PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844733

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844733

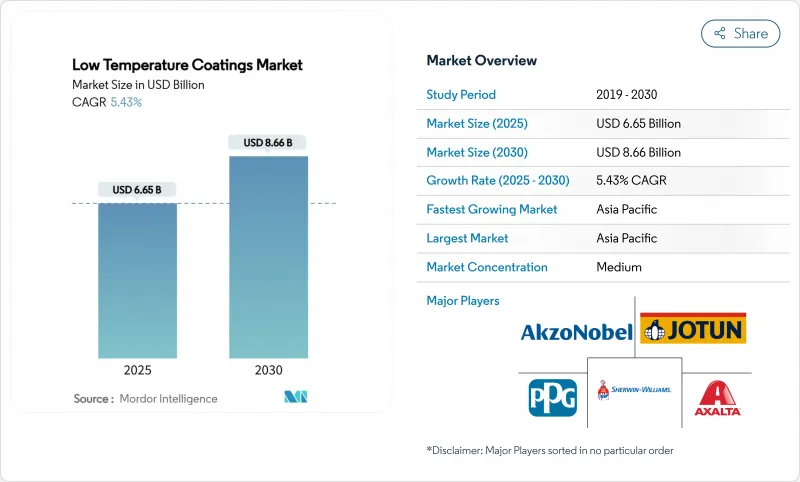

Low Temperature Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Low Temperature Coatings Market size is estimated at USD 6.65 billion in 2025, and is expected to reach USD 8.66 billion by 2030, at a CAGR of 5.43% during the forecast period (2025-2030).

The steady advance reflects regulatory pressure to trim process-heat emissions, rising energy prices that reward cooler cure profiles, and technological progress that now allows full performance at temperatures close to 120 °C. Energy savings of up to 25% have become common when plants shift from 375 °F bake cycles to formulations that cure at 285 °F, improving throughput and lowering carbon footprints. Demand is also boosted by the growing use of plastics, composites, and 3-D-printed parts that deform under conventional oven conditions, as well as the surge in electric vehicle (EV) production that requires thermally stable but gently cured battery enclosures. Competitive intensity is moderate: leading suppliers leverage resin chemistry, laser-assisted curing, and strategic acquisitions to defend share while niche players target ultra-low-bake segments such as offshore wind maintenance and additive manufacturing. Raw-material cost swings, notably titanium dioxide, and the technical difficulty of depositing ultra-thin films below 25 µm remain the principal headwinds.

Global Low Temperature Coatings Market Trends and Insights

Energy Savings from Reduced Cure Temperatures

Plants that retrofit to low-temperature powder systems save up to 25% in gas or electricity consumption, a figure confirmed by production lines that dropped cure peaks from 400 °F to 325 °F while maintaining corrosion resistance. Shorter oven residence also pushes line speeds higher, improving asset utilization. Regions with high energy tariffs such as California and Germany adopt these formulations first, yet the payoff is now similar elsewhere because carbon charges are widening. Payback is often achieved within one year thanks to slimmer utility bills and fewer filter-maintenance cycles. The move lowers scope 1 emissions, positioning users for future carbon-border fee regimes.

Growing Adoption for Heat-Sensitive Substrates in Electric Vehicles and Electronics

EV battery housings and electronic modules cannot tolerate the thermal shock typical of legacy bakes. Coatings that polymerize at 130 °C protect dielectrics, preserve adhesive layers, and meet insulation resistance targets without disturbing battery cell chemistries. Thermal interface materials are bonded at 35 °C, so paint shops now integrate integrated low-bake zones downstream of cell assembly. Semiconductor packaging lines mirror the trend by asking for sub-150 °C cycles that avoid warpage in fine-pitch boards. Asia-Pacific leads because of its EV supply-chain density, but North American gigafactories are rapidly specifying identical cure windows.

Limited Ability to Achieve Ultra-Thin Films

Below 25 µm, many powder chemistries suffer orange-peel and pore formation because lower oven temperatures restrict flow and leveling. Automotive clearcoat programs therefore hesitate to convert entire fleets, instead reserving low-bake lines for mid-coat layers where film build can remain thicker. Catalyst packages that accelerate crosslink density at 135 °C help but add formulation cost. Research into hybrid polyesters and nanofilled resins continues, yet large-scale breakthroughs remain two to four years away.

Other drivers and restraints analyzed in the detailed report include:

- Process-Heat Carbon Pricing Accelerating Adoption

- 3-D-Printed Parts Requiring Ultra-Low-Bake Coatings

- Competition from Ambient-Cure UV/EB Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyester systems accounted for 40.12% of 2024 revenue, supported by a long record of architectural durability and competitive pricing. Polyesters also bond well to galvanized steel, a high-volume substrate in construction, which cements their baseline position. The low temperature coatings market nevertheless favors polyurethane for applications demanding both flexibility and chemical resistance. Two-component and blocked isocyanate chemistries cure at 120 °C, opening plastic and composite categories that polyesters cannot reach.

Polyurethane volumes are projected to expand at a 7.18% CAGR, the fastest among resins, as EV makers specify flexible dielectric layers for battery covers. Mexico's 5-7% annual growth in polyurethane consumption underscores global momentum. Water-borne 2K-PUR hybrids meet VOC caps yet still deliver the adhesion required for consumer electronics bezels. These factors together reinforce polyurethane's rise within the low temperature coatings market.

Powder technology held 72.14% of 2024 revenue owing to scale economics and process familiarity. Formulators have driven cure thresholds from 180 °C a decade ago to 140 °C today, slashing energy intake per square meter by roughly one-third. The largest powder suppliers now offer laser-cured systems that reach full properties in three minutes at room temperature, an innovation poised to lift line productivity further.

UV/EB curing is the sprinter, forecast at a 7.45% CAGR to 2030. It merges solvent-free operation with cure temperatures as low as 110 °C, which appeals to MDF furniture lines and vinyl flooring plants. Adoption accelerates whenever operators need instant handling to feed just-in-time assembly zones. These capabilities broaden technological choice and stimulate healthy rivalry inside the low temperature coatings market size segment, where UV/EB solutions already command double-digit shares in industrial wood.

The Low Temperature Coatings Market Report is Segmented by Resin (Polyester, Epoxy, and More), Technology (Powder, Liquid - Solvent-Borne, Liquid - Water-Borne, UV/EB-cured), Substrate (Metals, Plastics and Composites, Wood, Other Substrates), End-User Industry (Architectural, Industrial, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated the landscape with 46.15% of 2024 revenue and is projected to compound at 7.27% CAGR, the fastest regional clip. China's vast powder coating clusters benefit from high-volume appliance and EV production, while India's automotive buildouts and Indonesia's appliance exports supply additional pull. Rising energy tariffs and intensifying VOC rules in major cities further encourage the adoption of cooler-cure chemistries.

North America ranks second in value; its growth rests on both policy and technology leadership. The U.S. Department of Energy's funding for laser-cured powder research shortens commercialization timelines, and California's process-heat regulations translate lab breakthroughs into real purchasing commitments. Mexico adds momentum by expanding coil-coat lines with USD 3.6 million in new capacity, strengthening cross-border supply chains.

Europe matches North America for innovation yet differs by wielding aggressive carbon pricing. The EU Industrial Carbon Management strategy sets explicit storage targets, nudging industrial coaters toward energy-lean options. Meanwhile, manufacturers across the Middle East, Africa, and South America gradually migrate to low-bake systems as multinational customers enforce uniform specifications, enlarging the overall low temperature coatings market footprint.

- Akzo Nobel N.V.

- Allnex GmbH

- APV Engineered Coatings

- Asian Paints Limited

- Axalta Coating Systems LLC

- BASF

- Beckers Group

- Covestro AG

- Hempel A/S

- IGP Pulvertechnik AG

- Jotun

- Kansai Paint Co. Ltd.

- Nippon Paint Holdings Co. Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- TCI Powder

- Teknos Group

- The Sherwin-Williams Company

- Tiger Coatings GmbH and Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy savings from reduced cure temperatures

- 4.2.2 Growing adoption for heat-sensitive substrates in electronic vehicles and electronics

- 4.2.3 Process-heat carbon pricing accelerating adoption

- 4.2.4 3-D printed parts requiring ultra-low-bake coatings

- 4.2.5 Offshore wind tower maintenance shift to low-temp cures

- 4.3 Market Restraints

- 4.3.1 Limited ability to achieve ultra-thin films

- 4.3.2 Competition from ambient-cure UV/EB systems

- 4.3.3 Thermal-shock defects on composite substrates

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin

- 5.1.1 Polyester

- 5.1.2 Epoxy

- 5.1.3 Polyurethane

- 5.1.4 Acrylic

- 5.1.5 Other Resins

- 5.2 By Technology

- 5.2.1 Powder

- 5.2.2 Liquid - Solvent-borne

- 5.2.3 Liquid - Water-borne

- 5.2.4 UV / EB-cured

- 5.3 By Substrate

- 5.3.1 Metals

- 5.3.2 Plastics and Composites

- 5.3.3 Wood

- 5.3.4 Other Substrates

- 5.4 By End-User Industry

- 5.4.1 Architectural

- 5.4.2 Industrial

- 5.4.3 Automotive

- 5.4.4 Wood

- 5.4.5 Other End-User Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Allnex GmbH

- 6.4.3 APV Engineered Coatings

- 6.4.4 Asian Paints Limited

- 6.4.5 Axalta Coating Systems LLC

- 6.4.6 BASF

- 6.4.7 Beckers Group

- 6.4.8 Covestro AG

- 6.4.9 Hempel A/S

- 6.4.10 IGP Pulvertechnik AG

- 6.4.11 Jotun

- 6.4.12 Kansai Paint Co. Ltd.

- 6.4.13 Nippon Paint Holdings Co. Ltd.

- 6.4.14 PPG Industries, Inc.

- 6.4.15 RPM International Inc.

- 6.4.16 TCI Powder

- 6.4.17 Teknos Group

- 6.4.18 The Sherwin-Williams Company

- 6.4.19 Tiger Coatings GmbH and Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment