PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844737

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844737

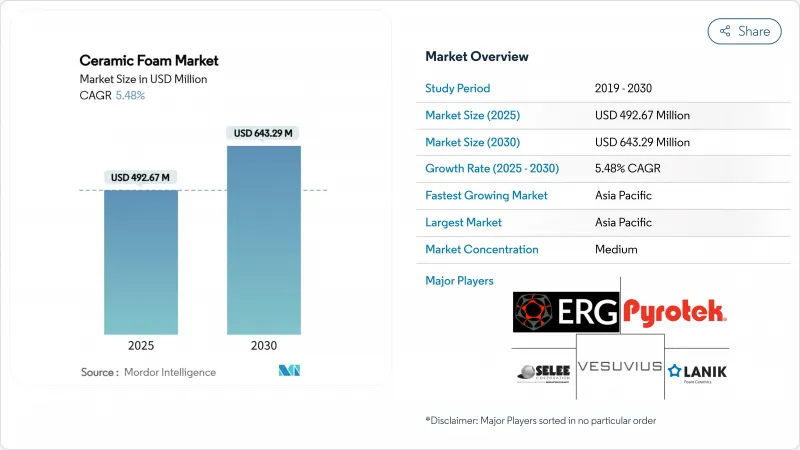

Ceramic Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ceramic Foam Market size is estimated at USD 492.67 million in 2025, and is expected to reach USD 643.29 million by 2030, at a CAGR of 5.48% during the forecast period (2025-2030).

Demand is accelerating as ceramic foam delivers high-temperature stability, chemical resistance and well-controlled porosity that outperform many legacy refractory and filtration media. Rapid growth in electric-vehicle casting hubs, hydrogen production facilities and circular-economy steel mini-mills is widening the customer base. Advanced replica processes retain cost advantages in high-volume production, while additive manufacturing opens profitable niches for complex open-cell geometries. Producers also see new insulation opportunities as North American and European zero-energy building codes tighten. Meanwhile, raw-material price volatility and brittleness challenges in fully automated foundries temper near-term margins, prompting suppliers to pursue material toughening and supply-chain hedging strategies.

Global Ceramic Foam Market Trends and Insights

Surging demand for low-emission molten metal filtration in EV casting hubs

Electric-vehicle platforms use large aluminum structural castings that require exceptionally clean melts to meet conductivity and fatigue targets. Ceramic foam filters now enable sub-10 ppm inclusion levels in battery housings and motor casings. Vesuvius reports 40% higher uptake of SEDEX silicon-carbide filters in EV-dedicated foundries compared with conventional automotive lines. Tesla's Shanghai operations and similar Asian facilities specify silicon-carbide foams for high-pressure die casting, driving regional volume. These specifications raise throughput and repeatability criteria that favor robust open-cell geometries produced via improved replica methods. Supply-chain localization efforts in Asia-Pacific further cement regional dominance of the ceramic foam market.

Rapid expansion of hydrogen production requiring high-temperature catalyst supports

Global electrolyzer and steam-reform expansion demands refractory carriers that withstand cyclic 600-900 °C operation in corrosive atmospheres. The Ceramics UK consortium validated 100% hydrogen-fired kilns, confirming ceramic foam suitability for next-generation energy systems. Saint-Gobain is investing USD 40 million in New York to scale catalyst-carrier output, highlighting North American momentum. Cordierite monoliths reinforced with ceramic foam achieve optimal selectivity at 800 °C, extending service intervals for reformers and solid-oxide fuel cells. As more regions publish national hydrogen roadmaps, catalyst support orders provide a durable growth pathway for the ceramic foam market.

Volatile alumina and zirconia prices pressuring profit margins

High-purity alumina and zirconia constitute a significant portion of the variable costs in ceramic foam production. Sharp price swings have forced quarterly contract renegotiations and spot purchases at elevated premiums. Zirconia toughening boosts compressive strength by 206% yet becomes less economical when raw-material indices spike. Morgan Advanced Materials noted a 4.6% revenue dip in its Thermal Ceramics unit despite stable order intake because surcharges lagged cost inflation. Smaller Asian producers, lacking long-term contracts, experienced margin compression that slowed plant upgrades and capacity additions within the ceramic foam industry.

Other drivers and restraints analyzed in the detailed report include:

- Additive manufacturing enabling complex, cost-efficient open-cell foam geometries

- Circular-economy push for recyclable refractory linings in steel mini-mills

- Brittleness leading to handling losses in automated foundries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silicon carbide commanded 45.18% share of the ceramic foam market in 2024 due to its stability above 1,500 °C, resistance to molten aluminum and superior thermal conductivity. Rising EV casting volumes and stringent inclusion limits underpin sustained demand. Other advanced compositions such as magnesium-aluminate spinel, boride ceramics and hybrid composites form the fastest-growing cluster at a 7.76% CAGR, fulfilling aerospace, nuclear and ultra-high-temperature needs. Aluminum oxide remains attractive for general-purpose iron casting thanks to cost-efficiency, though its temperature ceiling constrains penetration into new EV and hydrogen segments. Zirconium oxide retains a niche in chemically aggressive melts, where its premium price is justified by extended service life and enhanced corrosion resistance.

Second-generation boride foams demonstrate oxidation resistance above 1,800 °C, positioning them for hypersonic vehicle thermal-protection components. Research prototypes exhibit less than 5% mass loss after 1,000 thermal cycles, a milestone that could spur future commercialization. As material scientists synthesize multiphase foams combining whisker reinforcement and oxide scales, the ceramic foam market may witness incremental displacement of legacy alumina in extreme environments.

The replica or polymer-sponge process produced 67.24% of all ceramic foams shipped in 2024 owing to decades of equipment amortization, low scrap rates and familiar quality controls. It excels in producing filters with consistent pore sizes from 10 to 60 ppi, serving high-volume non-ferrous foundries. Despite its dominance, the ceramic foam market is pivoting toward additive manufacturing, the fastest-growing process at 7.91% CAGR. Laser-sintered alumina lattices and direct-ink-written cordierite carriers allow graded porosity and topology optimization unattainable with replica routes. Early adopters in catalyst support and aerospace exploit design freedom to enhance flow uniformity and mechanical resilience.

Direct foaming, which mixes gas into ceramic slurry then sinters the resulting froth, eliminates polyurethane templates and their associated burn-out emissions. Uptake is strongest in insulation panels targeting green-building credits. Gel casting endures in applications requiring near-net-shape precision, such as biomedical implants and semiconductor wafer supports, though its relatively long cycle times limit broader diffusion.

The Ceramic Foam Market Report is Segmented by Type (Aluminum Oxide, Silicon Carbide, and More), Manufacturing Process (Replica/Polymer Sponge Method, Direct Foaming, and More), Application (Molten Metal Filtration, Automotive Exhaust Filters, and More), End-User Industry (Foundry, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 46.82% revenue share in 2024 reflects its integrated supply chain encompassing raw materials, casting facilities and downstream EV production. China's continual steel output and Japan's advanced ceramics research sustain baseline volumes, while South Korea's hydrogen-economy roadmap raises future demand for catalyst foams. Forecasts indicate the region's ceramic foam market is projected to witness significant growth, supported by a robust 7.42% CAGR during the forecast period. Government grants for smart manufacturing and energy efficiency amplify adoption across foundry, automotive, and construction sectors.

North America represents a mature yet innovative arena. The region fields additive-manufacturing pioneers and benefits from federal hydrogen and battery-supply-chain funding. Saint-Gobain's New York expansion confirms confidence in domestic catalyst-support demand. Tightening US vehicle emissions rules stimulate ceramic exhaust filter consumption. Stable iron foundry operations in the Midwest and growing aluminum casting for EV parts ensure demand resilience.

Europe prioritizes circular economy mandates and carbon-neutral steel, driving uptake of recyclable refractory foams in mini-mills. Germany, France and Italy upgrade casting lines with automated filter-handling systems, spurring research into tougher foam formulations. EU grants back additive-manufacturing pilot lines that fabricate customized pore architectures for aerospace and defense. Stringent building energy directives stimulate ceramic insulation panel deployment in renovation projects.

South America and Middle East & Africa are smaller but rising. Brazilian and Argentinian automakers adopt aluminum casting filters, while new steel capacity in Saudi Arabia's Vision 2030 bolsters refractory demand. Foreign direct investment underpins advanced-materials institutes that enhance local competence. Infrastructure gaps and limited technical expertise slow adoption, yet localized production partnerships could unlock latent potential for the ceramic foam industry.

- Altech Alloys India Pvt. Ltd.

- ASK Chemicals

- Carpenter Brothers, Inc.

- Drache Umwelttechnik GmbH

- ERG Aerospace Corporation

- Ferro-Term Sp. z o.o.

- FILTEC PRECISION CERAMICS CO., LTD.

- Galaxy Enterprise

- Jiangxi Jintai Special Material LLC.

- LANIK s.r.o.

- Porvair Filtration Group

- Pyrotek

- SELEE Corp.

- Ultramet

- Vertix Co.

- Vesuvius

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for low-emission molten metal filtration in EV casting hubs

- 4.2.2 Rapid expansion of hydrogen production requiring high-temperature catalyst supports

- 4.2.3 Additive manufacturing enabling complex, cost-efficient open-cell foam geometries

- 4.2.4 Circular-economy push for recyclable refractory linings in steel mini-mills

- 4.2.5 Government incentives for zero-energy buildings boosting ceramic-foam insulation panels

- 4.3 Market Restraints

- 4.3.1 Volatile alumina and zirconia prices pressuring profit margins

- 4.3.2 Brittleness leading to handling losses in automated foundries

- 4.3.3 Emerging polymer-derived foams offering cheaper insulation alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Aluminum Oxide (Al2O3)

- 5.1.2 Silicon Carbide (SiC)

- 5.1.3 Zirconium Oxide (ZrO2)

- 5.1.4 Others Types (Magnesium Aluminate Spinel, etc.)

- 5.2 By Manufacturing Process

- 5.2.1 Replica/Polymer Sponge Method

- 5.2.2 Direct Foaming

- 5.2.3 Gel Casting

- 5.2.4 Additive Manufacturing

- 5.3 By Application

- 5.3.1 Molten Metal Filtration

- 5.3.2 Automotive Exhaust Filters

- 5.3.3 Thermal and Acoustic Insulation

- 5.3.4 Catalyst Support

- 5.3.5 Furnace Lining

- 5.3.6 Other Applications (Biomedical Scaffolds, etc.)

- 5.4 By End-User Industry

- 5.4.1 Foundry

- 5.4.2 Automotive

- 5.4.3 Construction

- 5.4.4 Pollution Control and Chemcial Synthesis

- 5.4.5 Other End-user Industries (Power Generation and Energy, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Altech Alloys India Pvt. Ltd.

- 6.4.2 ASK Chemicals

- 6.4.3 Carpenter Brothers, Inc.

- 6.4.4 Drache Umwelttechnik GmbH

- 6.4.5 ERG Aerospace Corporation

- 6.4.6 Ferro-Term Sp. z o.o.

- 6.4.7 FILTEC PRECISION CERAMICS CO., LTD.

- 6.4.8 Galaxy Enterprise

- 6.4.9 Jiangxi Jintai Special Material LLC.

- 6.4.10 LANIK s.r.o.

- 6.4.11 Porvair Filtration Group

- 6.4.12 Pyrotek

- 6.4.13 SELEE Corp.

- 6.4.14 Ultramet

- 6.4.15 Vertix Co.

- 6.4.16 Vesuvius

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technological Advancements in Production Techniques