO plays a critical interface role.

- Alfa Aesar (Thermo Fisher)

- American Elements

- Ascensus

- Grecian Magnesite

- High Purity Laboratory Chemicals Pvt. Ltd.

- Hongwu International Group Ltd

- Inframat Advanced Materials

- Martin Marietta Magnesia Specialties

- Merck KGaA

- Nanografi Advanced Materials.

- Nanoshel LLC

- Nanostructured & Amorphous Materials, Inc.

- Platonic Nanotech

- Sigma-Aldrich (MilliporeSigma)

- SkySpring Nanomaterials, Inc.

- Tateho Chemical Industries Co.,Ltd.

- US Research Nanomaterials, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from refractory industry

- 4.2.2 Growth in electrical insulation applications

- 4.2.3 Increasing use as fuel additive

- 4.2.4 Expanding adoption in flame-retardant polymer composites

- 4.2.5 Emergent role in solid-state battery electrolytes

- 4.3 Market Restraints

- 4.3.1 High production and purification costs

- 4.3.2 Aggregation and agglomeration issues

- 4.3.3 Tightening workplace exposure regulations for nanoparticles

- 4.3.4 Volatile magnesium feedstock supply

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Refractory Materials

- 5.1.2 Electric Insulation

- 5.1.3 Fuel Additive

- 5.1.4 Fire Retardent

- 5.1.5 Magnetic Devices

- 5.1.6 Others (Catalysts & Adsorbents,Biomedical, etc.)

- 5.2 By Synthesis Method

- 5.2.1 Physical Methods

- 5.2.2 Chemical Precipitation

- 5.2.3 Green/Bio-based Synthesis

- 5.3 By End-user Industry

- 5.3.1 Metallurgy

- 5.3.2 Construction

- 5.3.3 Oil & Gas

- 5.3.4 Automotive

- 5.3.5 Electrical & Electronics

- 5.3.6 Other End-user Industries (Chemical & Petrochemical,Healthcare & Pharmaceuticals, etc.)

- 5.4 By Geography (Value)

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Alfa Aesar (Thermo Fisher)

- 6.4.2 American Elements

- 6.4.3 Ascensus

- 6.4.4 Grecian Magnesite

- 6.4.5 High Purity Laboratory Chemicals Pvt. Ltd.

- 6.4.6 Hongwu International Group Ltd

- 6.4.7 Inframat Advanced Materials

- 6.4.8 Martin Marietta Magnesia Specialties

- 6.4.9 Merck KGaA

- 6.4.10 Nanografi Advanced Materials.

- 6.4.11 Nanoshel LLC

- 6.4.12 Nanostructured & Amorphous Materials, Inc.

- 6.4.13 Platonic Nanotech

- 6.4.14 Sigma-Aldrich (MilliporeSigma)

- 6.4.15 SkySpring Nanomaterials, Inc.

- 6.4.16 Tateho Chemical Industries Co.,Ltd.

- 6.4.17 US Research Nanomaterials, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment